GM to all of you nutcases. It’s Crypto Nutshell #766 cleanin’ up the mess… 🧤🥜

We’re the crypto newsletter that’s more mind-twisting than a man piecing together his life with memories that cannot be trusted… 🧩🕰️

What we’ve cooked up for you today…

🏦 Another one?

🎯 $1.5 Million by 2030 is still on

🔥 Dry Powder

💰 And more…

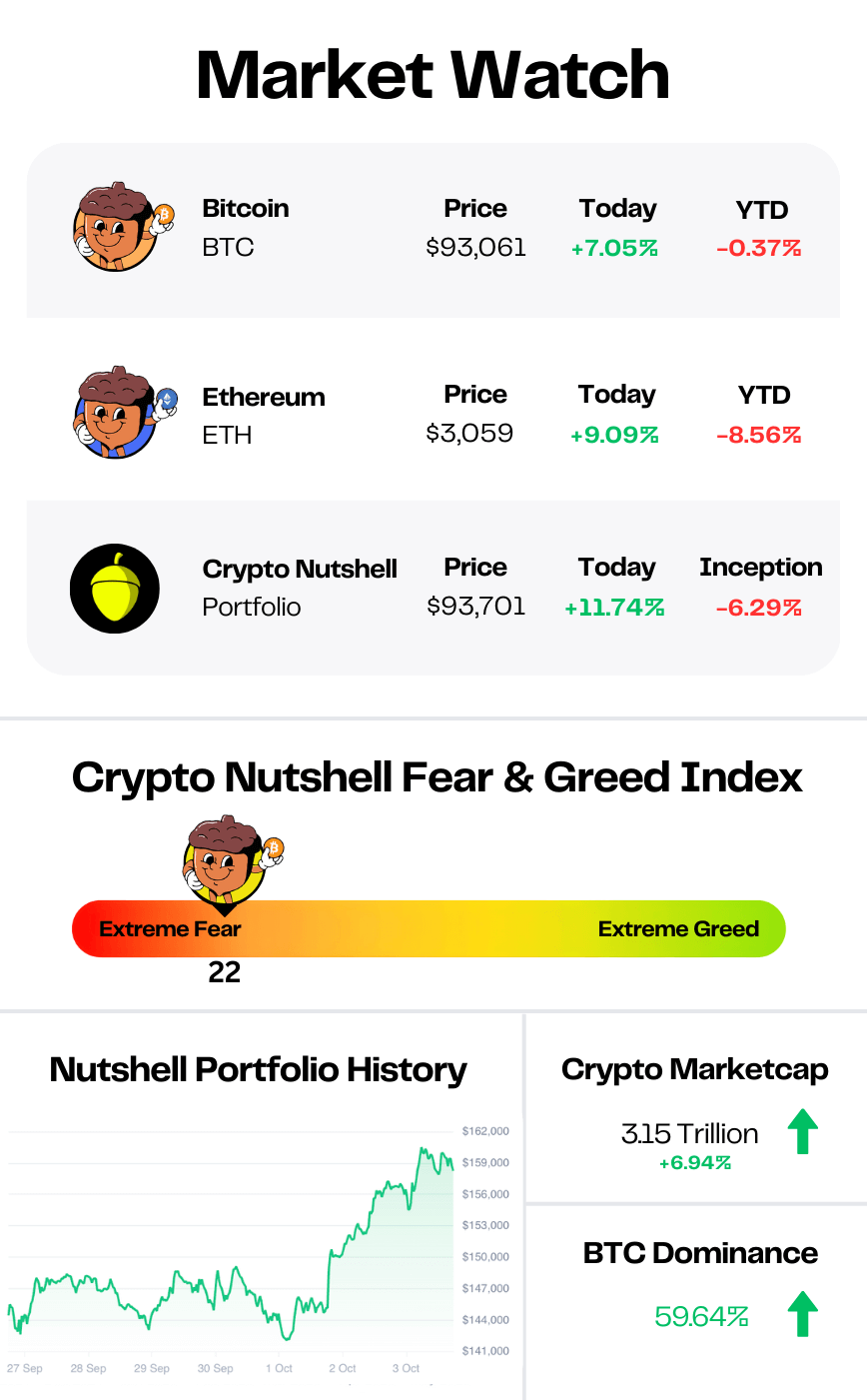

Prices as at 2:30am ET

ANOTHER ONE? 🏦

BREAKING: Bank of America Endorses Up to 4% Allocation of Wealth Management Portfolios to Crypto

The bullish news keeps on coming in…

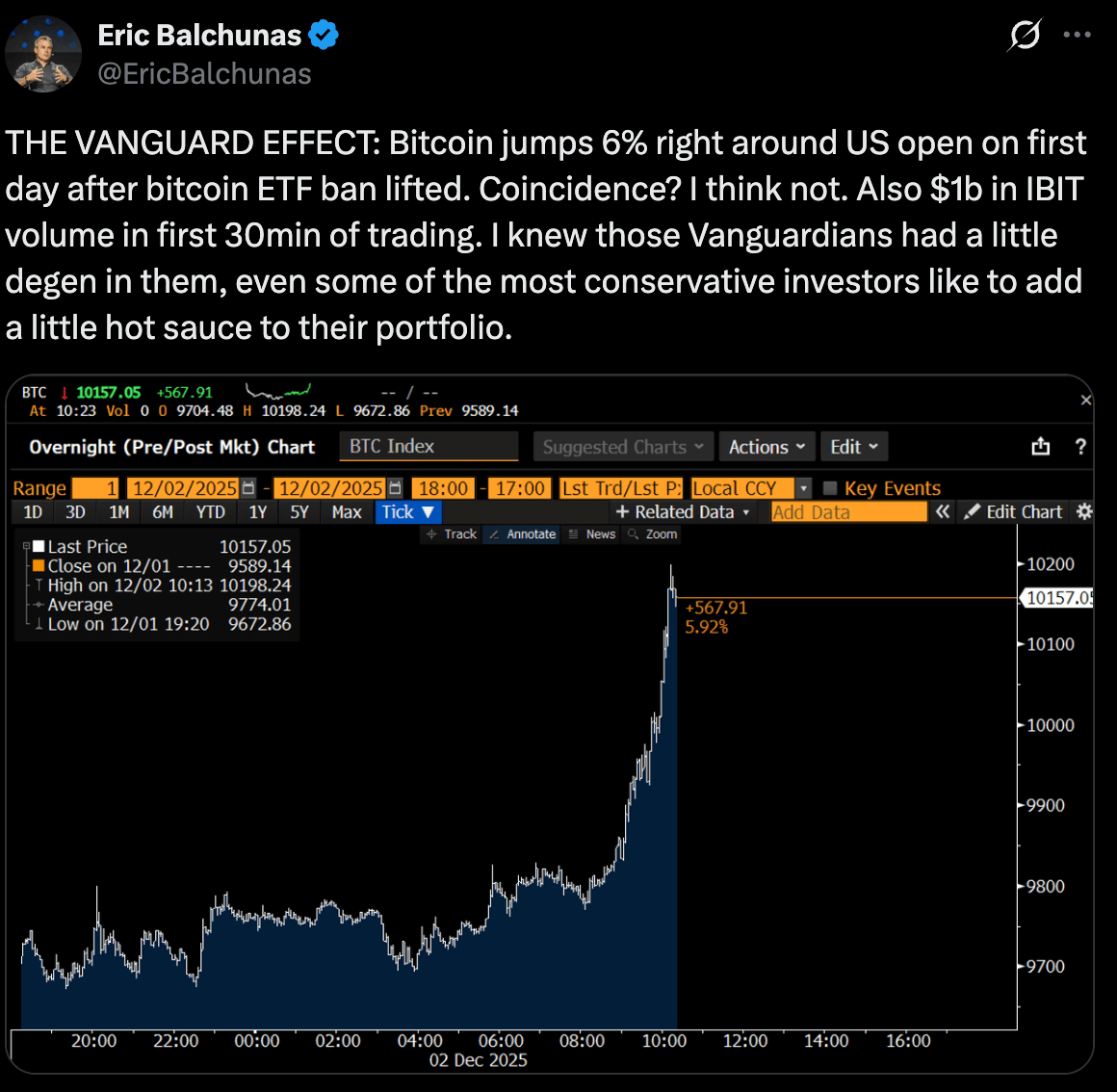

Yesterday it was Vanguard finally opening its platform to Bitcoin, Ethereum, XRP and Solana ETFs.

Today, Bank of America stepped in.

BoA will now recommend a 1 to 4 percent crypto allocation for suitable wealth clients.

And from January 5, they will start formal coverage of four spot Bitcoin ETFs: Bitwise BITB, Fidelity FBTC, Grayscale’s Bitcoin Mini Trust and BlackRock’s IBIT.

Over 15,000 advisers who were previously restricted can now actively suggest Bitcoin exposure through regulated products, not just wait for clients to ask.

CIO Chris Hyzy had this to say:

“For investors with a strong interest in thematic innovation and comfort with elevated volatility, a modest allocation of 1% to 4% in digital assets could be appropriate,”

Zoom out and you can see that playbook forming:

BlackRock has talked about 1 to 2 percent

Fidelity is in the 2 to 5 percent range

Morgan Stanley suggests 2 to 4 percent

Bank of America lands on 1 to 4 percent

Different firms. Same conclusion: low single digit crypto exposure as a normal part of a diversified portfolio.

All of this is landing just as markets bounce:

Total crypto cap back above $3 trillion

Bitcoin reclaiming $93K

Fed December cut odds pushing into the high 80s

Bloomberg’s Eric Balchunas even flagged that Bitcoin’s latest spike lined up almost perfectly with the first US session where Vanguard clients could buy spot ETFs.

Prices are still well off the highs. Sentiment is still fragile.

Yet the world’s largest asset managers are quietly doing the same thing:

Agreeing on how much crypto you should own. Clearing the way for their clients to buy it.

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

$1.5 MILLION BY 2030 IS STILL ON 🎯

As you know, the last ~2 weeks have been nasty for Bitcoin & crypto.

So naturally, when Cathie Wood was interviewed by Bloomberg this week, she was asked if her $1.5M Bitcoin by 2030 call is still intact.

Her answer?

Yes.

“Yes, it is our view.”

And she framed the selloff for what it actually is:

“I think right now we're in a risk-off period generally… Bitcoin has almost been a leader in terms of risk-on, risk-off.”

She then touched on what she believes will be the real driver going forward:

“We think we’re still in a bull market… deregulation in the U.S. will be very important for institutions moving into this asset class.”

So while price chops…

Her long-term call hasn’t moved an inch.

Same target 🎯

Same thesis 📚

Same conviction 🧱

This is the era of short-term fear, but long-term institutions.

DRY POWDER 🔥

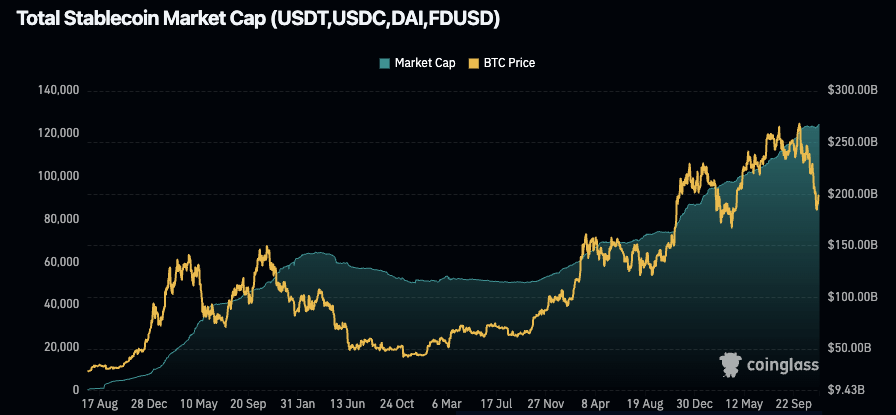

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Two weeks ago, the total stablecoin supply sat at $263.98 billion.

Today it’s $267.51 billion.

That’s a $3.53 billion increase in the past 14 days.

And if we zoom out…

The stablecoin supply is up $79.07 billion year-to-date.

These are not just digital dollars sitting around.

They are dry powder.

Billions in ready-to-deploy capital, already on-chain, just waiting for conviction to flip from fear back to risk-on. 🔥

CRACKING CRYPTO 🥜

Vanguard caves on crypto to retain clients as rivals win flows — opens $9.3T platform to crypto ETFs. Vanguard's embrace of crypto ETFs marks a pivotal shift, allowing its conservative client base access to the emerging industry.

ABTC Shares Plunge Tuesday Even as Bitcoin (BTC) Rallies. The collapse marks yet another disappointing Trump family crypto-related investment.

Grayscale predicts new bitcoin highs in 2026, dismisses 4-year cycle view. Grayscale Research said bitcoin could hit new highs in 2026, countering concerns that it's heading into a long, deep downturn.

Bitcoin mispricing deepens as BTC trades below $100K, but not for long. Bitcoin trades 66% below its global liquidity-implied fair value as gold continues to overperform.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Why are transaction fees on Solana typically very low?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Its high throughput spreads costs over many transactions 🥳

Solana’s design allows very high throughput, so the cost per transaction can stay tiny while still rewarding validators. ⚡

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.