GM to all 27,394 of you. Crypto Nutshell #175 swoopin’ in. 🕊️ 🥜

We’re the crypto newsletter that's as epic as a journey to destroy a powerful ring and save Middle-earth... 💍🌋

What we’ve cooked up for you today…

🧑⚖️ Gary Gensler speaks out

🔮 10 Crypto predictions for 2024

🤔 Is Bitcoin overvalued?

💰 And more…

MARKET WATCH ⚖️

Prices as at 4:25am ET

Only the top 20 coins measured by market cap feature in this section

GARY GENSLER SPEAKS OUT 👨⚖️

BREAKING: Gary Gensler acknowledges SEC’s ‘new look’ at Bitcoin ETFs post-Grayscale decision

SEC Chair Gary Gensler commented on pending Bitcoin ETF applications in a recent CNBC interview.

When asked about the Bitcoin ETF applications, Gensler had this to say:

“We have … between eight and a dozen [spot Bitcoin ETF] filings … And as you might know, we had in the past denied a number of these applications, but the courts here in the District of Columbia weighed in on that. And so we’re taking a new look at this based upon those court rulings.”

The court ruling mentioned here relates to Grayscales recent court victory over the SEC. The SEC was ordered to review Grayscale’s application to convert its Bitcoin trust to spot Bitcoin ETF.

Gensler declined to comment on this ruling increasing the approval odds for the pending ETFs. (but it definitely has…)

To no ones surprise, Gensler did take the opportunity to once again vocalise his issues with the crypto industry.

Namely, non-compliance surrounding securities laws as well as money laundering and public protection.

“We’ve brought somewhere between 150 and 175 cases either settled or litigated successfully. And what we have found is, this is really the wild west and it’s around the globe. I would say again, this is a small part of our U.S. Capital markets. But it can undermine confidence when so many people have been hurt and all they can do is then stand in line at a bankruptcy court.”

But all in all, another sign that the ETFs are closer than ever before…

Only 25 days left until the final deadline. ⏰

TOGETHER WITH THE EDGE 🤖

Crypto was the fastest adopted technology the world had ever seen… until Artificial Intelligence came along.

Which makes keeping up with A.I … complicated. 😕

Between learning the newest tools and knowing the latest news, Artificial Intelligence can feel overwhelming.

But it doesn’t have to. That’s where THE EDGE steps in.

Makes keeping up with the latest AI breakthroughs dead simple ✅

Helps you stay on top of the latest AI Tools with real life use cases 🔨

Delivered straight to your inbox every single day in a 3 min read 📨

The best part? They’re also completely FREE just like us.

Subscribe now by five star frog splashing that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

10 CRYPTO PREDICTIONS FOR 2024 🔮

Bitwise is the largest crypto index fund manager in the U.S.

They are also 1 of the 13 institutions in the race for a spot Bitcoin ETF.

Yesterday, they released a report that outlined 10 crypto predictions for 2024. Today, we'll cover the first 5.

Let’s dive in:

Prediction 1: Bitcoin will trade above $80,000, setting a new all-time high.

There are 2 major catalysts the will fuel this.

The launch of a spot Bitcoin ETF

The Bitcoin Halving

“More demand? Less supply? You do the math.”

Prediction 2: Spot Bitcoin ETFs will be approved, and collectively be the most successful ETF launch of all time.

Bitwise internal studies suggest spot Bitcoin ETFs will capture 1% of the $7.2 trillion U.S ETF market. This means inflows of $72 billion within 5 years.

For an asset class with a total market cap of ~$840 billion? This would be a game-changer.

Prediction 3: Coinbase revenue will double.

Wall Street estimates currently expect Coinbase revenue to grow 9% year over year.

Bitwise believes Wall Street is underestimating the power of a crypto bull run. They foresee Coinbase revenue growth to be 100% or more in 2024.

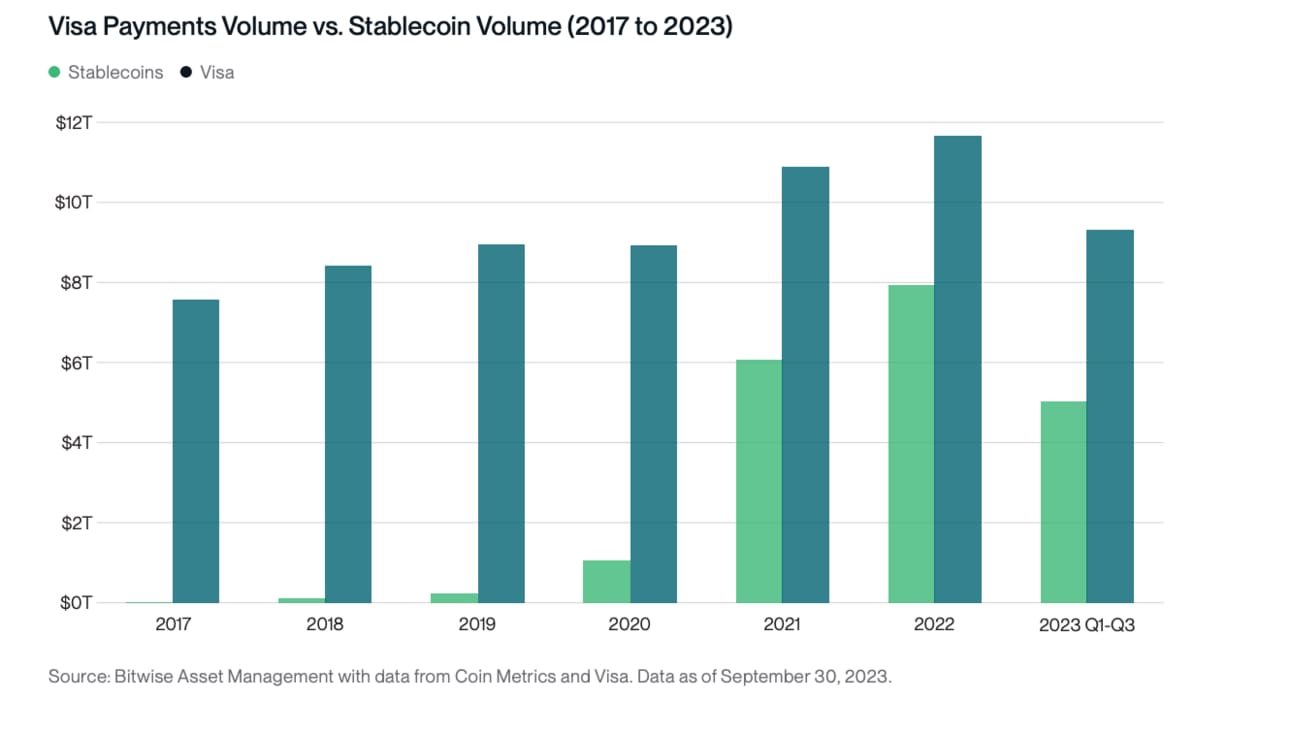

Prediction 4: More money will settle using stablecoins than Visa.

It's hard to believe stablecoins have only been around for 4 years.

They have gone from effectively $0 to a $137 billion market in that time.

This prediction may sound insane, but if you look at stablecoin volume vs Visa, the growth rate is nuts.

Prediction 5: J.P. Morgan will tokenise a fund and launch it on-chain as Wall Street gears up to tokenise real-world assets.

CEO Jamie Dimon has a well-documented history of skepticism & aversion towards crypto. Despite this, J.P Morgan has been exploring blockchain technology for years.

Bitwise believes in 2024, the efficiencies of blockchain will prove too much and J.P. Morgan will launch a fund, on-chain.

Bottom Line:

For reference, Bitwise did a report in 2022, in which they made 10 crypto predictions for 2023.

Their results? 5/10.

A 50% hit rate. Not bad for some fairly bold predictions.

Let’s hope their success rate is as good, if not better in 2024. 🥂 🥳

P.S We will cover Bitwise's final 5 predictions in tomorrows letter…

IS BITCOIN OVERVALUED? 🤔

Today we’ll be answering the question: is Bitcoin overvalued?

To do that, we’ll be taking a look at the Market Value to Realized Value Z-Score. This metric simply compares the market value to the realized value.

Market Value: current price of Bitcoin multiplied by the circulating supply

Reazlied Value: similar to market value, but uses the price at which each coin last moved

A market top (red zone) is categorised by market value being significantly higher than the realized value.

A market bottom (green zone) is categorised by market value being significantly lower than the realized value.

Taking a look at the chart above, notice how the MVRV ratio has only just bounced off of the green zone?

Using this metric, we can see that the best time to purchase Bitcoin is when it's in the green zone. 🤑

Anyway, Bitcoin still has a loooonnnngggg way to go before it’s anywhere near the red zone.

We’re only just getting warmed up for whats to come. 😎

Interestingly, this metric has consistently picked the cycle tops to within two weeks.

So it’s definitely one we’ll be checking in on every now and then as the cycle progresses. 🔮

We’ll keep you posted. 🫡

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 2 weeks 🥳

Bitcoin's mining difficulty is updated every 2,016 blocks (or roughly every two weeks).

Checkout this article to learn more about Bitcoin Mining.

GET IN FRONT OF 27,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.