GM to all of you nutcases. It’s Crypto Nutshell #796 racin’ the clock… ⏰🥜

We’re the crypto newsletter that’s more obsessive than a coder chasing the truth behind an unstoppable algorithm… 💻🧠

What we’ve cooked up for you today…

🏦 Fidelity makes a prediction

🧠 Raoul Pal’s 10-year bet

📈 Zoom out

💰 And more…

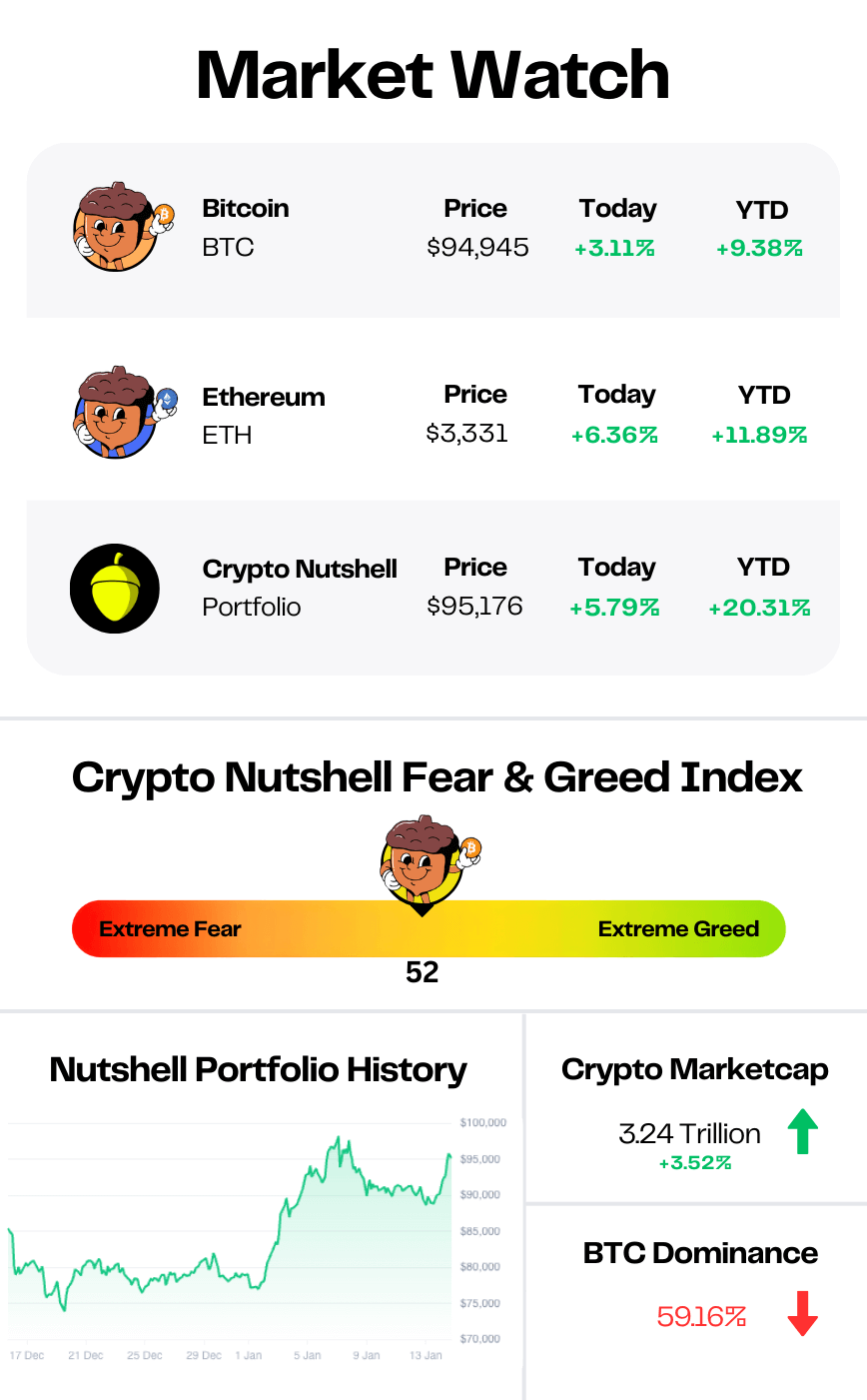

Prices as at 2:00am ET

FIDELITY MAKES A PREDICTION 🏦

BREAKING: Fidelity Calls Bitcoin 'Maturing,' Lays Out 2026 Bull and Bear Case

Fidelity just made a prediction for 2026…

Bitcoin may be shifting from its four-year cycle into a "supercycle" - longer highs, shallower drops, and structural changes that alter market behavior.

Parth Gargava, managing partner at Fidelity Labs, made the case in Fidelity's 2026 outlook.

The old pattern

As you probably know, Bitcoin has followed a four-year cycle tied to halvings.

Price has historically peaked roughly 18 months after each halving.

2016 halving → December 2017 peak

2020 halving → 2021 peak

2024 halving (April) → ???

The question: Has Bitcoin already peaked? Or has the cycle changed?

The supercycle thesis

"You might have more prolonged highs, longer highs, and shallower dips," Gargava said.

Three drivers:

1. Persistent ETF demand: Spot Bitcoin ETFs hold $123 billion. That's steady institutional capital, not retail speculation. Flows stay strong even when sentiment weakens.

2. Pro-crypto U.S. policy: Less regulatory uncertainty. The CLARITY Act could unlock DeFi growth.

3. Changing correlations: Bitcoin is decorrelating from the S&P 500 and precious metals. It's trading less like pure risk and more like a liquidity hedge.

The macro setup

Quantitative tightening has ended.

U.S. debt exceeds $38 trillion. Governments are choosing growth over austerity. Global M2 growth is turning positive.

$7.5 trillion sits in money market funds. If a fraction rotates into risk assets, Bitcoin absorbs it.

Fidelity calls Bitcoin a "liquidity sponge."

But inflation does remain sticky. The dollar is strong. And policy is easing but still restrictive.

If markets tip risk-off, Bitcoin can sell off hard alongside tech.

The takeaway

Gargava didn't declare the four-year cycle dead.

He said 2026 will answer whether Bitcoin follows its boom-bust pattern or shows a longer, steadier expansion.

Bitcoin is maturing into a macro asset shaped by liquidity cycles and institutional flows.

This time might just be different… 🚀

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

RAOUL PAL’S 10-YEAR BET 🧠

Raoul Pal is is a former Goldman Sachs macro trader and the founder of Real Vision, a $100M+ financial media business read & watched by hedge funds and sovereign wealth money.

So when he jokes, it is usually hiding something serious.

This week he tweeted:

It reads like humor. But it’s actually a serious blueprint.

Raoul has been saying the same thing for years.

Crypto is not a trade. It is a decade-long adoption wave driven by demographics, liquidity, and the digitization of finance.

He has talked endlessly about how global debt forces governments to print.

How younger generations live on the internet.

How money and assets are moving on-chain whether politicians like it or not.

So his “5 to 10 year plan” being crypto is not surprising. That is just him putting his money where his mouth is.

And the “overpriced JPEGs” (NFT’s) line is not really about cartoon pictures.

It is about digital property. Online identity. Status. Culture. The same thing that made domain names, Instagram handles, and skins in video games valuable.

2 asset classes. 1 same bet.

The world is going digital, and capital always follows attention.

Raoul is not trying to time tops or bottoms. He is not trading this stuff.

He is doing what he has always done.

Buying the future. Holding it. And letting the math do the work. 🛸

ZOOM OUT 📈

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Two weeks ago, the total stablecoin supply sat at $268.93 billion.

Today it's $266.93 billion.

That's a $2 billion drop in the past 14 days.

And at first glance, that doesn’t sound great.

But zoom out…

Over the last 365 days, stablecoin supply has climbed $76.64 billion.

A $2 billion dip is noise against a $76 billion buildup.

Stablecoins aren't just digital dollars sitting idle. They're loaded capital.

Billions already on-chain, waiting for the right entry. 🔥

CRACKING CRYPTO 🥜

How SharpLink Plans to Grow in 2026 After Amassing Nearly $3 Billion in Ethereum - Decrypt. Ethereum treasury firm SharpLink Gaming intends to lead the way when it comes to publicly traded firms productively using their ETH.

JPMorgan CFO calls stablecoin yield payout 'parallel' to legacy banking without safeguard. JPMorgan's Jeremy Barnum said the bank would compete with crypto offerings but warned that stablecoin yield products look like banks without the same regulation.

Senate Banking Committee's crypto market structure bill text sets up showdown over stablecoin rewards. Lawmakers and the crypto industry are sifting through pages and pages of bill text, with much of the focus being on stablecoin rewards.

BTC Breaks $93K as CLARITY Act Delay Tests Markets' Patience. BTC's break above $93,500 suggests investors are renewing their interest in the crypto market. Is $100,00 Bitcoin's next stop?

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What privacy technology does Monero use to hide transaction amounts?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Ring Confidential Transactions 🥳

Monero uses Ring Confidential Transactions (RingCT) to hide transaction amounts, combined with ring signatures to obscure the sender and stealth addresses to protect the receiver.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.