GM to all of you nutcases. It’s Crypto Nutshell #629 conductin’ tests… 🧪🥜

We're the crypto newsletter that's more legendary than a hero rising from the shadows to fulfill his destiny... 🦇🔥

What we’ve cooked up for you today…

🏦 Strategy keeps going

💣 $100 Trillion Catalyst

🔥 Streak remains

💰 And more…

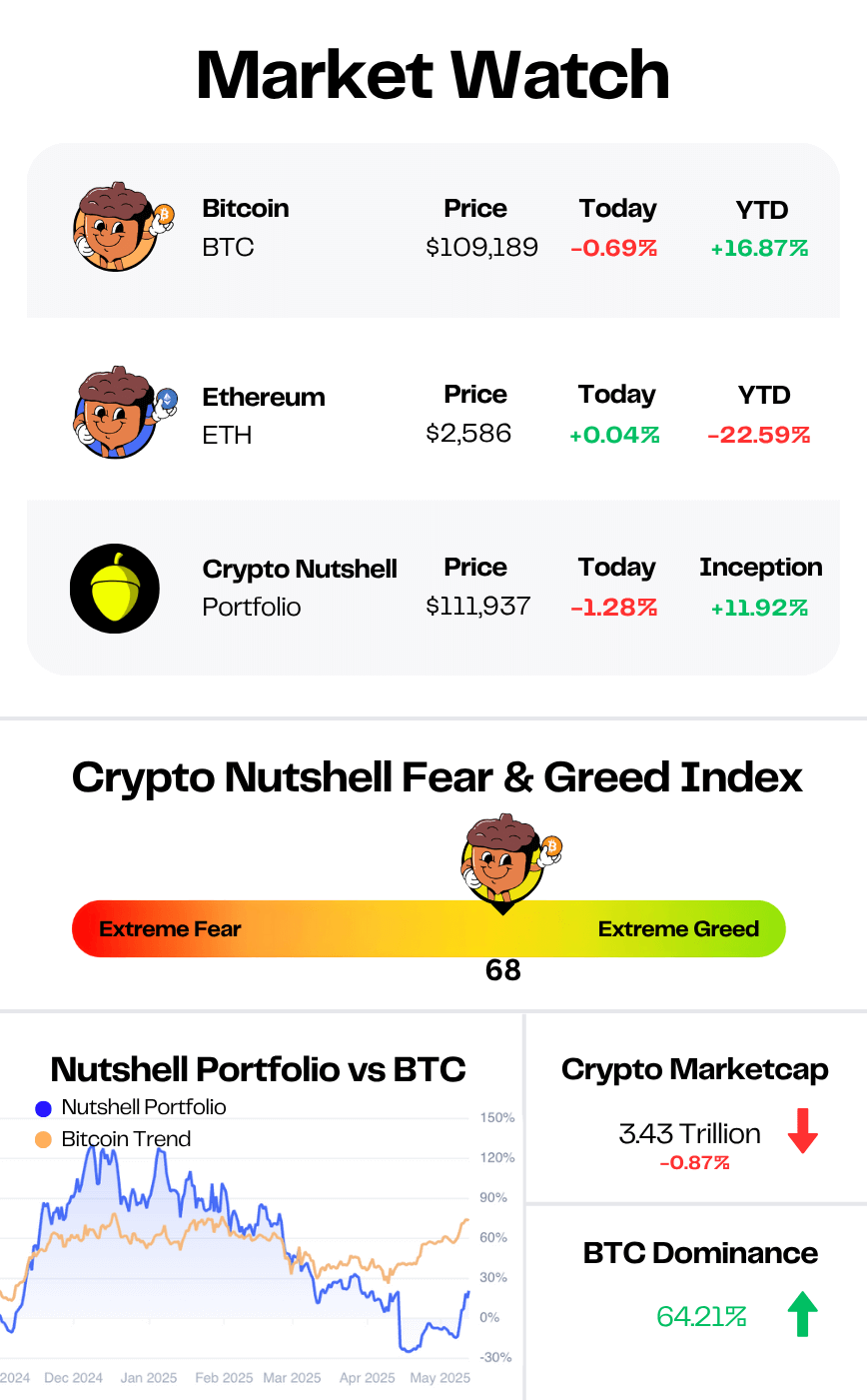

Prices as at 3:30am ET

STRATEGY KEEPS GOING 🏦

BREAKING: Strategy Shrugs Off Lawsuit, Buys Another Half Billion in Bitcoin

Some companies panic when they get hit with a lawsuit.

Michael Saylor’s Strategy?

Buy more Bitcoin.

This week, the world’s largest corporate Bitcoin holder added 4,020 BTC to its treasury - dropping $427 million at an average price of $106,237 per coin.

That brings Strategy’s total stash to 580,250 BTC, worth over $63.7 billion.

And that’s nearly 3% of all Bitcoin in existence.

Let that sink in.

Unfortunately…

Strategy stock is still down ~6.08% over the last five days due to the lawsuit alleging securities fraud tied to its Bitcoin strategy.

But instead of slowing down?

Strategy ramped up.

The company is aggressively raising capital through a combination of stock sales and preferred share offerings - including a $2.1 billion raise via Series A preferred shares (STRF) to keep stacking.

This is all part of Saylor’s infamous “42/42” plan to raise $84 billion in equity and notes to keep accumulating BTC through 2027.

And the ripple effects are spreading fast.

More than 70 companies now hold Bitcoin on their balance sheets.

Names like Twenty One, KULR, Nakamoto, Semler Scientific, and GD Culture are following Strategy’s playbook.

Analysts at Bernstein believe these “Strategy copycats” could inject $330 billion into Bitcoin’s market cap over the next five years.

Strategy’s conviction is stronger than ever.

And the rest of the market is starting to follow. 🚀

The key to a $1.3T opportunity

A new real estate trend called co-ownership is revolutionizing a $1.3T market. Leading it? Pacaso. Led by former Zillow execs, they already have $110M+ in gross profits with 41% growth last year. They even reserved the Nasdaq ticker PCSO. But the real opportunity’s now. Until 5/29, you can invest for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

$100 TRILLION CATALYST JUST DROPPED 💣

Something big just happened.

But no one’s talking about it.

The U.S. Senate just advanced a crypto bill that could reshape the entire financial system.

According to Bitwise CIO Matt Hougan, it’s possibly bigger than the Bitcoin ETF approval.

Here’s what’s going down:

The Bill: The GENIUS Act

The Senate just voted 66–32 to move the GENIUS Act toward final approval - with 16 Democrats crossing party lines to support it.

Translation:

Real crypto regulation is finally happening.

The GENIUS Act gives full regulatory clarity to stablecoins - arguably the most important “killer app” in crypto.

Why It Matters

If passed, the bill would:

Let banks like JPMorgan issue stablecoins 🏛️

Require they be backed 1:1 with U.S. Treasuries or cash 💵

Enforce audits, oversight, and AML compliance ✅

In short:

Stablecoins go legit. Wall Street truly joins the game.

Stablecoins are already a $200B+ market. But that’s without institutions.

Now imagine:

Amazon offering 2% off if you pay with stablecoins

Your paycheck arriving in USDC

And Ethereum, Solana, and DeFi becoming the new financial rails

“This is how $100+ trillion in assets move onchain.”

Final Take

First it was ETFs. Now it’s stablecoins.

Crypto is becoming the back-end of global finance.

And this is just the beginning. 🌍

STREAK REMAINS 🔥

The streak hits six…

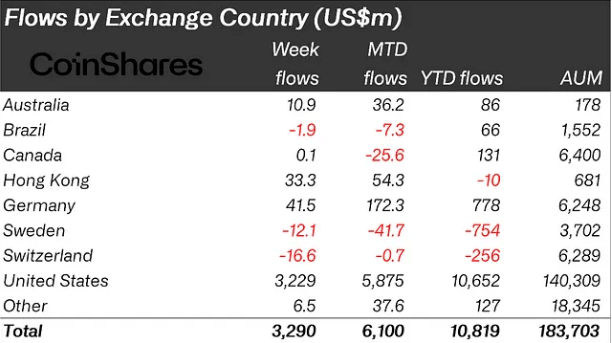

Digital asset funds just posted a monster $3.3 billion in inflows last week.

That pushes 2025’s year-to-date inflows to a record-breaking $10.8 billion.

Assets under management also briefly hit an all-time high of $187.5 billion.

Let’s break it down.

Bitcoin once again led the charge with $2.9 billion in inflows - now accounting for over a quarter of all 2025 inflows.

Short-Bitcoin also saw a surprising spike, pulling in $12.7 million - the most since December 2024.

Ethereum posted its fifth straight week of gains, with $326 million.

But the shock of the week?

XRP’s 80-week inflow streak snapped, with a record outflow of $37.2 million.

The U.S. completely dominated this week’s flows, experiencing $3.2 billion.

Germany followed with $41.5m, then Hong Kong ($33.3m) and Australia ($10.9m).

Switzerland, however, saw $16.6m in outflows as investors locked in profits.

CoinShares notes that the Moody’s downgrade and rising Treasury yields may be behind the surge.

Wall Street is waking up to the idea of Bitcoin as a hedge against financial uncertainty.

The rotation into crypto is accelerating.

And this time, it’s happening at record scale. ⚡

CRACKING CRYPTO 🥜

Dubai chooses XRP Ledger to power new real estate tokenization initative. Dubai Land Department's XRP Ledger (XRPL) collaboration aims to revolutionize real estate with blockchain technology.

BTC Price Rally Stalls as Short-Term Holders Take $11B Profits. Most U.S. markets were closed for Monday's holiday, but European stocks reacted positively to Trump's moratorium on 50% tariffs.

Trump Media Group to raise $3B for Bitcoin treasury. Trump Media and Technology Group is planning to raise $3 billion to purchase Bitcoin and other cryptocurrencies, according to a new report.

Coinbase sued in class action over stock price drop tied to data breach reveal, alleging disclosure 'omissions'. The exchange disclosed earlier this month that it had suffered a data breach in December, which appeared to trigger a stock drop that day.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which major movie franchise mentioned Bitcoin as a way to receive payment?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Fast & Furious 🥳

In Furious 7, a hacker character casually says, “I want my payment in Bitcoin.”

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.