Today’s edition is brought to you by TLDR Newsletter - catch up on the latest tech, startup, and coding stories.

GM to all of you nutcases. It’s Crypto Nutshell #611 holdin’ steady… ⚓🥜

We're the crypto newsletter that's more thrilling than racing through the streets of Gotham with a cape and a mission... 🦇🏙️

What we’ve cooked up for you today…

🎮 Global game theory

👑 1000% Returns

📉 There’s a trend forming

💰 And more…

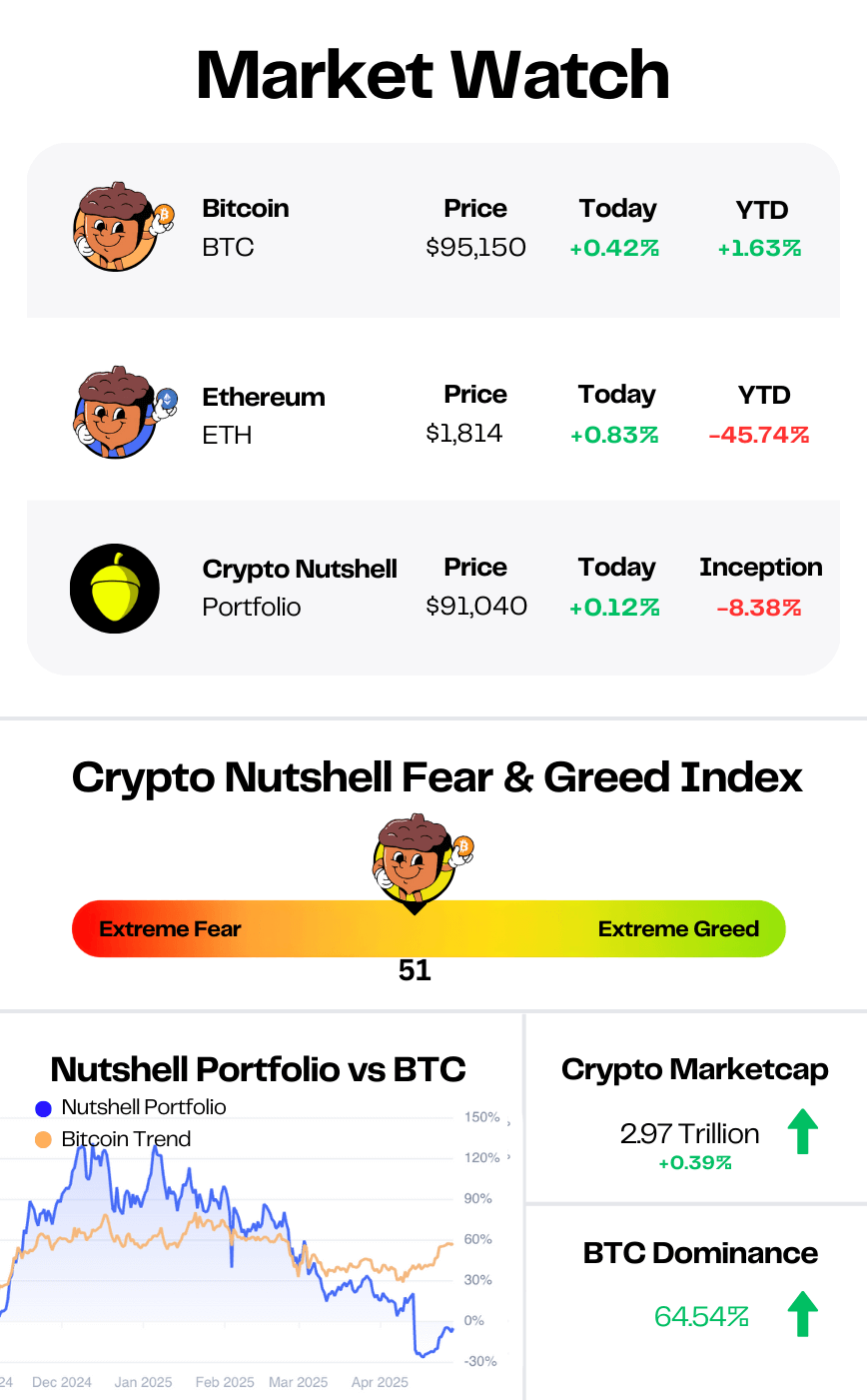

Prices as at 4:20am ET

GLOBAL GAME THEORY 🎮

BREAKING: Changpeng ‘CZ’ Zhao Is Advising Countries on How to Start Crypto Strategic Reserves

Changpeng “CZ” Zhao may have stepped down as Binance CEO…

But he’s not stepping away from crypto.

Fresh out of a four-month prison sentence, CZ is now advising governments around the world on how to build their own strategic crypto reserves.

“We are talking with many countries… basic fundamental stuff like what wallet solutions to use… Do you use professional custody or your own cold wallets?”

This comes just weeks after President Trump signed an executive order to create a U.S. Bitcoin reserve.

A historic step, even if things have gone quiet since…

“With one of the world’s largest economies holding Bitcoin… other countries are forced to do it… The later you do it, the more expensive your crypto will be.”

So far, Bhutan is leading the way.

One of its regions has officially added Bitcoin, Ethereum, and BNB to its national reserves.

Meanwhile, Europe is falling behind - with one exception.

“I don’t see Europe in this discussion… There’s an exception: Montenegro is actually quite pro-crypto, we have an active dialogue with the Prime Minister there… other than Montenegro, yeah [Europe] is kind of missing on the map.”

Despite being banned from managing Binance, CZ is offering his advice completely free - calling it essential not just for crypto adoption, but for long-term economic resilience.

“Out of 200 countries, 12 countries are just starting, right? Even, the U.S. is just starting… Everything’s just starting.”

The U.S. is exploring budget-neutral ways to add Bitcoin to the balance sheet.

Other nations won’t just sit back and let them stack solo.

This is global game theory in motion.

And as CZ said - it’s only just beginning. 🚀

STAY UP TO DATE ON ALL THINGS TECH 🤖

Love Hacker News but don’t have the time to read it every day? Try TLDR’s free daily newsletter.

TLDR covers the best tech, startup, and coding stories in a quick email that takes 5 minutes to read.

No politics, sports, or weather (we promise).

Subscribe for free now and you'll get their next newsletter tomorrow morning.

1000% RETURNS 👑

Max Keiser — one of Bitcoin’s longest-standing OGs — just laid out his latest prediction:

“Bitcoin should hit parity with gold.”

And if it does?

You’re looking at $850,000 per coin. 🤯

The Logic

Gold’s market cap sits around $15 trillion.

Bitcoin’s market cap right now?

About $1.7 trillion.

Keiser’s argument is simple:

Bitcoin does everything gold does (store of value, scarcity, portability)

But it does it better (divisible, verifiable, digitally native)

So in his view? Bitcoin should at least match gold’s market cap.

And if that happens during this cycle (next 5 years)...

$85K turns into $850K.

A 1000% return.

A 10X Over 5 Years?

Keiser calls a 1,000% return over the next 5 years a "reasonable expectation."

Not guaranteed.

Not hopium.

Just math.

Digital gold > physical gold.

Bottom line:

$850K Bitcoin isn’t some wild dream. It’s just Bitcoin doing what it was built to do:

Be better than gold. 👑

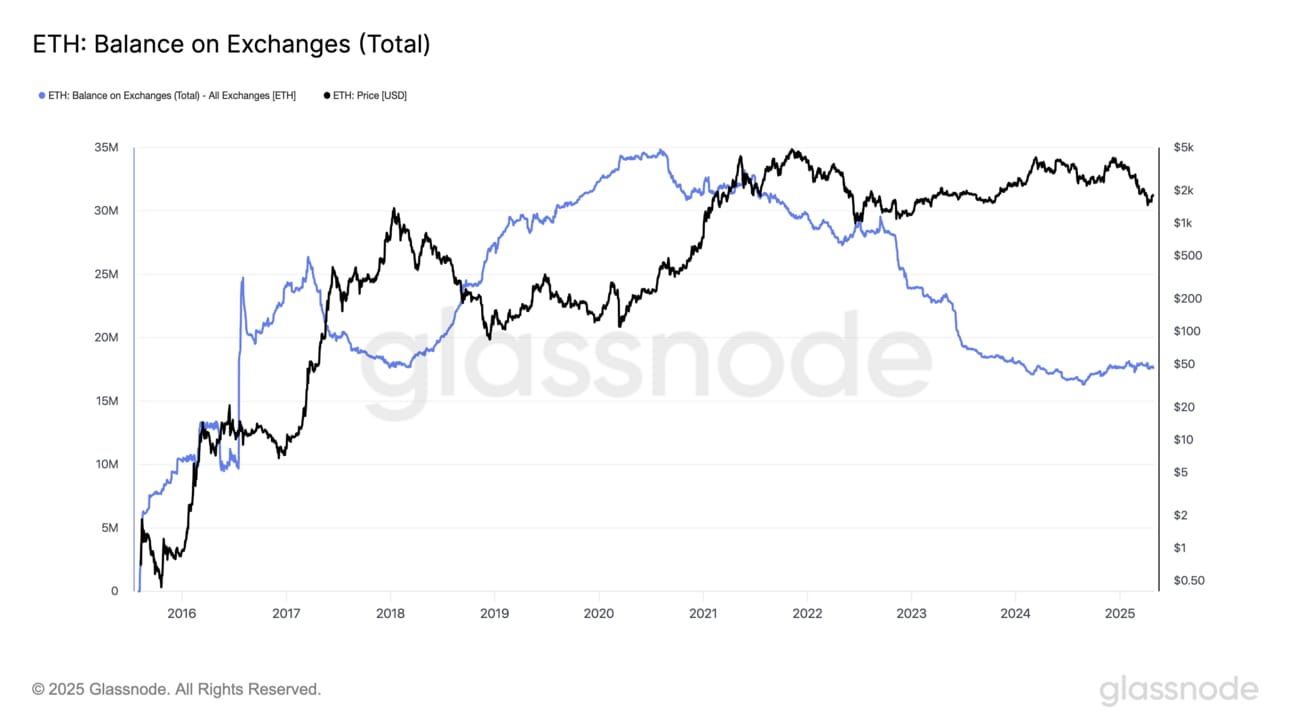

THERE’S A TREND FORMING 📉

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

According to Glassnode, just 17.57 million ETH sits on exchanges - that’s only 14.55% of the circulating supply.

And it’s not slowing down…

Over the past three months exchange balances have fallen by 439,452 ETH (~$789.98 million at today’s prices)

Despite all the noise in the market...

A clean trend is forming.

Ethereum’s supply is tightening fast.

Balances are hovering near multi-year lows.

And historically, that’s the kind of setup that comes before big moves.

Because when ETH disappears from exchanges...

You already know what tends to follow. 🚀

CRACKING CRYPTO 🥜

Bitcoin beats falling US GDP growth trend as Q1 data risks stagflationary economy. Bitcoin's appeal as a macro hedge grows amid US economic slowdown and inflation concerns.

Ripple $4B-$5B bid to purchase Circle rejected. Blockchain firm Ripple made a multibillion-dollar bid to acquire the USDC issuer, but the offer was rejected, according to Bloomberg.

Visa and Baanx Launch USDC Stablecoin Payment Cards. The Visa cards enable holders to spend USDC directly from their crypto wallets, using smart contracts to move a stablecoin balance.

Robinhood Q1 crypto revenue hits $252 million, down from record Q4 as volumes ease. The brokerage generated $141 billion in crypto trading volumes throughout 2024, driven by a huge surge in the fourth quarter.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which platform suffered one of the largest crypto hacks in history, losing over $600 million in 2021?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Poly Network 🥳

Poly Network got drained for $611 million, but crazy enough — the hacker later returned almost all the funds, claiming they did it “for fun.” 🤯

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.