GM to all of you nutcases. It’s Crypto Nutshell #771 chargin’ in… 🐘🥜

We’re the crypto newsletter that’s more unhinged than a clown-faced villain turning a city into his personal playground of chaos… 🃏🔥

What we’ve cooked up for you today…

📈 Are we back?

🦣 200x growth still ahead?

⚖ Right in the middle

💰 And more…

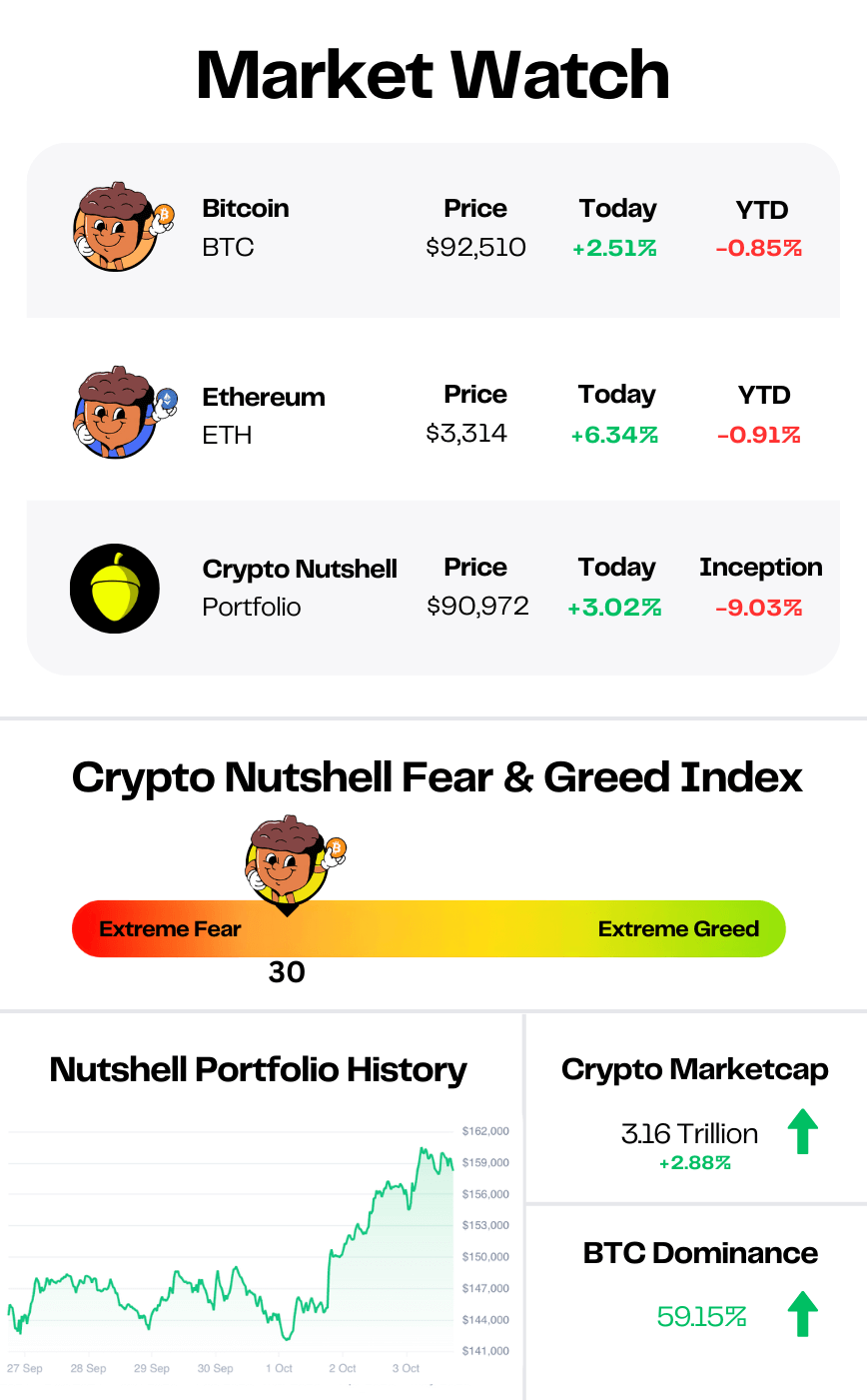

Prices as at 2:30am ET

ARE WE BACK? 📈

BREAKING: Bitcoin and ether surge on eve of FOMC decision fueling wave of liquidations

Bitcoin briefly turned positive for the year on Tuesday, surging past $94,000 and dragging the entire market up with it.

ETH reclaimed $3,300 for the first time in a month.

SOL and DOGE jumped over 8%.

And over $260 million in short positions got liquidated in just four hours.

And the timing isn’t a coincidence…

This happened just one day before the Fed's December meeting, where a 0.25% rate cut is almost fully priced in.

But here's the thing: the cut itself isn't the story.

Everyone already knows it's coming.

What matters is what Powell says about the path forward.

If he signals fewer cuts ahead, the odds of a Santa rally drop fast.

But analysts aren't calling this a bear market yet.

Kevin Hassett - ultra-dovish and likely Powell's replacement next year - could flip sentiment from depression to euphoria in early 2026.

Add in the Market Structure bill gaining momentum on Capitol Hill and growing institutional adoption, and the thesis hasn't broken. It's just delayed.

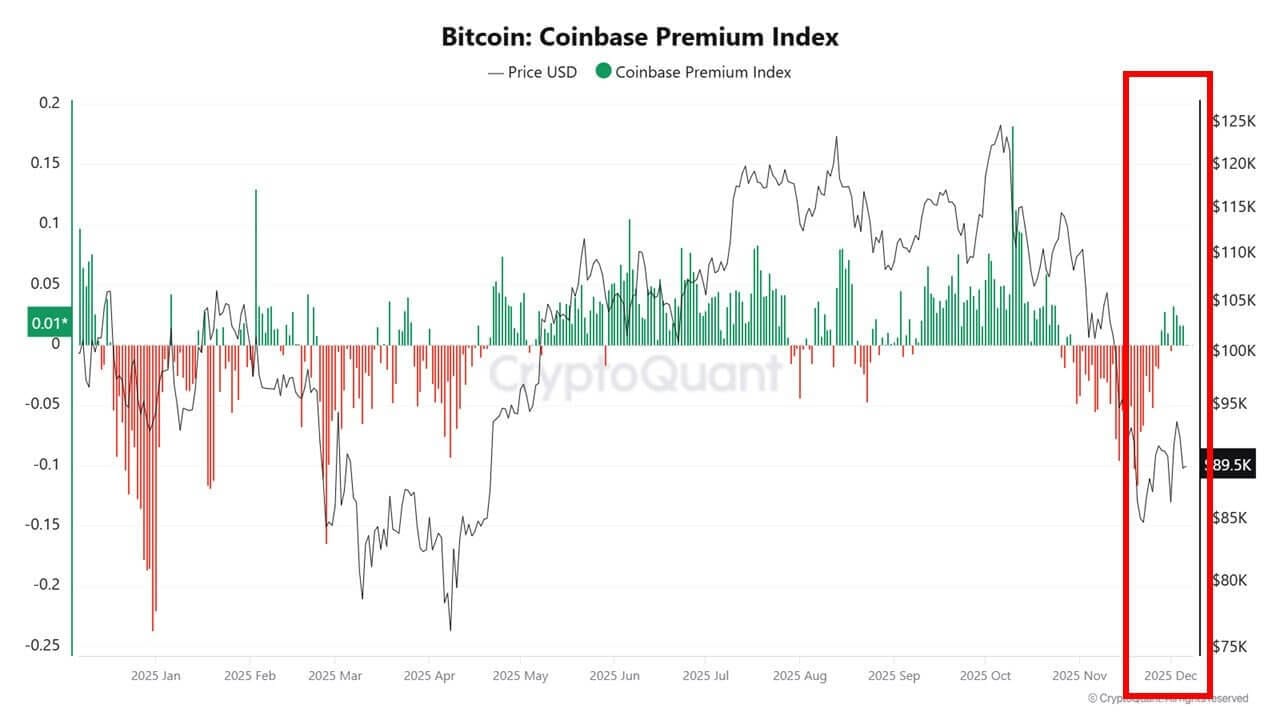

What's more interesting is the structure of the move.

For weeks, Bitcoin has bled during U.S. trading hours.

Tuesday flipped that script.

K33 Research noted positioning on derivatives markets was "deeply defensive" with investors bracing for more pain - exactly the kind of crowded short setup that snaps violently when sellers exhaust.

The Coinbase premium also turned positive over the past few days, signalling U.S. buyers are back.

The OCC also dropped a clarification on Tuesday: national banks can now engage in "riskless principal" crypto transactions, acting as intermediaries without holding inventory.

A small step, but another brick in the regulatory foundation.

So where does that leave us?

Bitcoin is back at $92,700 at the time of writing. The short squeeze added momentum, but the real question is whether this marks seller exhaustion or just another bounce in a structural reset.

The Fed decides tomorrow. Powell's tone will set the next leg. 🚀

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

200X GROWTH STILL AHEAD? 🦣

Tom Lee is one of the few Wall Street strategists who has been consistently right about crypto.

Not all of the time. But for the most part, he gets it correct.

He brings institutional discipline to a market that is usually driven by emotion.

And last week at Binance Blockchain Week in Dubai, the Chairman of Bitmine made a massive call…

Tom Lee at 2025 Binance Blockchain Week

His view?

The worst is over.

Here is the key line from his keynote:

“Crypto prices likely bottomed. The best years of growth are still ahead: there is 200x adoption to come.”

But in crypto, talk is cheap.

Predictions are easy.

So Lee put his money where his mouth is.

In just 48 hours last week, his firm Bitmine executed a massive buy:

$200 Million in Ethereum.

Translation:

He doesn't just think the bottom is in. He is betting 9-figures on it.

While retail investors are worried about the next 5% drop... the veterans are looking at a 200x horizon.

The smart money isn't panic selling.

They are loading the boat. 🚢

RIGHT IN THE MIDDLE ⚖

Today we're looking at BTC Risk - a simple way to gauge where we are in the cycle.

BTC Risk compresses years of price action into a number between 0 and 1:

Closer to 0 = historically cheap, good long term entry zones

Closer to 1 = historically hot, good long term distribution zones

It doesn't call exact tops or bottoms. It shows you when risk-reward is tilted in your favour.

Current BTC Risk: 0.424

That puts us below the 0.5 line, on the low to mid risk side of the spectrum.

We are well below the spikes that marked prior blow off tops, and comfortably above the despair levels of deep bear markets.

In plain English:

This is not an obvious selling zone.

It is also not a fire sale bottom.

It is the range where disciplined DCA still makes sense.

If BTC Risk drifts lower, the signal gets more attractive for buyers.

If it grinds up toward 0.8+, that's when you start thinking about trimming, not topping up.

CRACKING CRYPTO 🥜

The CFTC just authorized Bitcoin, ETH, USDC only for US leverage, leaving XRP, SOL stranded in risky limbo. While BTC and ETH gain approval as collateral, XRP's exclusion highlights the selective approach in CFTC's digital assets pilot.

New ETF proposal bets Bitcoin returns are made after hours. A proposed ETF with indirect exposure to Bitcoin would only buy the cryptocurrency when US markets close and sell when they open.

Michael Saylor Takes Bitcoin (BTC) Pitch to Middle East. The executive chairman of Strategy pitched BTC-backed banking and yield products as a $200 trillion opportunity at the Bitcoin MENA conference.

Bitcoin treasury XXI shares sink 20% in NYSE debut despite rising BTC price. Twenty One wants to distinguish itself from pure bitcoin-holding firms by pushing into brokerage, credit, and other financial services.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What does public Lightning Network capacity primarily measure?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: The total BTC locked in publicly visible Lightning channels 🥳

Lightning capacity reflects how much BTC is committed to public channels, hinting at the network’s usable liquidity. ⚡

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.