Today’s edition is brought to you by RAREMINTS

GM to all of you nutcases. It’s Crypto Nutshell #610 spinnin’ deep… 🌀🥜

We're the crypto newsletter that's more thrilling than a getaway driver caught between loyalty, love, and danger... 🚗🎶

What we’ve cooked up for you today…

🪨 BlackRock goes big

📈 $250k Bitcoin this cycle?

💪 Diamond hands

💰 And more…

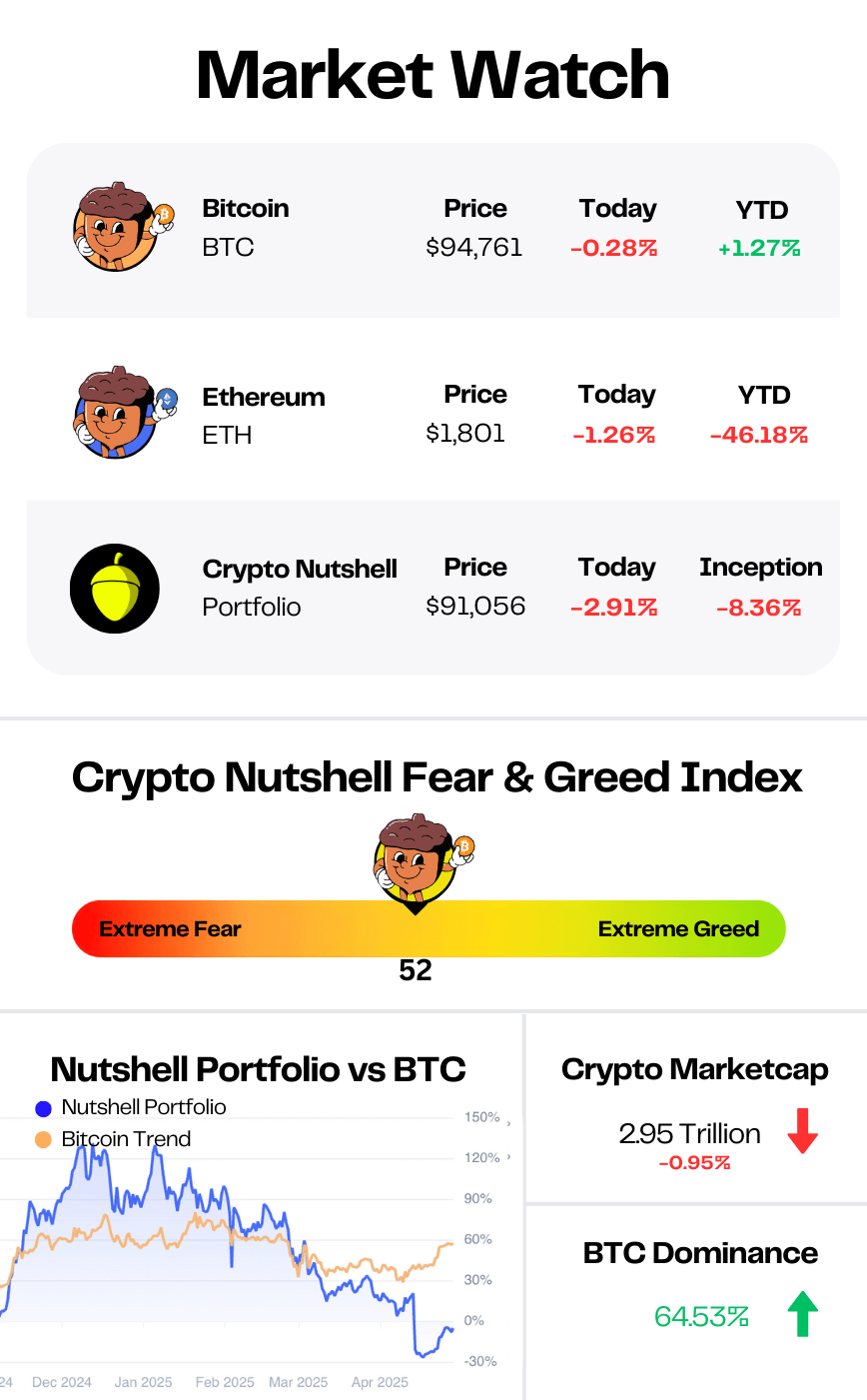

Prices as at 4:20am ET

BLACKROCK GOES BIG 🪨

BREAKING: BlackRock’s IBIT Sees Second-Largest Bitcoin Inflow Since Launch, Nearing $1 Billion

On Monday, we said the Bitcoin ETFs were back.

Well… BlackRock just took it to a whole new level.

On April 28, BlackRock’s IBIT ETF pulled in $970.9 million in fresh inflows - its second-biggest day ever, right behind the $1.12 billion haul from November 7, 2024.

And while Fidelity, Bitwise, and ARK are now seeing outflows…

BlackRock keeps stacking.

BTC ETF Flows

Since April 21, total inflows into U.S. spot Bitcoin ETFs have hit $3.83 billion - a serious momentum shift.

As Bloomberg ETF analyst Eric Balchunas put it:

“ETFs are in two steps forward mode after taking one step back, which is the pattern we predicted form the get-go.”

With these inflows, IBIT has now become the 33rd-largest ETF in the world, across both crypto and TradFi.

Yes - you read that right…

A spot Bitcoin ETF is up there with the TradFi big dogs.

And it’s no coincidence that Bitcoin’s rebound over the past few weeks came alongside this institutional buying spree.

Bottom line?

Retail might be quiet.

But institutions?

They’re not just back - they’re buying billions. 😎

DISCOVER THE NEXT 100X TOKEN 💎

The Harsh Truth About Crypto: Most retail traders lose money.

While those late to the party finally get in, project founders, VCs and early investors sell their bags for millions.

That said, there are still hundreds of tokens with 100X potential, you just need to find the right ones.

Crypto is an alpha-driven industry, where those who are early gain outsized returns, often for FREE via airdrops.

If you want to join RAREMINTS exclusive community where they break down trending crypto news, hand-pick tokens with 100X potential and share ALL of their trades, click on THIS LINK here.

What to expect:

Trending news, price alerts, and exclusive alpha to stay ahead of the curve

New projects and innovations broken down in under 5 minutes

Hand-picked tokens and memecoins with 100X potential, based on historical data and macro narratives

Join for FREE before others do. Your portfolio will thank you.

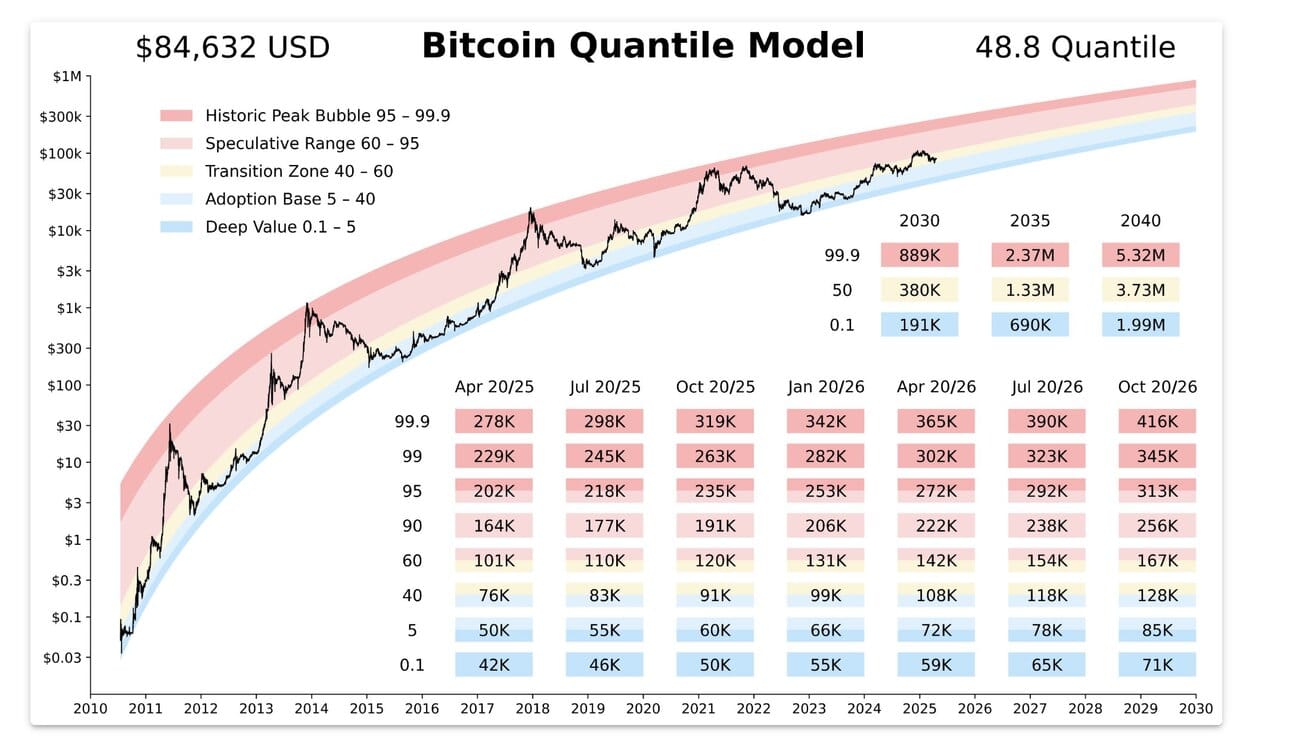

$250k Bitcoin This Cycle? 📈

Mathematician Fred Krueger just dropped his latest outlook…

And according to the Quantile Model?

Bitcoin is headed for the 95% zone - Which would put price targets at:

$250K if we hit it this year

$300K if it stretches into 2026

Here’s the Breakdown

Fred’s a mathematician. He doesn’t guess - he models.

This latest prediction is based off the Bitcoin quantile model, made by Bitcoin analyst Plan C.

His latest observations:

Quantile Model predicts Bitcoin will hit the 95% zone.

→ $250K–$300K depending on if it hits in 2025, or 2026.After the peak?

→ Retrace back to ~$150K (the “Yellow Zone”).His optimal plan?

→ Start trimming positions only after a $200K Bitcoin.

Right now?

We’re still climbing into the speculative range. This means the cycle has a LOT further to go.

The Playbook

Fred’s read is clear:

Hold strong until at least $200K.

Expect a blow-off top into the $250K–$300K range.

Then expect a retrace back to ~$150K afterward.

He’s not calling tops here. He’s saying the real move hasn’t even played out yet.

And if he’s right?

The best is still very much ahead. 🌅

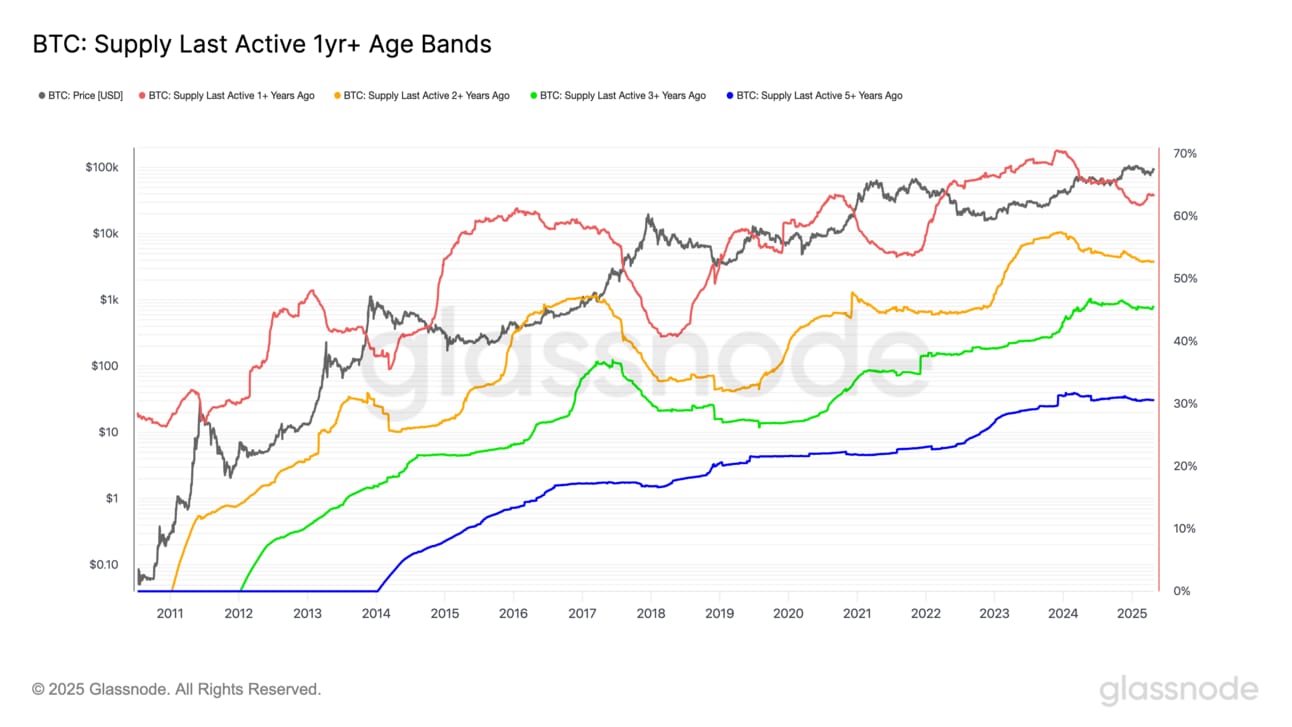

DIAMOND HANDS 💪

Let’s check in on one of our favourite metrics: Bitcoin’s supply last active 1+ years ago.

It’s a simple but powerful signal - tracking how much BTC has remained untouched as a percentage of total circulating supply.

Here’s the logic:

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

So what’s happening right now? 🤔

In short: Long-term conviction remains solid.

Here’s the latest supply breakdown (vs. two weeks ago):

🔴 Supply last active 1+ years ago: 63.25% (down from 63.32%)

🟠 Supply last active 2+ years ago: 52.66% (down from 52.71%)

🟢 Supply last active 3+ years ago: 45.44% (up from 45.18%)

🔵 Supply last active 5+ years ago: 30.58% (down from 30.59%)

At first glance, there’s a tiny softening in the 1+, 2+, and 5+ year bands.

But the real story?

The 3+ year cohort just posted a meaningful jump.

That’s important.

Because 3+ year holders - the true veterans - are growing, even as newer holders make minor moves.

And when you zoom out…

Nearly two-thirds of all Bitcoin hasn’t moved in over a year.

That’s diamond-handed patience. 💪

Bitcoin’s supply is still tightening quietly under the surface.

And historically, when supply locks up and demand picks back up?

Price doesn’t stay quiet for long. 🚀

CRACKING CRYPTO 🥜

Nasdaq files to list 21Shares Dogecoin ETF, signaling mainstream crypto acceptance. Nasdaq files to list 21Shares DOGE ETF with the SEC, offering passive Dogecoin price exposure minus speculative risks.

Bitcoin price always rallies at least 50% after these two patterns emerge. Bitcoin price goes on a near-parabolic rally everytime these two events happen.

SoFi Plans Major Push Into Crypto Amid New Regulatory Environment. There's been a “fundamental shift” in the crypto landscape in the U.S., CEO Anthony Noto said on Wednesday.

Former Rep. Patrick McHenry predicts a 'wicked hot summer' for crypto legislation. “It’s go time for digital asset policy,” said former Rep. Patrick McHenry.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which cryptocurrency was created from a split (hard fork) of Bitcoin in 2017?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Bitcoin Cash 🥳

Bitcoin Cash (BCH) forked off from Bitcoin in 2017 over disagreements about block size and scaling, leading to one of crypto’s biggest civil wars. ⚔️

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.