GM to all of you nutcases. It’s Crypto Nutshell #778 plantin’ the seeds… 🌱🥜

We’re the crypto newsletter that’s more dramatic than a family empire tearing itself apart over power and money… 👑🔥

What we’ve cooked up for you today…

🏦 The Clarity Act Delayed

🍷 Saylor’s 3 Predictions

📉 Exchange reserves collapsing

💰 And more…

Prices as at 2:25am ET

CLARITY IS COMING 🏦

BREAKING: Crypto CLARITY Act set for Senate markup in January, Sacks says

The CLARITY Act is finally moving forward…

White House crypto czar David Sacks confirmed on Thursday that the bill will reach the Senate for markup in January, after months of delays.

Senate Banking Committee Chair Tim Scott and Agriculture Committee Chair John Boozman both confirmed the timeline.

The CLARITY Act would hand the CFTC regulatory authority over most digital assets, define what qualifies as "digital commodities," and clarify the roles of the SEC and other financial regulators.

The goal: end the regulatory ambiguity that's kept crypto firms in legal limbo for years.

Industry advocates say clearer compliance pathways will unlock innovation and strengthen investor protections.

The Senate markup process will debate and potentially amend the bill before sending it to the full chamber for a vote.

If the Senate passes it with changes, the bill returns to the House for final approval before reaching Trump's desk.

Why the delays?

Senator Cynthia Lummis predicted in September the bill would be signed by the end of 2025.

That clearly didn't happen…

The record 43-day government shutdown in October and November stalled legislative momentum, though regulators continued working on the bill during the shutdown.

What happens next?

Scott needs a supermajority to pass the bill without it getting permanently stalled.

That's the challenge.

If he can't secure the votes, the CLARITY Act risks being abandoned entirely - leaving crypto regulation in the same fragmented state it's been in for years.

But if it passes, the U.S. finally gets the market structure framework the industry has been demanding since 2017. 🚀

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

SAYLOR’S 3 PREDICTIONS 🍷

Michael Saylor recently spoke at CNBC’s Money 20/20 in Las Vegas and laid out his price prediction for Bitcoin across 3 timeframes.

Saylor at Money 20/20 In Las Vegas

There’s nothing new in philosophy - but he has now become very clear and specific in his predictions.

Let’s dive in. 👇

1) $150,000 by year-end

Saylor said Bitcoin should continue moving higher into the end of this year, with volatility gradually compressing as the market matures.

“Our expectation right now is end of the year it should be about $150,000. And that’s the consensus of the equity analysts that cover our company and the Bitcoin industry right now.”

His base case isn’t a blow-off move - it’s steady upward pressure.

2) Volatility keeps coming down

According to Saylor, Bitcoin’s price behaviour is changing as the market becomes more institutional and more structured.

“I think Bitcoin is going to continue to grind up. I think the volatility is coming off of it as the industry becomes more structured with more derivatives and more ways to hedge it.”

3) $1M next, $20M long-term

On longer timeframes, his view remains unchanged.

“I don’t know why it won’t grind up to a million dollars a coin over the next 4 to 8 years.”

And further out:

“My long term forecast is it goes up about 30% a year for the next 20 years. And we’re headed toward $20 million Bitcoin.”

This isn’t a call about next month or next quarter.

It’s a framework built around time, capital markets, and adoption.

Same thesis. Longer runway.

There’s a reason why Saylor’s a billionaire. 💲

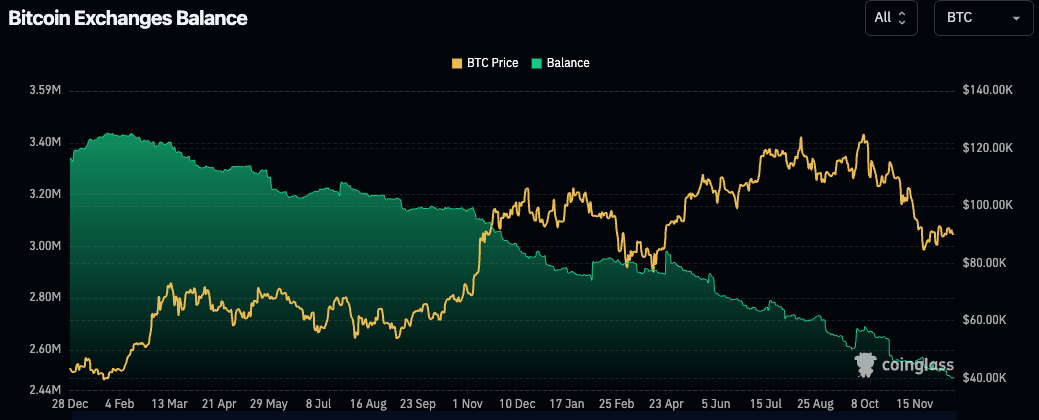

EXCHANGE RESERVES COLLAPSING 📉

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Just 2.49 million BTC now sit on exchanges - 12.47% of the total supply.

Since January, around 440,000 BTC have been withdrawn - pulled off the open market and into cold storage, treasuries, and long-term wallets.

That's not rotation. That's conviction.

Yes, some weak hands are breaking. Short-term holders are folding. But the bigger picture hasn't budged.

The liquid float keeps shrinking. The base of committed holders keeps expanding.

This isn't what distribution looks like. It's what re-accumulation looks like. 🧱

CRACKING CRYPTO 🥜

New SEC rules lets Morgan Stanley, Goldman Sach legally “control” your private keys without the safety net you assume exists. Regulators just quietly removed the primary "safe harbor" requirement, allowing banks to claim custody of your assets.

Why the ‘great China Bitcoin mining crackdown’ fell short of early claims. Data suggests that recent concerns about Xinjiang-related Bitcoin mining have overstated the impact, with most hashrate losses proving brief and driven partly by US power curtailments.

What if crypto's U.S. market structure effort just never gets there? Guessing the direction of Congress is akin to long-range weather prediction, with so many variables in play, and the industry's fate depends on a break in the storm.

Bitwise joins race to launch SUI ETF with latest SEC filing. Crypto index fund manager Bitwise is seeking to launch an exchange-traded fund tracking the SUI token.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Are you ready for this week’s quiz?

5 questions. All from this week’s issues. If you’ve been paying attention, you’ll crush it. If you’ve been skimming, it’ll show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 10,000 BTC 🥳

On May 22, 2010, Hanyecz paid 10,000 BTC for two Papa John's pizzas. At today's prices, that's around $900 million worth of Bitcoin.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.