Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all 96,759 of you. Crypto Nutshell #558 keepin’ it sweet… 🍇🥜

We're the crypto newsletter that's more chaotic than a group of magicians pulling off impossible heists with a deck of cards... ♠️🎩

What we’ve cooked up for you today…

🤔 The Bull run is just starting?

🔭 Time to zoom out

😱 The end

💰 And more…

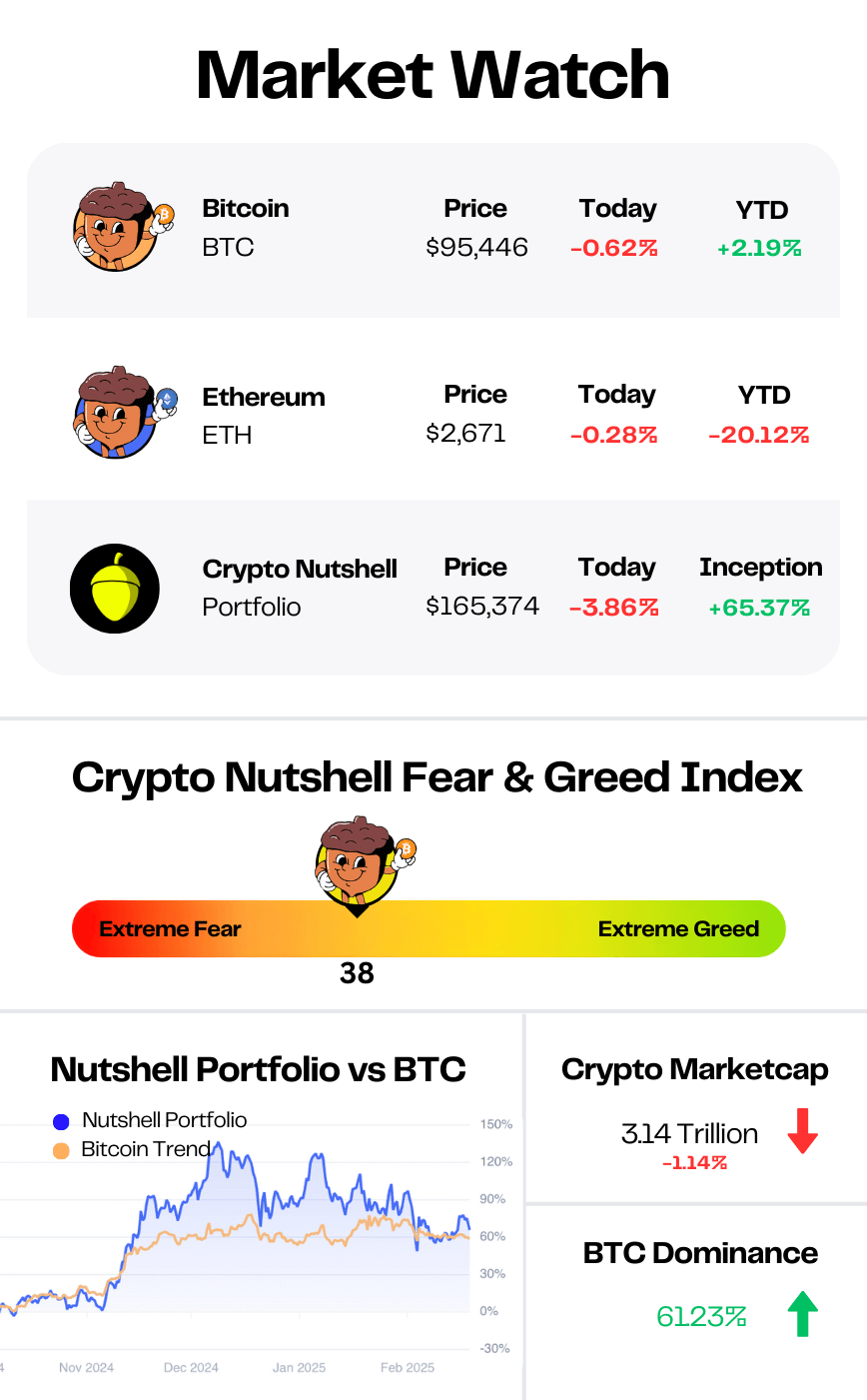

Prices as at 3:05am ET

THE BULL RUN IS JUST STARTING? 🤔

BREAKING: U.S. Crypto Task Force to Focus on Delivering National Bitcoin Reserve: Bernstein

Although market sentiment isn’t the greatest right now…

Bitcoin’s bull run isn’t slowing down, it’s only just getting started.

According to Bernstein analysts, the next major wave of demand will come from institutions and sovereign wealth funds.

Bernstein notes that Trump’s crypto task force is making the establishment of a national Bitcoin reserve a top priority.

"A creation of a U.S. Bitcoin reserve could lead to a global race amongst sovereigns to Buy bitcoin as one of the reserve assets."

But how would the US fund such a large Bitcoin purchase?

Bernstein outlines 3 possibilities:

Sell some of its gold reserves

Use the $20B in Bitcoin already seized from criminal enterprises

Issue more debt

And it doesn’t stop there.

The Trump administration is also working on creating a sovereign wealth fund (SWF).

Bernstein believes this fund will likely invest in key US crypto companies, such as MicroStrategy and Coinbase.

The logic behind this assumption is that the two cabinet members tasked with creating the SWF are known Bitcoin and crypto bulls. (Scott Bessent & Howard Lutnick)

“Investors should position themselves for the next leg of the bull market across Bitcoin and Bitcoin-linked equities.”

But the big money isn’t just sitting around waiting for the US to make a move.

Just last week, Abu Dhabi’s sovereign wealth fund disclosed a $436 million Bitcoin ETF purchase.

“The confluence of adoption by banks, institutional investors, corporates and eventually sovereigns (directly or via sovereign funds) is positioning Bitcoin as the clear challenger to gold.”

With institutional adoption accelerating, Bernstein analysts predict Bitcoin will hit $200,000 by the end of 2025.

“With accelerating institutional adoption, we expect Bitcoin to hit $200,000 by the end of 2025. And that’s being conservative.”

Governments and institutions are continuing to stack, and people are bearish out there?

MAKE EVERY TRANSACTION COUNT 💳

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.*

TIME TO ZOOM OUT 🔭

Crypto’s been rough in 2025.

Bitcoin’s flat at best, most altcoins are bleeding.

Everyone’s calling the cycle dead.

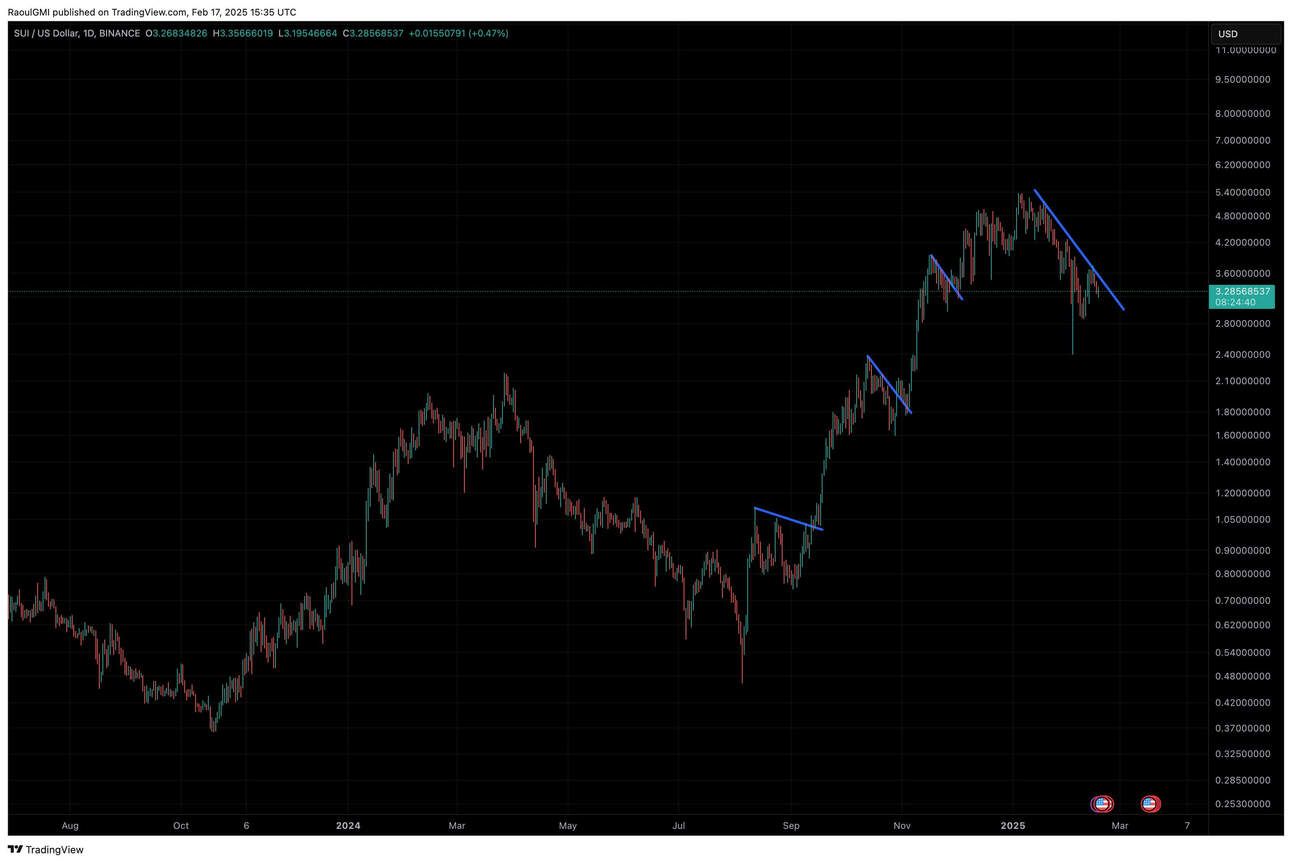

Raoul Pal says: zoom out.

Raoul is a veteran macroeconomic expert with one of the best track records in crypto.

Today, he shared 4 charts to remind everyone where crypto is going.

1. Bitcoin:

2. Ethereum:

3. Solana:

4. Sui:

When you zoom out on all the majors, it’s clear where they’re heading:

Up & to the right.

“We remain in the midst of the Greatest Macro Trade of ALL TIME. All the wiggles and the timeline FUD are just noise. All you require to capture it is not be too far out on the risk curve, not using leverage and the ability to have patience and zoom out. Don't F*ck This Up.”

A timely reminder. ⏰

THE END 😱

The streak is over. 😥

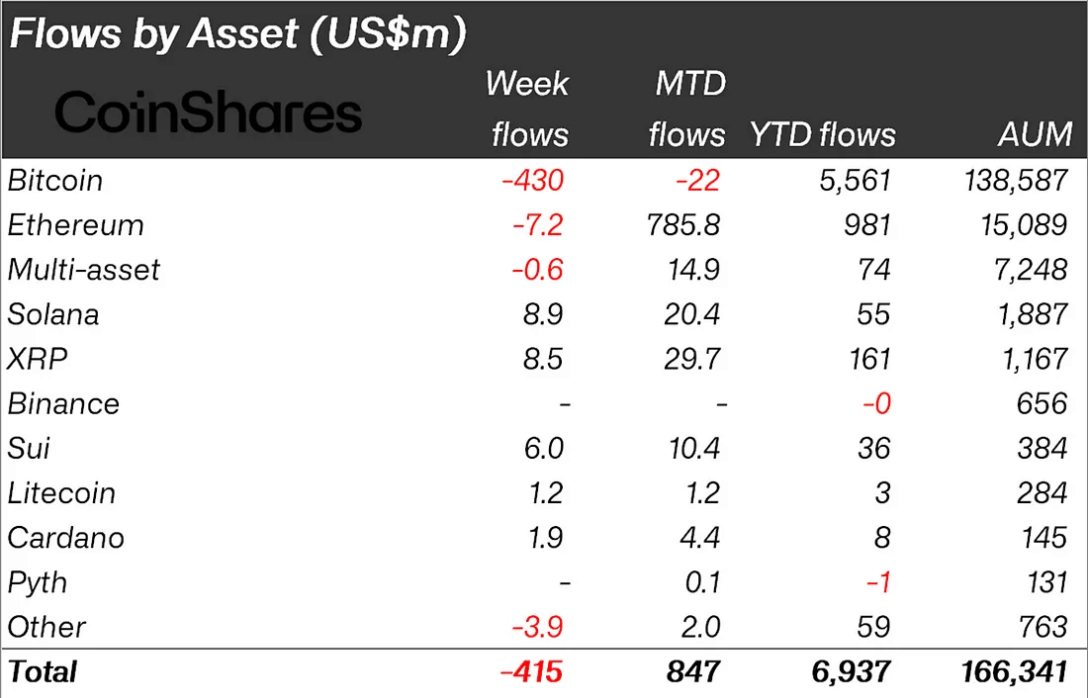

Last week Digital asset funds saw net outflows totalling $415 million.

This ended an impressive 19 week inflow streak, totalling $29.4 billion.

Let’s break it down.

Bitcoin saw the majority of outflows this week, with $430 million.

Ethereum also experienced outflows, with $7.2 million exiting.

Meanwhile…

Solana had an impressive week, with net inflows of $8.9 million.

XRP also saw solid inflows, adding $8.5 million.

As always, the United States was the focal point, with a massive $464 million in net outflows.

Germany, Switzerland and Canada all saw net inflows of $21m, $12.5m & $10.2m respectively.

So what caused this sudden outflow?

The sell-off was triggered by Jerome Powell’s congressional hearing last week, where he signalled a more hawkish monetary policy stance.

On top of that, inflation came in way hotter than expected, further reducing hopes for interest rate cuts.

With rate cuts now unlikely until at least October 2025, market sentiment has shifted.

This marks the first major reversal after months of steady inflows.

However, with institutional interest still growing, we believe this is only a short-term shakeout.

CRACKING CRYPTO 🥜

Argentina's stock market plummets amid President Javier Milei's LIBRA memecoin scandal. Argentina faces political and financial uproar as President Milei distances himself from the collapsing LIBRA memecoin.

Ether Rally Turns Into Crypto Market Slide With Bitcoin Slipping Below $96K. Ether's brief run to $2,850 on Monday was due to a catch-up trade that could reverse later, one trader said.

‘Bitcoin fixes this’ — Here’s why BTC is better than Fort Knox gold. US Senator Rand Paul has called for an audit of Fort Knox gold reserves, sparking a debate over Bitcoin's transparency and financial trust compared to traditional assets.

Bitcoin dominance nears multi-year high amid Libra memecoin collapse. Bitcoin’s market dominance has surged past 60%, driven by institutional investment.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When did FTX file for bankruptcy?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) November 2022 🥳

FTX was a leading cryptocurrency exchange that went bankrupt in November 2022.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.