GM to all of you nutcases. It’s Crypto Nutshell #705 fuelin’ up… ⛽🥜

We're the crypto newsletter that's more magical than a nanny flying in with an umbrella to fix a broken family... ☂️✨

What we’ve cooked up for you today…

🏦 Crypto supply chain attack

⚰️ 4 year cycle is gone

📉 Has sentiment flipped?

💰 And more…

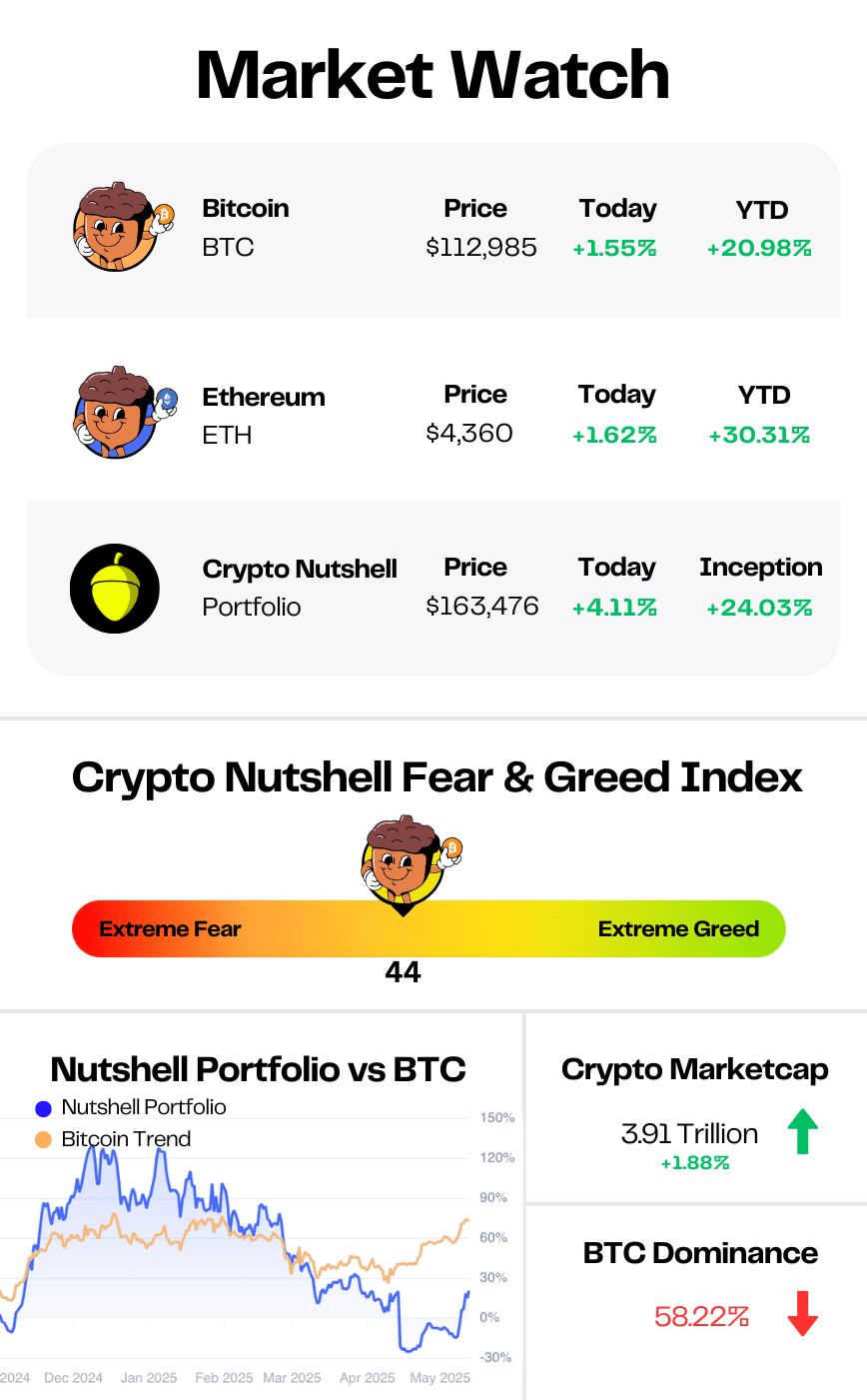

Prices as at 4:00am ET

CRYPTO SUPPLY CHAIN ATTACK 🏦

BREAKING: Ledger CTO warns users to halt onchain transactions amid massive NPM supply chain attack

The biggest supply chain attack in history just hit crypto. 🚨

Ledger CTO Charles Guillemet sounded the alarm today after hackers compromised the NPM account of a well-known developer.

And to be clear - this isn’t just a Ledger issue. It potentially impacts everyone in crypto.

The breach injected malicious code into popular JavaScript libraries like chalk, strip-ansi, and color-convert - utilities buried in the dependency trees of countless projects.

Together, they’re downloaded billions of times every single week.

The attack is as simple as it is devastating: a crypto-clipper that silently swaps wallet addresses mid-transaction, diverting funds to the attacker.

It doesn’t auto-drain wallets, but it can hijack what happens when you hit “send” or “swap.”

Unless you’re double-checking every detail on a hardware wallet with Clear Signing, you may not even notice until it’s too late.

Security experts say this could be the largest supply chain attack ever - one that shows just how dependent crypto still is on Web2’s open-source infrastructure.

Researchers from Blockaid to DefiLlama warned that software wallets are most exposed, while hardware wallets with secure screens remain safe.

NPM has already disabled the compromised packages, but the risk lingers.

Developers who updated in the last few hours may have unknowingly pulled in malicious versions.

And because users can’t easily tell which websites were affected, experts are urging extreme caution until the ecosystem cleans up.

The bottom line: this wasn’t a bug in some obscure protocol.

It was a breach in the very plumbing of the internet. Even the strongest crypto stacks are only as secure as their weakest dependency.

Let this be a reminder…

Always verify before you sign, and triple-check addresses before you send.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

4 YEAR CYCLE IS GONE ⚰️

It’s the biggest question in crypto right now:

Will Bitcoin peak in October, November, December - like it always has in past cycles?

Or are we about to see this bull run stretch deep into 2026?

Well, Tom Lee - Wall Street veteran, Fundstrat founder, and now the driving force behind Ethereum treasury companies - gave his answer.

Tom is of the camp that the 4-year cycle is dead.

In his latest appearance on the Coin Stories podcast, Tom Lee said the 4-year cycle is finished:

“I think Bitcoin should be over a million over time… and I kind of prescribe to the view that maybe the four-year cycle’s ending for Bitcoin because of the way institutional adoption is taking place.”

Lee believes permanent institutional holders have changed the game.

The old retail-driven boom/bust rhythm no longer applies.

We agree. The 4-year halving cycle isn’t the map anymore. Institutions are.

However, Tom does still think we will get a large rally into the end of 2025.

According to Lee, Bitcoin should “really build upon $120K before the end of the year” he is targeting a whopping $200K - $250K by year’s end.

I don’t think any of us would be unhappy with that. 🥂

HAS SENTIMENT FLIPPED? 📉

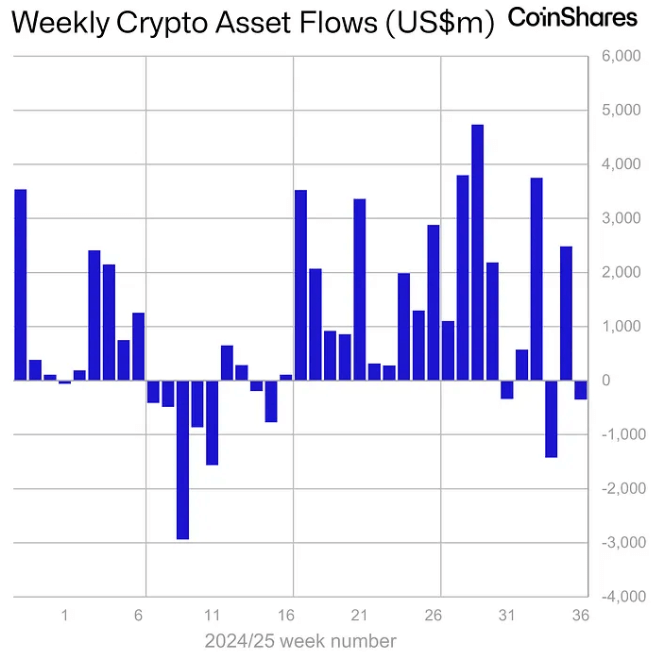

After a solid week of inflows, outflows returned…

Digital asset funds saw outflows totalling $352 million last week.

Let’s break it down.

Ethereum was primarily responsible for the weekly outflows, with $912.4 million exiting.

Despite this outflow, yearly inflows remain high at $11.18 billion.

Whilst Bitcoin saw inflows of $524 million for the week.

Solana and XRP continued their hot streaks with inflows of $16.1M and $14.7M respectively.

Regionally, the U.S. led with $440M in outflows, followed by Sweden (-$13.5M) and Switzerland (-$2.7M).

Meanwhile, Germany ($85.1M), Hong Kong ($8.1M), and Canada ($4.1M) all saw inflows.

Trading volumes dropped 27% week-on-week, despite weak payrolls and rising odds of a September rate cut.

CoinShares notes that the mix of lighter flows and softer volumes points to a market briefly cooling.

But the bigger picture holds. Year-to-date inflows of $35.18B are still running 4.2% ahead of last year’s pace on an annualized basis.

In other words, sentiment hasn’t cracked. It’s just taking a breather.

CRACKING CRYPTO 🥜

Tether CEO refutes claims that the firm sold Bitcoin and bought gold. CEO Paolo Ardoino said that Tether did not sell any BTC and that it will continue to invest in “safe assets like Bitcoin, Gold and Land.”

US SEC crypto task force to tackle financial surveillance and privacy. The SEC's crypto task force, headed by Commissioner Hester Peirce, will conduct another roundtable event in October amid proposed policy changes in coordination with the CFTC.

BitMine Now Holds $9B in Crypto Treasury, Fuels 1,000% Surge in WLD-Linked Stock. BMNR also announced a $20 million investment in Eightco Holdings (OCTO), which plans to hold worldcoin (WLD) as its primary treasury asset.

'Bias against bitcoin': Analysts compare Strategy's S&P 500 exclusion to previous Tesla, Facebook snubs. Strategy, the software company turned corporate bitcoin treasury, was not included in the latest rebalancing of the S&P 500 index.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What key mechanism introduced after the London upgrade (EIP-1559) reduces Ethereum’s supply over time?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Transaction fee burning 🥳

With EIP-1559, a portion of every transaction fee is burned, making ETH deflationary during high activity. 🔥

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.