GM to all of you nutcases. It’s Crypto Nutshell #683 heatin’ up… 🍲🥜

We're the crypto newsletter that's more thrilling than a master thief plotting the biggest casino heist in history... 🎰💼

What we’ve cooked up for you today…

🏦 Harvard goes in

🧠 Why 0.01 Bitcoin Matters

🤯 Supply shock

💰 And more…

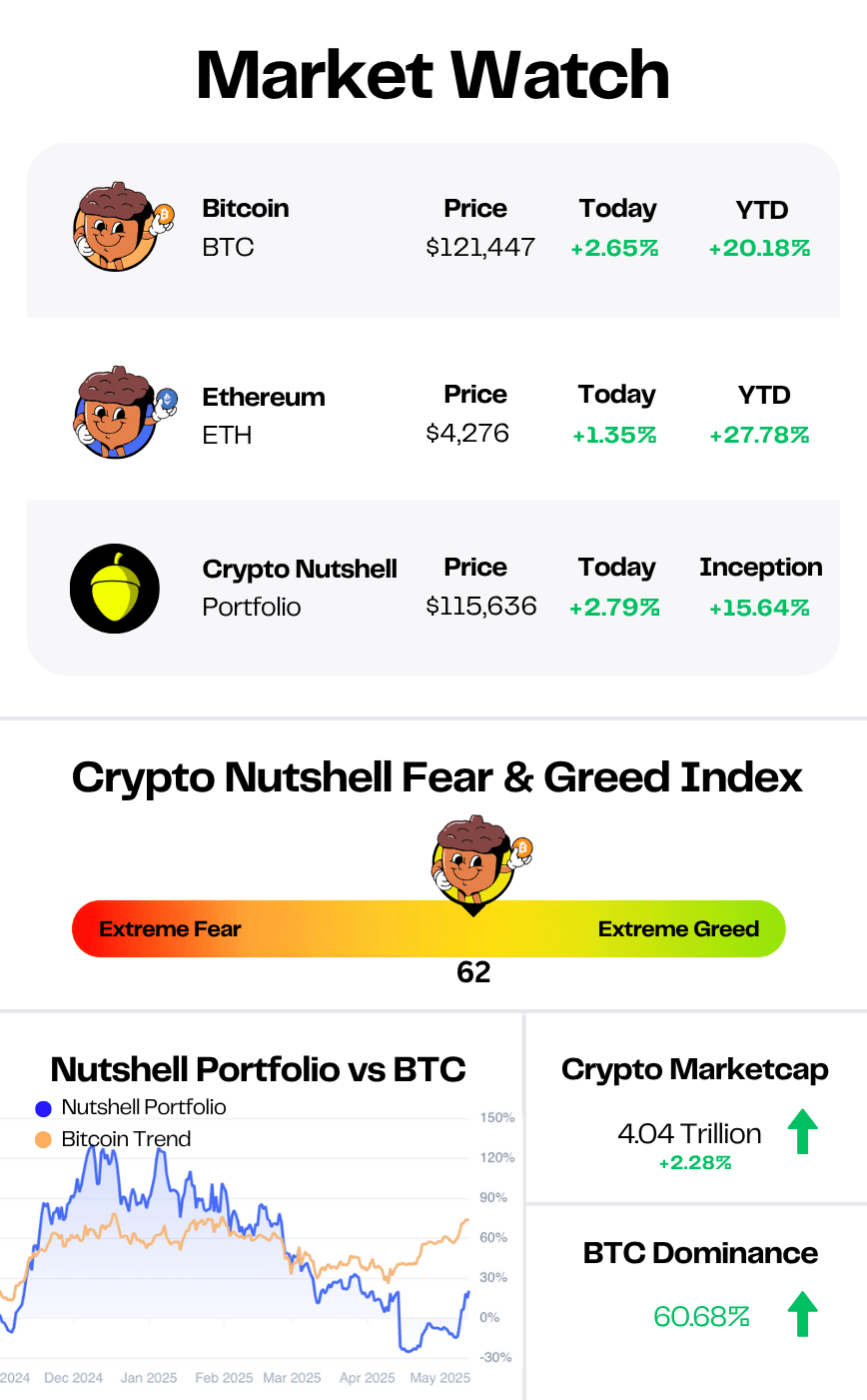

Prices as at 5:20am ET

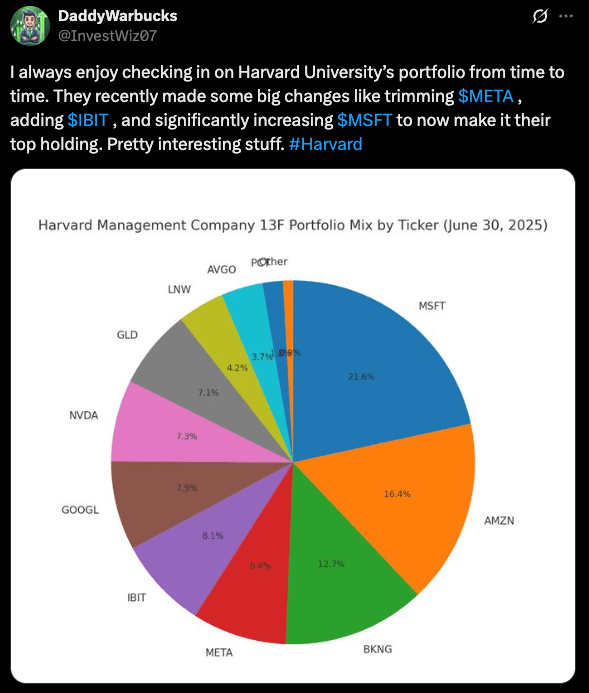

HARVARD GOES IN 🏦

BREAKING: Harvard Reports $116M Stake in BlackRock’s iShares Bitcoin ETF in Latest Filing

Harvard just made one of the biggest Bitcoin moves we’ve ever seen from a U.S. university endowment…

In its latest SEC filing, Harvard Management Company - which runs the school’s $53B endowment - disclosed a $116 million position in BlackRock’s Bitcoin ETF (IBIT).

That’s 1.9 million shares.

It’s also Harvard’s fifth-largest holding, ahead of Alphabet (Google’s parent company).

And it sits just behind Microsoft, Amazon, Booking Holdings, and Meta.

BlackRock’s IBIT, launched in January 2024, has been a rocket ship.

Now managing $84B in assets, it’s pulled in everyone from sovereign wealth funds to state pensions.

For institutions, it’s the perfect package: regulated, liquid Bitcoin exposure - no wallets, no custody headaches, full SEC oversight.

Bitcoin ETF Flows

This isn’t just a flashy headline. It’s a signal.

Spot Bitcoin ETFs are moving from “new product” to core portfolio position for the biggest players in finance - right alongside blue-chip tech stocks.

And as more endowments, pension funds, and asset managers join in, the wall of money flowing into regulated Bitcoin products is only getting taller.

Bottom line: Harvard isn’t just talking about Bitcoin anymore. It’s stacking it - and that speaks volumes about where institutional conviction is headed. 🚀

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

WHY 0.01 BITCOIN MATTERS 🧠

Let’s say it how it is: Bitcoin is expensive in 2025.

It’s now well over $100,000+… and people keep asking:

“Did I miss the boat?”

Not even close.

In fact, owning as little as just 0.01 BTC puts you ahead of 99.96% of the world.

And in our return to YouTube, we’re breaking it all down - the 5 levels of Bitcoin wealth, ranging from 0.01 BTC to 10+ BTC.

Here’s the kicker:

If you hold just 0.01 BTC - that’s rarer than:

A vintage Ferrari 🏎️

A beachfront villa 🏖️

A million-dollar net worth 💰

Why?

Global population: 8 billion 🌍

True Bitcoin supply: ~16.6 million ₿

Divided evenly: just ~0.002 BTC per person 🧮

If you own more than that - you’re already above the mathematical average.

In this video, we cover:

✅ The new 5 Bitcoin wealth tiers (and where you rank)

✅ How insanely rare 0.01 BTC really is

✅ Why time is running out to stack even a small amount

From Compys to Titanosaurs…

We have built a new 5-Level Bitcoin wealth ladder - and odds are, you’re richer than you think:

(With all signs pointing to Bitcoin and crypto heating up BIG in the second half of 2025, we knew we had to come back to YouTube.

Daily uploads start this week - covering the most important moves, narratives, and macro shifts you need to know.

If you’re new here, hit subscribe - we promise you won’t regret it 😉)

SUPPLY SHOCK? 🤯

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 17.08% (up from 16.91%)

1y - 2y: 11.54% (up from 11.31%)

2y - 3y: 7.65% (down from 7.73%)

3y - 4y: 6.20% (down from 6.55%)

4y - 5y: 8.91% (up from 8.70%)

5y - 10y: 14.54% (down from 14.58%)

>10y: 8.90% (up from 8.88%)

TL;DR: 74.82% of all Bitcoin hasn’t moved in over six months 🔒

The latest shift tells a clear story.

Coins that were moving earlier this year are steadily aging into longer-term holding bands.

The 6–12 month group saw one of the largest jumps, and both the 1–2 year and 4–5 year cohorts climbed as well.

That’s fresh capital turning into committed capital.

Meanwhile, small pullbacks in the 2–3 year, 3–4 year, and 5–10 year ranges point to selective profit-taking - not a wave of selling.

These dips are minor compared to the total held supply.

The bigger takeaway? Even at or near record prices, Bitcoin’s base of long-term holders isn’t flinching.

Supply is still tightening, conviction remains firm, and every passing week locks up more BTC in deep storage. 🚀

CRACKING CRYPTO 🥜

Bitcoin’s ‘mid-cycle strength’: Tuur Demeester predicts $500k target and historic institutional bull run. Adamant Research and Tuur Demeester say Bitcoin’s bull run is far from over, and predict that prices could rise 4–10x.

Vitalik Buterin reclaims ‘onchain billionaire’ crown as Ether tops $4.2K. On Saturday, Arkham noted that Ethereum co-founder Vitalik Buterin regained his onchain billionaire status just days after Ether topped $4,000 for the first time in eight months.

Arthur Hayes ‘Had to Buy It All Back’ After Selling $8.3M ETH Previously. The quick buyback suggests Hayes may see renewed upside in ether, contradicting his earlier prediction of a market downturn.

White House crypto council head Bo Hines to step down, return to private sector. Hines will be replaced by his current deputy, Patrick Witt, also a former college football player and GOP congressional candidate.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Roughly how much Bitcoin must someone hold to be considered a whale?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 1,000 BTC or more 🥳

A Bitcoin whale typically holds 1,000 BTC or more — enough to sway market prices with a single large trade.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.