Today’s edition is brought to you by Crypto Nutshell Pro.

If you’re interested in altcoin coverage, buy recommendations & want to know what’s in the Crypto Nutshell Portfolio, click here to join now the waitlist now!

GM to all of you nutcases. It’s Crypto Nutshell #709 makin’ magic… 🧙♂️🥜

We're the crypto newsletter that's more inspiring than a boxer rising from nothing to become a champion... 🥊⭐

What we’ve cooked up for you today…

🏦 The digital asset treasury (DAT) trend

⏳ The first 5-year cycle

📉 Profit taking?

💰 And more…

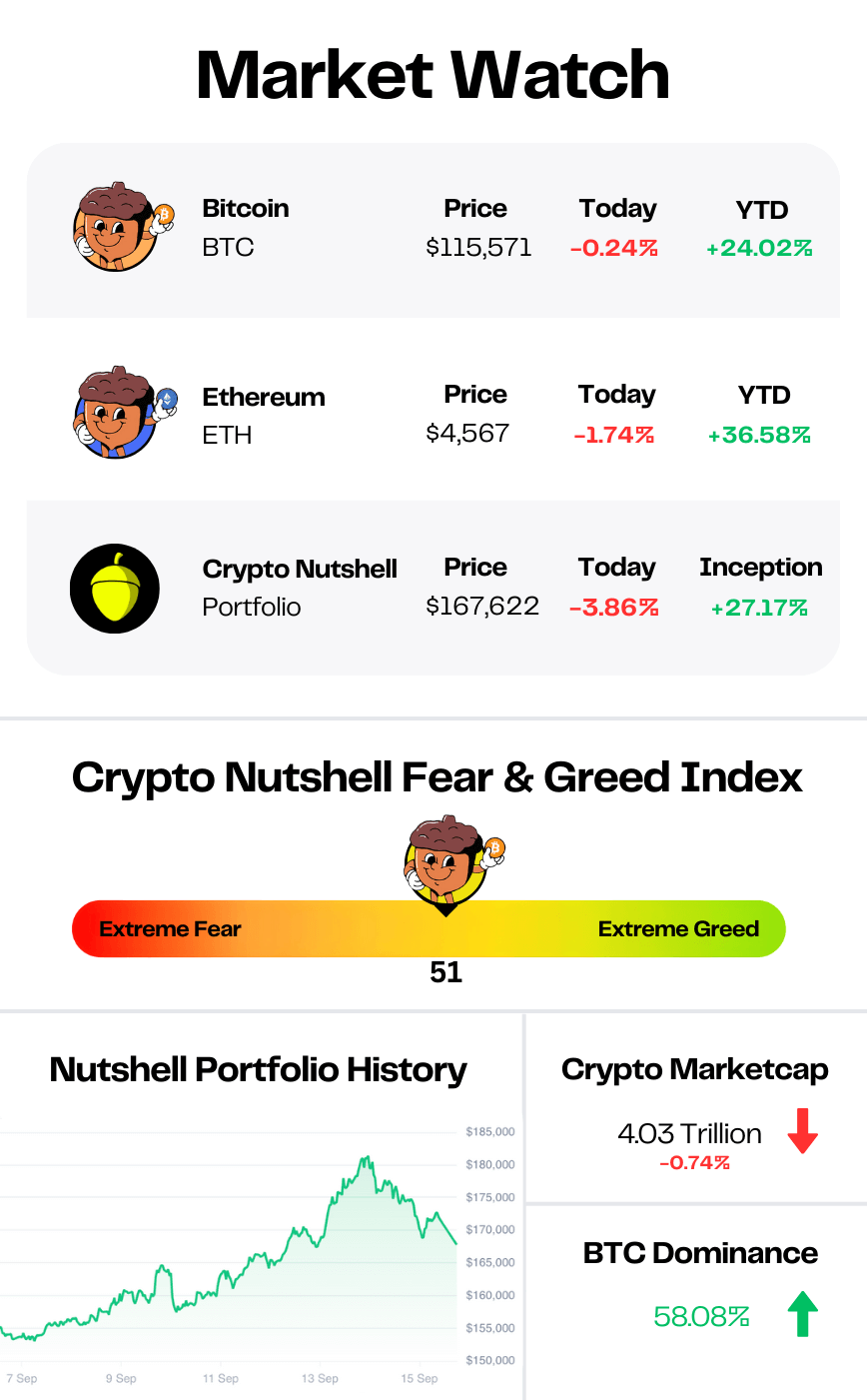

Prices as at 4:10am ET

THE DIGITAL ASSET TREASURY TREND 🏦

BREAKING: Corporate Bitcoin Buying Slows in August as Treasuries Add $5B

Bitcoin treasuries just hit a milestone… and a slowdown…

In August, tracked entities added 47,718 BTC ($5.2B).

That’s less than half of July’s frenzy - but it still pushed total holdings to 3.68M BTC worth $400B.

And for the first time ever, public companies alone crossed 1 million BTC, doubling their balances from late 2024.

The month’s biggest movers:

Bullish (BLSH) revealed 24,000 BTC on its books following its IPO. CEO Tom Farley told CNBC: “It feels like institutional investors think this could be the moment.”

KindlyMD (NAKA) purchased 5,744 BTC ($679M), its first big buy since merging with Nakamoto Holdings. CEO David Bailey called Bitcoin the “ultimate reserve asset” and doubled down on the firm’s mission to accumulate 1 million BTC.

Metaplanet added 1,859 BTC, bringing its total above 18,900 BTC. President Simon Gerovich said the company is “on track to reach 30,000 BTC in 2025 and 1% of all Bitcoin by 2027.”

But while corporate conviction remains sky-high, the pace of buying slowed.

Strategy, KindlyMD, and Metaplanet announced more than $15B in equity raises, but much of that dry powder hasn’t hit the market.

The lag between announcements and actual purchases may explain why Bitcoin’s August rally to $123K faded back under $109K.

Galaxy’s Mike Novogratz summed it up:

“I think we’ve probably gone through peak treasury company issuance of new companies. What will be most interesting is which of the existing companies become monsters, right?… These treasury companies have done an amazing job of bringing people into the crypto tent, and I think they’re going to continue to play a pretty important part.”

The takeaway?

Corporate Bitcoin adoption isn’t stalling - it’s consolidating.

Holdings are climbing. New players are entering. Milestones are falling.

And with fundraising running ahead of buying, the next wave hasn’t even started. 🌊

Out-Return Bitcoin This Cycle 🚨

Our top altcoin pick hasn’t just survived 2025’s tough market… it’s crushed it…

Since we added it:

Our #1 altcoin pick → +249.72%

Ethereum → +96.75%

Bitcoin → +87.18%

Altcoins have struggled in 2025. Our portfolio hasn’t.

Crypto Nutshell Pro isn’t open right now, but the waitlist is.

When we do open, spots are limited. Join early, or miss out.

If you’re interested in altcoin coverage, buy recommendations & want calls that outperform Bitcoin, click below to join the waitlist:

THE FIRST 5-YEAR CYCLE ⏳

Everyone’s obsessed with the 4-year cycle.

But Jesse Eckel - crypto analyst turned $1.7M→$10M portfolio builder - says the story has changed.

This will be the first 5-year cycle… 👀

The Real Driver of Bull Markets 🚀

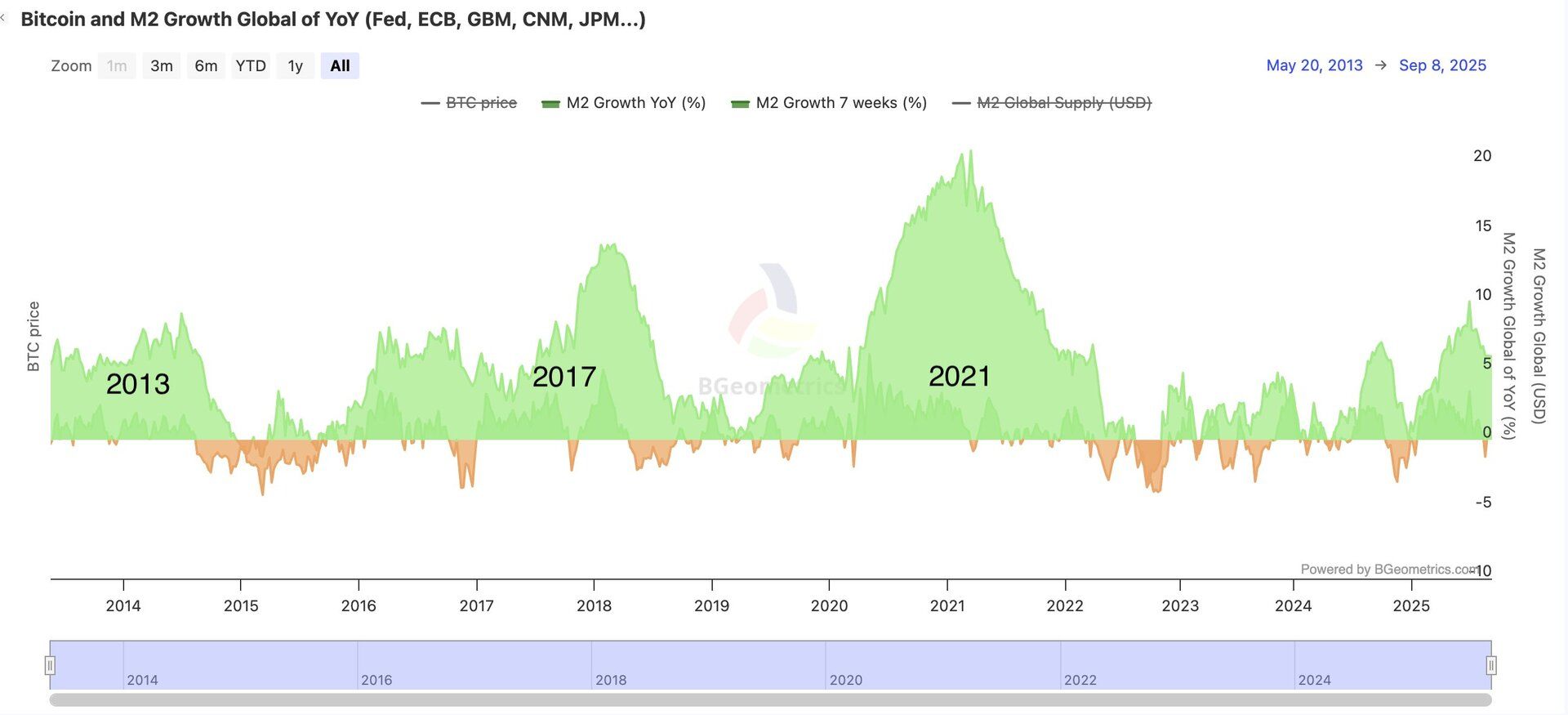

It was never the halving.

People love to say Bitcoin’s “halving” (when new supply gets cut in half) is what drives bull markets. But that’s not what really moves the market.

In Jesse’s latest post, he broke down the real driver of crypto bull markets.

The real driver has always been liquidity - how much cheap money is flowing through the system. Every ~4 years, government policies created bursts of easy credit, and crypto boomed alongside it.

How COVID Changed Everything 🦠

The massive global response to COVID in 2020 broke that old rhythm.

Governments printed and spent at unprecedented levels, which distorted the normal cycle.

This time around, the usual wave of cheap credit never came, so we never saw true “euphoria” in crypto.

This Cycle Was Different 📉➡️📈

Instead of wild money-printing, this cycle has been mostly narrative-driven:

Crypto ETFs

Institutions entering the space

Clearer regulation + nationstate adoption

2026 Could Be the Big One 💥

According to Jesse, everything changes going into 2026:

Governments are preparing to cut interest rates and make credit cheaper, heading into year 5 of the cycle.

Policy tweaks will push even more money into markets.

The Clarity Act will unlock a flood of new crypto adoption.

Altcoin ETFs could ignite the next big boom in non-Bitcoin assets.

👉 Translation: Crypto’s current cycle won’t follow the old 4-year pattern.

Jesse says this will be the first true 5-year cycle - and the real fireworks are still ahead.

We agree. 🎆

PROFIT TAKING? 📉

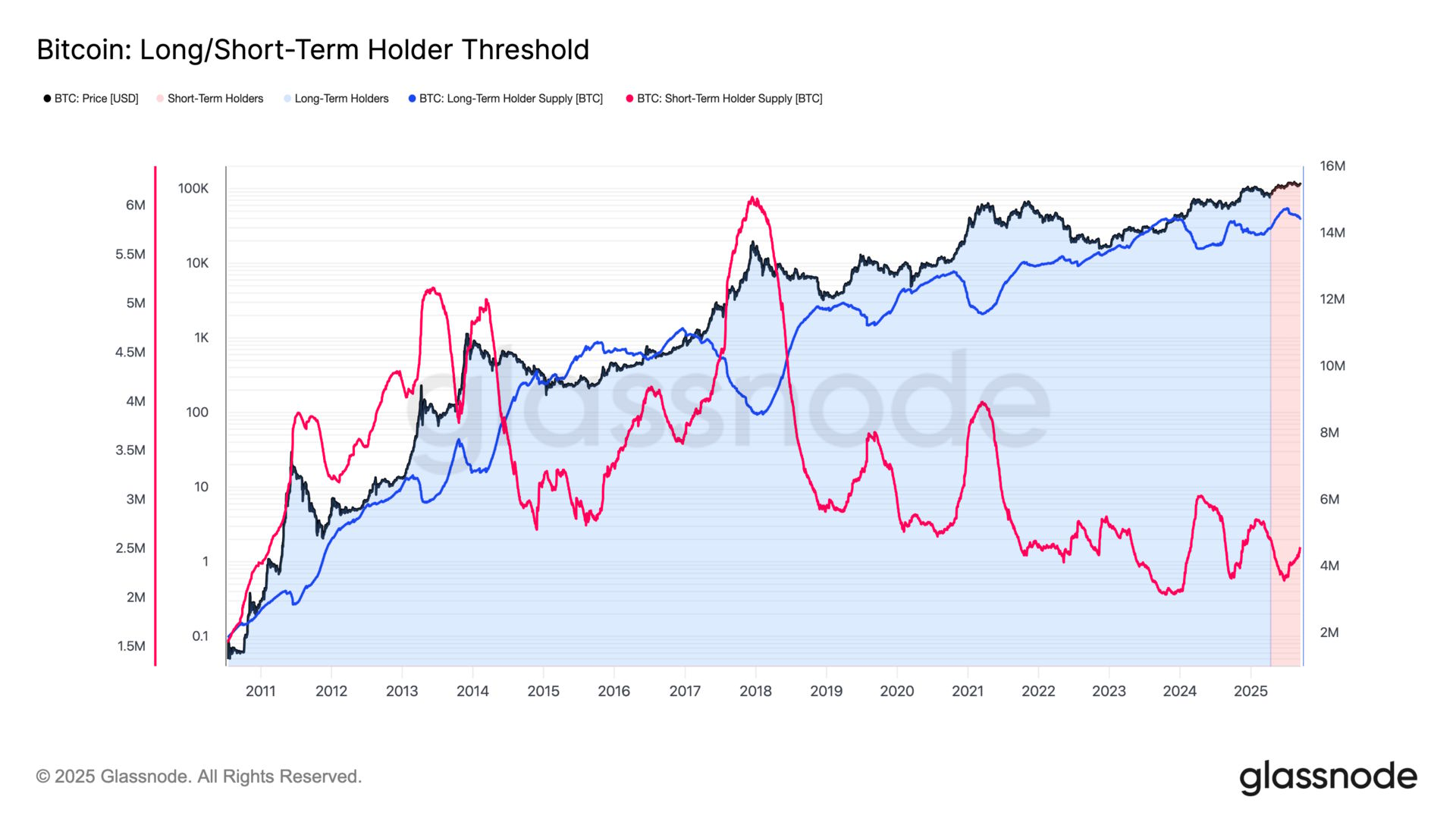

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): Coins held for less than 155 days

🔵 Long-Term Holders (LTHs): Coins held for more than 155 days

🟥 Short-Term Holder Cost Basis: All coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: All coins purchased in this price range are LTHs

This metric is powerful because it shows exactly what price range long and short term holders bought their Bitcoin at. 🔍

The new key cutoff date is April 13, 2025 - when Bitcoin was hovering near $84K.

Anything bought before that? Long-term (LTH).

After? Short-term (STH).

Here’s the breakdown:

LTHs: 14.44M BTC → 72.49% of supply

STHs: 2.51M BTC → 12.60% of supply

Over the past two weeks, long-term holders unloaded a net 58,945 BTC - indicating some level of profit taking.

But let’s keep perspective: more than 70% of all Bitcoin is still locked up in long-term hands.

That’s massive. Conviction hasn’t gone anywhere - the base remains rock solid. 🚀

CRACKING CRYPTO 🥜

Institutions like Strategy and Metaplanet now hold 12.3% of the total Bitcoin supply. Institutions now hold 12.3% of all Bitcoin in existence and it's a trend that will continue as Bitcoin supply rotates from early holders.

Investment giant Capital Group’s $1B bet on Bitcoin treasuries balloons to $6B. Capital Group’s $1 billion entry into Bitcoin treasury stocks has grown to over $6 billion, with major holdings in Strategy and Metaplanet and led by Mark Casey.

Gemini (GEMI) Stock News: Soaring in First Trades After IPO. The Winklevoss-led crypto exchange had sold 15.2 million shares, raising $425 million.

Pakistan's crypto regulator invites crypto firms to get licensed, serve 40 million local users. Pakistan is looking for crypto firms who have already been regulated in major jurisdictions to serve its 40 million crypto users with Sharia-compliant service.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What consensus mechanism secures the Bitcoin network?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Proof of Work 🥳

Over 99% of Bitcoin will be mined by 2040, but the very last fraction won’t be mined until 2140. ⏳

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.