GM to all of you nutcases. It’s Crypto Nutshell #822 stackin’ evidence… 🗃️🥜

We’re the crypto newsletter that’s more explosive than a cartel war where nobody plays fair… 💣🌵

What we’ve cooked up for you today…

🤝 AI and crypto

🧮 The simple math behind $500k Bitcoin

🪗 Never been this tight

💰 And more…

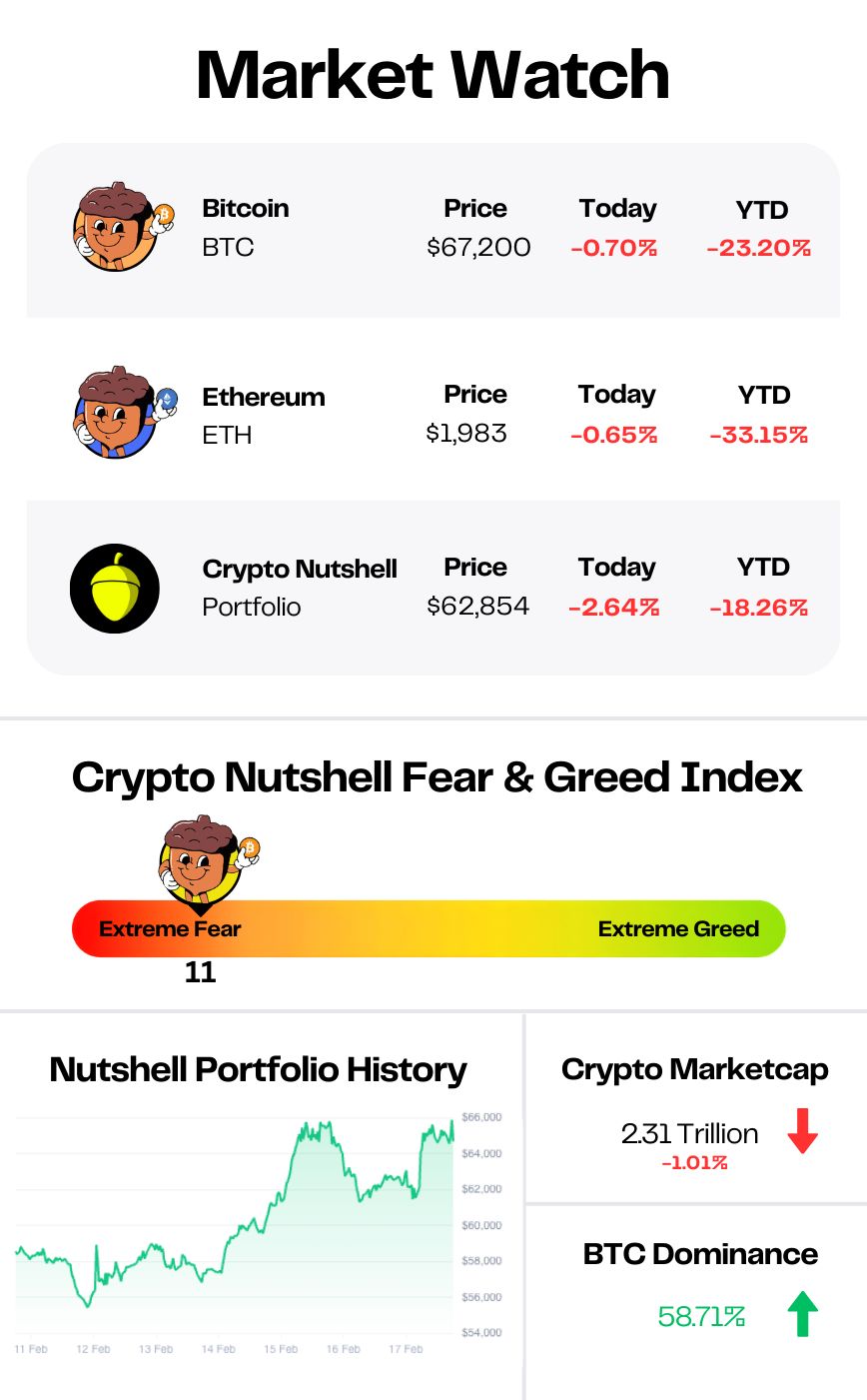

Prices as at 2:30am ET

AI AND CRYPTO 🤝

BREAKING: OpenAI just teamed up with one of crypto's biggest investors to let AI hunt for smart contract bugs

AI and crypto just got a lot closer…

OpenAI and Paradigm have launched EVMbench - a new tool designed to test whether AI agents can find, fix, and even exploit vulnerabilities in Ethereum smart contracts.

Smart contracts power almost everything in DeFi.

Lending protocols, decentralized exchanges, token launches - all built on code that can't be changed once it's live.

That's the whole point. But it also means one bug can drain millions.

And it keeps happening…

Just this month, DeFi protocol Moonwell was exploited through vulnerable code that was actually written with AI assistance. (The irony…)

CrossCurve lost around $3 million in a separate smart contract attack.

So now the question is simple: can AI fix what AI helped break?

EVMbench tests that across three modes:

Detect - find the bug

Patch - fix it without breaking the contract

Exploit - try to drain the funds in a sandboxed environment

And the results so far are promising.

OpenAI's GPT-5.3-Codex scored 72.2% in exploit mode. That's up from just 31.9% for GPT-5 six months earlier. Detection and patching still lag behind, but the trajectory is steep.

The benchmark draws on 120 real vulnerabilities from 40 audits, including security work done on Tempo - Stripe's purpose-built Layer 1 blockchain for stablecoin payments.

That's traditional finance infrastructure being stress-tested by AI. A year ago that sentence wouldn't have made sense.

And OpenAI isn't alone here.

Anthropic published a report late last year arguing that AI agents have already progressed enough to identify smart contract flaws - meaning exploit costs are likely to fall.

The question now isn't whether AI will reshape crypto security.

It's how fast. 🚀

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

THE SIMPLE MATH BEHIND $500K BITCOIN 🧮

Ric Edelman manages $270 billion in assets. He's one of the most respected financial advisors in the world, advising everyone from retail investors to institutional giants.

And he just laid out the bull case for $500,000 Bitcoin.

Not with hope. With arithmetic.

Here's how he broke it down in his latest interview.

The total value of all the world's assets - stocks, bonds, real estate, gold, cash - adds up to roughly $750 trillion.

The average investor in the world does not yet own Bitcoin.

But that's changing. Governments are buying. Sovereign wealth funds are buying.

Pension funds, endowments, hedge funds, insurance companies, banks, brokerages - they're all starting to move in.

Edelman's thesis is simple. If everyone who holds a diversified portfolio ends up allocating just 1% to Bitcoin, that's $7.5 trillion in inflows.

Add that to Bitcoin's current market cap, and you land at roughly $500,000 per coin.

That's it. That's the math.

Now, Edelman was clear: this will not be a straight line. The road from here to there will be bumpy. The past couple of months have already proven that.

But the direction? He's not questioning it.

And neither is the institutional money that's quietly building positions while everyone else panics over short-term drawdowns.

1% from everyone changes everything. 🚀

NEVER BEEN THIS TIGHT 🪗

Time for check in on Ethereum’s supply side dynamics.

To do that we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

37.23 million ETH is now locked in staking. That's up 1.24 million ETH since the start of 2026.

30.85% of the entire supply - locked. Earning yield. Not returning to exchanges.

Meanwhile, exchange balances keep draining. Long-term holders stay put.

The circulating supply has never been this tight.

What happens when demand finally collides with that kind of scarcity?

ETH doesn't drift. It rips. 🚀

CRACKING CRYPTO 🥜

Why Bitcoin Open Interest Has Seen Its Largest Decline in Almost 3 Years. Bitcoin open interest has plunged 55% from its October 2025 peak, marking the steepest decline since April 2023 as traders unwind leverage.

ECB To Launch Payment Provider Selection For Digital Euro. The ECB will start selecting PSPs this quarter for its digital euro pilot, giving providers early experience and supporting local payment networks.

Goldman Sachs' David Solomon says he owns 'very little' bitcoin. “I’m an observer of bitcoin,” Solomon said at the World Liberty Forum on Wednesday, saying he's still trying to understand how it moves.

OpenAI and Paradigm partner on AI agent tool for smart contract security. DeFi lending protocol Moonwell and CrossCurve have both recently suffered exploits connected to smart contracts.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 2011 🥳

Satoshi's last public forum post was in December 2010, but their final known communication was an email to Bitcoin developer Gavin Andresen in April 2011 saying "I've moved on to other things."

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.