GM to all of you nutcases. It’s Crypto Nutshell #770 cookin’ it up… 🍳🥜

We’re the crypto newsletter that’s more intense than a squad sneaking through alien-infested corridors with the lights flickering… 👽🔦

What we’ve cooked up for you today…

📈 The four year cycle is over

🦠 A 2020-style rally?

🔥 Streak is building

💰 And more…

Prices as at 1:40am ET

THE FOUR YEAR CYCLE IS OVER 📈

BREAKING: Bernstein reveals new Bitcoin target amid market pullback

Since the October 10 liquidation, Bitcoin has chopped between $80K and $93K. (If you want a full breakdown of what triggered that wipeout, check out our latest YouTube video)

We’ve reclaimed $90K and lost it again multiple times.

So the big question is simple:

Is this the same old four year cycle… or something different?

Historically, the pattern has been:

Halving cuts supply

Accumulation

Big blow off bull market

Brutal bear market reset

That template worked in 2012, 2016 and 2020.

But more and more analysts now say this cycle will not follow that same script.

Bitmine chair Tom Lee told Binance Blockchain Week:

"I think that in the next 8 weeks we will break the 4-year Bitcoin cycle. This time it won't be a 4-year cycle."

Bernstein is now backing that idea.

In a new research note, they argue that the recent 30% correction has not broken the cycle. It’s stretched it.

Their key points:

ETF outflows during the drawdown were less than 5% of assets under management

Institutional demand has stayed intact while retail panic sold

The market looks more like a slow, elongated bull than a sharp boom and bust

In their words, Bitcoin has likely moved beyond a strict four year pattern into an extended bull cycle, with sticky institutional buying offsetting retail fear.

Bernstein also updated their price targets:

$150K in 2026

Cycle peak around $200K in 2027

Long term target of roughly $1 million per BTC by 2033

All of this is playing out with macro back in focus.

The next FOMC meeting on December 9–10 will shape rate cut expectations heading into 2026.

A cut would add fuel to the bull case. A hold probably means more chop in the same range.

The bigger picture though is clear:

Price has pulled back. Fear is still loud.

But the people writing the new playbook for Bitcoin are mapping out a longer, institution led cycle, not an 80% crash and a four year reset.

And the Crypto Nutshell community agrees with that view.

Around 85% of you said the next big move is over $100k.

Let’s hope you’re right…

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

A 2020-STYLE RALLY? 🦠

If you look at your timeline right now, the vibes are... not great.

Everyone is bearish. Everyone is waiting for lower prices.

But mathematician and serial entrepreneur Fred Krueger sees this as a massive green flag.

Why?

Because when everyone is looking down, the market usually likes to punish them by going up.

Here’s what he tweeted:

Translation:

If "everyone" is bearish, then "everyone" has likely already sold.

There is no one left to dump.

Instead, you have a mountain of cash sitting on the sidelines, waiting for a dip that might never come.

Fred’s logic is simple market game theory:

The market tends to do whatever causes the most pain to the majority.

Right now, the majority is betting on a crash.

So the most painful thing Bitcoin could do?

Leave them behind. 👋

STREAK IS BUILDING 🔥

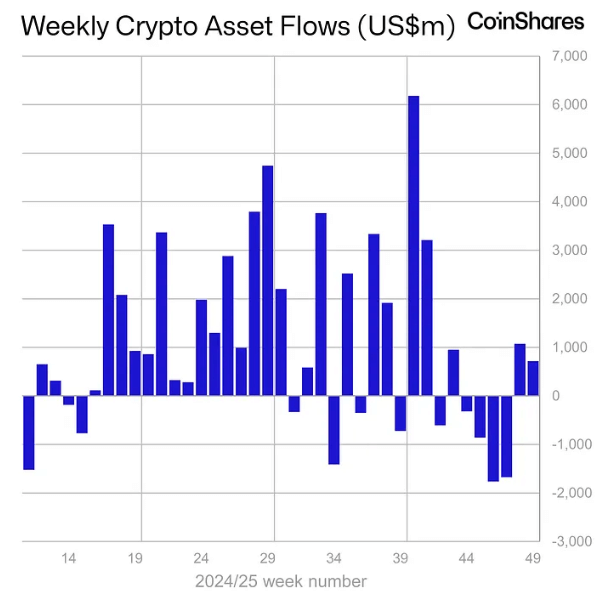

Digital asset funds saw a second week of inflows, with $716 million coming in last week.

Total assets under management have risen by 7.9% from their November lows to $180 billion. (That’s still well below their all-time high of $264 billion)

Let’s break it down.

Bitcoin saw the largest inflows at $352 million.

XRP continued its strong run with inflows of $244.7 million.

Chainlink also saw substantial inflows of $52.8 million. (The largest on record)

Whilst Ethereum saw modest inflows of $39.1 million.

Almost all regions globally saw inflows, with the most notable being the US, Germany and Canada with inflows of $483m, $96.9m and $80.7m respectively.

Short-bitcoin products (ETFs that profit if BTC goes down) saw $18.7 million in outflows last week.

That is the largest weekly exit since March 2025.

Back then, outflows of that size lined up with a similar price low.

The message from ETF traders now is pretty clear:

A lot of people who were betting against Bitcoin are closing their positions.

In other words, they are starting to act like the worst of the negative sentiment might be behind us.

CRACKING CRYPTO 🥜

Tether just moved $4 billion Bitcoin for Twenty One, but the chain data reveals a deceptive liquidity trap. Traders mistaking this 43,033 BTC custody transfer for a fresh buy order risk misinterpreting the flow.

Why Grayscale thinks Bitcoin will ignore the 4-year cycle this time. Explore Grayscale’s data-driven view on why Bitcoin may break from its four-year halving cycle shaped by institutional demand, macro forces and onchain trends.

BTC, ETH, USDC as Collateral in CFTC Crypto Pilot. Acting Chair Caroline Pham has unveiled a first-of-its-kind U.S. program to permit tokenized collateral in derivatives markets, citing "clear guardrails" for firms.

BitMine reports $13.2 billion in holdings as ETH treasury expands after November slowdown. Tom Lee said BitMine is seeing improving market conditions roughly eight weeks after October’s liquidation shock.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Including the most recent one, how many Bitcoin halving events have occurred so far?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Four 🥳

Bitcoin has halved its block reward four times, each time cutting new supply and historically kicking off major bull cycles. ⏳

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.