GM to all of you nutcases. It’s Crypto Nutshell #769 checkin’ in… 💳🥜

We’re the crypto newsletter that’s more high-stakes than a gambler putting everything on one last hand to change his life… ♠️🎲

What we’ve cooked up for you today…

📈 Fears overblown

🦄 The 4-year cycle is now a myth

🫴 Transfer

💰 And more…

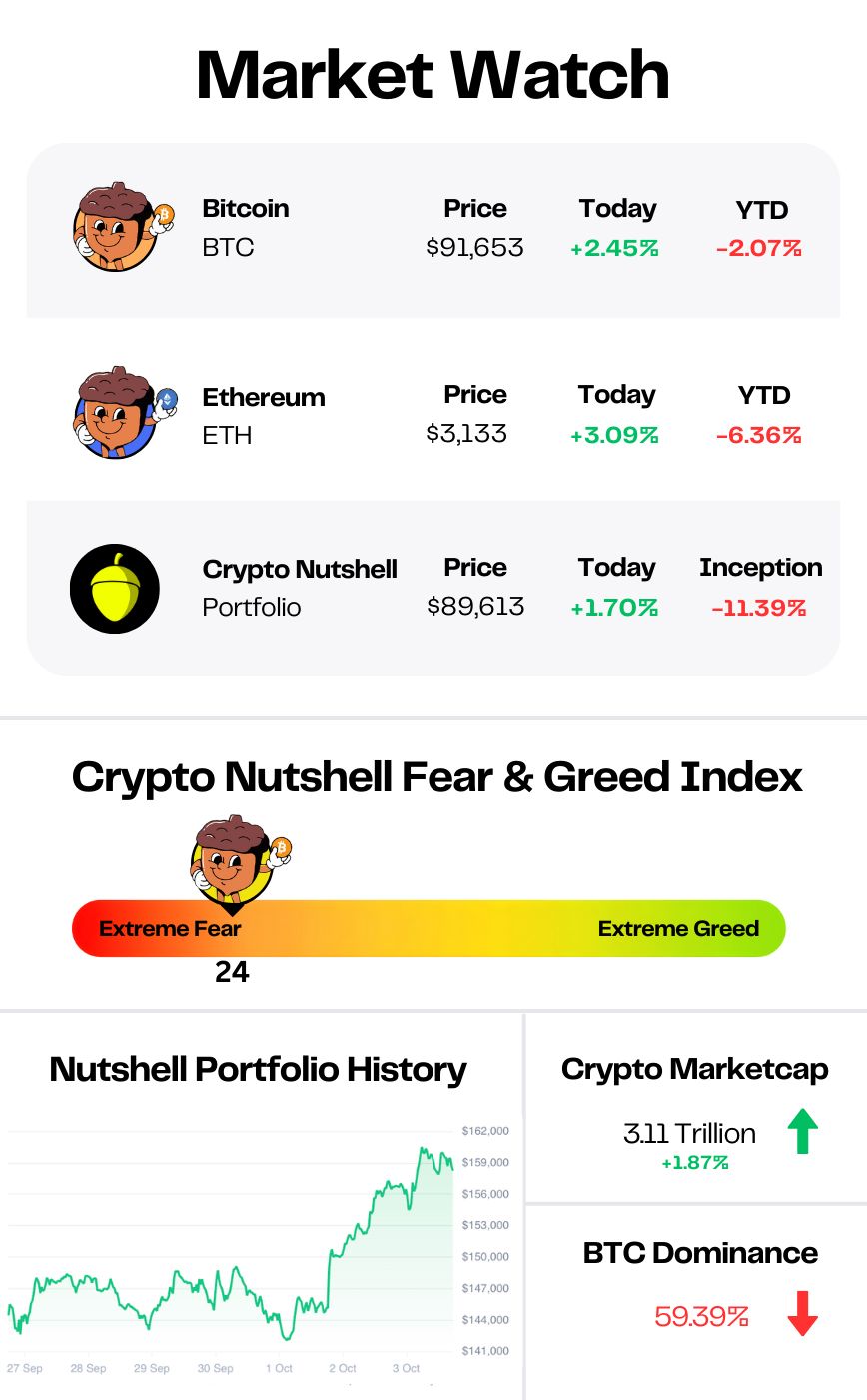

Prices as at 2:30am ET

FEARS OVERBLOWN 📈

BREAKING: Bitcoin market fears are overblown as policy shifts open medium-term upside, K33 says

Fear is still in control of this market…

We’ve just had the sharpest pullback since the 2022-23 bear market.

And the market has grabbed onto three big scare stories:

Quantum computers killing BTC

Strategy being forced to dump coins

Tether blowing up any minute

But according to K33 Research, all three are long term risks, not reasons to panic at $90K.

Quantum risk is real but years away and fixable with coordination.

Strategy has just raised about $1.44 billion, which gives it breathing room on dividends instead of forcing near term sales.

Tether is earning roughly $500 million a month on Treasuries, with billions in excess equity and most of its reserves in low risk assets.

None of that looks like an immediate trigger.

Under the surface, the structure also looks healthier than the headlines:

Bitcoin is back above major support on $80k

Leverage is low by recent standards

CME futures activity is muted

On top of that, the policy backdrop is quietly shifting in Bitcoin’s favor.

New 401(k) rules could open a $9 trillion retirement market to crypto.

The Clarity Act is moving forward.

A more dovish, pro-crypto Fed setup is on the table.

K33’s conclusion is simple: the odds of another 80% style collapse look lower than the odds of a medium term rebound.

December looks less like the start of a new bear market and more like an entry window for investors who can stomach the volatility.

But now we want to hear from you…

Where do you see Bitcoin going next?

Let us know your thoughts in the poll below. 👇

Where do you see Bitcoin going next?

We’ll share the results in tomorrow’s newsletter.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

THE 4-YEAR CYCLE IS NOW A MYTH 🦄

Investors love to try and predict the future.

Many believed Bitcoin would follow a strict, repeatable 4-year schedule based on old charts.

But commercial litigator Joe Carlasare says: it’s time to stop looking at the past.

His argument?

You can't compare the tiny Bitcoin of 2013 to the financial giant it is today.

Here his argument he wrote in a thread today:

“You don’t get identical ‘cycles’ when the asset’s market cap has grown >150x. Put simply, Bitcoin today is incompatible with the market structure of 2013 or 2017.”

He points out that in previous years, US Spot ETFs didn't even exist.

Today?

ETFs hold 1.4 million BTC (6% of supply) and CME futures open interest is at record highs ($39B).

The market has fundamentally changed from a retail-driven casino to a serious institutional machine.

His message to the 4-year cycle believers?

“Today BTC trades like a macro asset, not a halving horoscope.”

Translation:

Wall Street has completely rewritten the game.

The crypto market is now too big, too hedged, and too liquid to move just because the calendar said it should.

We aren't waiting on a magical cycle anymore - we are waiting on liquidity and interest rates.

The 4-year patterns worked when Bitcoin was a baby. 👶

But Bitcoin isn't a baby anymore.

It's a global macro asset.

Time to start treating it like one. 🌍

TRANSFER 🫴

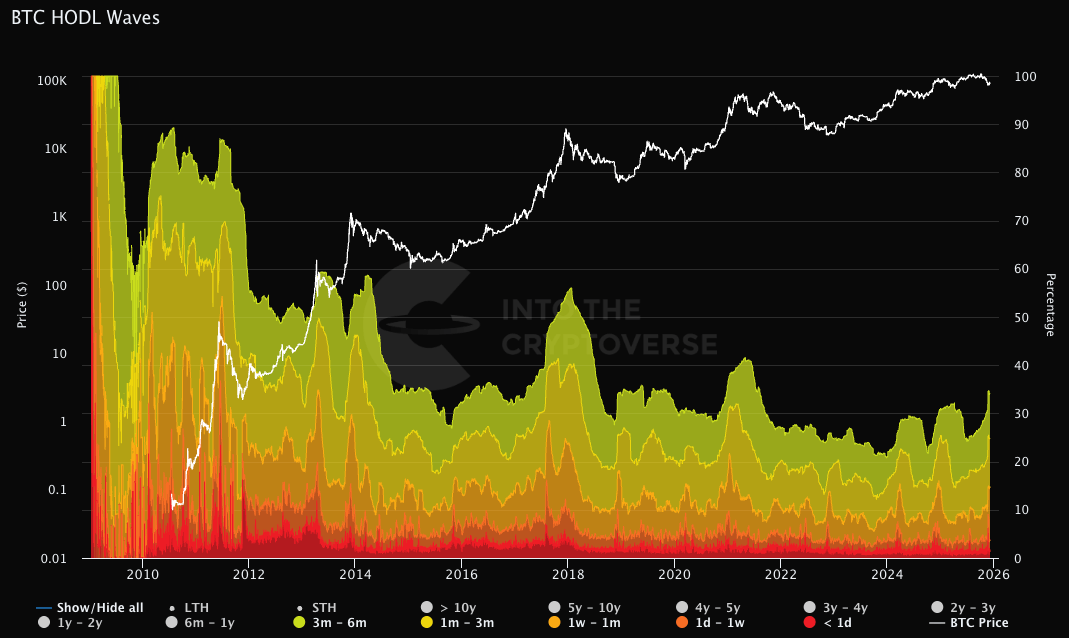

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The warmer the colour, the younger the coins - with red showing Bitcoin that has been held for less than one day.

Today, we’re focusing on short-term holders (STHs) - defined as coins held for less than six months.

Here’s how the Bitcoin supply breakdown looks today:

<1 day: 1.37%

1d - 1w: 2.29%

1w - 1m: 10.88%

1m - 3m: 10.22%

3m -6m: 9.39%

TL;DR: 34.15% of all Bitcoin is in the hands of short-term holders 🔒

Since the October 10 liquidation event, that share has climbed by about 6.55%.

That tells you two things at once.

Coins are rotating out of older hands and into newer, more reactive ones. And plenty of buyers have been willing to step in during the drawdown.

Short term, a bigger short-term holder base means more sensitivity to headlines and price swings.

As long as the long-term base remains dominant, this is not a structural problem.

If these coins survive the chop and age into older bands, this spike will end up looking like another transfer from weak hands to stronger ones.

CRACKING CRYPTO 🥜

A sudden $13.5 billion Fed liquidity injection exposes a crack in the dollar that Bitcoin was built for. $13.5 billion Fed repo spike shifts dollar liquidity and sets a new backdrop for Bitcoin traders heading into December.

French banking giant BPCE to launch in-app crypto trading. BPCE will allow customers to trade Bitcoin, Ether, Solana and USDC directly in its Banque Populaire and Caisse d’Épargne apps, expanding access through 2026.

Debunking The Yen Carry Trade Unwind Alarms. Speculators maintain net bullish positions in the yen, limiting scope for sudden JPY strength and mass carry unwind.

MetaMask moves into prediction markets with Polymarket integration. Founded in 2020, Polymarket is now reportedly courting a valuation of up to $15 billion amid a breakout year.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What has been one of the biggest practical impacts of Ethereum’s Dencun upgrade on Layer 2 networks?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: It sharply reduced transaction costs on rollups 🥳

By introducing data blobs (EIP-4844), Dencun made it much cheaper for L2s to post data, cutting user fees. 💸

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.