Today’s edition is brought to you by Topper

Topper makes off-ramping effortless, fast, and accessible. Get started now and convert your crypto to cash, fee-free!

GM to all you crypto nuts. Crypto Nutshell #506 rollin’ steady… 🚜🥜

We're the crypto newsletter that's more adventurous than a daring rescue mission across the galaxy... 🚀🪐

What we’ve cooked up for you today…

🕵 It wasn’t a conspiracy?

🧠 All-time highs are coming

📉 The sell-off continues

💰 And more…

Prices as at 2:10am ET

IT WASN’T A CONSPIRACY? 🕵

BREAKING: FDIC asked financial institutions to pause crypto-related activity according to letters obtained through Coinbase lawsuit

We’ve heard it over and over again…

Notable figures & companies in the crypto industry have often complained of being blocked from US banking services.

But many just dismissed it as a “conspiracy” theory.

Well now we finally have proof…

Coinbase took the FDIC and SEC to court in June and finally won access to certain internal FDIC communications.

These documents reveal that the FDIC blocked any crypto related banking activity at a large number of US banks in 2022.

“We respectfully ask that you pause all crypto asset-related activity… The FDIC will notify all FDIC-supervised banks at a later date when a determination has been made on the supervisory expectations for engaging in crypto asset-related activity."

If you’re interested, you can view all of the letters here.

Just a quick heads up, the letters are heavily redacted and don’t mention any specific names or companies.

Coinbase’s Chief Legal Officer, Paul Grewal, had this to say on the issue:

"The letters show that this was no conspiracy theory at all, that this was not just rank speculation or the musings of a paranoid industry… There was a concerted plan on the part of the FDIC that they carried out — without any reluctance — to deny banking services to a legal American industry. That should give everyone great pause."

Coinbase’s CEO, Brian Armstrong, also mentioned this issue in a Twitter post two weeks ago:

Posted by Brian Armstrong on November 28, 2024

This debanking campaign has become known as “Operation Choke Point 2.0” in the crypto industry.

Which comes from “Operation Choke Point 1.0” where the US government previously looked at debanking legal but controversial businesses in 2013.

Newly appointed Crypto Czar, David Sacks, had this to say:

Paul Grewal also noted that Coinbase’s fight is not over yet…

The next step is to release the full unredacted versions of these letters.

Which should be easily achievable under the new administration.

This entire situation shines a glaring spotlight on one undeniable truth:

The banks are terrified of crypto.

Good.

Off-Ramping Crypto Doesn’t Have to Be Hard 🤑

Converting crypto to fiat can be frustrating—limited asset support, high fees, and long delays. That’s why Topper’s new Off-Ramp is a game-changer.

With Topper Off-Ramp, you can:

✅ Withdraw over 200+ assets: From Bitcoin and Ethereum to emerging tokens, access one of the largest supported asset libraries in the crypto space, giving you the freedom to manage your portfolio your way.

✅ Access your funds instantly: Say goodbye to waiting days for withdrawals. Topper ensures your funds reach your debit card almost immediately, making your crypto as liquid as cash.

✅ Enjoy global coverage: With Visa and Mastercard debit card support in the U.S.and Europe—and Visa Original Credit Transactions worldwide—off-ramp securely, no matter where you are.

Special Launch Offer:

From now until December 22, 2024, Topper is offering zero transaction fees on any crypto that you sell!

Topper makes off-ramping effortless, fast, and accessible—giving you complete control over your digital assets.

ALL-TIME HIGHS ARE COMING 🧠

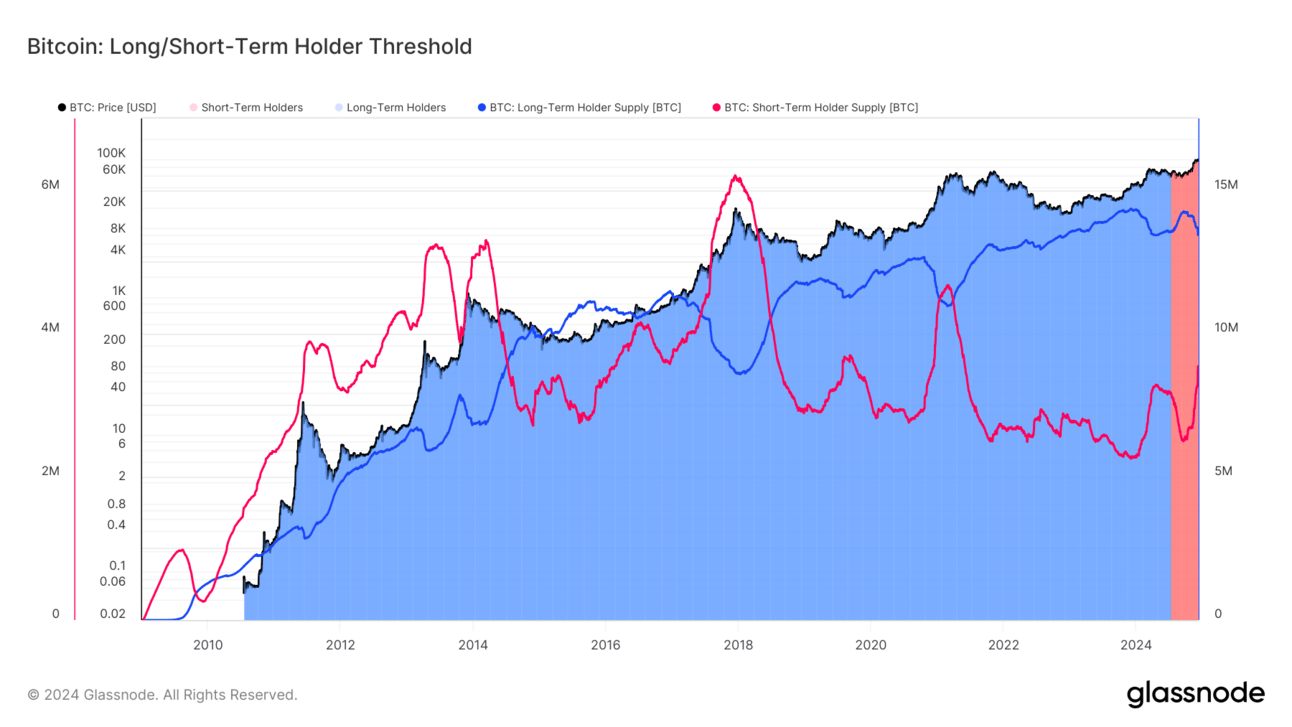

For the first time in 9 months, Ethereum recently climbed over $4,000.

It will soon be trading at new all-time highs.

That’s the latest prediction out from macroeconomic analyst, Pentoshi.

If you’re not familiar with Pentoshi, he’s a technical analyst who regularly posts his charts, trades, and macro predictions on X.

At Crypto Nutshell he’s one of our favourite analysts for 2 reasons:

His impressive technical analysis 📈

His stunningly accurate macro calls 🔎

To maintain his anonymity, he writes under the pseudonym "Pentosh1" and uses a cartoon penguin as his avatar. 🐧

In a series of recent tweets, he pointed out:

He also added:

“If the ETFs continue to buy at $100-$250 million per day, this will get pretty wild quick.”

What Pentoshi has noticed is that the Ethereum ETFs have been popping off lately.

These were the inflows last week:

Monday: $24.2 million

Tuesday: $132.6 million

Wednesday: $167.7 million

Thursday: $428.5 million

Friday: $83.8 million

That’s a combined $836.8 million for the week. 🤯

These inflows are so huge that they’re larger than all previous weeks combined (on a net inflow basis).

That’s insane.

Our take?

It’s only a matter of time before Ethereum sets a new all-time high ($4,891.70).

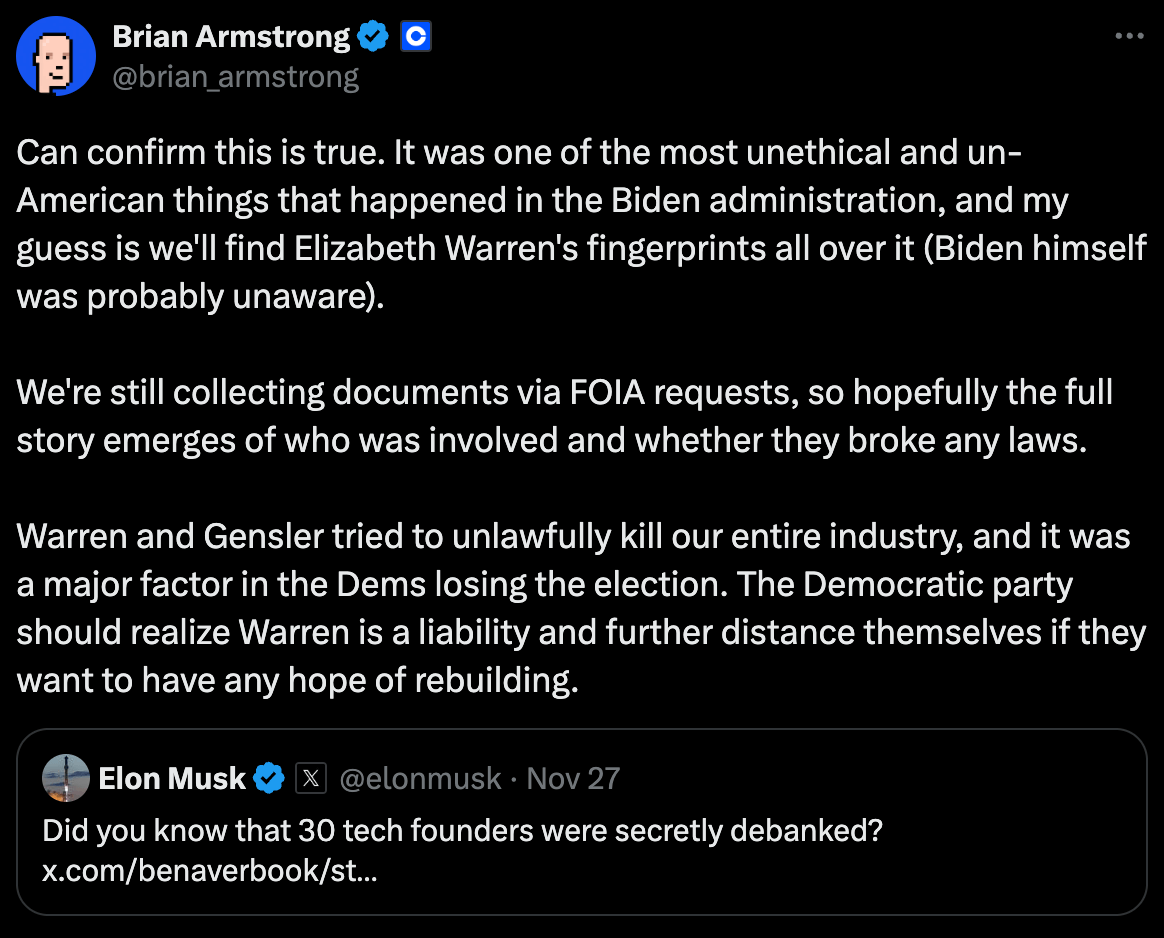

Ever since the Merge in 2022, Ethereum’s supply has been deflationary:

In other words, supply is shrinking while demand is exploding.

A perfect recipe for fireworks. 🎆

THE SELL-OFF CONTINUES 📉

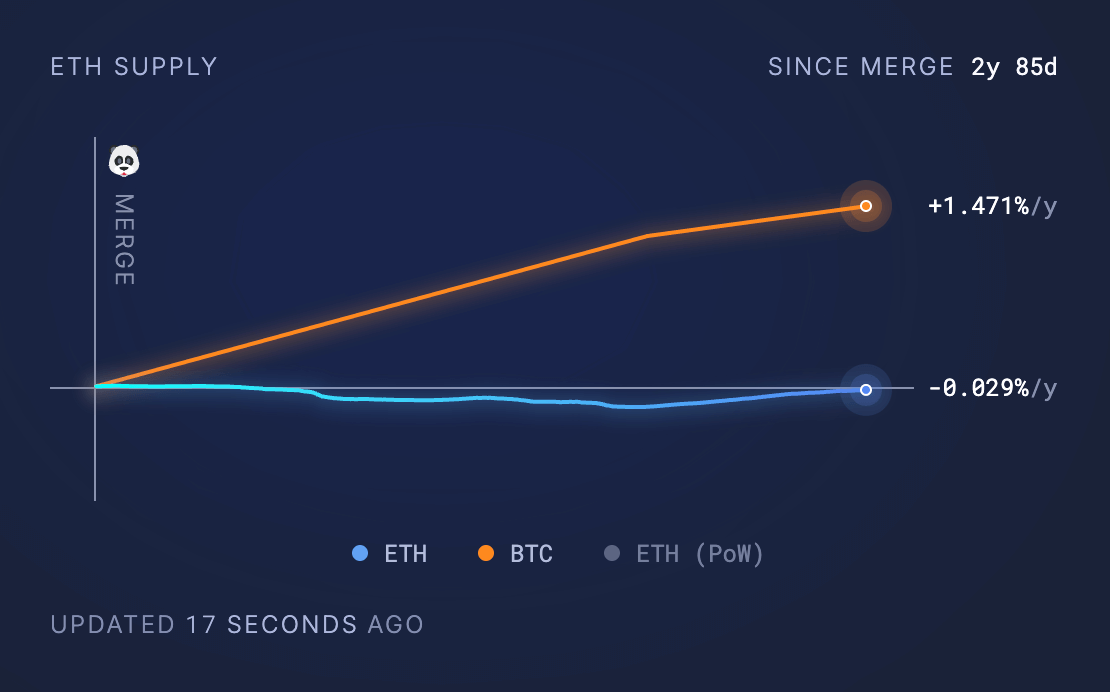

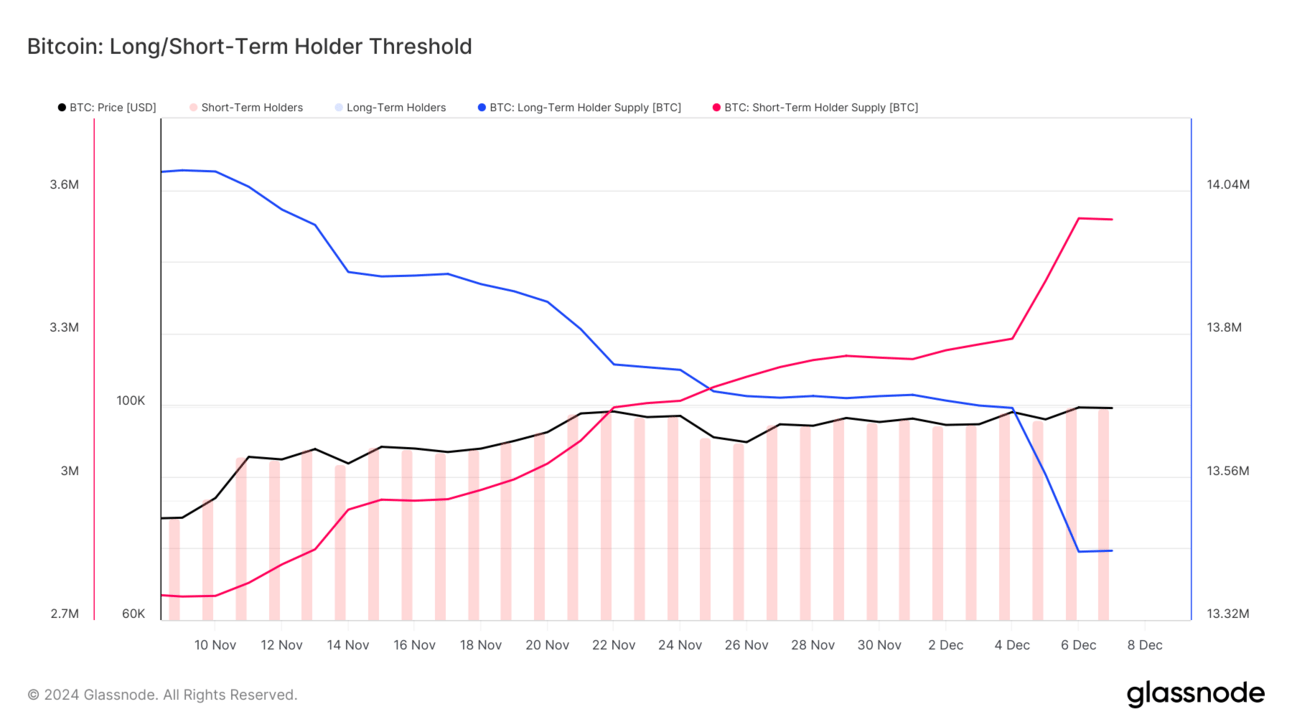

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): coins that have been held for less than 155 days

🔵 Long-Term Holders (LTHs): coins that have been held for more than 155 days

🟥 Short-Term Holder Cost Basis: all coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: all coins purchased in this price range are LTHs

This metric is extremely powerful as we can see exactly what price STHs and LTHs purchased Bitcoin at. 🔎

The LTH / STH threshold is currently at 6th July 2024, when Bitcoin was ~$58,200.

All coins purchased before this date are classified as LTHs.

All coins purchased after this date are classified as STHs.

Today, there are currently 13,436,089 Bitcoin in the hands of LTHs. (67.88% of the circulating supply) 💪

Whereas the amount of coins held by STHs is only 3,538,525. (17.88% of the circulating supply)

And with Bitcoin sitting at around $100,000, by definition, every single long-term holder is in profit.

This means some long-term holders are bound to sell at least a little Bitcoin…

As we explained two weeks ago, that’s exactly what we’ve been seeing recently.

30 day chart

Over the past 30 days, long-term holders have sold 635,084 Bitcoin.

That’s ~$63.41 billion at today’s prices!

But…

Interestingly, these sell-offs are actually coming from the “youngest” long-term holders.

And what we mean by that is long-term holders who have purchased Bitcoin between March and June of this year.

So what does this mean?

Despite a large amount of Bitcoin being sold by long-term holders…

It’s more comparable to a high level of trading activity than a massive liquidation of long-term holders.

A true top signal would be indicated by substantial selling of long-dormant Bitcoin.

For now, we haven’t seen that.

Higher.

CRACKING CRYPTO 🥜

Crypto industry frustrated over possibility of SEC commissioner Caroline Crenshaw’s renomination. Coinbase COO Emilie Choi called Caroline Crenshaw, one of two SEC commissioners to oppose Bitcoin ETFs, 'anti-crypto.'

U.S. Regulator Told Banks to Avoid Crypto, Letters Obtained by Coinbase Reveal. Coinbase's Paul Grewal says this is hard evidence proving the industry hasn't been spouting conspiracy theories about being shoved out of U.S. banking.

El Salvador’s Bitcoin gains top $300M. El Salvador’s unrealized gains of more than $300 million on its Bitcoin purchases came as BTC broke through the $100,000 milestone price.

Hacked Cardano Foundation X account posts fake token, false SEC lawsuit notice. In a statement, the Cardano Foundation confirmed the compromised account.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Twice weekly Bitcoin news

Crypto Pragmatist (link) - Actionable alpha 3x a week

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 2 weeks 🥳

The difficulty is adjusted every 2016 blocks (roughly 2 weeks) based on the time it took to find the previous 2016 blocks

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.