Today’s edition is brought to you by Coinbase - the easiest way to purchase crypto.

GM to all of you nutcases. It’s Crypto Nutshell #793 slicin’ through noise… 🔪🥜

We’re the crypto newsletter that’s more nerve-shredding than a town realizing the monster was real all along… 🚨🦈

What we’ve cooked up for you today…

🏦 The bottom is in?

🏜️ Abu Dhabi wants Bitcoin

📈 Only up

💰 And more…

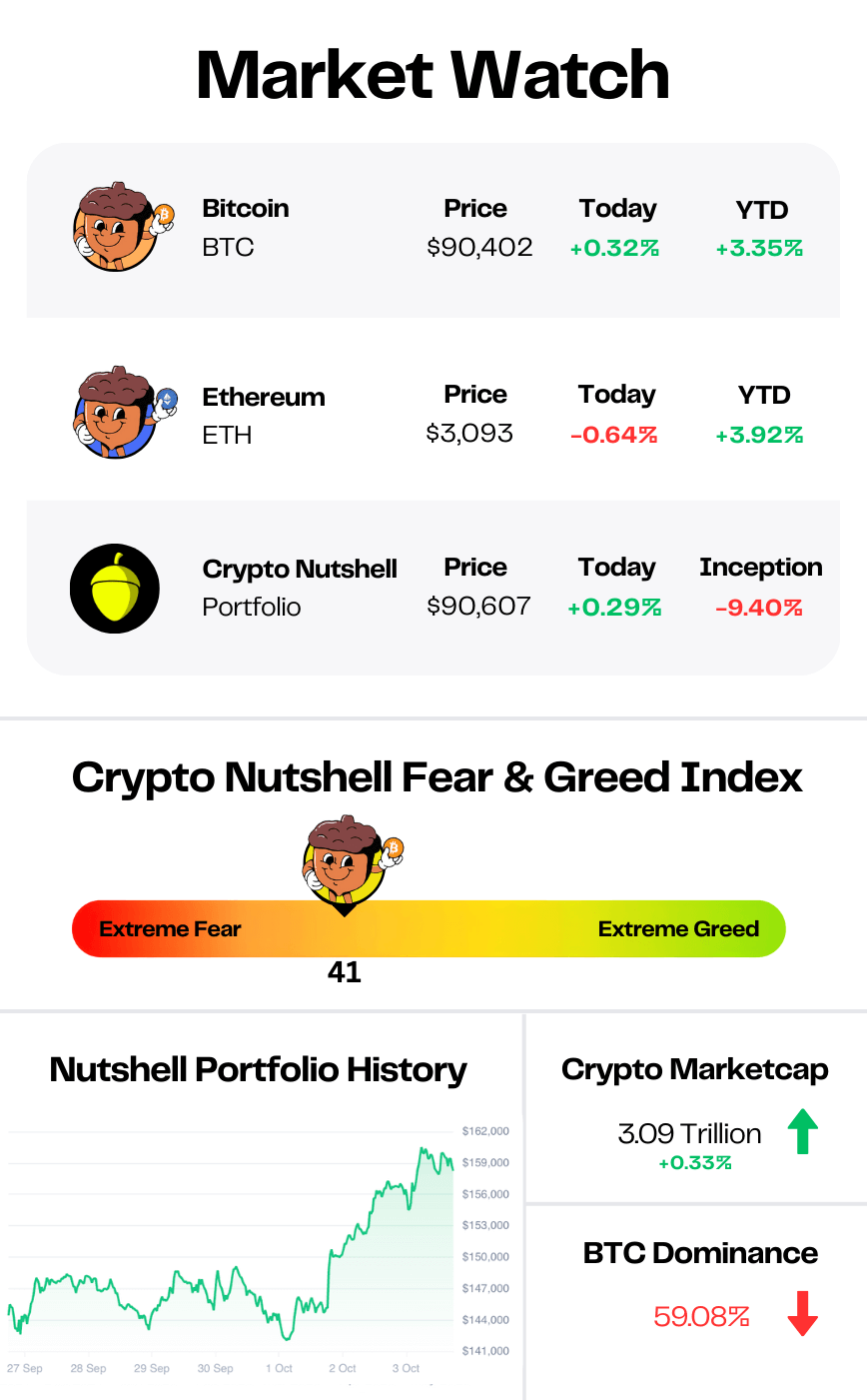

Prices as at 6:45am ET

THE BOTTOM IS IN? 🏦

BREAKING: JPMorgan says the crypto selloff may be nearing a bottom as ETF outflows ease

JPMorgan says the crypto selloff may be nearing a bottom.

ETF flows are stabilising. Positioning data suggests the de-risking is done.

And liquidity held up better than many thought.

What JPMorgan found

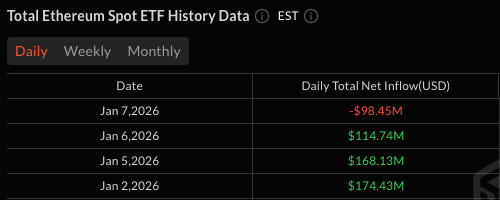

Bitcoin and Ethereum ETFs saw heavy outflows in December while global equity ETFs attracted a record $235 billion in inflows.

That divergence showed how sharply investors cut crypto exposure into year-end.

But January data is telling a different story.

"Signs of a bottoming out in January are also seen in other crypto indicators in perpetual futures and in our position proxies on CME futures."

Bitcoin ETFs have logged $439 million in net inflows so far this year.

Ethereum ETFs pulled in roughly $359 million.

Perpetual futures and CME positioning proxies show similar signs of stabilisation - suggesting retail and institutional investors largely completed their position reductions in Q4 2025.

MSCI relief helped

The analysts said MSCI's decision not to exclude digital asset treasury companies from its indexes in February provided "near-term relief, particularly for Strategy-linked exposure."

That removed the risk of forced selling tied to index changes - at least for now.

Liquidity held up

JPMorgan pushed back on the idea that deteriorating liquidity drove the correction.

The bank's market breadth metrics - which measure price impact of trading volumes in CME Bitcoin futures and major Bitcoin ETFs - show little evidence of worsening liquidity.

Instead, the firm argued that de-risking triggered by MSCI's October announcement was the primary catalyst.

The takeaway

JPMorgan concluded that:

"the bulk of the crypto position unwind now appears to be behind the market, with January's data pointing to a possible bottoming phase rather than the start of a new leg lower."

Bitcoin trades near $91,000. Ethereum sits around $3,100.

Both remain well off their recent peaks.

But if JPMorgan is right, the worst of the selling pressure is over. 🚀

CRYPTO MADE SIMPLE 🤑

Buying crypto can be easy.

Knowing which exchange to trust? That’s where it gets complicated.

That’s why over 100 million users have started their journey with Coinbase - the most recognised crypto exchange in the U.S.

Here’s what makes Coinbase stand out:

A beginner-friendly platform with a clean interface, helpful tips, and easy access to 250+ cryptocurrencies 💰

Coinbase Advanced for pro-level trading tools - no separate account needed 📈

Staking made simple: earn rewards on ETH, SOL, ADA, and more, all without leaving the app 🥩

You’ll also get access to learning rewards (yes, free crypto), recurring buys, and a sleek mobile app - all backed by a publicly traded company with transparent financials and industry-leading security.

Whether you’re stacking Bitcoin weekly or diving into deep altcoin research…

ABU DHABI WANTS BITCOIN 🏜️

While everyone’s been obsessing over short term price action, Abu Dhabi’s been doing the opposite.

According to their latest report, the Abu Dhabi Investment Council more than tripled its Bitcoin exposure into the volatility of late 2025:

“They've more than tripled their position right in the weeks and months up to the sell off.”

And the size matters:

“They disclosed their position at the end of September. That was worth around $520 million dollars.”

This isn’t framed as a trade either. It’s framed as a portfolio asset:

“They really see it as the digital equivalent of gold.”

Zoom out and it fits a bigger UAE strategy.

The cleanest takeaway is the simplest:

“It looks like the Abu Dhabi Investment Council is going to be in it for the long term… And this just really gives it legitimacy.”

When a state owned fund from one of the richest countries is putting reserve money into Bitcoin exposure, that’s not nothing.

It’s a new world. 🌍

ONLY UP 📈

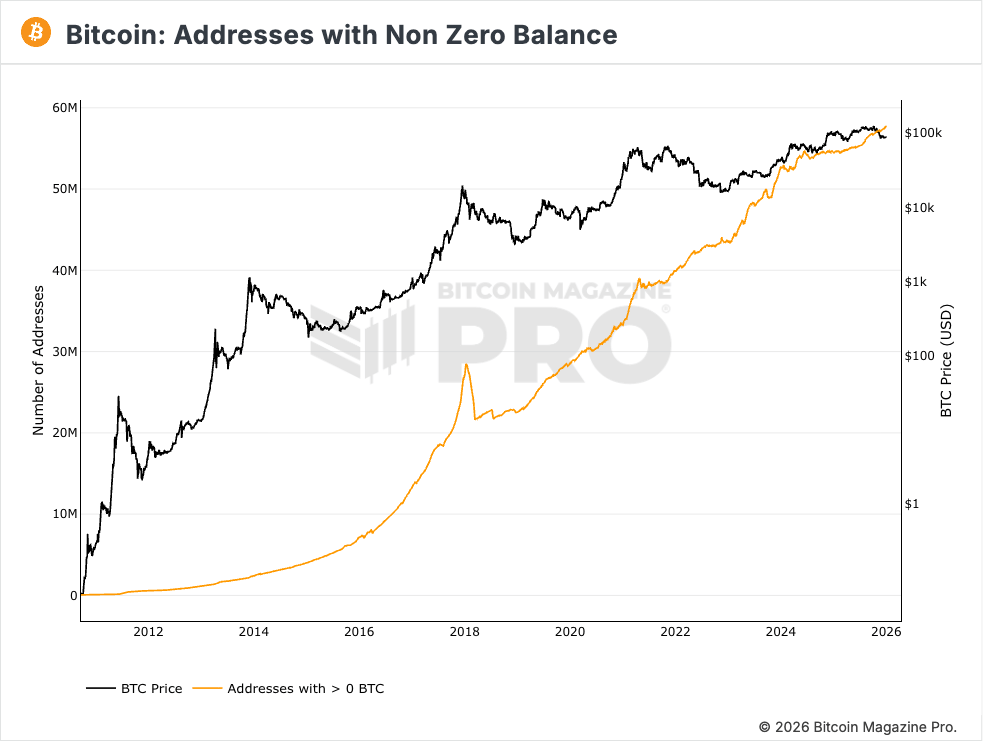

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

There are now 57.75 million wallets holding Bitcoin.

That's roughly 100,000 more wallets than two weeks ago.

Zoom out - this number is up 3.28 million since the start of 2025.

Price has been choppy. Sentiment has turned sour. ETF flows have been messy.

And yet adoption hasn't slowed.

More wallets. More holders. More distribution.

The base keeps widening. 💪

CRACKING CRYPTO 🥜

Zcash Plunges Double Digits After ECC Team ‘Constructively Discharged’. In a statement, the board said that the disagreements stemmed from recent proposals to privatize the Zashi mobile wallet.

BlackRock Buys $900M BTC as Long-Term Selling Hits 2017 Lows. Institutional investors ramped up their Bitcoin buying as a sharp drop-off in selling suggests that BTC is reversing its bear trend.

Bitcoin price outlook: BTC's 'boring' price action likely to continue, say analysts. Experts say the next major rally may come only when long-term holders are exhausted, and true institutional capital enters the market.

Morgan Stanley continues crypto push, plans wallet in the second half of 2026. Morgan Stanley's head of wealth management told Barron's the firm plans to launch a proprietary digital wallet later this year.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Are you ready for this week’s quiz?

5 questions. All from this week’s issues. If you’ve been paying attention, you’ll crush it. If you’ve been skimming, it’ll show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

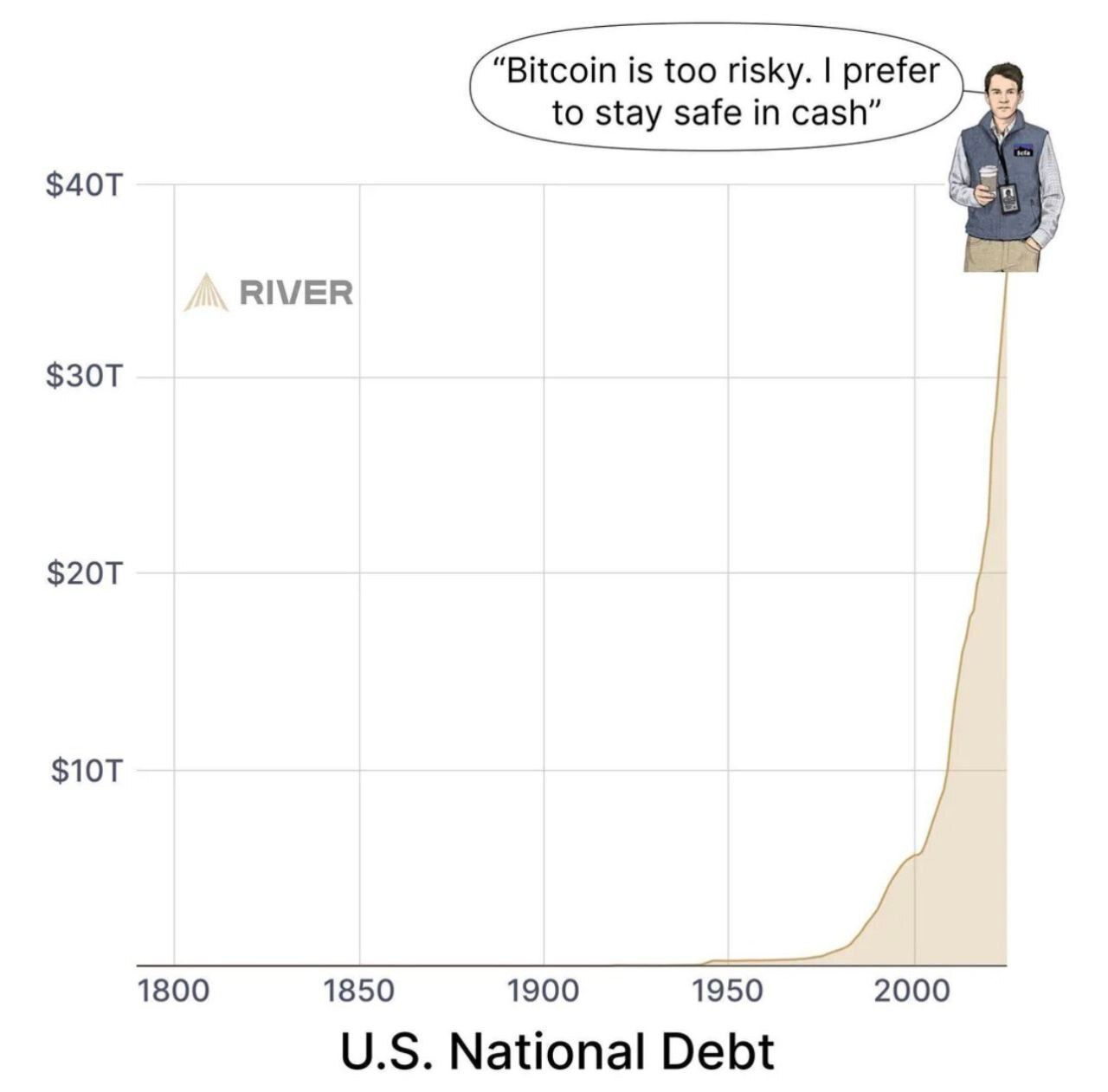

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.