GM to all of you nutcases. It’s Crypto Nutshell #797 touchin’ down… 🛩️🥜

We’re the crypto newsletter that’s more brutal than a deal gone wrong in a world where trust gets you killed… 🔫🩸

What we’ve cooked up for you today…

🏦 Are we back?

🦆 Billionaire: Bitcoin’s been amazing, obviously

💎 Accumulating

💰 And more…

Prices as at 2:20am ET

ARE WE BACK? 🏦

BREAKING: Bitcoin price tags $97K despite high producer price inflation, no US tariff ruling

Bitcoin just broke above $97,000 for the first time since mid-November 2025.

What’s causing this rally? 🤔

Let’s break it down.

ETF demand returns

U.S. spot Bitcoin ETFs pulled in $840.6 million yesterday - the strongest single day since October.

Year-to-date, institutional flows are back.

Bitcoin ETF inflows

Tax-loss harvesting is done. Rebalancing is happening.

And institutions are recognizing ETFs as structural, regulated demand rather than speculative positioning.

BlackRock led with $648.4 million. Fidelity added $125.4 million. Ark brought in $27 million.

Total ETF assets now sit at $123 billion - roughly 6.5% of Bitcoin's market cap.

Short squeeze accelerates

Over $680 million in short positions got liquidated in the past 24 hours as Bitcoin broke resistance.

Bitcoin accounted for $385 million of those liquidations. Ethereum added $251 million. Solana $33 million.

Bears betting against the breakout above $91,000 got caught offside. The forced buying amplified the move.

Haven demand

A criminal investigation into Fed Chair Jerome Powell triggered a flight to haven assets.

Gold hit $4,600 an ounce. Silver topped $91. Bitcoin rallied alongside.

"Markets are being pulled in multiple directions as geopolitics, trade policy uncertainty, and concerns over central bank independence dominate sentiment."

Tech stocks lagged. The Nasdaq 100 is flat year-to-date while Bitcoin is up 10%.

Investors are increasingly rotating into assets that sit outside traditional financial system control.

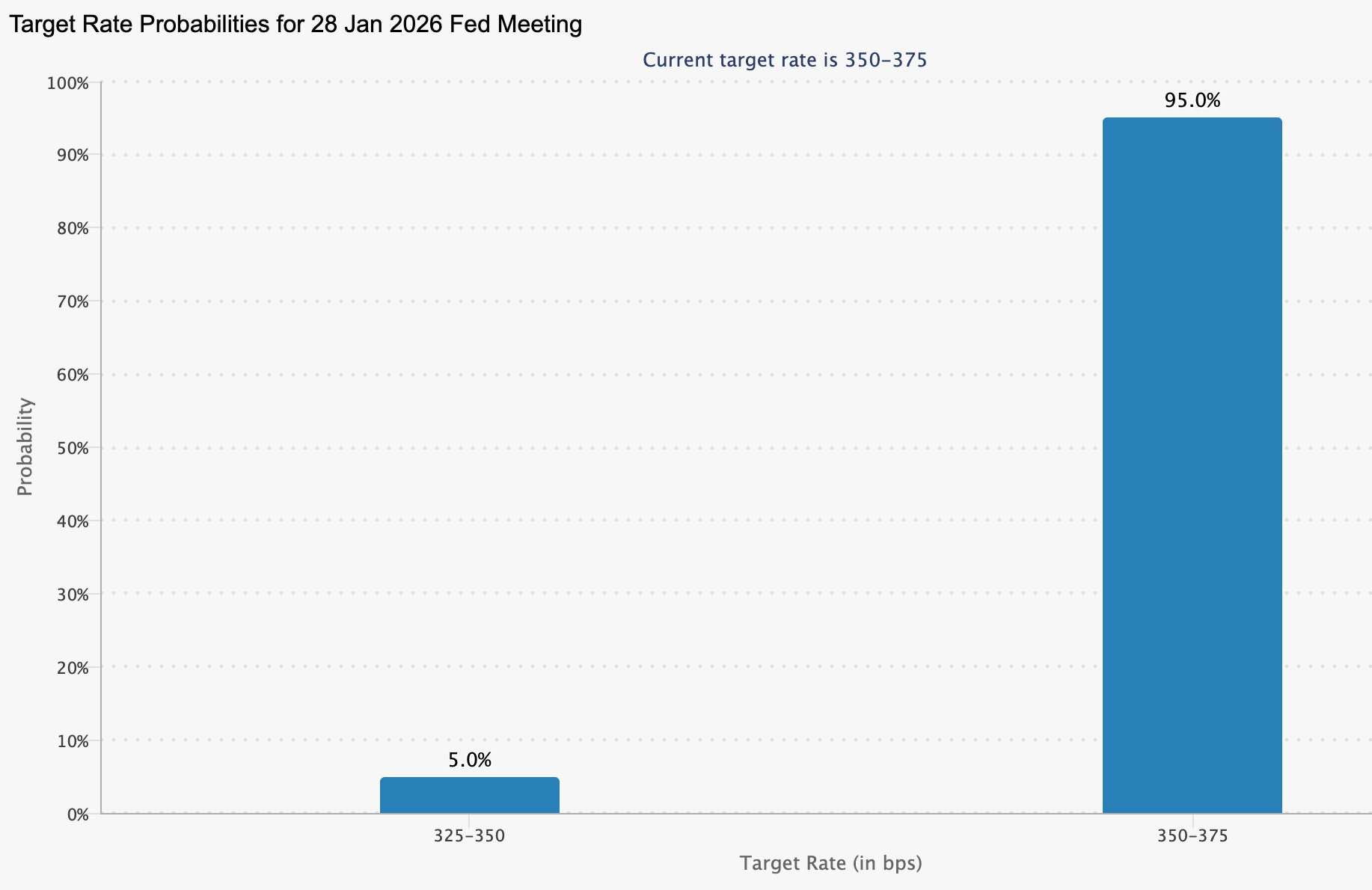

Macro backdrop

PPI inflation came in hot at 3% versus 2.7% expected.

Normally that's bearish for risk assets…

But Bitcoin ignored it.

Markets had already priced in a Fed pause at the January 28 meeting.

And The Supreme Court delayed its tariff ruling again, removing near-term uncertainty.

On top of that, the CLARITY Act is advancing. The Senate Banking Committee holds markup today.

What happens next

Polymarket now prices 60%+ odds Bitcoin hits $100,000 before January ends.

Nexo analyst Iliya Kalchev noted that when advances are led by allocation demand rather than leverage, "volatility often remains contained before expanding later."

Translation: This rally is driven by institutions absorbing supply, not degenerate leverage. That's more sustainable.

Bitcoin needs to close the week above $93,500 to confirm the breakout. If it holds, $100K comes into focus. 🚀

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

BILLIONAIRE: BITCOIN’S BEEN AMAZING 🦆

Ron Baron is a billionaire fund manager who built Baron Capital into one of the most successful long-term investment firms on Wall Street.

This week on CNBC, he laid it out for everyone:

“Bitcoin’s been amazing, obviously.”

Billionaire Ron Baron

Here’s what he said, verbatim:

“The value for money falls 4% or 5% a year, that’s inflation. Falls 4% or 5% percent a year and the economic growth has been about 2% a year.

So it’s about 7% a year growth and that means everything doubles in ten years.

The value of your money falls in half every 15 years.

So you’ve got to make twice what you’re making today in 15 years to stay even.

And so stock market, you know, so Bitcoin’s been amazing, obviously.”

Read that again.

This is not necessarily a Bitcoin pitch.

It’s a math problem.

If your currency is losing 4–5% a year, and the world is growing on top of that, prices must rise. Assets must go up. You are forced into risk whether you want to be or not.

You cannot save your way to safety.

You have to invest just to stand still.

That is why stocks go up over decades.

That is why real estate goes up.

That is why Bitcoin exists.

Bitcoin is not competing with your checking account.

It is competing with the fact that your cash is designed to decay.

So when a billionaire who made his fortune riding long-term compounding looks at Bitcoin and shrugs, “it’s been amazing, obviously,” he is not being trendy.

He is just reading the scoreboard.

Inflation never stops.

Growth never stops.

And assets that cannot be printed will always be where the value goes. 👀

ACCUMULATING 💎

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Only 16.49 million ETH are left on exchanges.

That's just 13.66% of the entire supply.

Since January, another 166,381 ETH has been withdrawn.

ETH's been under pressure. Sentiment's weak. Yet exchange balances keep falling.

That's conviction.

Veteran holders aren't panicking. They're accumulating. 💎

CRACKING CRYPTO 🥜

LINK Hits Monthly High as Bitwise Launches Chainlink ETF on NYSE. Bitwise launched its Chainlink ETF Wednesday, becoming the second spot LINK fund in the U.S. following Grayscale's December debut.

Bitcoin Price Ignores PPI Overshoot to Hit $97,000. Bitcoin returns to $97,000 for the first time two months as bulls ignore high PPI inflation and a lack of Supreme Court decision on US trade tariffs.

More than half of all crypto tokens have failed — and most died in 2025. Over 13.4 million tokens have been erased between mid-2021 and 2025, according to a new analysis by CoinGecko.

Senate crypto bill nears crunch time as amendments pile up, lobbying intensifies ahead of Senate Banking Committee hearing. Lawmakers face a pivotal Senate hearing with over 70 amendments in play, as debates over stablecoin yield and DeFi come down to the wire.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

During Bitcoin's 2017 block size debate, what size blocks did the Bitcoin Cash fork implement?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 8 MB 🥳

Bitcoin Cash launched in August 2017 with 8 MB blocks, compared to Bitcoin's 1 MB limit. The fork was created by those who wanted bigger blocks for cheaper transactions. BCH later increased to 32 MB blocks in 2018.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.