Today’s edition is brought to you by Animus Technologies.

GM to all 58,207 of you. Crypto Nutshell #272 stampedin’ in. 🦬 🥜

We’re the Crypto Newsletter that's more liberating than Django's quest for freedom and vengeance in the heart of the Old South... 🔓🤠

What we’ve cooked up for you today…

😱 ETF outflows continue

🏇 Back the fastest horse

💪 HODLer breakdown

💰 And more…

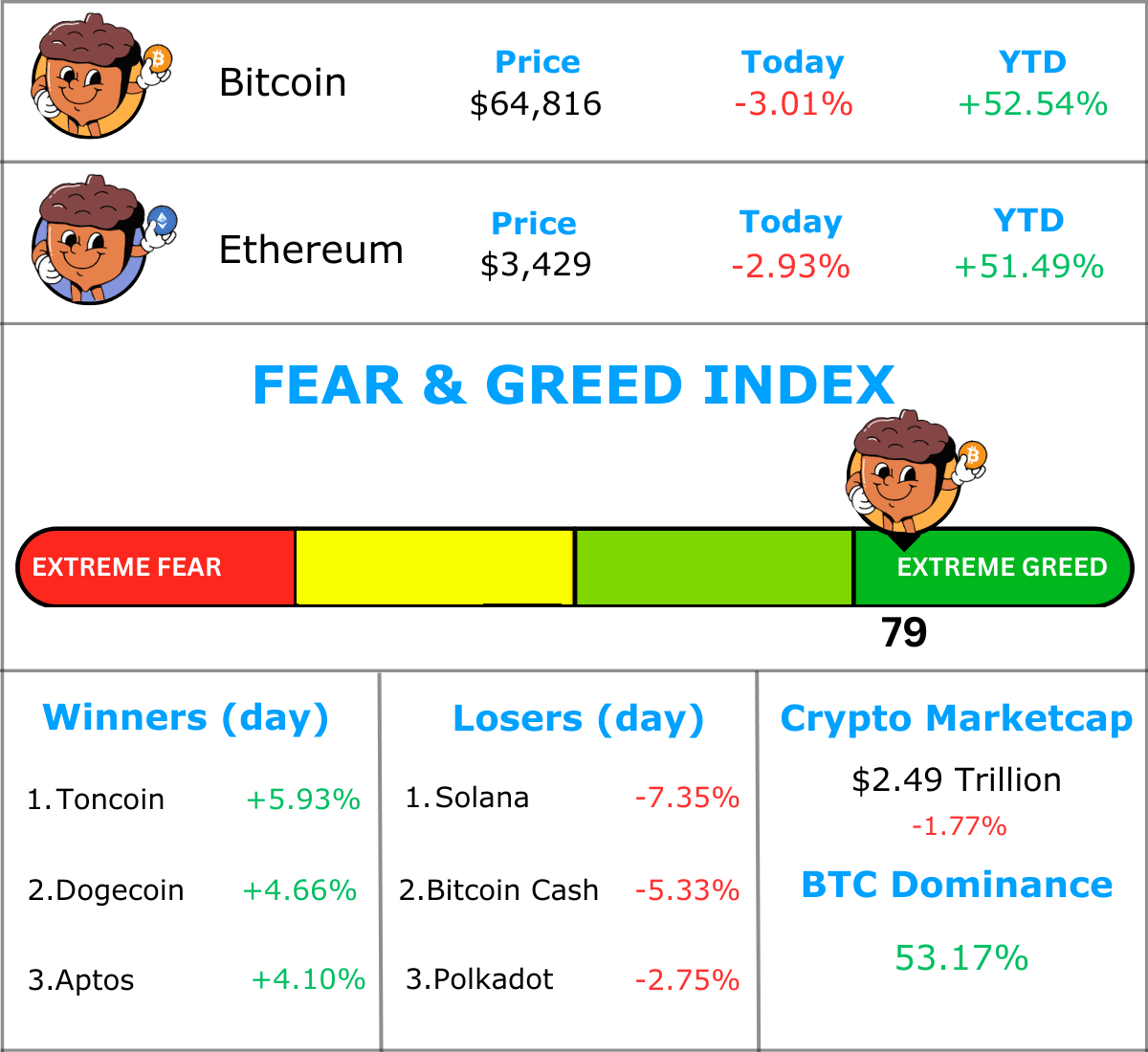

MARKET WATCH ⚖️

Prices as at 6:30am ET

Only the top 20 coins measured by market cap feature in this section

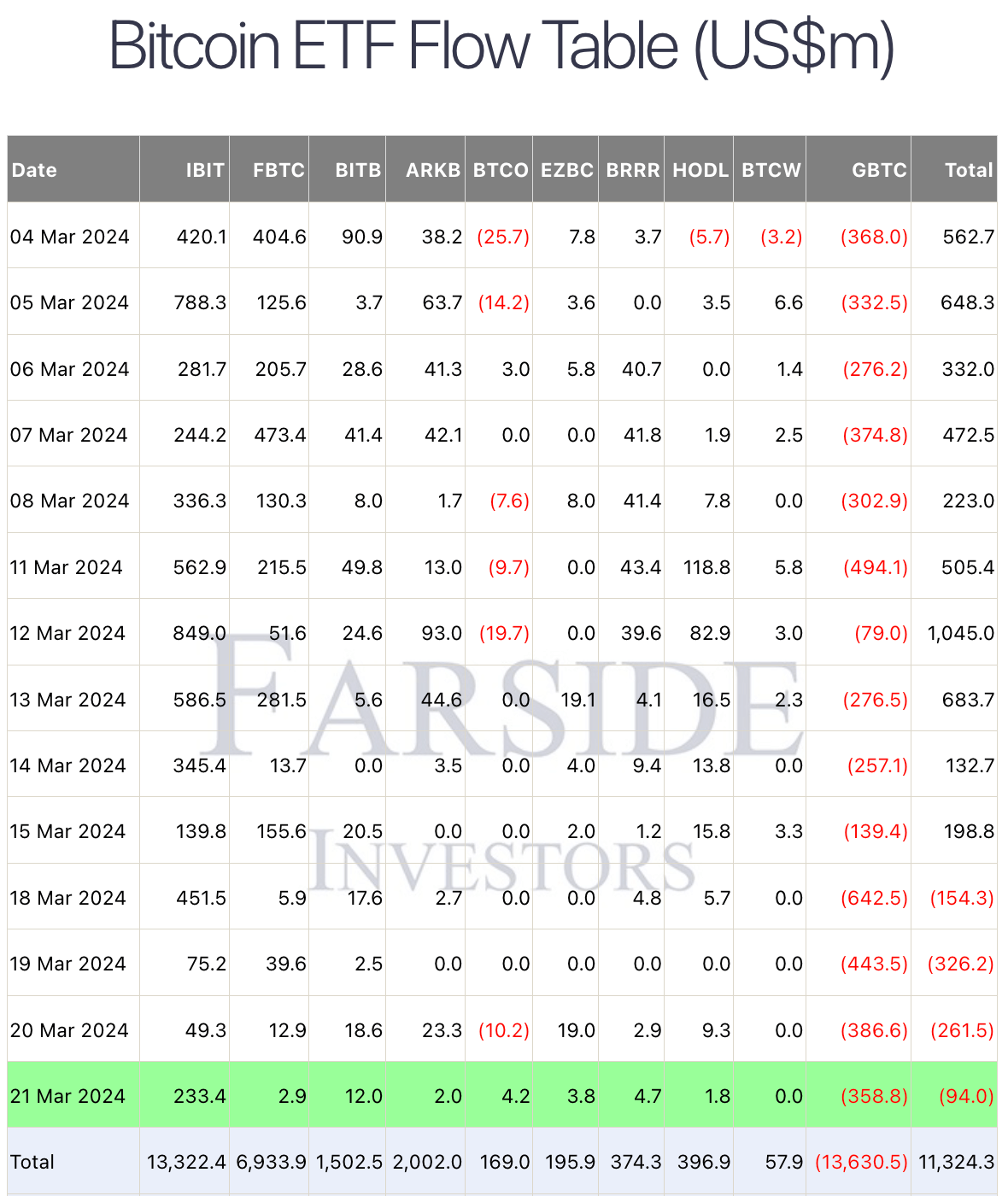

ETF OUTFLOWS CONTINUE 😱

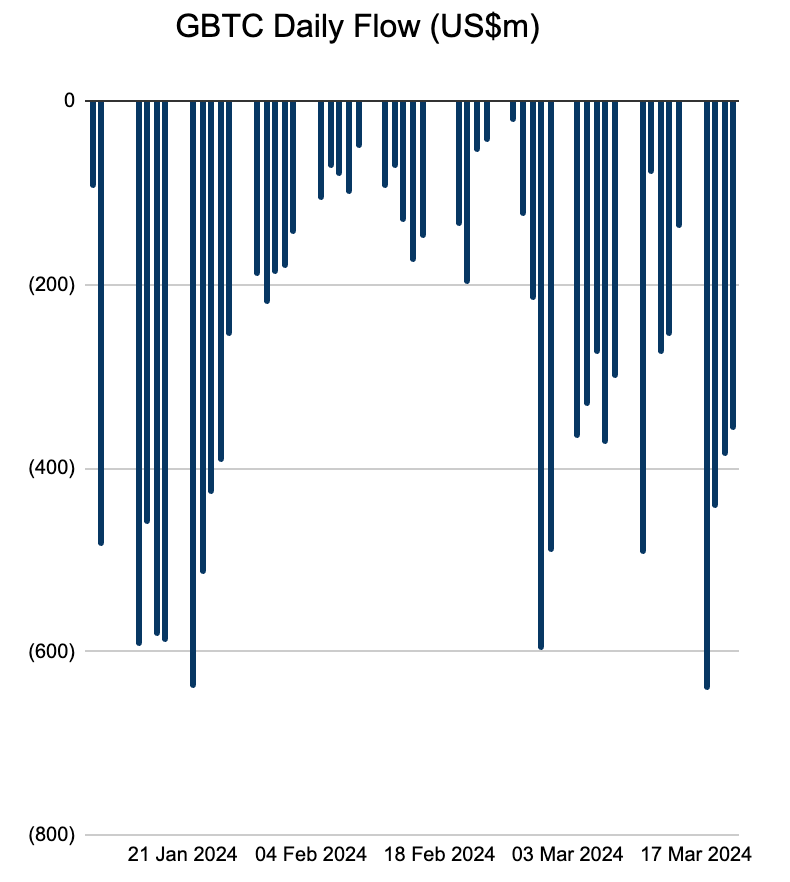

BREAKING: GBTC outflows top $358M, but one theory suggests it’s almost over

It’s been another big day of outflows from Grayscale.

Yesterday $358.8 million exited the fund.

This brings Grayscale’s weekly outflows to $1.83 billion. And consequently marks the fourth straight day of outflows for all 10 Bitcoin ETFs.

Fidelity also recorded it’s lowest inflow day with only $2.9 million coming in.

But ETF analyst Eric Balchunas believes these outflows might be coming to an end soon.

“The more I think about it the more likely the uptick in flows is related to the bankruptcies [Gemini/Genesis] because of the size and consistency.”

Balchunas explains that the flows in February show what retail outflows look like - smaller and random.

“Takeaway: the worst is prob close to being over. Once it is, only retail will be left and flows should look more like the Feb trickle.”

Also keep in mind, every other Bitcoin ETF has experienced net inflows to date.

So it’s not all doom and gloom…

To date, we’ve seen net inflows of $11.32 billion.

Once these bankruptcies are finished selling GBTC, things will be back to normal.

(Checkout this article, in case you’re wondering what bankruptcy we’re talking about.)

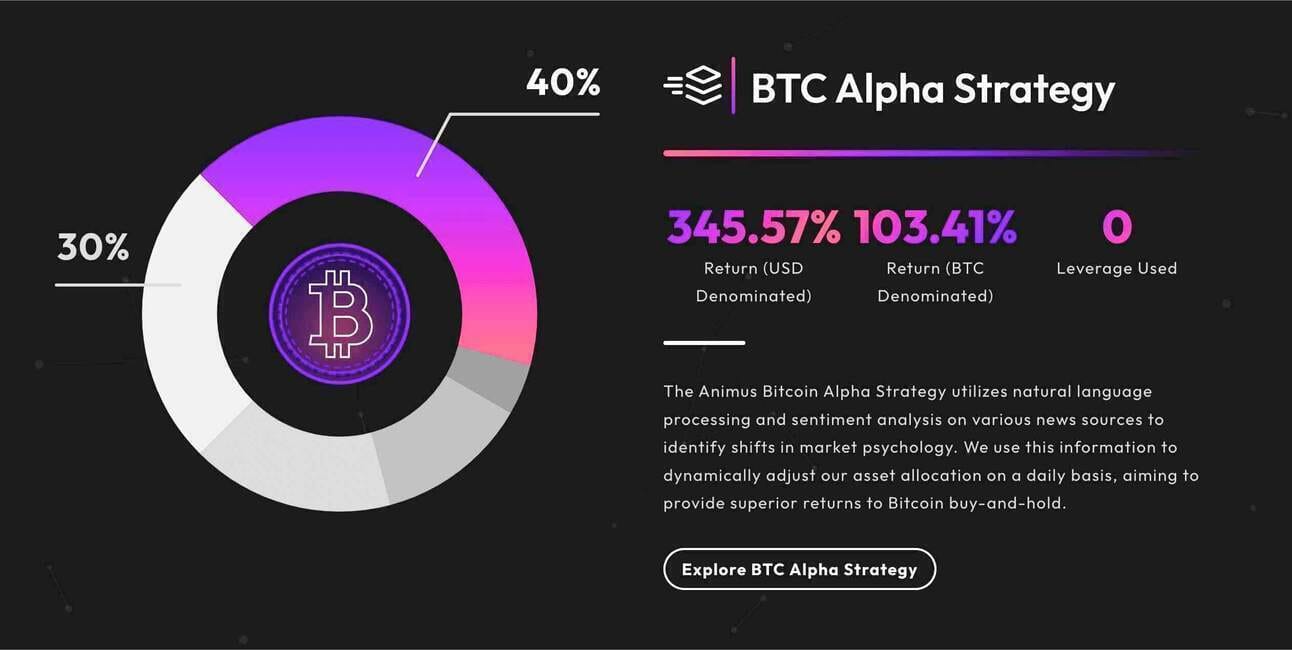

TOGETHER WITH ANIMUS 👾

Over the past year, the crypto market has been on fire. 🔥

12-months ago, Bitcoin was trading at $20,000 and Ethereum was trading at $1,500.

But where will prices go now?

Will there be a sell-off before the Bitcoin halving?

Or will there be a move up in anticipation?

Truth is - timing the market is extremely difficult.

But what if we could use the power of A.I to help us.

That’s where Animus Technologies comes in.

Animus Technologies takes the guess-work out of crypto.

They’ve developed data-driven trading strategies to out-perform the market without the need to add any excess risk.

Developed over 6+ years, their track record is incredible:

Uses cutting-edge artificial intelligence and sentiment analysis to out-return Bitcoin on an outright & risk adjusted basis ✅

Animus Technologies has crushed it, returning +345.57% vs Bitcoin +119.05% 📈

Won Bitcoin Magazines ‘Bitcoin Alpha Competition’, receiving $1 million in seed capital 🌱

Animus is looking at taking on a limited number of new clients.

If you are looking to leverage A.I and out-return Bitcoin, you can click here to book a call with their team to see if they’re right for you.

BACK THE FASTEST HORSE 🏇

Crypto is the biggest macro opportunity of all time.

It’s a gift.

That’s the latest message out from Raoul Pal.

For those who don’t know Raoul, he’s the CEO & founder of Real Vision.

Raoul is a veteran in both crypto & financial markets, having first bought Bitcoin 10+ years ago.

In Real Vision’s latest livestream, Raoul once again broke down his simple thesis.

“If everything is correlated and driven by this same debt cycle. Then you want to back the fastest asset, and by a long way it’s crypto. This is the biggest macro opportunity of all time.”

Let’s break this statement down.

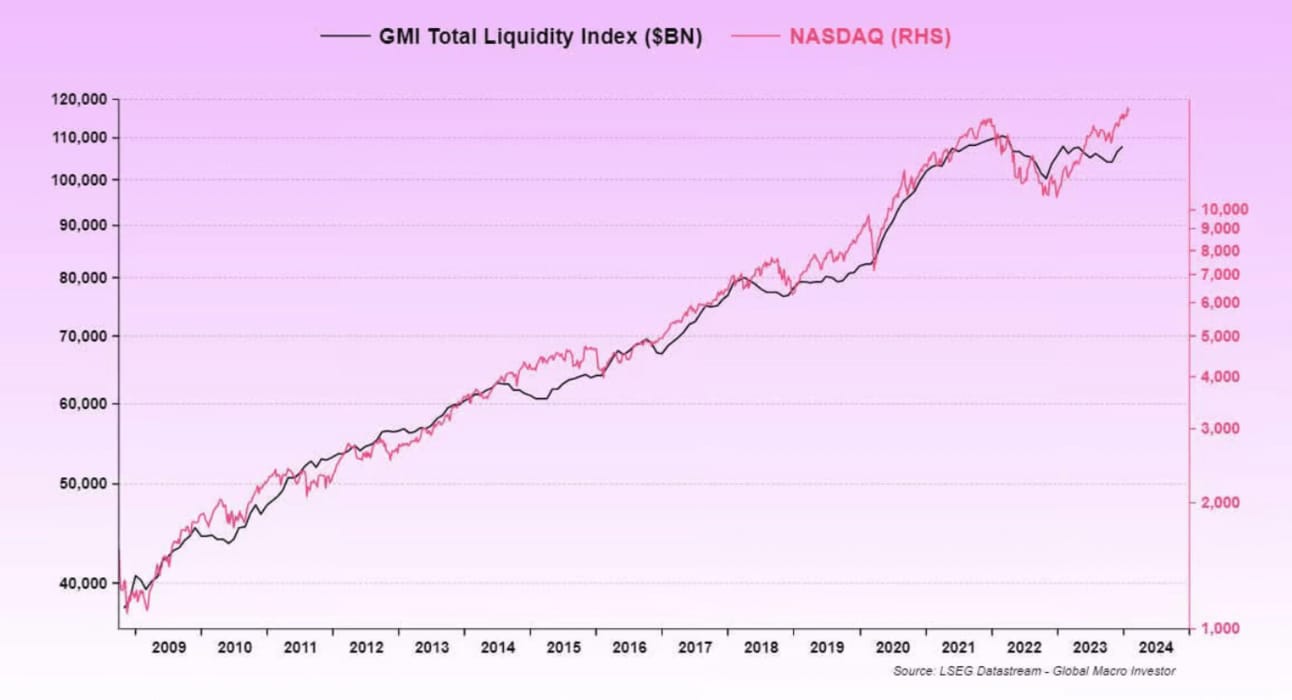

To do that we’ll be looking at the Total Liquidity Index. This index shows a consolidated view of all major central bank balance sheets from around the world. 🌏

If we overlay the NASDAQ onto the total liquidity index you’ll notice that they track each other almost perfectly.

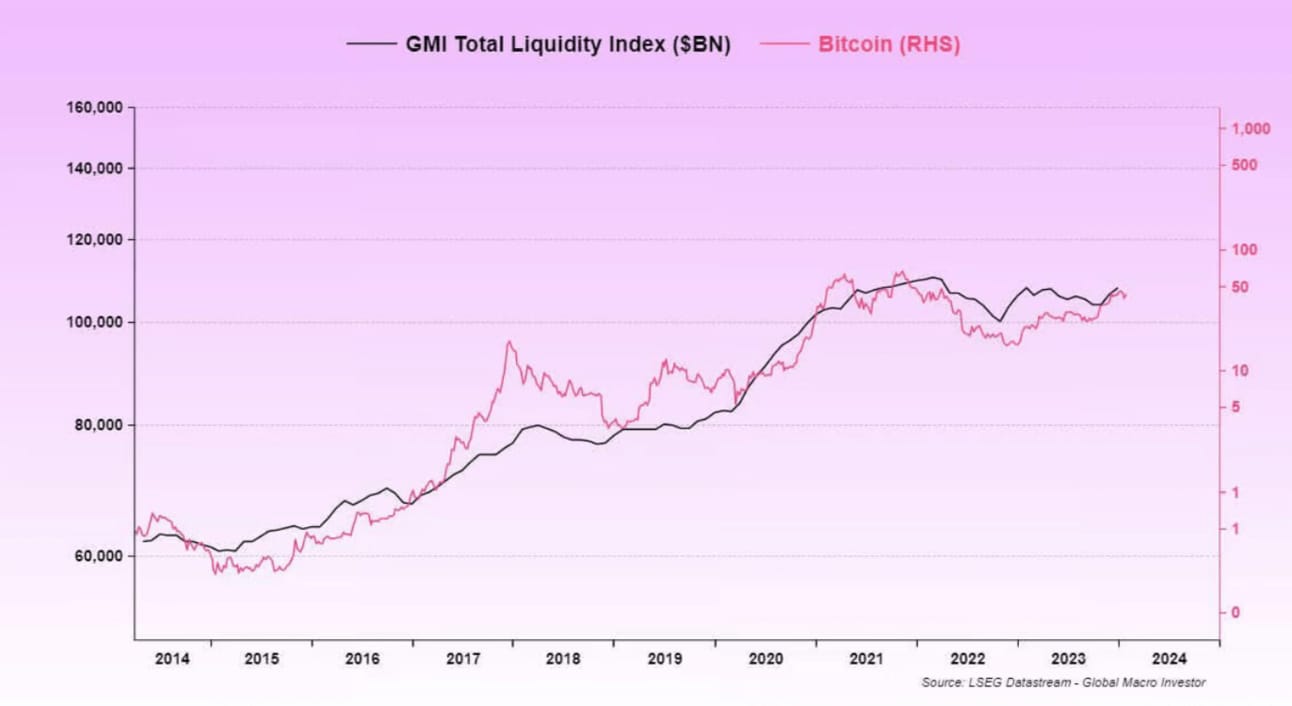

And if we overlay Bitcoin onto the total liquidity index…

It also closely tracks the total liquidity index.

So if both assets closely track the total liquidity index, the smart thing to do would be to back the one that gives the most returns right?

It really is that simple when broken down like this.

Closing out the video, Raoul reminds us all not to overthink this.

“I’ve kind of just left my brain behind. Liquidity goes up over time over the business cycle, these are the assets to own and it works incredibly. Everyone overthinks it, over worries, short-term trades it. Don’t overthink it.”

It’s fascinating when charts like these line up.

Your job is simple.

Just buy and hold.

Don’t f*ck this up. 😎

HODLER BREAKDOWN 💪

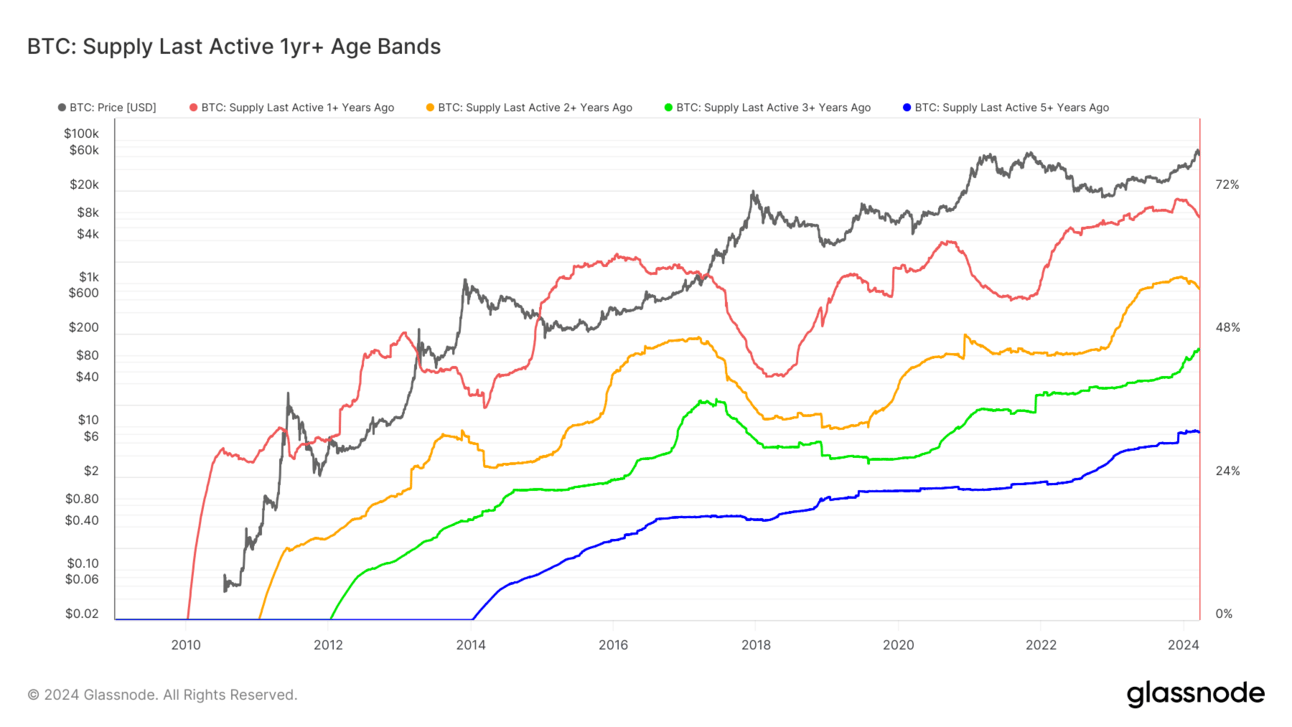

It’s time to check in on the supply of Bitcoin last active 1+ years ago.

We love this chart. It’s simple to understand and extremely useful.

It categorises coins based on how long it’s been since they last moved on-chain. (as a percentage of the circulating supply)

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

Taking a look at the chart below you’ll notice significant dips in these metrics when Bitcoin reaches new all-time highs. (especially with the 1+ year age band)

Here’s the breakdown for each cohort (compared to what it was 2 weeks ago):

🔴 Supply last active 1+ years ago: 67.44% (down from 68.09%)

🟠 Supply last active 2+ years ago: 55.44% (down from 55.96%)

🟢 Supply last active 3+ years ago: 45.29% (up from 44.91%)

🔵 Supply last active 5+ years ago: 31.47% (up from 31.62%)

The 1+ and 2+ age bands have slightly decreased.

But the 3+ and 5+ age bands have slightly increased.

As Bitcoin recently set a new all-time high, it’s only natural that some investors decide to lock in profits.

Take a look at previous all-time highs (2021 & 2017) and you’ll notice that the 1yr+ age band always significantly dips throughout the bull market.

However, all age bands are still relatively close to their all-time highs.

Previously, when Bitcoin has broken it’s all-time high, we saw much larger dips.

This times, holders are stronger.

This means, despite the new highs, long-term conviction in Bitcoin is still extremely high. 😎

CRACKING CRYPTO 🥜

Memecoin donations pour in for BlackRock $100 million token fund partnered with Coinbase. Asset management firm BlackRock and Coinbase partner for groundbreaking $100 million tokenized asset fund on Ethereum.

Coinbase to launch DOGE futures, says it ‘transcended’ meme origins. Coinbase Derivatives has announced plans to launch futures contracts for Dogecoin, Litecoin, and Bitcoin Cash as soon as April 1.

Ether ETFs coming in May? Here’s why many are bearish. Despite consensus that US spot ether ETFs are coming, industry executives agree regulatory deliberation is set to stall approvals in the near term.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) BNB 🥳

BNB currently has a market cap of ~$85 billion.

GET IN FRONT OF 58,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.