GM to all of you nutcases. It’s Crypto Nutshell #621 feelin’ lucky… 🎲🥜

We're the crypto newsletter that's more thrilling than watching dreams collapse like dominos inside someone else's mind... 💤🌀

What we’ve cooked up for you today…

😃 Extremely optimistic

🍌 Banana zone is upon us…

📉 Multi year low

💰 And more…

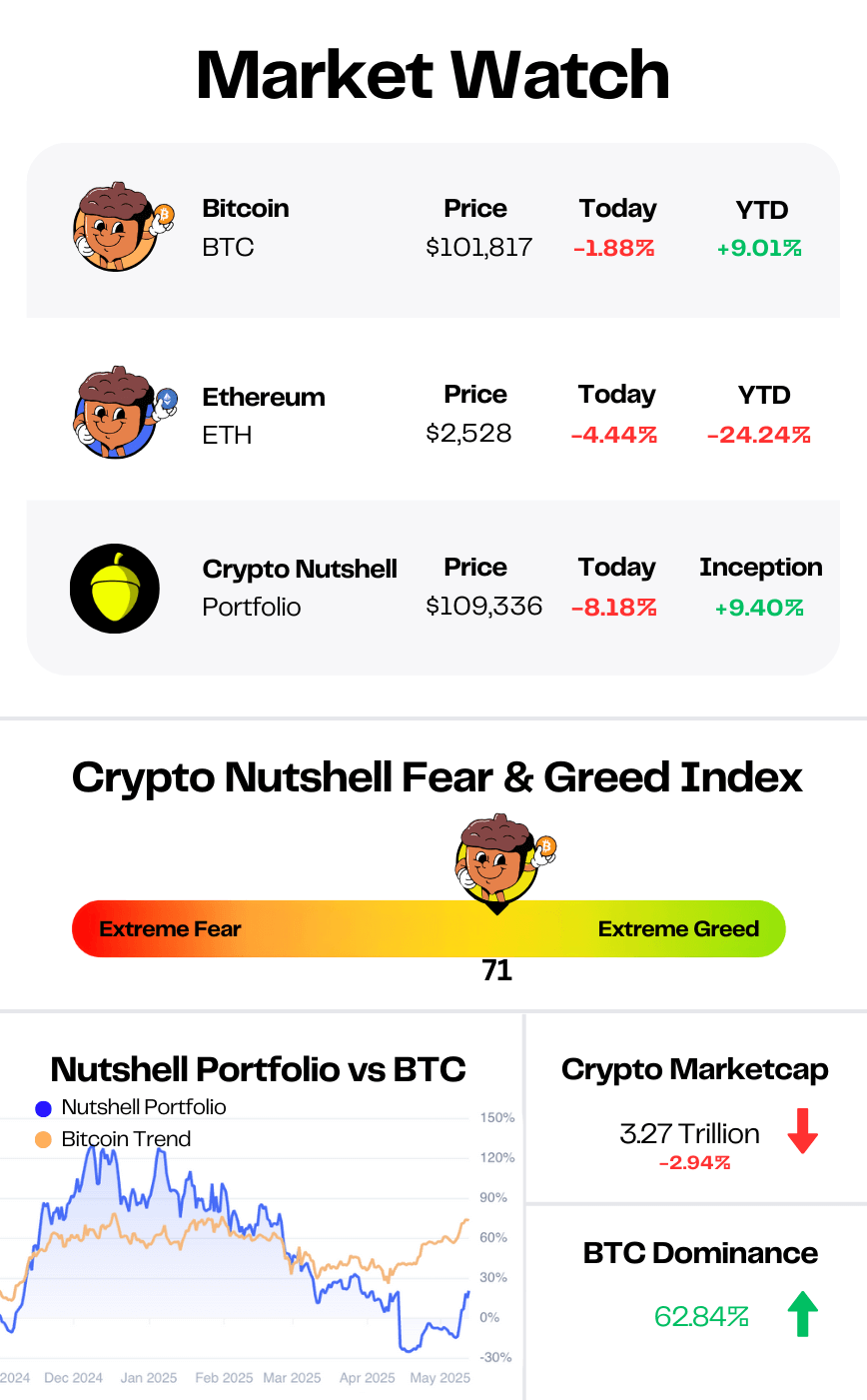

Prices as at 4:00am ET

EXTREMELY OPTIMISTIC 😃

BREAKING: Trump Still on Track to Sign Crypto Legislation by August, White House's Bo Hines Says

Despite recent setbacks, Trump’s digital asset agenda is still moving forward.

According to Bo Hines, the administration expects to get stablecoin and market structure legislation signed before Congress breaks in August.

Speaking at Consensus, Hines made it clear:

“I’m extremely optimistic. I think we’re going to deliver on the President’s wishes to get stablecoin and market structure legislation on his desk before August recess. Our colleagues are working extremely hard - making a ton of progress.”

So, who is Bo Hines?

He’s not just another talking head - he’s the President’s top digital asset advisor.

Translation: when he speaks, crypto policy insiders listen.

Hines also addressed criticism over the Trump family’s ties to crypto ventures:

"His sons have the right to engage in capital markets as private business people, like anyone else does in the U.S… I don't see any conflict in doing so. By the way, it should be exciting that they're engaging in this space. If you're a good business person, you should be looking at digital assets and saying, 'how can I get involved?' Because this is the next generation of finance."

And what about more details on U.S. Strategic Bitcoin Reserve?

According to Hines, the working group are still hammering the details on that front.

These things unfortunately take quite a lot of time…

So why does all of this matter?

Regulatory clarity has been the final barrier keeping many institutional giants on the sidelines.

If the Trump administration delivers - we could see a wave of fresh capital flood into the crypto space.

We can’t overstate how important this is for the industry.

CRYPTO NUTSHELL PRO IS NOW OPEN 🚨

Everyone is asking the same questions:

“Is now the time to buy?”

“Are altcoins about to run?”

“When is it time to sell?”

Crypto Nutshell Pro gives you the answer — every single week.

Our team of full-time on-chain analysts track 10+ critical indicators across:

📈 On-chain metrics

📉 Technical signals

📊 Liquidity flows

🧠 Social sentiment shifts

🌍 Macro trends

So you’ll know exactly when to buy.

But more importantly, when to sell.

Here’s what we told members when Bitcoin dipped to $75K last month:

“We’re at or very close to the bottom. This is what the reversal looks like.”

As you know, Bitcoin has since rebounded to $102K…

And today we’re opening 25 new spots — but they won’t last long. 🚀

Signups are first come first served until we reach the 25 new member cap.

(we cap members to keep alpha in the group as high as possible.)

No lock in, cancel anytime.

Don’t do 2025 alone - eliminate the guesswork this bull run.

See you on the inside!

First in, first served. (Crypto Nutshell has 95,000+ daily readers — you do the math.)

THE BANANA ZONE IS UPON US… 🍌

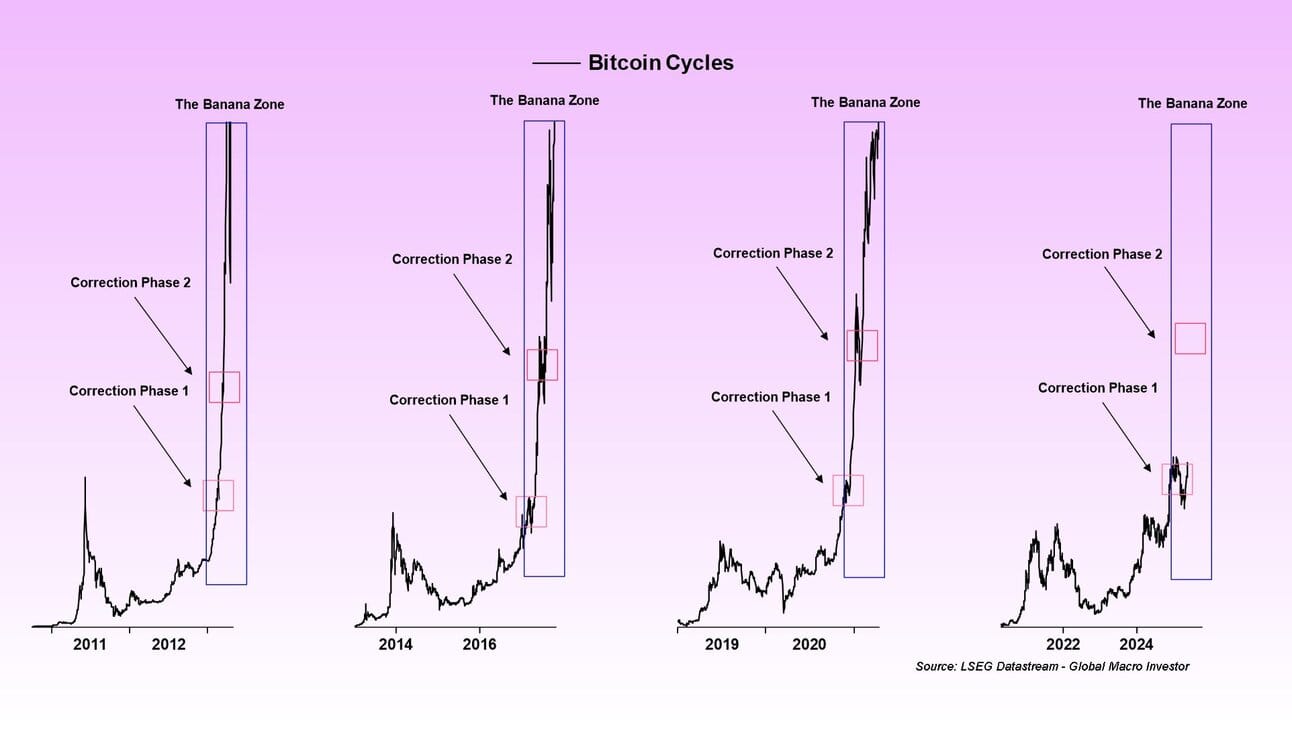

Julien Bittel is back with an update.

And if you know his work, you know what this chart means:

Updated Banana Zone Chart

The Banana Zone is once again upon us — the part of the Bitcoin cycle where things get… vertical.

Who is Julien Bittel?

He’s the Head of Macro Research at Global Macro Investor, the firm founded by Raoul Pal.

Together, they built The Everything Code — a thesis that liquidity drives all asset prices in a predictable 4-year cycle.

And right now?

That cycle says Bitcoin is entering its most explosive phase.

What’s the Banana Zone?

It’s the final stretch of every crypto cycle — where prices goes parabolic.

The banana zone has 3 distinct phases:

Correction Phase 1 (early shakeout)

Correction Phase 2 (last exit for non-believers)

Banana Zone (straight up)

Julien’s chart makes it clear:

Each cycle follows the same pattern. Right now, we’ve just moved past Correction Phase 1.

If the pattern holds?

We’re entering a stretch of “up only” price action through August — exactly what Raoul and Julien are suggesting.

You can fade the memes.

Or you can zoom out and respect the structure.

Because according to Julien?

The Banana Zone is upon us. 🍌📈

MULTI YEAR LOW 📉

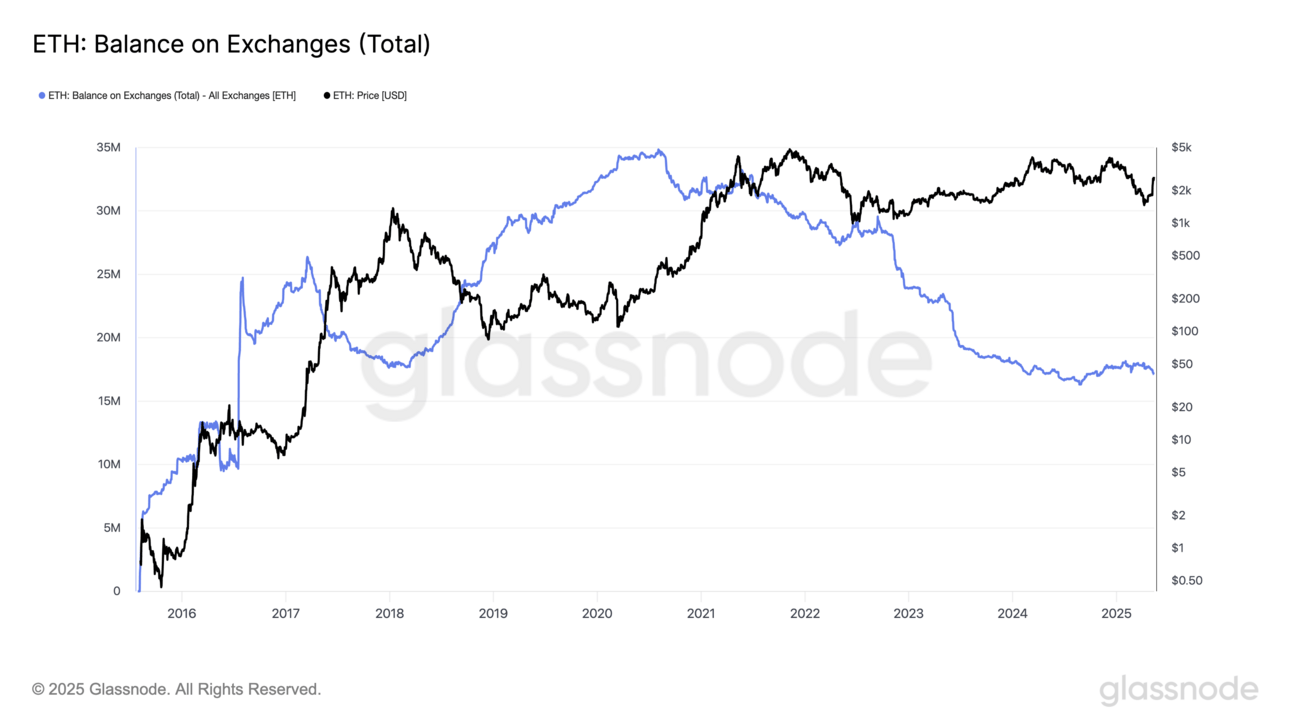

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

According to Glassnode, just 17.1 million ETH remains on exchanges.

That’s only 14.1% of the entire circulating supply…

In the past three months exchange balances dropped 715,231 ETH (≈ $1.9 B).

The kicker: that drain came while ETH ripped 44% in seven days.

Holders aren’t cashing out, pushing exchange reserves to multi-year lows.

With supply thinning and demand rising, order books are getting lighter.

History says that mix tends to lift price. 🚀

CRACKING CRYPTO 🥜

Chinese-linked firm raises $300M from private investor to buy TRUMP memecoin. Struggling TikTok vendor with zero revenue announces massive investment in TRUMP memecoin and Bitcoin.

Top South Korean presidential hopefuls support legalizing Bitcoin ETFs. While the three leading presidential candidates have indicated a pro-Bitcoin ETF stance, previous political promises have yet to materialize in South Korea.

Banks Exploring Stablecoin Amid Fears of Losing Market Share, BitGo Executive Says. BitGo’s stablecoin-as-a-service has drawn significant interest from U.S. and international banks, Ben Reynolds said.

Morgan Stanley head of digital asset markets Andrew Peel steps down to launch tokenization startup in Switzerland. Morgan Stanley’s head of digital asset markets has left after joining the bank in 2018.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What was unique about Grayscale’s Bitcoin ETF approval in 2024?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: It converted an existing trust into an ETF 🥳

Grayscale’s GBTC was already the biggest Bitcoin trust — and when it was approved to convert into an ETF, it became a spot ETF overnight, making waves across the market. 🔄🧠

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.