GM to all of you nutcases. It’s Crypto Nutshell #643 thinkin’ hard… 🧠🥜

We're the crypto newsletter that's more exhilarating than a street race through Tokyo with everything on the line... 🏁🏙️

What we’ve cooked up for you today…

🏦 ETH Treasury?

🧠 Bear market’s not coming back…

🥵 Drying up

💰 And more…

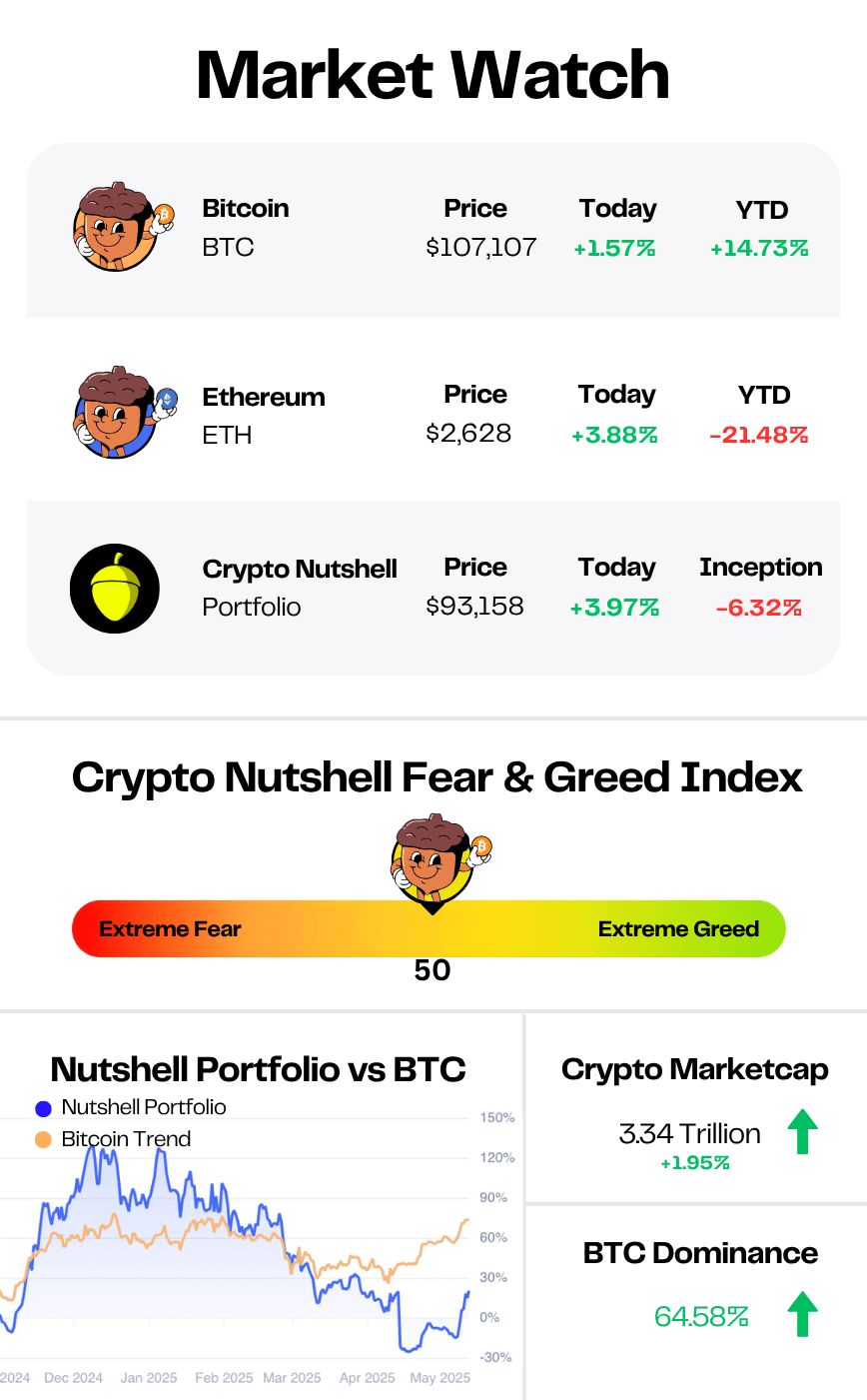

Prices as at 3:50am ET

ETH TREASURY? 🏦

BREAKING: SharpLink Gaming Buys $463 Million in Ethereum, Becomes Largest ETH Treasury Firm

We’ve all heard of Bitcoin treasury companies…

But what about Ethereum?

This week, SharpLink Gaming became the world’s largest publicly traded holder of ETH - acquiring 176,271 ETH, worth $463 million.

The Nasdaq-listed sports betting firm funded the move through a $425M private placement led by Consensys, plus an additional $79M in equity sales under its $1B ATM program.

“We believe Ethereum is foundational infrastructure for the future of digital commerce and decentralized applications. Our decision to make ETH our primary treasury reserve asset reflects deep conviction in its role as programmable, yield-bearing digital capital.”

But SharpLink isn’t just stacking ETH.

95% of its holdings are already deployed in staking and liquid staking platforms, generating yield while securing the network.

That’s a key edge Ethereum treasury firms hold over Bitcoin-based strategies - productive capital instead of idle coins.

As of today, SharpLink holds more ETH than any public company - second only to the Ethereum Foundation.

“This is a landmark moment for SharpLink and for public company adoption of digital assets,”

But the move hasn’t come without drama…

After the initial ETH announcement, SharpLink shares rocketed 400%.

But confusion around an SEC S-3 filing triggered a 73% after-hours crash, wrongly interpreted as insider dumping.

Chairman and Ethereum co-founder Joe Lubin clarified: it was a routine disclosure.

Now the dust is settling - and the model is clear:

SharpLink is to ETH what MicroStrategy is to Bitcoin.

And with ETH still trading under $2,600…

The playbook is wide open.

Is this the beginning of the Ethereum treasury rush? 🤔

Investment picks returning 200%+

AIR Insiders get weekly expert investment picks and exclusive offers and perks from leading private market investing tools and platforms. So if you’re looking to invest in private markets like real estate, private credit, pre-IPO venture or crypto, the time to join FOR FREE is now.

THE BEAR MARKET ISN’T COMING BACK 🐻

Everyone keeps asking:

“When’s the next Bitcoin winter?”

Michael Saylor’s answer?

"Winter’s not coming back. We’re past that. We’re past that phase."

Why?

In his latest interview with Bloomberg, Saylor explained:

Bitcoin’s no longer a fringe asset. 🏛️

It has presidential support, institutional custody, and regulatory clarity.Natural daily supply is just 450 BTC. 🪙

That’s around $50 million a day - and treasury buyers are already scooping it all up.ETFs and nation-states are piling in too. 🌍

BlackRock, sovereigns, even Trump’s media org - all buying.

Saylor put it bluntly:

“If Bitcoin’s not going to zero, it’s going to a million.”

At current levels, it only takes $50M a day to push the price higher.

That’s a rounding error for Wall Street and sovereigns.

You may not be early anymore.

But we’re nowhere near late.

DRYING UP 🥵

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

As always, we’re focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 15.94% (up from 12.31%)

1y - 2y: 10.88% (down from 11.01%)

2y - 3y: 8.03% (up from 7.90%)

3y - 4y: 6.81% (up from 6.74%)

4y - 5y: 8.67% (down from 8.68%)

5y - 10y: 14.81% (down from 14.82%)

>10y: 9.28% (up from 9.26%)

TL;DR: 74.42% of all Bitcoin hasn’t moved in over six months. 🔒

That’s a meaningful jump from 70.72% just two weeks ago - a +3.70% increase.

The biggest standout?

A sharp rise in the 6–12 month band, signalling that a wave of short-term holders are aging into long-term conviction.

Meanwhile, the small declines in the 1–2y, 4–5y, and 5–10y bands likely reflect light profit-taking or minor reallocations - not structural weakness.

The bigger picture is clear:

Long-term holders aren’t budging.

Supply is tightening.

And the longer this persists, the more upside pressure builds.

Bitcoin’s liquid supply is drying up - fast.

CRACKING CRYPTO 🥜

Trump earned over $58 million from crypto ventures in 2024. Trump's earnings from World Liberty Financial were his single-largest income in 2024, with this year's earnings expected to be far greater.

Vietnam legalizes crypto under new digital technology law. Vietnam’s new digital tech law brings crypto assets under regulation and introduces bold incentives for AI and semiconductor industries, positioning itself for global tech leadership.

Will the ‘Digital Oil’ Narrative Fuel ETH’s Rally to New Highs Despite Middle East Turmoil? Ether is staying above $2,500 days after being called a foundational asset for a global, on-chain financial system and a major opportunity for institutions.

Prospective SOL ETF issuers submit updated S-1 filings, hinting at potential listing. Franklin Templeton and Galaxy Digital submitted updated S-1s, a registration statement needed for an ETF to gain SEC approval for public trading.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 3.125 BTC 🥳

With the 2024 halving, Bitcoin’s block reward dropped from 6.25 BTC to 3.125 BTC - cutting miner rewards in half and reinforcing Bitcoin’s deflationary design. 📉🪙

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.