Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all of you nutcases. It’s Crypto Nutshell #573 stayin’ sharp… 🔪 🥜

We're the crypto newsletter that's more chaotic than a group of misfit criminals on a disastrous mission for redemption... 🎭💥

What we’ve cooked up for you today…

😱 It got worse…

🧸 How are people bearish?

📉 Outflows continue

💰 And more…

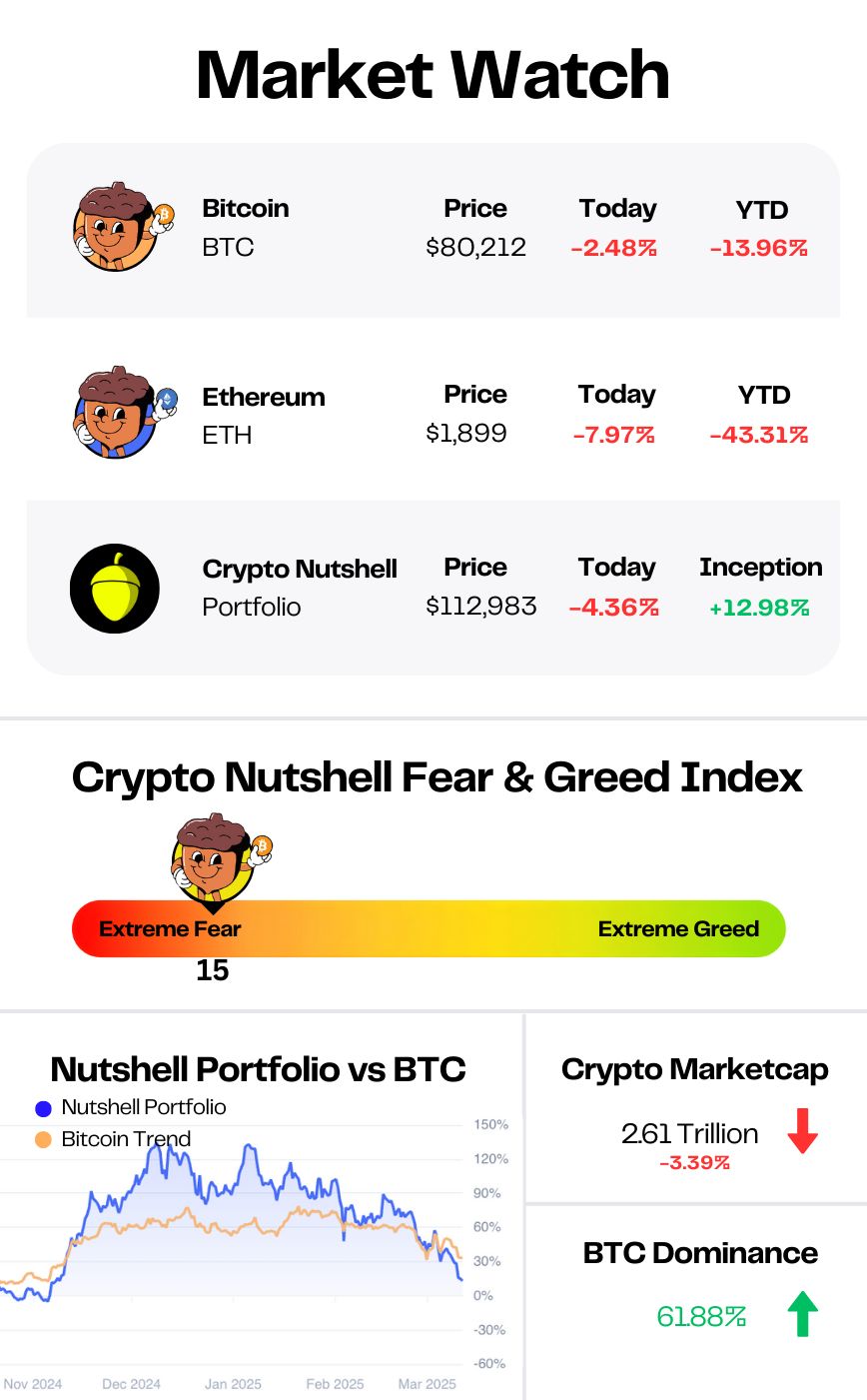

Prices as at 3:20am ET

IT GOT WORSE… 😱

BREAKING: Bitcoin slides below $80,000, Ether falls to 16-month low near $1,800 amid broader market sell-off

The sell-off continues… 😱

Bitcoin briefly dipped below $77,000 on Monday before recovering slightly to ~$80,200 at the time of writing.

Meanwhile, Ethereum plunged 11% below $1,800 - its lowest price since October 2023.

And altcoins?

It’s a sea of red:

Dogecoin: -14% (biggest drop among top 10)

XRP: -10.7%

Cardano: -10.2%

But as we explained yesterday, this isn’t just a crypto correction, it’s a full-blown risk-off event:

S&P 500: -2.7% (worst day of 2025)

Dow Jones: -2.08%

Nasdaq: -4% (biggest drop since September 2022)

Markets are still digesting the impact of trade wars, spending cuts and potential recession risks.

But here’s the thing…

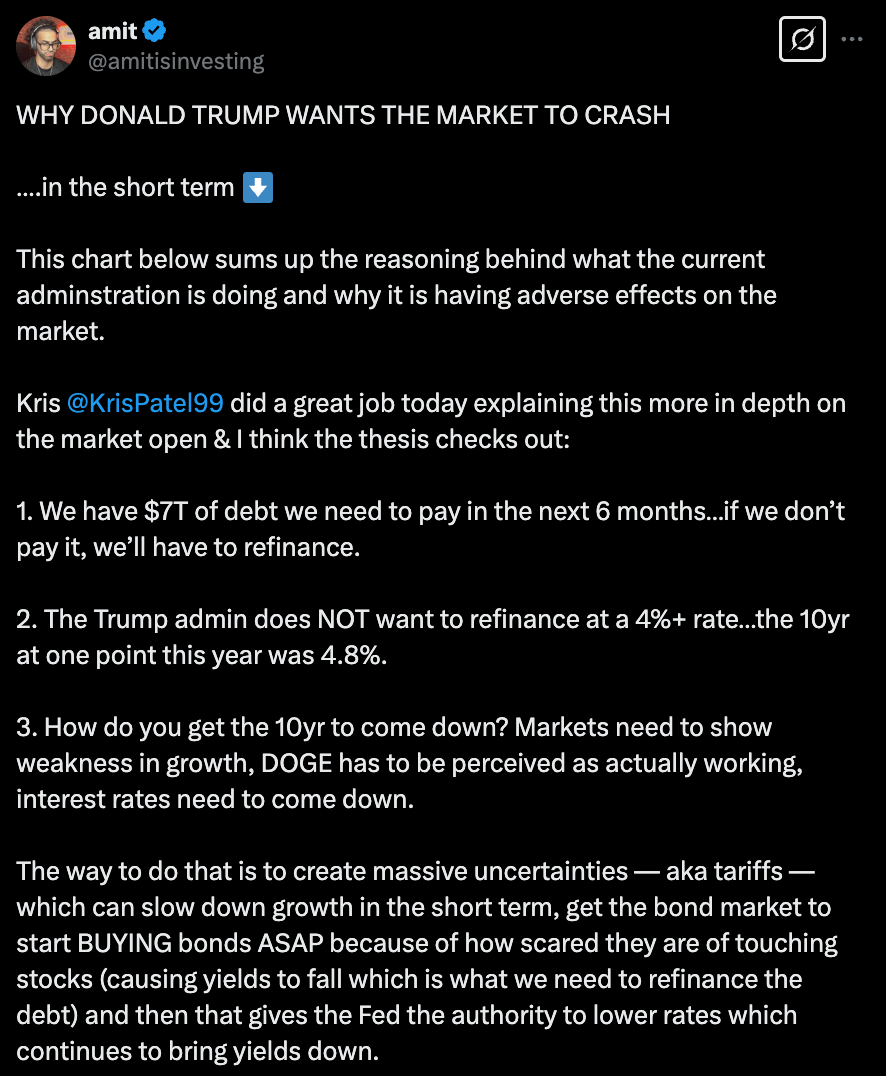

According to Treasury Secretary Scott Bessent, this market downturn is all part of the plan:

“We are trying to get rates down… The market and the economy have become hooked, become addicted, to excessive government spending and there’s going to be a detox period.”

This raises the question…

Is Trump intentionally tanking the stock market to force the Fed’s hand on rate cuts?

Some believe this short-term pain is part of a long-term strategy to push the Fed into easing financial conditions.

Others think it’s reckless…

But we want to here from you. 🫵

Is Trump intentionally tanking asset prices to force the Fed’s hand?

Is this a short-term pain for long-term gain kind of scenario?

Or has Trump completely lost his mind?

Let us know your thoughts in the poll below. 👇

Is Trump Intentionally Tanking The Markets?

MAKE EVERY TRANSACTION COUNT 💳

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.*

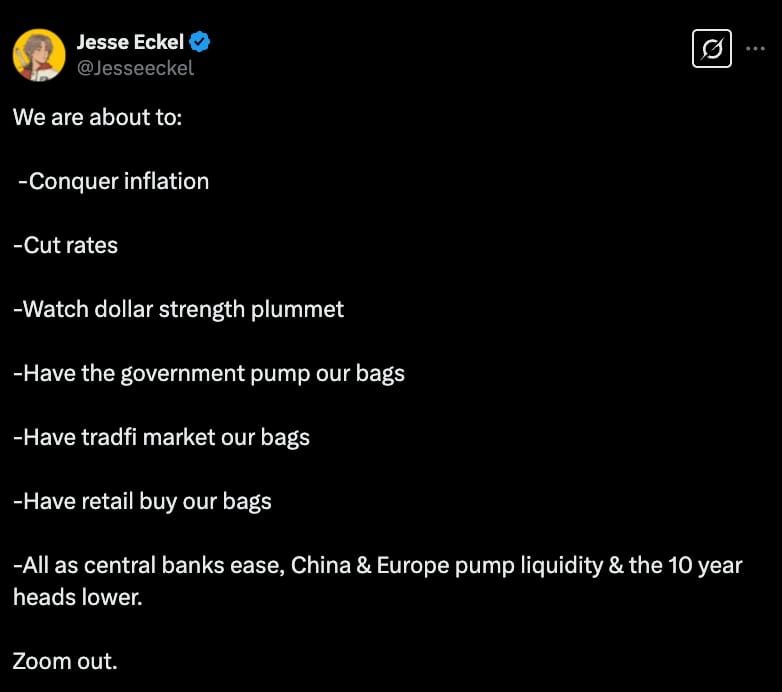

HOW ARE PEOPLE BEARISH? 🧸

This is the easiest crypto setup, of all time.

It’s unfathomable how people are bearish.

That’s the latest out of Jesse Eckel.

If you don’t know Jesse Eckel, he’s a crypto analyst with an impressive track record.

Jesse went from being unemployed during the 2020/2021 bull run to building a crypto portfolio worth over $1.7 million by the end of the cycle.

Now, he's working to grow it to $10+ million in our current cycle.

This week, Jesse pointed out 7 major catalysts that are coming for crypto:

He’s not wrong, either.

When you look at Truflation, it’s gone off a cliff:

When inflation drops, governments can cut interest rates and stimulate the economy - essentially, print more money.

And when rates fall and liquidity flows, risk assets soar - that means Bitcoin & crypto.

Given the setup, Jesse can’t fathom how anyone is bearish right now:

We agree.

The U.S. government just unveiled a Strategic Bitcoin Reserve, a digital asset stockpile & they’re looking into buying more Bitcoin.

Add Jesse’s 7 major catalysts, and this is arguably the best crypto setup in history.

Yet, the market is gripped with panic.

Smells like opportunity. 👃

OUTFLOWS CONTINUE 📉

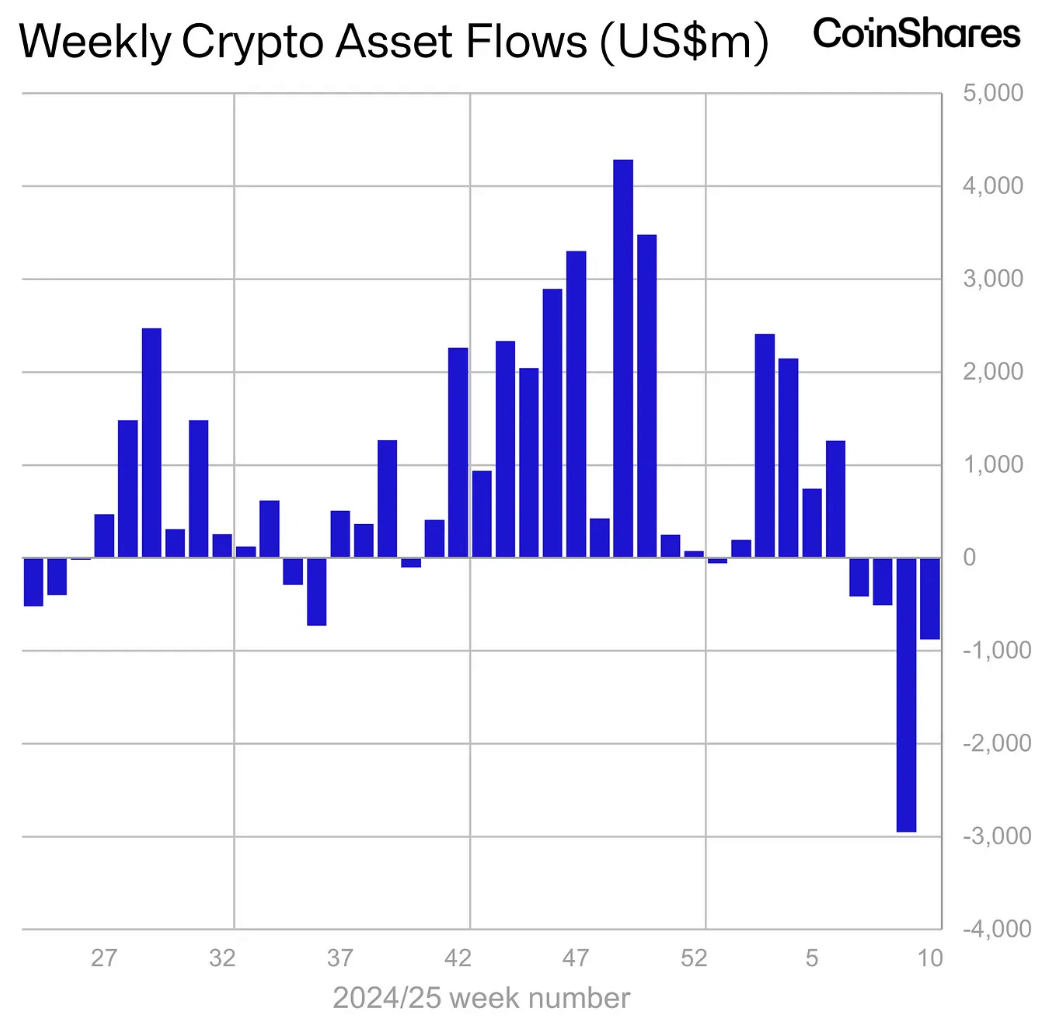

The outflow streak continues…

For the fourth straight week, Digital asset funds saw net outflows, with $876 million exiting.

While still a substantial figure, it’s a notable slowdown from the prior week’s massive $2.9 billion in outflows.

Let’s break it down.

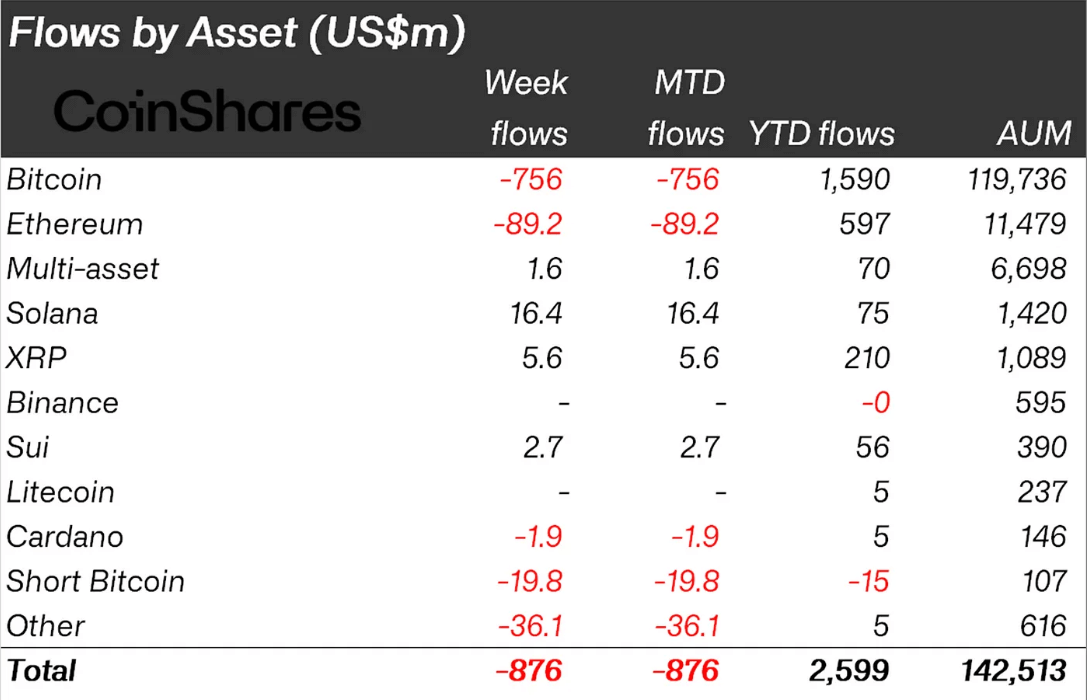

Bitcoin once again saw the majority of outflows, with $756 million exiting.

Ethereum also saw significant outflows of $89.2 million.

Conversely Solana, XRP and Sui continued to see inflows totalling $16.4m, $5.6m and $2.7m respectively.

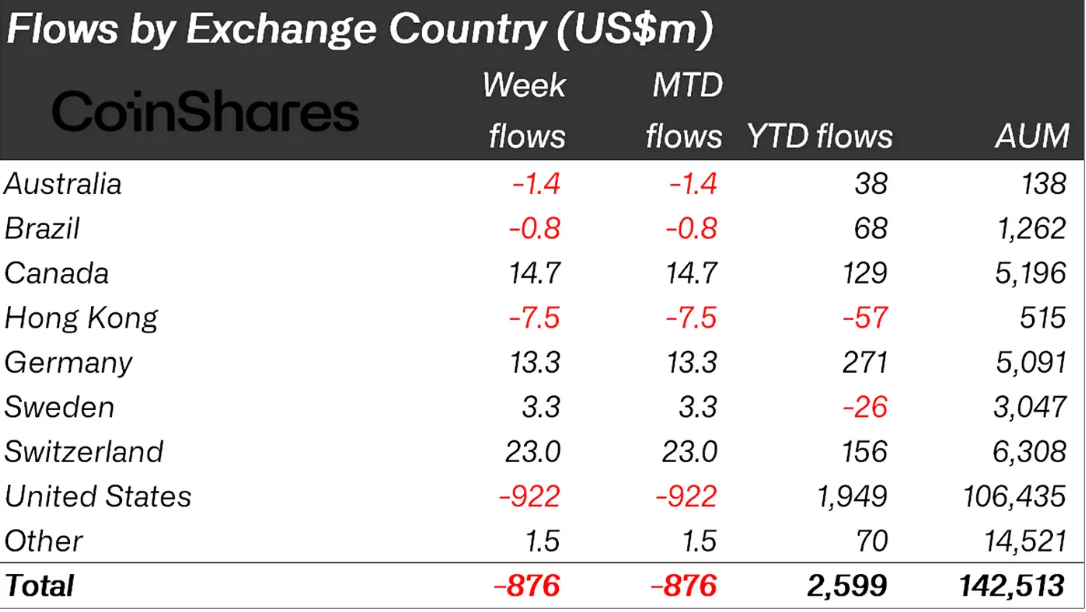

As expected, the U.S. led outflows, with $922 million leaving digital asset funds.

But outside the U.S.?

Some regions saw this as a buying opportunity:

Switzerland, Canada and Germany all saw inflows of $23.0m, $14.7m and $13.3m respectively.

Despite the slowdown in outflows, investor confidence remains shaky.

Cumulative outflows over this period are now up to $4.75 billion.

Resulting in YTD inflows falling to $2.6 billion.

As we covered earlier, these outflows are fuelled by extreme uncertainty in the markets.

Stay strong. 💪

CRACKING CRYPTO 🥜

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend. Nayib Bukele-led El Salvador increases Bitcoin reserves during market dip, risking International Monetray Fund (IMF) deal tension.

Utah’s Senate passes Bitcoin bill — but scraps key provision. Utah lawmakers have passed a Bitcoin bill after amending it to remove a section that would have authorized the state treasurer to invest in Bitcoin.

Strategy Comes Off the Sidelines With $21B Preferred Stock ATM Offering. A fresh round of purchases of bitcoin would bring the company's holdings above 500,000 tokens.

Bitcoin’s safe-haven role under scrutiny as stock market poised for correction. While gold remains a trusted hedge, experts argue bitcoin still behaves like a high-risk tech stock during market turbulence.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Litecoin 🥳

Created by Charlie Lee in 2011 as a lighter and faster alternative to Bitcoin, Litecoin is often referred to as the "silver" to Bitcoin's “gold.”

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.