Today’s edition is brought to you by TLDR Newsletter - catch up on the latest tech, startup, and coding stories.

GM to all of you nutcases. It’s Crypto Nutshell #619 gearin’ up… 🧰🥜

We're the crypto newsletter that's more legendary than a Viking prince avenging his father in a blood-soaked saga... 🩸⚔️

What we’ve cooked up for you today…

🤓 Strategy squared?

🐻 Bears changing mind

🔥 Heating up

💰 And more…

Prices as at 4:05am ET

STRATEGY SQUARED? 🤓

BREAKING: There’s Another Bitcoin Holding Company in Town—And It Just Raised $710 Million

Another Bitcoin treasury company has entered the game…

Nakamoto Holdings, founded by Bitcoin Magazine CEO and Trump crypto advisor David Bailey, just merged with healthcare firm KindlyMD to launch a publicly traded Bitcoin treasury powerhouse.

And they’re not coming in quiet…

The deal raised $710 million, making it the largest Bitcoin treasury capital raise to date.

$510 million via private investment in public equity (PIPE) deal

$200 million in senior secured convertible notes

200+ investors including VanEck, ParaFi, Arrington Capital, and crypto figures like Adam Back and Balaji Srinivasan

And check this out…

KDLY stock exploded +650% on the news.

The Playbook 🧠

The new company will hold Bitcoin on its balance sheet and aggressively grow Bitcoin per share (BTC Yield) through:

Equity & debt raises

Hybrid financial instruments

Strategic acquisitions of Bitcoin-native companies

Literally the Saylor playbook.

“We believe a future is coming where every balance sheet — public or private — holds Bitcoin.”

But Bailey’s vision?

Not just another MicroStrategy - this is “Strategy, squared.”

A global Bitcoin-native conglomerate operating in every major capital market.

The Healthcare Angle 🏥

KindlyMD will continue to operate its clinics, focused on treating opioid addiction.

The merger allows it to integrate a Bitcoin treasury model without abandoning its healthcare mission.

The Bigger Picture 🌍

With Bitcoin near all-time highs, ETF inflows rising, and U.S. states legalising BTC reserves, this is more than a corporate pivot — it’s a paradigm shift.

The Bitcoin balance sheet era has begun.

Who’s next? 👀

STAY UP TO DATE ON ALL THINGS TECH 🤖

Love Hacker News but don’t have the time to read it every day? Try TLDR’s free daily newsletter.

TLDR covers the best tech, startup, and coding stories in a quick email that takes 5 minutes to read.

No politics, sports, or weather (we promise).

Subscribe for free now and you'll get their next newsletter tomorrow morning.

BEARS ARE CHANGING THEIR MIND 🐻

Two months ago, Ki Young Ju — one of the most respected on-chain analysts in the game — said the Bitcoin bull cycle was over.

This week?

He admitted he was wrong.

Who Is Ki Young Ju?

He’s the founder of CryptoQuant — a leading on-chain analytics platform used by institutions, traders, and researchers worldwide.

When it comes to tracking liquidity and sell pressure, Ki sees the flows before the headlines do.

What Changed?

Ki just admitted he got it completely wrong.

The bull cycle is far from over:

His core message:

Selling pressure is easing

Massive ETF inflows are ramping up

And the old 4-year cycle theory? It’s breaking down.

“In the past, the Bitcoin market was like musical chairs… But now it’s merging with TradFi.”

Instead of watching whale sell-offs, he says it’s time to track institutional inflows — because they’re starting to dominate the market. 🐳

Ki makes one thing clear: this isn’t the end of the bull cycle.

It’s the start of a different kind of one.

The old models don’t work anymore

Institutional inflows are rewriting the script

And the real move is still be ahead

The game’s changed.

And this bull run? It’s just getting warmed up. 🔥

HEATING UP 🔥

The streak continues…

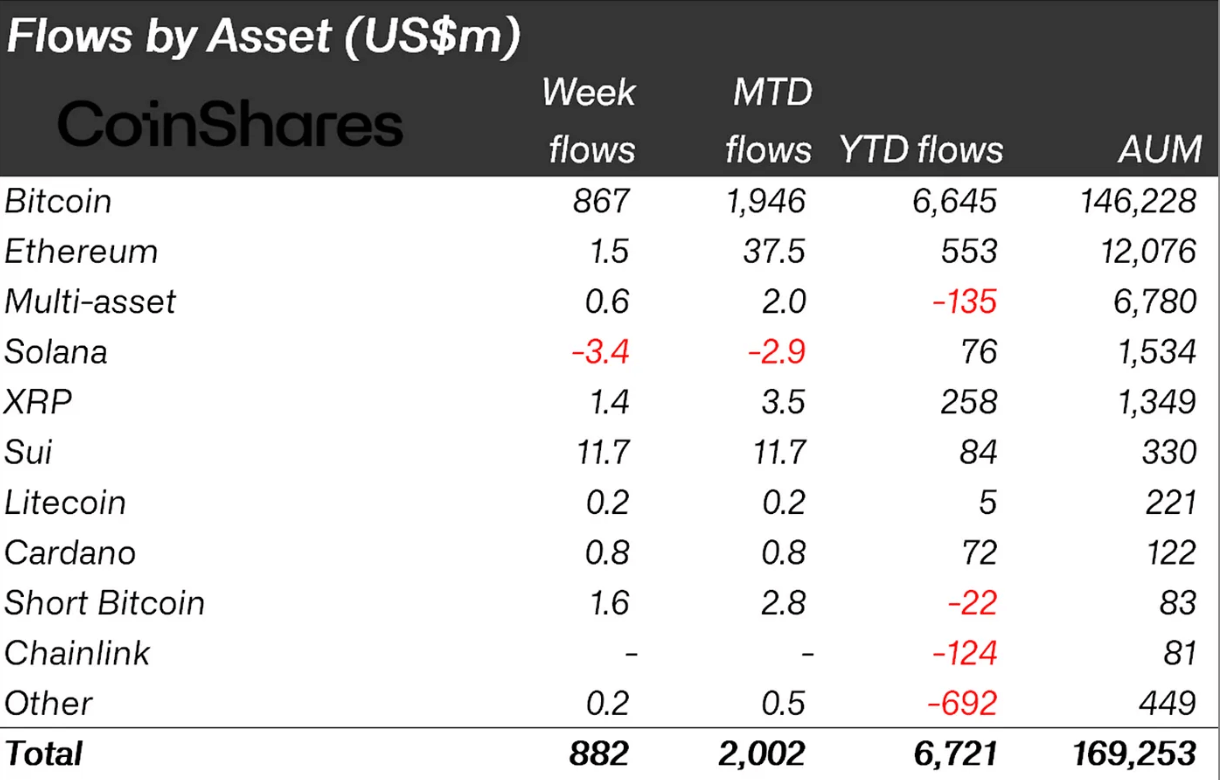

Digital asset funds just posted their fourth consecutive week of inflows, with $882 million pouring in.

Year-to-date inflows now stand at $6.7 billion, approaching the $7.3 billion peak reached in early February this year.

Let's break it down.

Bitcoin once again led the pack with $867 million in inflows.

Despite Ethereum’s sharp price appreciation, its inflows were disappointing at just $1.5 million for the week.

Sui surprised with a standout $11.7 million in weekly inflows.

Solana, however, stumbled — recording $3.4 million in outflows.

As usual, the US saw the majority of inflows with $840 million coming in for the week.

Germany, and Australia followed with inflows of $44.5m and $10.2m respectively.

Whilst Sweden, Canada and Hong Kong saw outflows of $12.0m, $8.0m and $4.3m respectively.

So, what’s driving this fresh surge?

According to CoinShares, it’s a trifecta of macro tailwinds:

Global M2 expansion

Rising stagflation fears in the U.S.

Several US states approving Bitcoin strategic reserves

And here’s another interesting stat for you…

Since launching in January 2024, U.S. Bitcoin ETFs have now surpassed $62.9 billion in total inflows — breaking past the February peak. ($61.6 billion)

Institutional demand isn’t just back…

It’s picking up speed. 🏎️💨

CRACKING CRYPTO 🥜

Trump family-backed Bitcoin reserve company American BTC to go public this year. American Bitcoin's stock-for-stock merger with Gryphon Digital Mining aligns operational focus on efficient Bitcoin accumulation using Hut 8 infrastructure.

BlackRock flags quantum computing as risk for Bitcoin ETFs. The asset manager added a detailed overview of quantum computing threats to the risk disclosure in its Bitcoin ETF's regulatory filing.

Strategy Makes $1.34B Bitcoin Buy, Adding Another 13,390 BTC. The Michael Saylor-led company now holds 568,840 bitcoin.

SEC Chair Paul Atkins unveils his vision for crypto regulation as the agency charts a friendlier approach to digital assets. “It is a new day at the SEC,” said SEC Chair Paul Atkins on Monday.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

On what date was the Bitcoin Genesis Block (Block #0) mined?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: January 3, 2009 🥳

January 3rd, 2009 marks the birth of Bitcoin — when Satoshi mined the first block and etched that iconic message about bank bailouts into history. ⛏️🗞️

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.