GM to all of you nutcases. It’s Crypto Nutshell #655 puttin’ it together… 🧩🥜

We're the crypto newsletter that's more gripping than a mother surviving a monster apocalypse with a newborn in silence... 👶🤫

What we’ve cooked up for you today…

🏦 Altcoins given green light

🧸 Bears take note

📈 Another all-time high

💰 And more…

Prices as at 5:50am ET

ALTCOINS GIVEN GREEN LIGHT 🏦

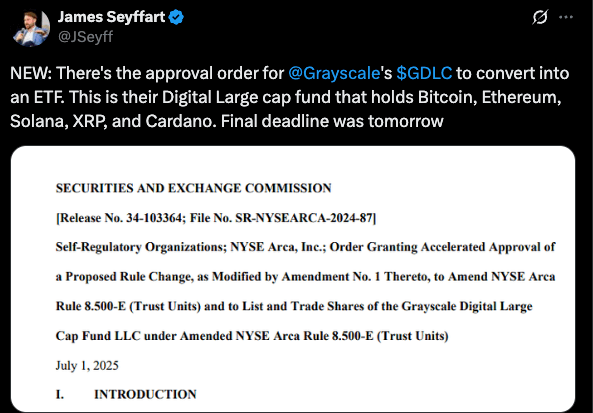

BREAKING: SEC approves Grayscale's mixed crypto fund, signaling momentum for other ETF proposals

The SEC has officially approved the first-ever multi-crypto index ETF in U.S. history.

And it could change everything for altcoin adoption…

Grayscale’s Digital Large Cap Fund - holding Bitcoin (80%), Ethereum (11%), XRP (4.8%), Solana (2.8%), and Cardano (0.8%) - is now cleared to trade as a fully regulated ETF on NYSE Arca.

This isn’t just a milestone for Grayscale.

It’s a clear signal: the SEC is finally opening the door to altcoins.

For the first time ever, XRP, Solana, and Cardano have been granted spot ETF exposure in the U.S.

The floodgates are now open…

Analysts say this paves the way for a wave of individual altcoin ETFs, with Solana and XRP likely leading the charge.

As Nate Geraci of the ETF Store put it, this move is a “test run” for broader approvals.

And the timing couldn’t be better.

Yesterday, Rex and Osprey announced the first-ever staked Solana ETF - cleverly structured as a C-corp to bypass the traditional spot approval process.

Meanwhile, Bitwise, Hashdex, and Franklin Templeton are all lining up to convert or launch their own diversified crypto ETFs.

The bottom line?

The ETF era is expanding fast - and it’s no longer just about Bitcoin and Ethereum.

Altcoins are officially going mainstream. 🍽️

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

BEARS TAKE NOTE 🧸

One of the sharpest macro minds on Crypto Twitter just broke his silence.

He posts under the name Pentoshi.

He’s private. Pseudonymous.

But he’s been calling major market turns for years - and smart money follows his feed.

His Current Thesis?

Despite the noise…

1. Market structure is still bullish. 📈

Bitcoin and stocks are near all-time highs.

No breakdown on high timeframes.

2. FUD is getting instantly bought. 🔁

Every fear narrative - recession, war, Mt. Gox, ETF outflows -

Has been followed by a V-shaped move to new highs.

3. The U.S. is spending more to “outgrow” its debt. 💸

That’s not a tightening cycle.

That’s stimulus.

4. The Fed is preparing to cut. ✂️

Rate cuts = more liquidity.

More liquidity = good for assets.

And Bitcoin is the fastest horse.

Final Take:

Until the charts break or the narrative flips?

Smart money is staying long. ✅

“If the market proves these ideas to be incorrect, then you can pivot. I see no reason to be bearish with this in mind.”

There’s a reason we keep listening to this guy.

His track record? Scary accurate. 👻

He still sees more upside - and we wouldn’t bet against him.

Bears, you might want to take notes... ✍️🧸

ANOTHER ALL-TIME HIGH 📈

Today we’ll be taking a look the overall stablecoin supply.

Stablecoins are the backbone of crypto liquidity, used for seamless trading and instant cross-border transactions.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

Two weeks ago, total stablecoin supply sat at $221.29 billion.

Today, it’s climbed to $223.34 billion - a $2.05B surge in just 14 days.

But that’s not all…

Earlier this week, stablecoin supply hit a new all-time high of $223.43B - capping off a $38.29B increase since the start of the year.

Why does that matter?

Because stablecoins are more than just digital dollars - they’re dry powder.

When supply rises, it means new capital is flowing into the system.

And historically?

These surges often lead the market - acting as a precursor to major altcoin breakouts.

Stablecoin supply doesn’t just follow momentum.

It precedes it.

CRACKING CRYPTO 🥜

Bitcoin powerhouse Strategy nears S&P 500 inclusion as net income soars. Strategy's (formerly MicroStrategy) Bitcoin-centric approach set for S&P 500 validation amid $14 billion profit speculation

Deutsche Bank to launch crypto custody accounts in 2026. Germany’s biggest bank, Deutsche Bank, reportedly expects to allow its clients to store cryptocurrencies like Bitcoin next year.

Congress' Budget Bill Advances From Senate Without Crypto Tax Provision. Hopes rose then quickly fell on a potential effort to slip a crypto tax provision into the legislation meant to activate Trump's core policy agenda.

Design app Figma owns $70 million worth of Bitwise Bitcoin ETF shares as of Q1. In recent months, a wave of companies and organizations have opted to buy cryptocurrencies, specifically Bitcoin.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which of the following is a Layer 2 solution designed to scale Ethereum?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Optimism 🥳

Optimism is a Layer 2 that uses Optimistic Rollups to bundle transactions and post them to Ethereum — boosting speed and slashing fees. ⚙️🚀

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.