GM to all of you nutcases. It’s Crypto Nutshell #785 hittin’ the moves … 🪩🥜

We’re the crypto newsletter that’s more cutthroat than traders turning friendship into leverage when the money gets real… 💼🔪

What we’ve cooked up for you today…

🏦 Strategy loads up

🧩 A big prediction

🌊 Outflows taking over

💰 And more…

Prices as at 5:15am ET

STRATEGY LOADS UP 🏦

BREAKING: Strategy reloads on bitcoin, acquires a further 1,229 BTC for $109 million

Strategy is back to buying Bitcoin.

Michael Saylor's company acquired 1,229 BTC last week for $108.8 million at an average price of $88,568 per coin.

That brings total holdings to 672,497 BTC, acquired for $50.44 billion at an average cost basis of $74,997.

This purchase ended a brief pause.

Last week, Strategy skipped Bitcoin buying entirely and instead boosted its USD reserve to $2.19 billion to cover preferred dividends and debt interest.

2025: The most active year yet

Strategy disclosed Bitcoin purchases in 41 separate weeks in 2025.

That's up from 18 purchases in 2024 and just eight in 2023.

The company ended 2024 holding 447,470 BTC. It's added 225,027 BTC this year alone.

The largest single purchase came on March 31: 22,049 BTC for $1.92 billion.

This week's 1,229 BTC ranks among the smallest buys of the year.

The broader context

Public companies now hold over 1.08 million Bitcoin across 192 entities, mostly U.S.-based.

Strategy remains the largest corporate holder by a wide margin. MARA Holdings ranks second with 53,250 BTC.

Several new Bitcoin treasury companies launched in 2025:

Twenty One Capital: 43,500 BTC

Bullish: 24,300 BTC

Bitcoin Standard Treasury: 30,021 BTC

Trump Media & Technology Group: 11,542 BTC

The MSCI wildcard

Markets are watching whether MSCI removes Strategy from its equity indices. A decision is due January 15 ahead of February rebalancing.

MSCI proposed excluding companies whose crypto holdings exceed 50% of total assets.

Strategy pushed back, warning the move would create index instability and conflict with U.S. policy supporting digital asset innovation.

If Strategy gets removed, passive funds tracking MSCI indices would be forced to sell MSTR shares - potentially creating significant selling pressure.

The decision could define how traditional finance treats Bitcoin treasury companies going forward. 🚀

Winning “Brewery of the Year” Was Just Step One

Coveting the crown’s one thing. Turning it into an empire’s another. So Westbound & Down didn’t blink after winning Brewery of the Year at the 2025 Great American Beer Festival. They began their next phase. Already Colorado’s most-awarded brewery, distribution’s grown 2,800% since 2019, including a Whole Foods retail partnership. And after this latest title, they’ll quadruple distribution by 2028. Become an early-stage investor today.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

A BIG PREDICTION 🧩

While most of the market is convinced this cycle is over, and that 2026 will be a dead year, the people closest to the data are saying something very different.

Jason Yanowitz, co-founder of Blockworks, just dropped 15 predictions on his latest podcast.

In a nutshell? 2026 should be a very good year.

Jason Yanowitz - Co-founder of Blackworks

Of the 15 predictions, 1 stood out above all of them:

Jason isn’t just anyone - he runs one of the largest crypto research and media firms in the industry, serving on-chain data, macro analysis, and institutional insight to the funds and allocators that actually move size.

And importantly:

Almost all of his net worth is tied to crypto

His entire liquid portfolio is 100% crypto

His business lives or dies with this industry

So when he says the 4-year cycle is done, it’s not a hot take.

It’s coming from someone who talks daily to institutions, sees capital pipelines forming, and is aligned with the long-term outcome, not short-term noise.

Now zoom out.

The dominant narrative right now is simple:

This cycle topped.

2026 is a down year.

New lows ahead.

But quietly, the people closest to the data are saying the exact opposite:

Jason Yanowitz

Matt Hougan

Raoul Pal

Tom Lee

Different perspectives. Same conclusion.

The market thinks 2026 is a write-off.

But founders, CIOs, and institutional operators keep calling for new highs.

Something to think about… 👀

OUTFLOWS TAKING OVER 🌊

The outflow streak is heating up…

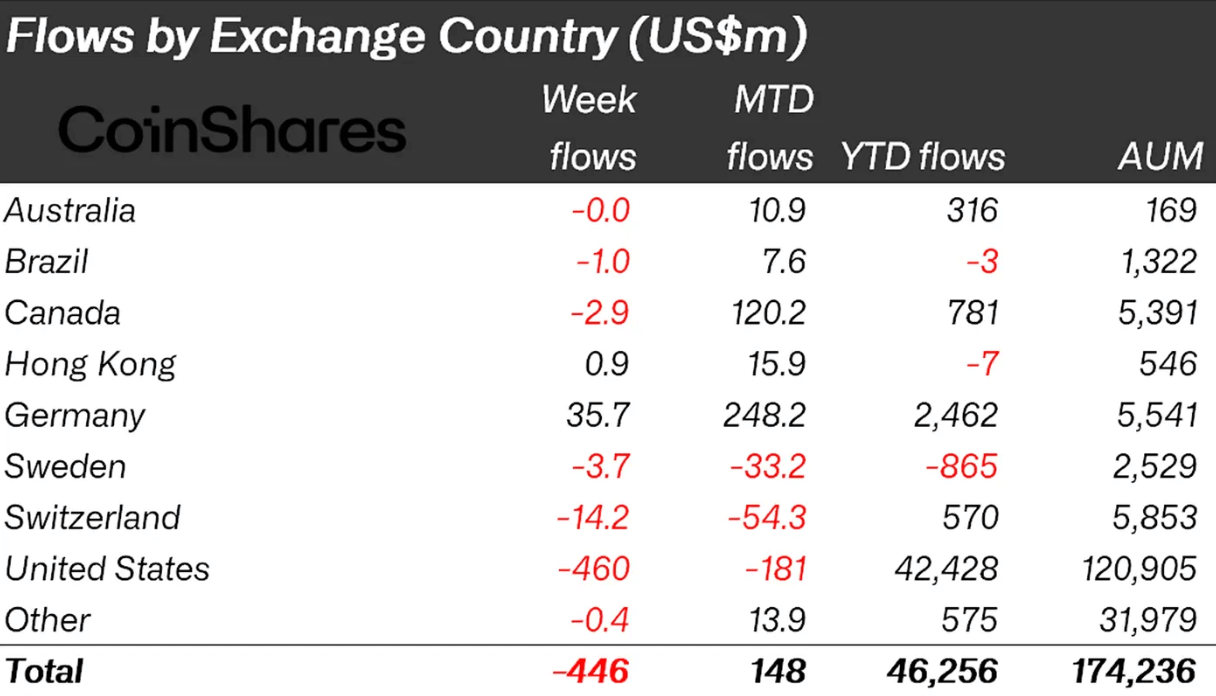

Digital asset funds saw outflows for the second time in a row last week, totalling $446 million.

Let’s break it down.

The outflows were concentrated on Bitcoin last week which saw $443 million exit.

Ethereum followed with $59.3 million in outflows.

Whilst XRP and Solana saw inflows of $70.2m and $7.5m respectively.

From a regional perspective, the negative sentiment was focused on the US which saw outflows of $460 million.

Switzerland, Sweden and Canada also saw outflows of $14.2m, $3.7m and $2.9m respectively.

Investor sentiment clearly hasn’t fully recovered.

However, year-to-date flows remain relatively in line with last year, with inflows so far totalling $46.3 billion compared to $48.7 billion in 2024.

CRACKING CRYPTO 🥜

Ethereum’s record staking queue looks bullish, but one corporate giant is secretly distorting the real signal. BitMine's single-entity surge obscures the true sentiment in Ethereum's staking dynamics as regulatory clarity emerges.

Strategy Buys $109M in Bitcoin as Corporate BTC Treasuries Expand in 2025. Strategy added 1,229 Bitcoin using common stock sales, bringing holdings to 672,497 BTC, as data shows public companies now hold more than 1.08 million Bitcoin.

Bitcoin price reverses early gains as Nasdaq futures wilt. Bitcoin has reversed its Asian session gains, dropping below $88,000 and affecting major altcoins.

Tom Lee's Bitmine adds 44,463 ETH and starts staking as treasury tops 3.4% of supply. Bitmine has started staking ETH, with more than 400,000 ether tokens now generating yield ahead of its planned MAVAN rollout in 2026.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What message did Satoshi embed in Bitcoin's genesis block on January 3, 2009?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks" 🥳

A headline from that day's newspaper. It served as both a timestamp and a political statement about the 2008 financial crisis that inspired Bitcoin's creation.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.