Today’s edition is brought to you by Topper

Topper makes off-ramping effortless, fast, and accessible. Get started now and convert your crypto to cash, fee-free!

GM to all 84,827 of you. Crypto Nutshell #530 wadlin’ by… 🦆🥜

We're the crypto newsletter that's more thrilling than piecing together your past in a maze of lies and espionage... 🕵️♂️💼

What we’ve cooked up for you today…

🏦 The US wants to sell Bitcoin

🎆 $200,000 Bitcoin this year

📈 The slow grind

💰 And more…

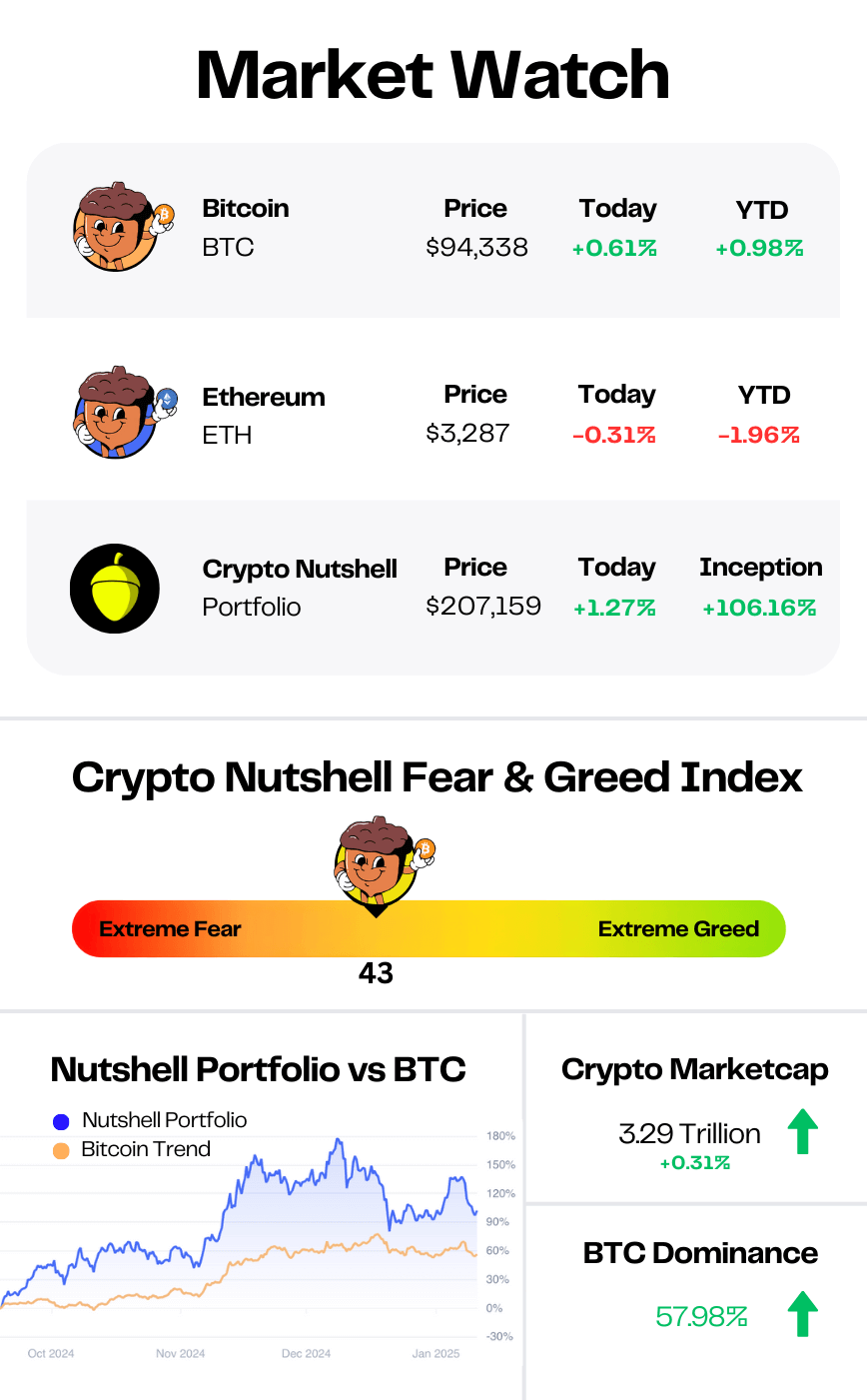

Prices as at 2:35am ET

THE US WANTS TO SELL BITCOIN 🏦

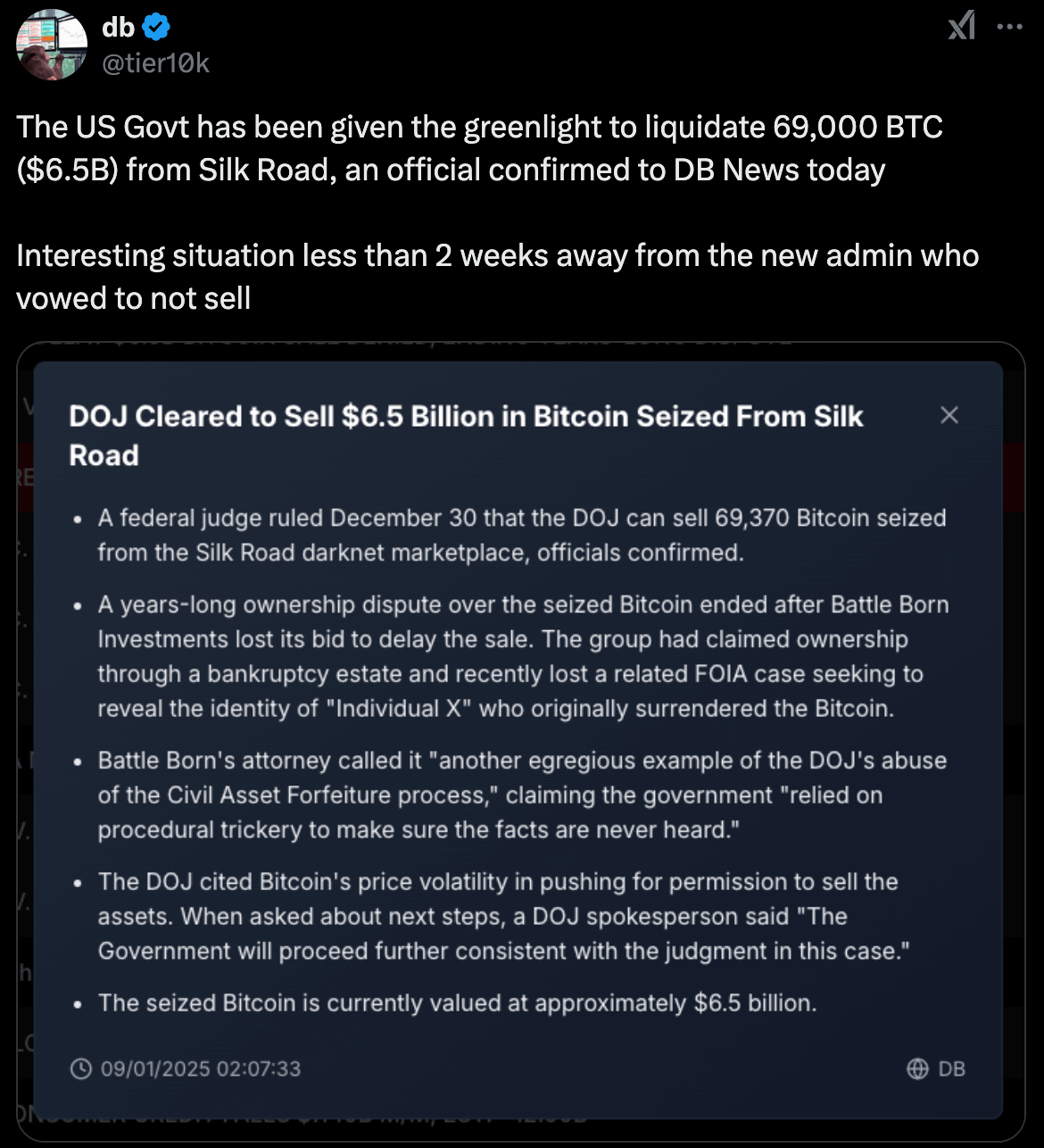

BREAKING: US Court Greenlights Sale of $6.5B in Seized Silk Road Bitcoin

The timing of this news is a little suspicious…

Right in the midst of a downtrend, the US government has been given the greenlight to liquidate 69,000 Bitcoin that it seized from Silk Road.

At today’s prices, that amount of Bitcoin is worth ~$6.5 billion.

According to data from Arkham Intelligence, the US government currently holds ~198,000 Bitcoin, worth ~$18.44 billion.

And we want to be clear: NONE of this Bitcoin has moved on-chain yet.

Which means, this Bitcoin likely has not been sold yet.

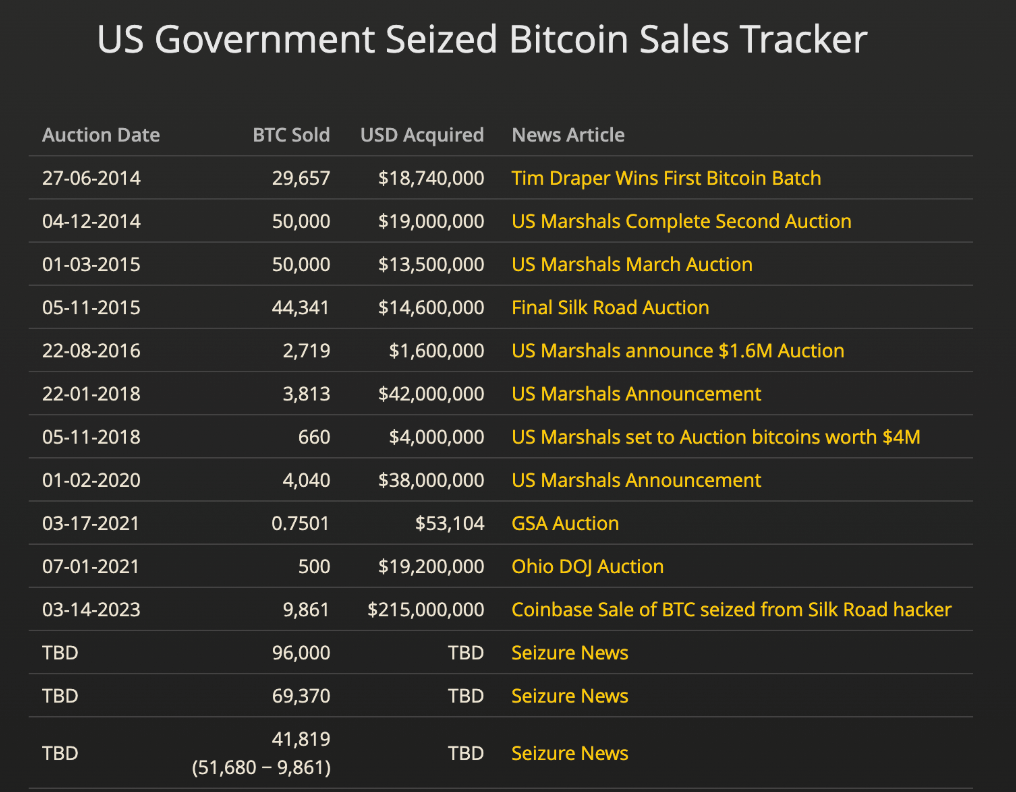

Also since we’re on the topic of the US government selling Bitcoin, here’s how that process works:

Once forfeited, the Department of Justice hands over the Bitcoin to the US Marshals.

The US Marshals then manage the sales via public auctions.

They DO NOT go directly to exchanges to unload this Bitcoin.

Here’s an overview of all previous US government Bitcoin auctions:

HoSome analysts are speculating that the outgoing Joe Biden administration is attempting to sell all government held Bitcoin before Trump takes office…

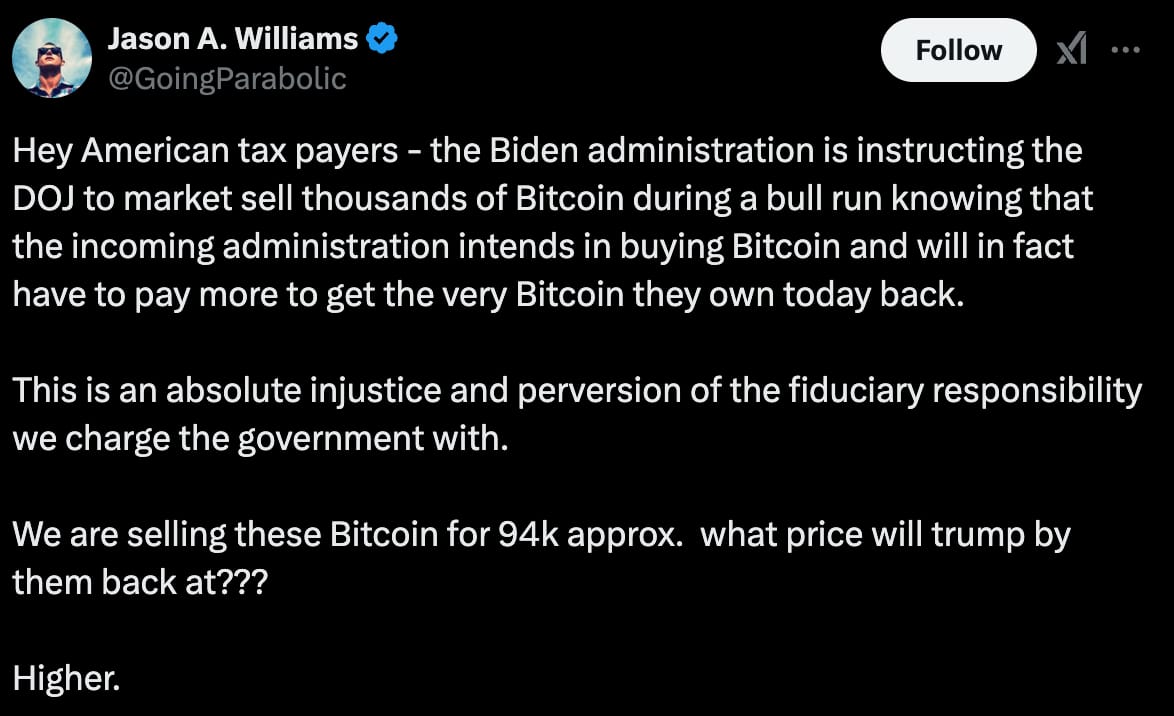

Here’s what Fox Business contributor Jason Williams had to say:

Now remember, this is only speculation.

We’re not claiming that the Biden administration is maliciously selling the governments Bitcoin.

But the timing of this whole announcement is a little suspicious…

After all, Trump did say “Never sell your Bitcoin”, back in July 2024.

And it’s only 10 days until Trump’s inauguration…

Off-Ramping Crypto Doesn’t Have to Be Hard 🤑

Converting crypto to fiat can be frustrating—limited asset support, high fees, and long delays. That’s why Topper’s new Off-Ramp is a game-changer.

With Topper Off-Ramp, you can:

✅ Withdraw over 200+ assets: From Bitcoin and Ethereum to emerging tokens, access one of the largest supported asset libraries in the crypto space, giving you the freedom to manage your portfolio your way.

✅ Access your funds instantly: Say goodbye to waiting days for withdrawals. Topper ensures your funds reach your debit card almost immediately, making your crypto as liquid as cash.

✅ Enjoy global coverage: With Visa and Mastercard debit card support in the U.S.and Europe—and Visa Original Credit Transactions worldwide—off-ramp securely, no matter where you are.

Take control of your digital assets today with Topper’s Off-Ramp and experience a faster, smarter way to convert crypto to cash.

$200,000 BITCOIN THIS YEAR 🎆

Bitcoin will hit $200,000 by the end of this year.

By 2029, it will hit $500,000.

By 2032? $1,000.000.

That’s the latest out of asset manager Bernstein.

If you haven’t heard of Bernstein, they’re a U.S. based asset manager who provide financial advice to ultra-high-net-worth individuals.

They’re big too, currently managing over $800 billion in assets.

This week, their analysts released a report detailing their 2025 crypto predictions.

Here are the best 3:

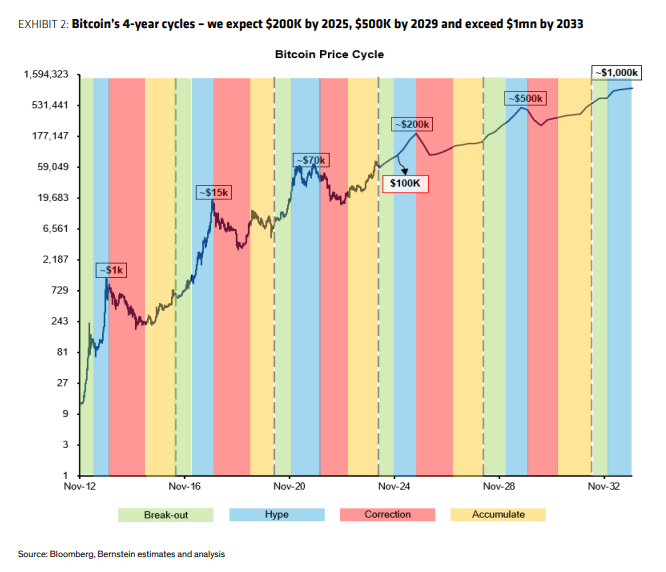

1. Bitcoin Will Hit $200,000 In 2025

Bernstein reaffirmed their $200,000 Bitcoin target for this year, driven by rising institutional and sovereign adoption.

They then project $500,000 by 2029 & $1,000,000 by 2032:

However, they expect the way forward to be less volatile than the journey so far:

“Expect less of boom-bust patterns… Crypto is now firmly on the radar of corporations, banks and institutions, weaving itself into the very fabric of our financial systems.”

2. Bitcoin ETFs Will See $70+ Billion In Inflows

Bernstein predicts we’ll see at least $70 billion in Bitcoin ETF inflows this year.

This is a big call, as it’s double the ~$37 billion seen in 2024.

They attribute the surge to growing adoption by hedge funds, banks, & wealth managers.

3. The Ethereum Comeback

Bernstein expects Ethereum to be the comeback kid of 2025, solidifying its position as the second most valuable blockchain over the next 12 months.

Deflationary supply dynamics & its growing utility in decentralised finance will drive this momentum.

Ethereum's strong late-2024 price action was the first sign of rising adoption & growing institutional interest.

Bottom Line

This week’s crypto price action might hurt - nobody likes a sea of red. But take a step back and remember the bigger picture.

These are the kinds of predictions asset managers are sharing with their ultra-high-net-worth clients.

The big picture has genuinely never looked brighter. 🌄

THE SLOW GRIND 📈

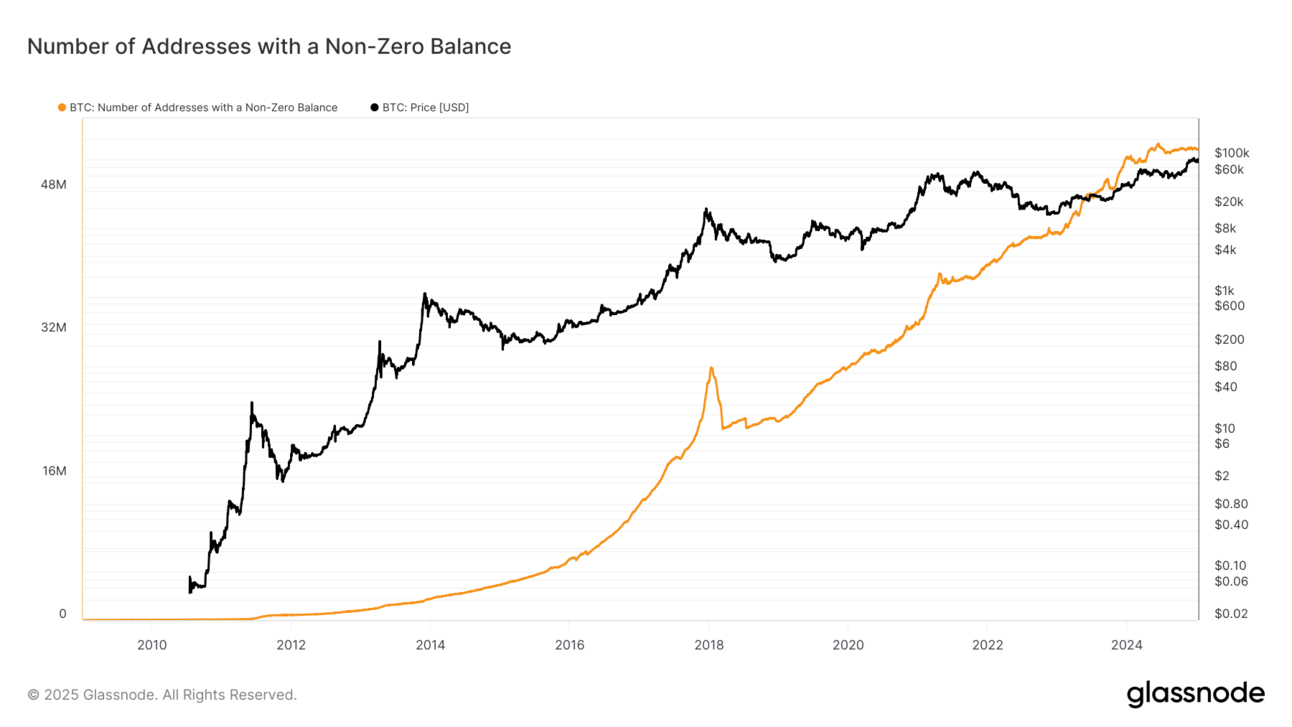

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric provides a high level overview of the Bitcoin network’s user base/activity.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

As of today there are 52,602,690 addresses holding at least a little Bitcoin.

Which marks an increase of 79,153 wallets compared to when we looked at this metric last week.

However…

Growth in this metric has somewhat stalled.

Right now it’s still 577,364 wallets less than the all-time (53,180,054) which it hit in early June 2024.

Here’s the thing with this metric:

It’s all about that trend line.

And if you zoom out that overall trend is without a doubt up & to the right.

CRACKING CRYPTO 🥜

Fidelity believes Bitcoin is at the precipice of mass adoption, says investors are not 'too late'. Drawing on Carlota Perez's theories, Fidelity envisions Bitcoin transitioning from speculative frenzy to widespread adoption in 2025.

Oklahoma senator introduces Bitcoin Freedom Act for BTC payments. “If Washington D.C. can ruin something, it likely will. And it is certainly ruining the US dollar,” said Senator Deevers after introducing the bill.

Solana Pushes Validators to Test Early 'Firedancer' Upgrade. The upgrade from Jump Crypto could drastically boost transaction throughput, helping Solana support legacy financial markets.

Gemini onboards three more senior executives amid European regional expansion. Gemini brought on Mark Jennings to serve as its head of Europe, Daniel Slutzkin as head of UK and Vijay Selvam as international-focused general counsel.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Twice weekly Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) HODL 🥳

VanEck’s Bitcoin ETF trades under the ticker $HODL

GET IN FRONT OF 85,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.