GM to all 36,748 of you. Crypto Nutshell #203 soakin’ it in. 🌞 🥜

We’re the crypto newsletter that's less mysterious than solving crimes with your unique deductive reasoning in Victorian London... 🔍🎩

What we’ve cooked up for you today…

🌊 ETF day one flows

🐢 Elon Musk crawling back to Bitcoin

💪 Bitcoin’s long-term holders

💰 And more…

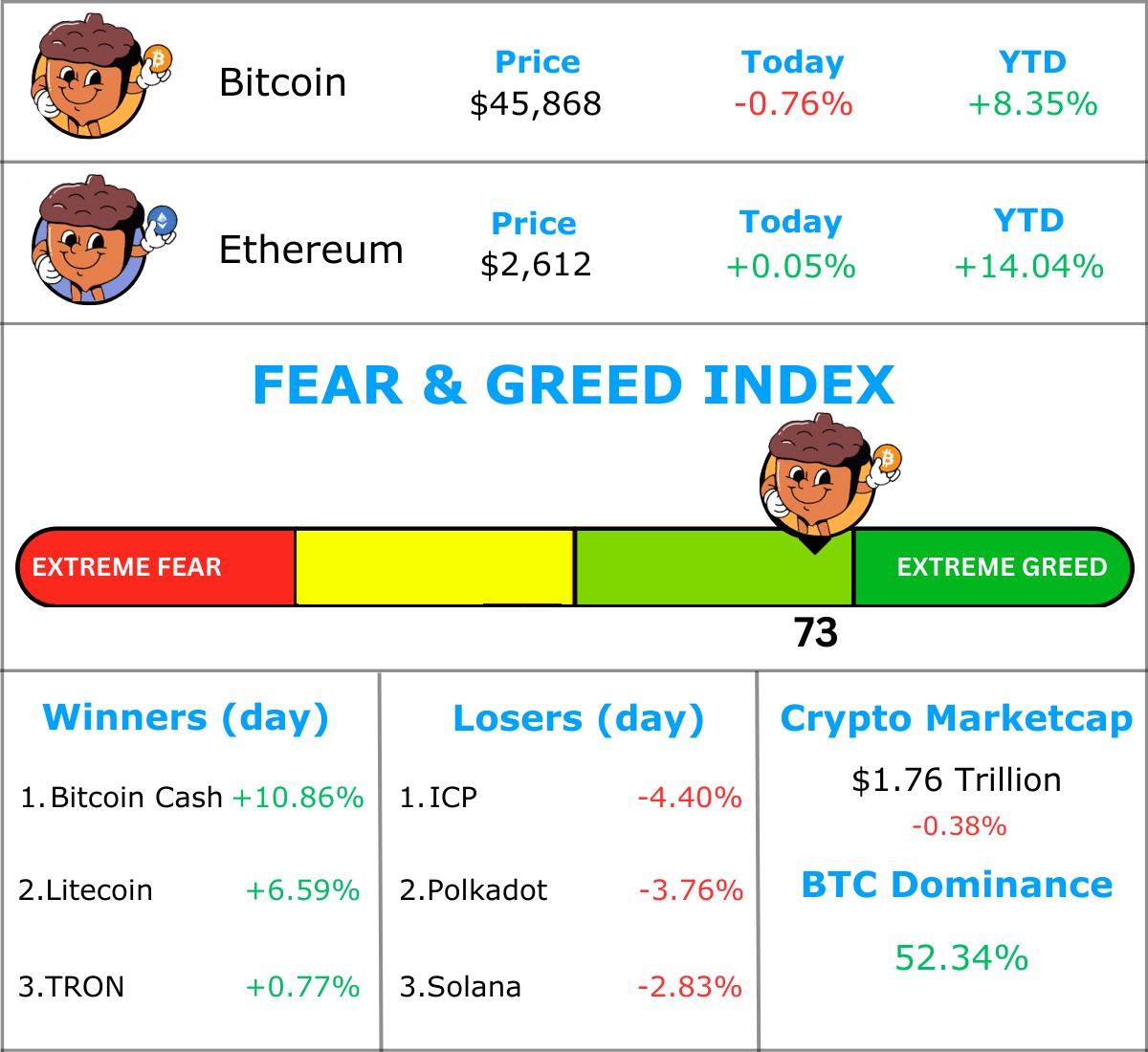

MARKET WATCH ⚖️

Prices as at 5:20am ET

Only the top 20 coins measured by market cap feature in this section

BIGGEST DAY ONE IN ETF HISTORY 🌊

BREAKING: Spot Bitcoin ETF trading volume breaks above $4 billion on first day

The Bitcoin ETFs clocked in over $4 billion in trading volume on their first day. 😱

That is absolutely insane.

What’s more is that ETF analyst Eric Balchunas has described this day as:

“Easily the biggest day one splash in ETF history.”

Grayscale (GBTC), BlackRock (IBIT) and Fidelity (FBTC) dominated the majority of the flows.

Taking a look at the numbers below, you may notice something strange…

Why is Grayscale’s (GBTC) volume so ridiculously high? 🤔

That’s because trading volume accounts for both inflows and outflows.

We won’t know for sure until the data comes in later today, but the going theory is that a majority of Grayscale’s volume was outflows.

(the rest of the ETFs are all inflows as they are new products)

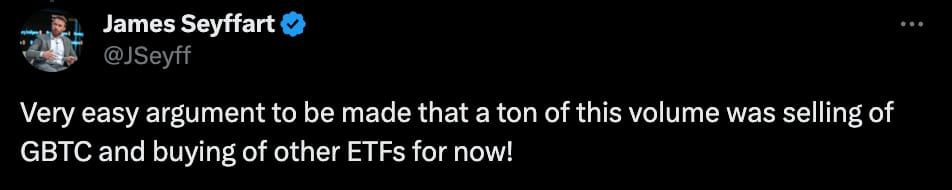

ETF analyst James Seyffart speculates that many were selling GBTC and buying into other ETFs such as IBIT. (likely for the lower fees)

Regardless, today was a record-breaking day.

This is only just the beginning. 😎

TOGETHER WITH THE EDGE 🤖

Crypto was the fastest adopted technology the world had ever seen… until Artificial Intelligence came along.

Which makes keeping up with A.I … complicated. 😕

Between learning the newest tools and knowing the latest news, Artificial Intelligence can feel overwhelming.

But it doesn’t have to. That’s where THE EDGE steps in.

Makes keeping up with the latest AI breakthroughs dead simple ✅

Helps you stay on top of the latest AI Tools with real life use cases 🔨

Delivered straight to your inbox every single day in a 3 min read 📨

The best part? They’re also completely FREE just like us.

Subscribe now by body slamming that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

ELON MUSK CRAWLING BACK TO BTC? 🐢

Elon Musk has history with Bitcoin.

In early 2021, Tesla invested $1.5 billion dollars of cash into Bitcoin. They also began accepting Bitcoin as payment.

SpaceX followed & also added Bitcoin to their balance sheet.

Elon then revealed he personally owned Bitcoin, Ethereum & Dogecoin.

It appeared as if Elon was a fan of Bitcoin & an ally of the crypto space.

Then everything changed.

In 2022, Tesla sold 75% of their Bitcoin at a loss. They stopped accepting Bitcoin as payment for their products.

Why?

Concerns over the energy usage of the Bitcoin network.

Since selling, Elon hasn’t spoken much about Bitcoin or crypto.

However, this week, he hinted he might be coming back. Following the approval of the Bitcoin ETFs, Cathie Wood hosted a twitter spaces to celebrate. One of the speakers was Elon.

Within the spaces, Cathie asked Elon if he was planning on incorporating Bitcoin into Twitter. (Elon is building Twitter into a payments platform.)

Elon said he was open to the idea.

“I'm open to the idea of using Bitcoin.”

He then revealed that SpaceX has continued to hold its Bitcoin:

“SpaceX still has most of its Bitcoin.”

He also addressed the energy usage concerns Tesla had surrounding Bitcoin.

He pointed out the situation has improved.

“At one point it really seemed like the use of electricity for Bitcoin was quite a lot of dirty electricity… I think things have gotten better. It's still a little bit of a concern but it seems to be not as serious of a concern as it was in the past.”

Finally, Elon was asked what form of money would be used on Mars. ☄️

"It probably would make sense to use some some kind of cryptocurrency on Mars.”

Elon Musk craves attention.

With the crypto bull-run gaining steam & Tesla's Bitcoin energy concerns resolved…

We wouldn’t be surprised to see him rejoin the crypto narrative at some point in 2024.

Will he come crawling back?

Watch this space. 👀

BITCOIN’S LONG-TERM HOLDERS 💪

Today we’ll be checking in on the supply of Bitcoin last active 1+ years ago.

This one’s nice and simple. It categorises coins based on how long it’s been since they last moved. (as a percentage of the circulating supply)

As long-term investors continue to accumulate coins, these metrics will rise. 📈

However, when long-term investors finally decide to sell, this metric declines. This is due to “older” coins becoming “young” again as they change hands. 📉

Here’s the breakdown for each cohort (compared to what it was 2 weeks ago):

🔴 Supply last active 1+ years ago: 70.30% (up from 70.21%)

🟠 Supply last active 2+ years ago: 57.22% (down from 57.27%)

🟢 Supply last active 3+ years ago: 43.64% (up from 42.31%)

🔵 Supply last active 5+ years ago: 31.26% (up from 31.25%)

HODLing is still the name of the game. All age bands have seen slight increases over the last two weeks, except for the 2+ years cohort.

Just goes to show how strong long-term conviction is in Bitcoin. 💪

No one is willing to let go yet.

Prices will still have to go WAY higher before we see a significant amount of long-term holders beginning to sell.

Let us know what age band you fall into in the poll at the bottom of this newsletter. 👇

CRACKING CRYPTO 🥜

Vanguard to ban all Bitcoin ETFs on its platform. Vanguard has restricted its customers from purchasing Bitcoin ETFs and reportedly plans to ban these products from its platform for being too risky.

Spot ETFs tipped to accelerate Bitcoin use cases, act as tailwind for the crypto industry. The launch of spot Bitcoin ETFs on Wall Street's major exchanges is expected to have a ripple effect across the crypto industry.

Bitcoin price rockets past $49k as spot bitcoin ETFs begin trading. Bitcoin’s price has reached a local high of $49,102 on Coinbase, according to TradingView data.

How to Buy a Bitcoin ETF. What are Bitcoin ETFs? How do they differ from stocks and how can you buy one? Here’s everything you need to know.

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Sponsored

Fast Food Club

The Official Fast Food Club. Get access to the world's largest group for fast food secrets, news, tips, menu hacks, and secret recipes. Once you subscribe you'll become a member.

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) IBIT 🥳

BlackRock’s Bitcoin ETF stock ticker is IBIT.

GET IN FRONT OF 36,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.