Today’s edition is brought to you by Animus Technologies.

To leverage A.I and start out-returning Bitcoin, book a call with them today!

GM to all 15,011 of you. Crypto Nutshell #126 roamin’ by. 🐆 🥜

We’re the crypto newsletter more exhilarating than chasing ghosts in a famously haunted hotel... 👻🏨

Today, we’ll be going over:

🥊 Coinbase vs SEC court date set

💣 The biggest thing to happen to Bitcoin…

🚨 New metric alert

🤑 And more…

MARKET WATCH ⚖️

Prices as at 7:15am ET

Only the top 20 coins measured by market cap feature in this section

COINBASE VS SEC DATE SET 🥊

BREAKING: Court Approves Coinbase’s Request For Oral Arguments In SEC Lawsuit

We’ve got some interesting news for you this morning.

The US District Court has officially granted Coinbase the opportunity to present oral arguments in its case against the SEC. The date to lookout for is January 17, 2024.

The argument is centred around whether digital assets should be considered securities under US law.

The SEC believes they should be. Whereas Coinbase believes they shouldn’t.

If you’re not sure what any of this is about, click here for more context.

John Deaton (XRP lawyer) believes the court granting Coinbase this opportunity is huge:

“Often times, judges won’t schedule an oral argument on a MTD (Motion to Dismiss). Most of the time, a MTD is denied on the papers alone. This motion is different, however, and Judge Failla is giving it the attention it deserves.”

A sign that Coinbase’s argument has some weight to it?

Now why does this matter?

January 17, 2024 will be a pivotal moment in crypto.

If Coinbase is successful in its mission, the way digital tokens are classified would be completely overhauled. Which ideally means greater clarity surrounding regulation for the crypto industry.

Crypto firms would no longer have to waste time going back and forth with the SEC over vague rules.

Clear & transparent regulation is a fantastic thing for the space. It essentially helps de-risk crypto as an investment class & makes it much more attractive to the big players. 🎩

TOGETHER WITH ANIMUS 👾

Let’s be real.

There’s probably one main reason you love crypto.

The returns.

Bitcoin is the best-performing benchmark of the decade.

But what if you could do better.

Recently Bitcoin Magazine launched a ‘Bitcoin Alpha Competition’, a campaign to find the most promising approach for generating alpha.

The winners? Animus Technologies.

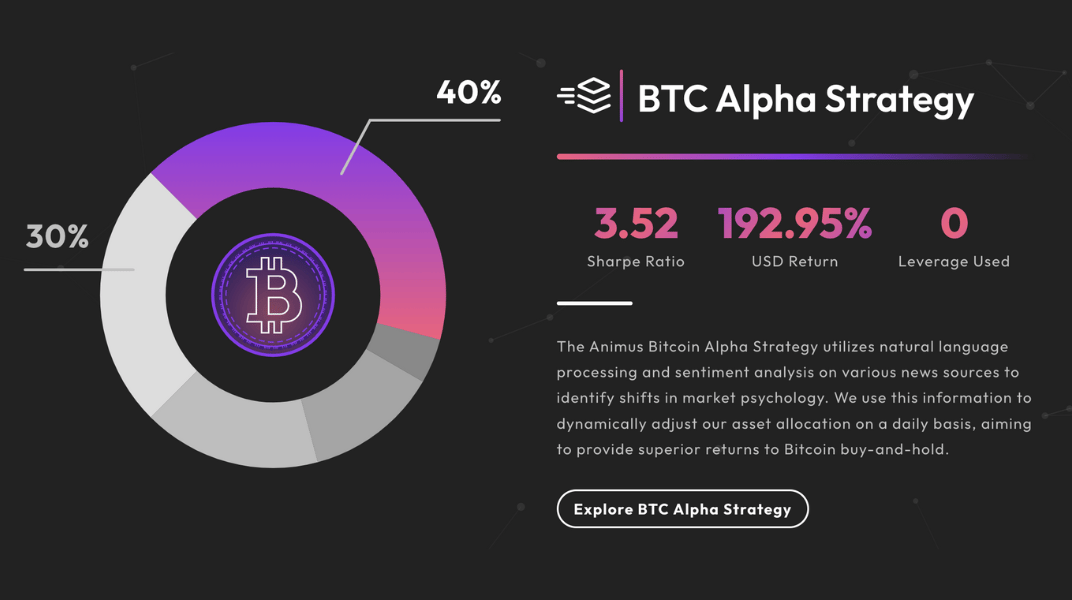

Animus Technologies is an AI-platform designed to develop data-driven trading strategies for cryptocurrencies.

Their mission: Provide clients with sustainable success in crypto markets through curated investment strategies.

Developed over 6+ years, their results are nuts:

Launching in 2020, Animus Technologies has returned 192.98% vs Bitcoin 40.95% 📈

Uses cutting-edge artificial intelligence and sentiment analysis to out-return Bitcoin on an outright & risk adjusted basis ✅

Won Bitcoin Magazines ‘Bitcoin Alpha Competition’, receiving $1 million in seed capital 🌱

Animus Technologies is looking at taking on a limited number of new clients.

If you are looking to leverage A.I and out-return Bitcoin, you can click here to book a call with their team today to see if they’re right for you.

THE BIGGEST THING TO HAPPEN TO BITCOIN… 💣

Are you bursting at the seams with anticipation for the coming Bitcoin ETF?

We are too.

In case you’re not, here’s some even more hopium…

This week, Ryan Rasmussen, a researcher at Bitwise Asset Management, was interviewed on CNBC.

Bitwise Asset Management is the world’s largest crypto index fund manager.

They believe that the coming Bitcoin ETF is the biggest thing to happen to Bitcoin since it’s creation:

“We think, at Bitwise, a Bitcoin ETF is the biggest thing to happen to Bitcoin since it was created in 2009.”

Why?

Ryan believes it’s the biggest unlock of capital for Bitcoin in its history.

He estimates that 80% of the wealth in America has historically not had access to Bitcoin.

The ETF fixes this & will be a huge influx of demand. 🌊

Ryan has the numbers to back it up too.

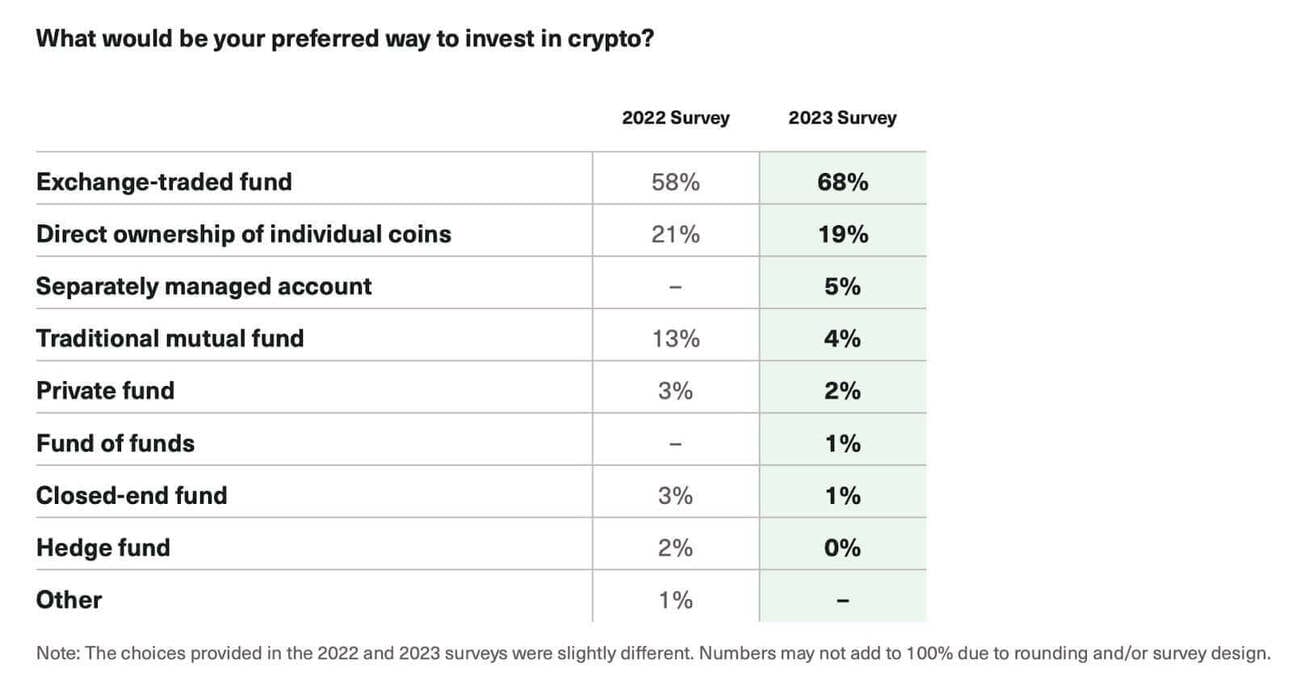

At Bitwise, over the last 5 years, they asked financial advisors what their preferred method of accessing Bitcoin would be.

The number one answer by an overwhelming margin?

A spot Bitcoin ETF. 🤑

Remember, the spot ETF approval could come at anytime… 💣

NEW METRIC ALERT 🚨

Yesterday we took a look at the profitability of short-term holders (STH). We did this by comparing the unrealized profit/loss (MVRV) to the realized profit/loss (SOPR).

Well as luck would have it, Glassnode has just released a new metric that combines the MVRV and SOPR.

They call it the New Investor Confidence Trend. It’s used to analyse the sentiment of short-term holders (held BTC for less than 155 days).

If you need a recap of what MVRV and SOPR are click here.

Here’s how it works:

🔵 STH cost basis (held): derived from MVRV. Looks at coins that have not yet been spent.

🟡 STH cost basis (spent): derived from SOPR. Looks at coins that have recently been spent.

🟩 Positive sentiment: when the cost basis of spenders is greater than the holders

🟥 Negative sentiment: when the cost basis of spenders is lower than the holders

New investor confidence has been on the rise with the recent buzz surrounding the approval of the Bitcoin ETF’s. 🤑

Recently 🟡 has crossed over 🔵 indicating a growing confidence in the price trend among STH’s.

This crossover is notable but it’s still early days. The chart below is a zoomed in version so that we can identify the transition point.

Bottom Line: A neat new metric from Glassnode that combines the MVRV and SOPR for short-term holders.

This is definitely one to keep an eye on.

Short-term holders are the most price sensitive investor cohort. So growing confidence from their side is always a positive for the overall market. 😎

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

Sponsored

Founding Journey

Join 80,000+ founders getting tactical advice to build, grow, and raise capital for their startup from an a16z-backed founder

Sponsored

The Intrinsic Value Newsletter

The weekly newsletter devoted to breaking down business and estimating their intrinsic value, in just a few minutes to read — Join 35,562 readers

CAN YOU CRACK THIS NUT? ✍️

Have you been paying attention?

Yesterday we learned that short-term holders recently moved back into profit. On average how much profit are they now in?

A) 20%

B) 15%

C) 25%

D) 10%

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) 20% 🥳

Checkout yesterday’s newsletter for the breakdown.

GET IN FRONT OF 15,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.