GM to all of you nutcases. It’s Crypto Nutshell #818 gearin’ up… ⚙️🥜

We’re the crypto newsletter that’s more chaotic than a plan held together by luck, lies, and bad decisions… 🎭💥

What we’ve cooked up for you today…

🏦 More pain incoming?

🥇 Bitcoin always follows

📈 The long-term trend

💰 And more…

Prices as at 2:25am ET

MORE PAIN INCOMING? 🏦

BREAKING: Standard Chartered Warns Bitcoin Could Drop to $50K, Ethereum to $1,400

Standard Chartered just issued a warning:

Bitcoin could fall to $50,000 and Ethereum to $1,400 before this downturn ends.

"I think we are going to see more pain and a final capitulation period… They will be buy levels."

The call came alongside sweeping cuts to year-end targets.

Standard Chartered now sees Bitcoin at $100,000 by December - down from $150,000.

Ethereum's target was slashed from $7,500 to $4,000.

Altcoins got hit even harder.

The bank cut Solana from $250 to $135, XRP from $8 to $2.80, BNB from $1,755 to $1,050, and Avalanche from $100 to just $18.

Why the bearish outlook?

ETF investors are underwater.

Standard Chartered estimates the average Bitcoin ETF buyer paid around $90,000 - leaving them down roughly 25% at current prices.

Holdings have dropped by nearly 100,000 BTC since October's peak. Kendrick believes these investors are more likely to sell than buy the dip.

Macro conditions aren't helping either. Markets don't expect rate cuts until mid-year, limiting support for risk assets.

JPMorgan sees it differently

But not everyone is as bearish.

JPMorgan pegs Bitcoin's production cost - which has historically acted as a price floor - at $77,000.

That's down from $90,000 earlier this year after mining difficulty dropped by 15%, the steepest decline since China's 2021 mining ban.

The bank sees this as miner capitulation - painful, but stabilizing.

"We are positive on crypto markets for 2026," JPMorgan analysts wrote, citing expected institutional inflows and regulatory progress.

Long-term outlook intact

Despite the near-term pain, both banks remain bullish over time.

Standard Chartered still targets $500,000 Bitcoin and $40,000 Ethereum by 2030.

JPMorgan maintains a $266,000 BTC target based on volatility-adjusted comparison to gold.

The message from Wall Street: more pain ahead, but the long-term thesis isn't broken. 🚀

Your money needs a system. Yours might be broken.

Money always flows — the question is whether it’s flowing with you or against you.

The Find Your Flow Assessment reveals how your income, expenses, debt, and decisions interact as a system — and where misalignment is quietly costing you time, energy, and, well, money.

In 5 minutes, you'll see:

your current money flow clearly

get language for what's felt off

find a grounded starting point for better decisions.

So if you’re a founder and operator who knows something isn't working right, the Find Your Flow Assessment is the smartest way to spend five minutes today.

For educational purposes only.

BITCOIN ALWAYS FOLLOWS 🥇

Cathie Wood just addressed the question every Bitcoiner has been asking the past few months:

If Bitcoin is digital gold… why has been gold ripping while BTC struggles?

For newer readers, Cathie is the founder and CIO of ARK Invest, one of the first major institutions to publicly back Bitcoin when it was still considered fringe.

When she talks about crypto cycles, people pay attention.

Cathie Wood

Here’s what she said in her latest investor update:

“If you do the correlation between Bitcoin and gold… the correlation has been 0.14… very low, almost no correlation.”

Translation: they actually don’t move together nearly as much as people assume.

But here’s the part that matters:

“Gold tends to precede a big move in Bitcoin… and we’d have a gigantic circle around what has happened recently. And so maybe that will happen again. We actually think it will.”

Read between the lines.

Gold running isn’t a contradiction to the Bitcoin thesis.

Historically, it’s been the setup.

Capital typically rotates into traditional stores of value first… then moves into the higher-beta version once confidence builds.

In other words:

Gold walks.

Bitcoin runs.

So while it feels uncomfortable watching metals outperform…

Cathie’s view is simple:

This may not be a warning sign.

It may be the signal. 🥇

THE LONG-TERM TREND 💰

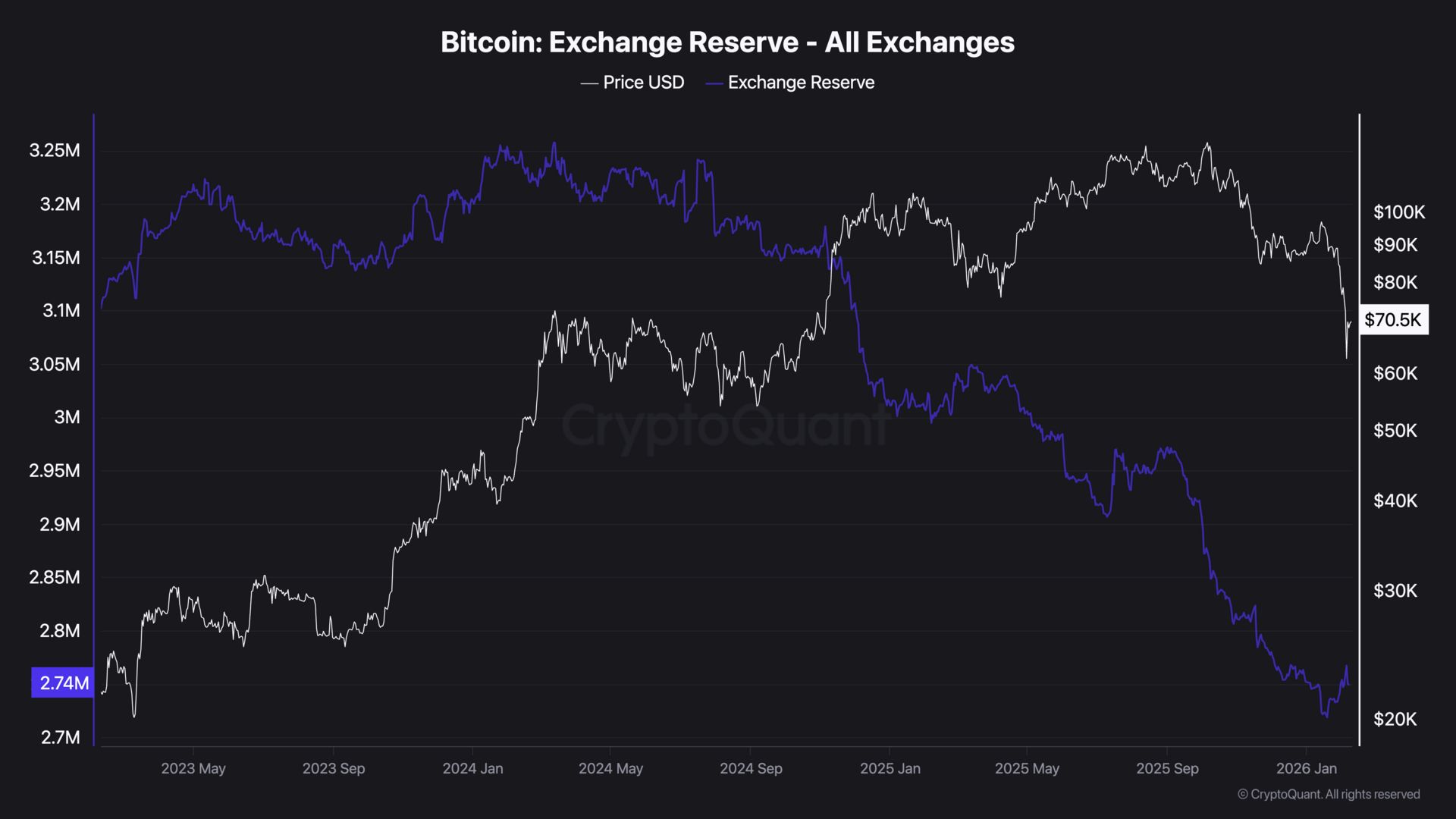

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Just 2.75 million BTC now sit on exchanges - 13.76% of the circulating supply.

Since the start of 2026, around 2,305 BTC have been withdrawn - essentially flat.

Some weak hands are breaking. Recent price action has forced capitulation.

Fear's running its course.

But step back. The long-term trend hasn't reversed.

Available supply keeps draining. Committed holders keep buying.

Distribution? No.

Consolidation. 🧱

CRACKING CRYPTO 🥜

Bitcoin Treasuries Added $3.5 Billion in January—Almost All By Strategy. Bitcoin-buying firms delivered on demand last year, but they struggled to keep up with market leader Strategy for a fourth straight month.

Spot ETH ETFs Losses Outpace Bitcoin As Monthly Netflows Remain Negative. Bitcoin and Ether prices remain below most investors’ cost basis for their respective spot ETFs, but according to Bloomberg analysts, Ether holders are in more trouble.

Coinbase misses Q4 estimates as transaction revenue falls below $1 billion. "Crypto is cyclical, and experience tells us it’s never as good, or as bad as it seems," said the company.

'Clock is ticking': crypto bill's 2026 fate hinges on Trump and stablecoin yields. Crypto industry views diverge on the likelihood that Washington will pass legislation in 2026, with estimates ranging from 25% to 60%.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What was the approximate floor price of Bored Ape Yacht Club NFTs at their peak in April 2022?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 150 ETH 🥳

BAYC floor price peaked around 150 ETH in late April 2022 (roughly $430,000 at the time). The collection became the most valuable NFT project, with celebrity owners including Eminem, Snoop Dogg, and Steph Curry.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.