Today’s edition is brought to you by Crypto Nutshell Pro.

If you’re interested in altcoin coverage, buy recommendations & want to know what’s in the Crypto Nutshell Portfolio, click here to join now the waitlist now!

GM to all of you nutcases. It’s Crypto Nutshell #715 holdin’ the line… 🛡️🥜

We're the crypto newsletter that's more nerve-wracking than surviving in a casino heist where every second counts... 🎲💰

What we’ve cooked up for you today…

🏦 Redtember returns

🦑 The great Bitcoin drain

🔥 Two in a row

💰 And more…

Prices as at 5:50am ET

REDTEMBER RETURNS 🏦

BREAKING: $1.7 billion in liquidations sweep crypto markets over past day as bitcoin slide sparks broader selloff

Just when it looked like we’d dodged the September curse… It all came crashing down…

In just 24 hours, $1.7 billion was wiped out - the biggest liquidation wave since December 2024.

More than 400,000 traders were forced out as Bitcoin sank to $112K and Ethereum cratered nearly 10%.

Dogecoin, Solana, XRP, and smaller alts got crushed even harder.

The hit was one-sided: $1.6 billion in long positions obliterated, a classic cascade of leverage unwinding.

ETH alone saw half a billion flushed, with Bitcoin adding another $300 million.

This is why they call it Redtember.

Since 2013, September has been Bitcoin’s weakest month - almost always ending in pain.

But here’s the thing: shakeouts like this aren’t unusual.

They’re the reset. As CZ put it:

Now the focus shifts to October.

Markets call it “Uptober” for a reason.

Bitcoin has finished green in 10 of the last 12 Octobers, with monster runs of +48% in 2017 and +40% in 2021. A similar surge this year could send BTC from $112K to $165K in weeks.

And there are reasons to believe the setup is there:

The Fed just cut rates and futures markets now price 92% odds of another cut in October.

Liquidity drains from the Treasury General Account are nearly complete, a trigger Arthur Hayes calls the signal for “up only” mode.

Seasonality has flipped positive: September clears leverage, October lights the match.

But not everyone’s convinced.

Analysts like Augustine Fan warn that “any BTC rallies may be muted” thanks to low volatility and lingering profit-takers.

Others say “Uptober” might not play out as cleanly this year.

But if history is any guide, these violent September flushes are rarely the end. More often, they’re the prelude.

The bottom line?

This bloodbath didn’t kill the cycle. It reset it. The leverage is gone, fear is back, and the stage for October is wide open.

Know Exactly Where We Are In The Cycle

Everyone is always asking the same questions:

“Is the cycle over?”

“Am I too late?”

“When is it time to sell?”

Crypto Nutshell Pro delivers the answers — every single week.

Our full-time on-chain analysts track 10+ critical signals across:

On-chain metrics 📈

Technical signals 📉

Liquidity flows 📊

Social sentiment 🧠

Macro trends 🌍

So you’ll know exactly when to buy… and more importantly, when to sell.

Pro isn’t open right now - but the waitlist is.

If you’re interested in altcoin coverage, buy recommendations & want calls that outperform Bitcoin, click below to join the waitlist:

Spots are limited. When we open, first in = first served.

THE GREAT BITCOIN DRAIN 🦑

The numbers don’t lie.

Bitcoin’s supply is vanishing.

New data from Bitwise shows something extraordinary:

U.S. Bitcoin ETFs alone are buying up more BTC than miners are producing.

In the last 30 days, ETFs absorbed 22,853 BTC

Over the same stretch, only 14,056 BTC was mined

The math is simple: U.S ETFs by themselves are hoovering up more than all of new supply.

And remember - this is just 1 channel. It doesn’t include:

Corporate treasuries stacking Bitcoin

Retail buyers

Global demand ETF outside the U.S.

If just one pipeline is already draining 100%+ of new issuance…

The question isn’t whether a supply shock is coming…

It’s how violent the squeeze will be. 🦑

TWO IN A ROW 🔥

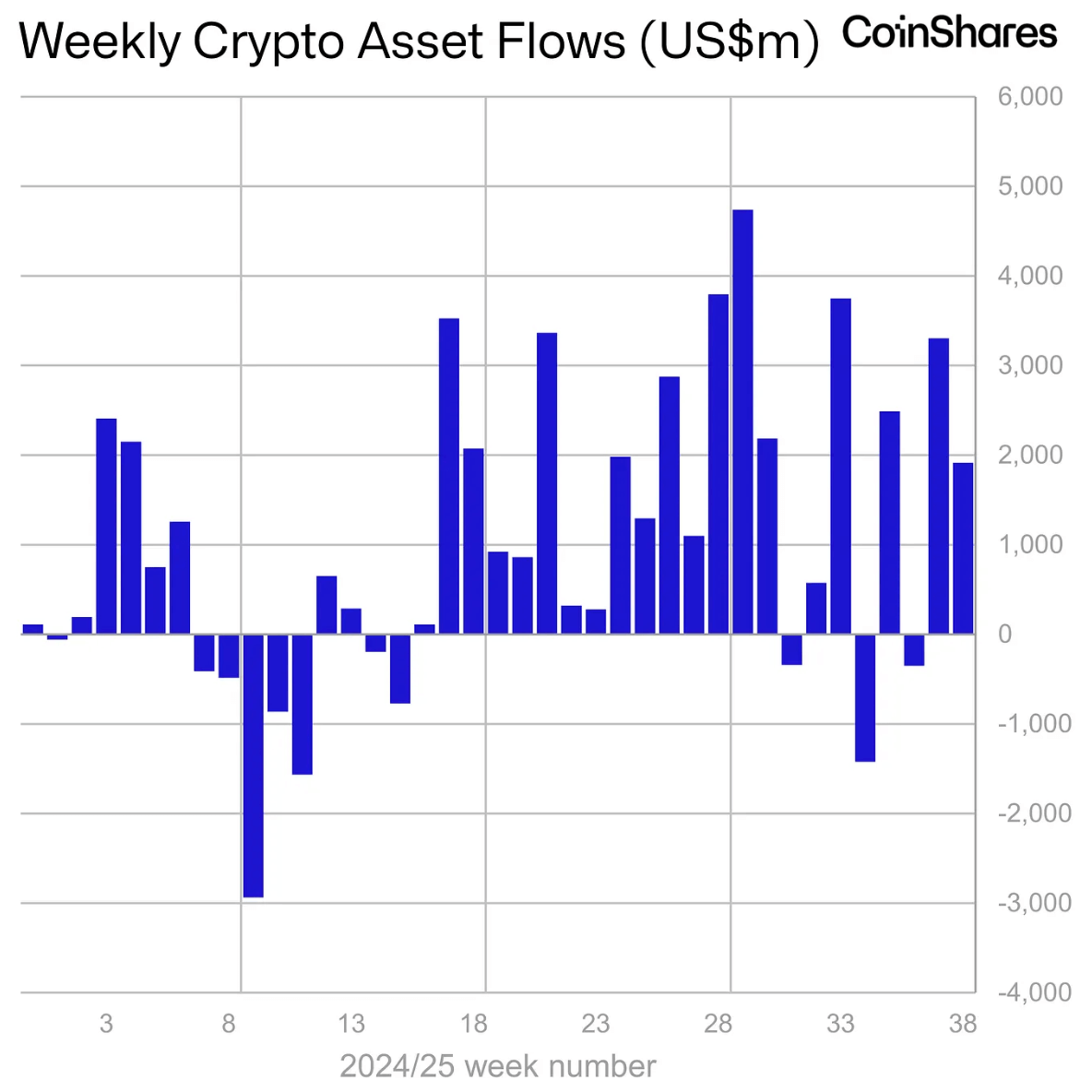

Digital asset funds saw a second consecutive week of inflows, totalling $1.9 billion.

That pushed total assets under management to a new YTD high of $40.4 billion, putting 2025 on pace to blow past last year’s $48.6 billion.

Let’s break it down.

Bitcoin once again led the charge, attracting $977 million in inflows.

Ethereum wasn’t far behind, with $772 million - enough to push its total assets under management to a record $40.3 billion.

Solana and XRP also saw meaningful allocations, with $127.3 million and $69.4 million respectively.

The U.S. dominated regionally, accounting for $1.79 billion of inflows.

Germany added $51.6 million, Switzerland $47.3 million.

But not everywhere was bullish: Sweden saw outflows of $13.6 million and Hong Kong $3.1 million.

After months of anticipation, the Fed finally cut rates last week.

CoinShares noted investors were cautious at first, but by Thursday and Friday the floodgates opened - with $746 million pouring into digital asset products in just two days.

CRACKING CRYPTO 🥜

Strive bets $675 million to acquire Bitcoin treasury company at 200% premium to stock price. Strive leverages Bitcoin equity strategy as it absorbs Semler Scientific, aiming for preventative diagnostics expansion.

Michael Saylor’s Strategy acquires $100M in Bitcoin amid Fed rate cut. Strategy acquired 850 Bitcoin for $99.7 million last week as BTC briefly rose to multiweek highs above $117,000 following the Fed's interest cut.

Gold Rallies an Hour After BTC Drops, Suggesting a Profit Rotation Into Metals. Safe-haven flows pushed gold to new records while bitcoin stumbled, highlighting shifting investor dynamics.

Pantera-backed Helius Medical purchases over 760,190 SOL, kicking off $500 million DAT strategy. Earlier this month, Helius Medical Technologies soared 250% on a $500 million SOL treasury raise led by Pantera and Summer Capital.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the term for the combined value of all cryptocurrencies in circulation?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Total Market Capitalization 🥳

The total market cap tracks the dollar value of the entire crypto market. 🌍📊

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.