GM to all 26,994 of you. Crypto Nutshell #174 floatin’ over. 🎈🥜

We’re the crypto newsletter that won't bewilder you like a detective trying to capture a serial killer who uses the seven deadly sins... 🕵️♂️📦

What we’ve cooked up for you today…

🧑⚖️ Government turf war over crypto regulation

⚡️ Greatest marketing blitz in history

🤔 Did short-term holders take profits?

💰 And more…

MARKET WATCH ⚖️

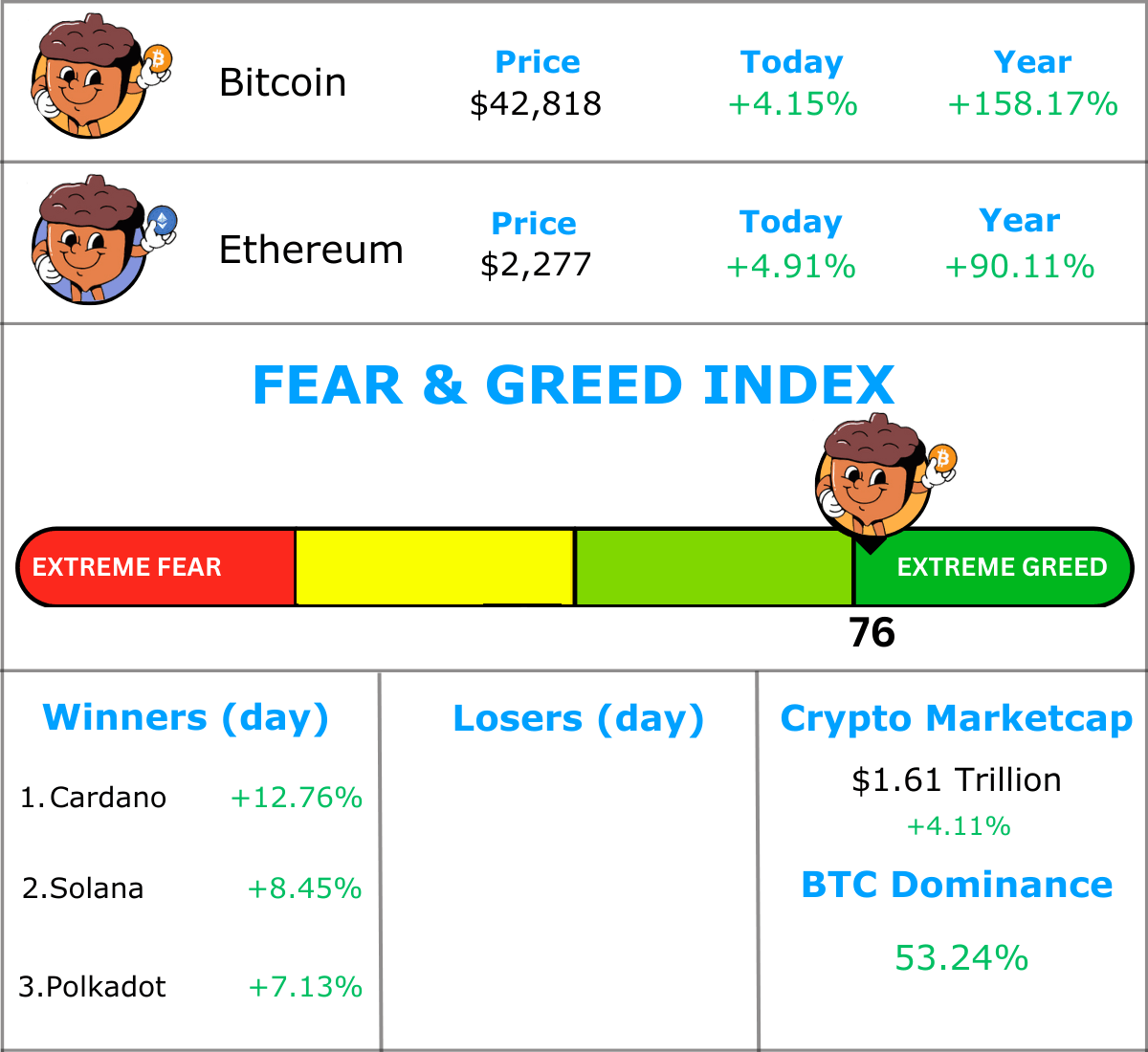

Prices as at 4:45am ET

Only the top 20 coins measured by market cap feature in this section

GOVERNMENT TURF WAR OVER CRYPTO REGULATION 🧑⚖️

BREAKING: CFTC chair says most cryptocurrencies are commodities under current laws

Commodities Futures Trading Commission (CFTC) Chairman Rostin Behnam believes that most cryptocurrencies are commodities under existing laws.

Appearing on CNBC, Behnam laid out his current thoughts regarding crypto regulation.

“Under existing law, many of the tokens constitute commodities, under this rubric there is a gap in regulation and I need congress to step in…We’ve been talking about this for years and we still don’t have a regulated environment or a regulated entity.”

The CFTC views the crypto industry completely different to the SEC. They believe most crypto's are commodities.

Whereas the SEC believes most crypto are securities.

Both agencies have been "fighting" over who regulates the industry. (Behnam stressed that he gets along with Gary Gensler) 🥊

Behnam believes it’s about time congress steps in. A final decision needs to be made on how digital assets are regulated.

The old laws just aren’t going to cut it…

“It’s about figuring out how existing decades old law fits within this new technology that seems to be changing and ultimately needs a new way of thinking around policy and legislation.”

For the full article click here.

TOGETHER WITH WEBSTREET 🕸️

WebStreet is the first platform to offer accredited investors passive ownership of cash flowing online businesses. How? They acquire high-growth businesses like Micro-Saas, and Amazon FBA at low multiples giving investors an asymmetric bet to the upside.

So while real estate bubbles are popping and the stock market is looking shaky, WebStreet is on track to deliver over 20% IRR to its investors. Find out why investors are buzzing about their newest round here.

GREATEST MARKETING BLITZ IN HISTORY ⚡️

Anthony Pompliano or “Pomp” is a well known entrepreneur & investor in the crypto space.

He co-founded Morgan Creek Digital Assets & has been a huge advocate of Bitcoin for years.

He believes the greatest marketing blitz in finance history is coming for Bitcoin.

It all comes down to the cut-throat competition that will surround the coming Bitcoin ETF.

Pomp predicts that in the first 1-2 years, a spot Bitcoin ETF will attract $50 - $100 billion worth of capital.

The ETFs are likely going to charge a 1% management fee.

Which means, in the first 2 years, there is between $500 million and $1 billion up for grabs in annual revenue.

The majority of which will go to the winner of the ETF race.

Pomp has 1 question:

What would you do if you were one of the ETF issuers that gets approved?

His answer:

Spend an insane amount of money to capture as much market share as possible. 💰

In the ETF world, once a clear winner is established, it tends to keep the dominant position.

Which is why Pomp believes Bitcoin is about to undergo the greatest marketing blitz in finance history.

“This is why I believe we will see the most insane marketing blitz in the history of financial markets in 2024. In my estimation, asset managers will collectively spend $100 million or more trying to woo investors and capital to their respective ETFs.”

Financial juggernauts such as BlackRock, Fidelity & ARK Invest will be fighting tooth & nail to attract capital to their ETF. 🥊

Back in 2021, we saw crypto ads everywhere, mainly for exchanges.

The 2022 Super Bowl was dominated by crypto advertising.

Pomp believes that was nothing compared to what’s coming.

“The blitz is coming. It will be so epic that you will be tired of the ads. Everywhere you turn, someone will be asking you to invest in the bitcoin ETF.”

This is one of the many reasons investors are so excited for the ETF’s.

The greatest marketing campaign in Bitcoin’s history is about to begin. ⚡️

DID SHORT-TERM HOLDERS TAKE PROFITS🤔

Yesterday we learned that the amount of Short-Term Holders (STHs) in profit reached a year-to-date high.

The next logical step is to check whether this incentive was actually enough for STHs to sell their Bitcoin.

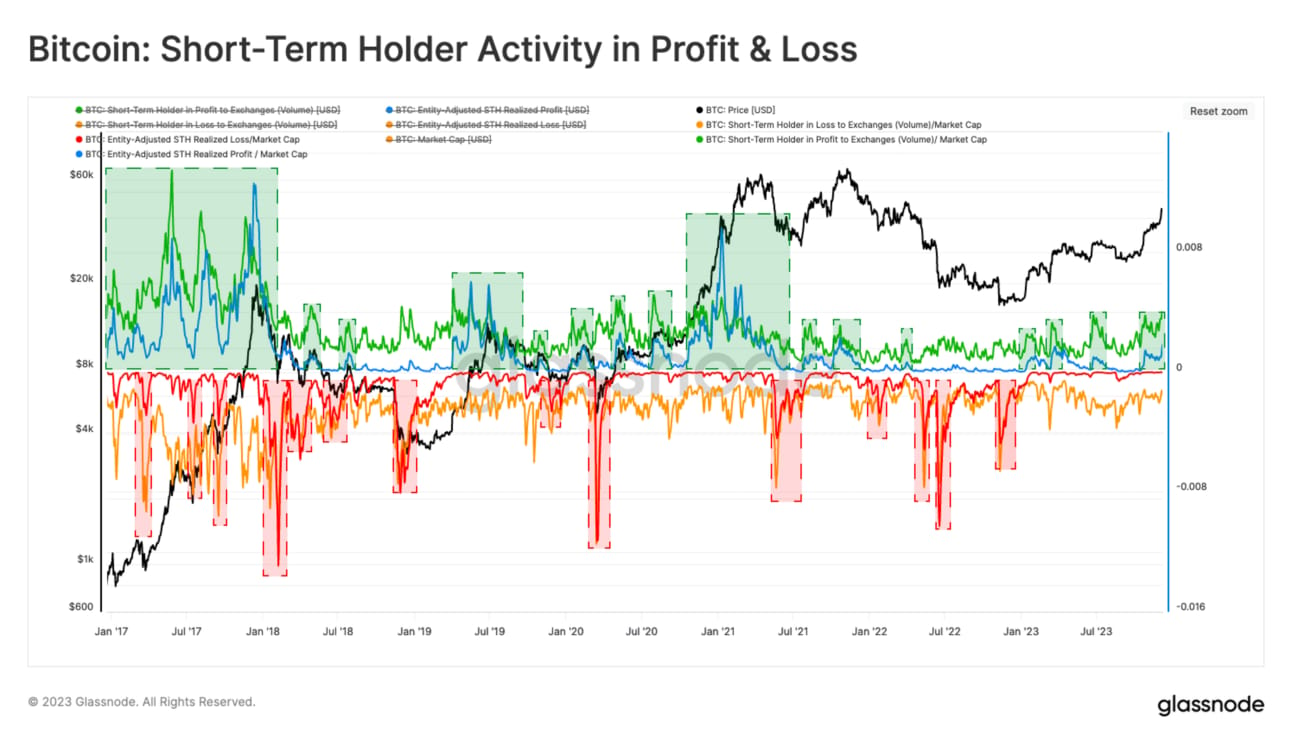

To do that, we’ll be taking a quick look at the Short-Term Holder Activity in Profit & Loss.

Now this metric may seem a little complicated, but really it’s quite simple:

🟢 STH volume in profit being sent to exchanges: the amount of “in-profit” coins STHs are transferring to exchanges

🔵 STH realised profit: measures the difference between acquisition price and selling price

🟠 STH volume in loss being sent to exchanges: the amount of “in-loss” coins STHs are transferring to exchanges

🔴 STH realised loss: measures the difference between acquisition price and selling price

On the chart above, green shaded areas are categorised by:

Large amount of profitable STH coins being sent to exchanges

Significant difference between acquisition price and selling price

Bitcoin’s recent rally to $44,000 resulted in a large amount of STH profit taking. (notice how it’s shaded green)

So it turns out, the high amount of unrealised profit held by STHs was enough to begin profit taking. 🤑

This played a part in Bitcoin’s recent price correction. As sell side pressure increases from a significant amount of STHs deciding it’s time to take profits.

Don’t forget that Bitcoin’s move from $37,000 to $44,000 only took 5 days…

A lot of STHs would have seen their investments become profitable almost immediately. 😎

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 4 years 🥳

The Bitcoin Halving occurs every 210,000 blocks which translate to approximately every 4 years.

GET IN FRONT OF 26,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.