Today’s edition is brought to you by Animus Technologies.

To leverage A.I and start out-returning Bitcoin, book a call with them today!

GM to all 15,445 of you. Crypto Nutshell #130 hoppin’ in. 🐰 🥜

We’re the crypto newsletter that won't warp your reality like a mind-bending journey through dreams within dreams... 💤🌀

Today, we’ll be going over:

🎂 The Bitcoin white paper celebrates 15 years

✂ The halving is not priced in

🤑 Uptober Delivered

💰 And more…

MARKET WATCH ⚖️

Prices as at 5:50am ET

Only the top 20 coins measured by market cap feature in this section

WHERE IT ALL BEGAN 👴

BREAKING: Bitcoin white paper turns 15 as Satoshi Nakamoto’s legacy lives on

Back in 2008, Satoshi Nakamoto sent a very important email to a group of cryptographers. The email contained Bitcoin's white paper and opened with the following quote:

“I’ve been working on a new electronic cash system that’s fully peer-to-peer, with no trusted third party,”

A link to the original white paper can be found here (just a warning, it’s pretty technical).

The Bitcoin white paper, titled "Bitcoin: A Peer-to-Peer Electronic Cash System," was released during the global financial crisis of 2008. Perhaps in direct response to the growing distrust of the traditional banking system.

Nakamoto’s vision was clear:

To create a currency free from government control, that was censorship-resistant and borderless.

The white paper is only 9 pages in length. But it clearly outlines the concept of a little something known as the blockchain. And how Bitcoin works as currency.

Bitcoin also aimed to address the double-spending problem. A decentralized network of computers would confirm transactions in a public ledger. This made it virtually impossible for someone to manipulate transactions.

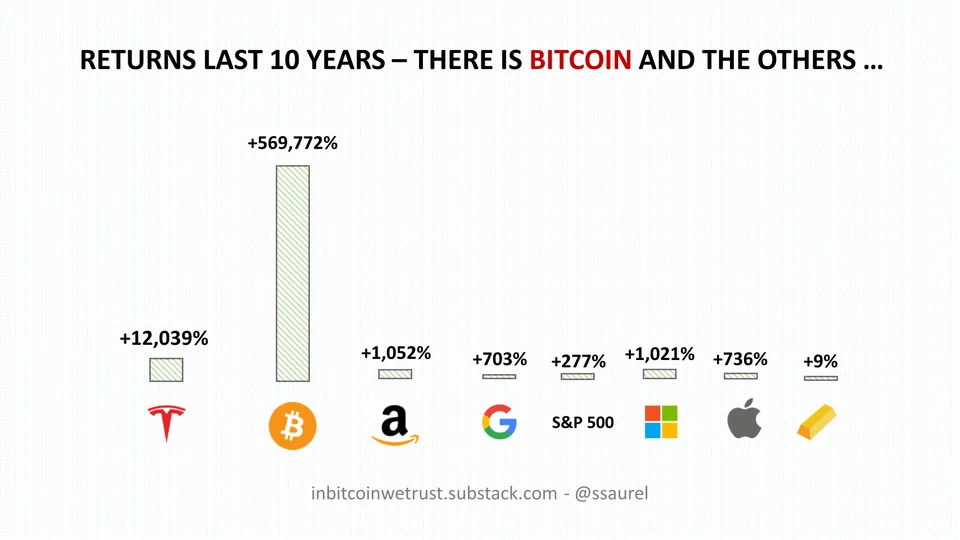

Since 2008, Bitcoin has become a global phenomenon. And is the best performing asset of the last decade.

It's wild to think that we're all here right now because of an email sent on October 31, 2008... 😱

Oh and look who decided to celebrate… 👀

The story of how Bitcoin came to be is seriously fascinating.

For a full breakdown of Bitcoin’s history checkout this article.

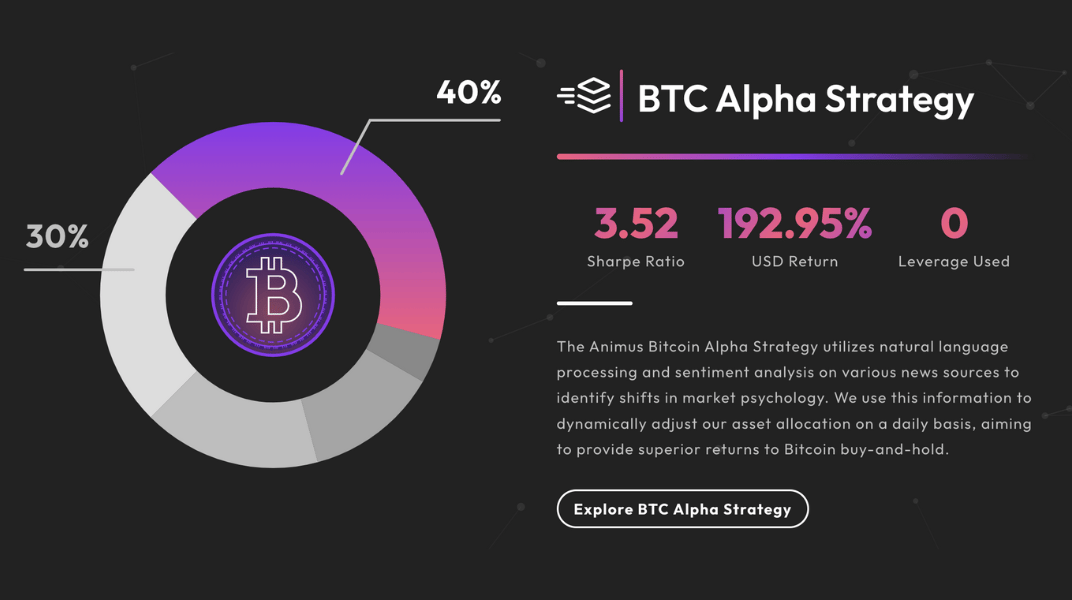

TOGETHER WITH ANIMUS 👾

Let’s be real.

There’s probably one main reason you love crypto.

The returns.

Bitcoin is the best-performing benchmark of the decade.

But what if you could do better.

Recently Bitcoin Magazine launched a ‘Bitcoin Alpha Competition’, a campaign to find the most promising approach for generating alpha.

The winners? Animus Technologies.

Animus Technologies is an AI-platform designed to develop data-driven trading strategies for cryptocurrencies.

Their mission: Provide clients with sustainable success in crypto markets through curated investment strategies.

Developed over 6+ years, their results are nuts:

Launching in 2020, Animus Technologies has returned 192.98% vs Bitcoin 40.95% 📈

Uses cutting-edge artificial intelligence and sentiment analysis to out-return Bitcoin on an outright & risk adjusted basis ✅

Won Bitcoin Magazines ‘Bitcoin Alpha Competition’, receiving $1 million in seed capital 🌱

Animus Technologies is looking at taking on a limited number of new clients.

If you are looking to leverage A.I and out-return Bitcoin, you can click here to book a call with their team today to see if they’re right for you.

THE HALVING IS NOT PRICED IN ✂

Bitcoin is the greatest asymmetric bet to ever exist.

That’s the message out from Bitcoin expert, Parker Lewis.

Lewis is an on-chain Bitcoin analyst & head of business development at Unchained Capital.

Last week he did a keynote at Old Parkland in Dallas.

The main takeaway?

Bitcoin is the greatest asymmetric bet to ever exist.

What asymmetry is he referring to?

According to Lewis, the downside compared to the upside.

Here’s why:

1. Lewis argues that asymmetric events are generally low probability. Not Bitcoin. It has passed the point of no return.

Bitcoin global adoption is now probable, but it’s still being priced as possible.

2. Printing money is inevitable. Lewis makes the point that the government has printed itself into a corner.

No matter what course of action they choose to take, it will all lead to the same outcome: More money printing. Which means more devaluation of the dollar.

3. The Bitcoin Halving is not priced in. Lewis believes that the market only prices in the Halving at the time of its actual occurrence.

To put the Halving in perspective of dollars - before the Halving, the market has to absorb $31 Million dollars worth of new Bitcoin supply per day.

Post Halving, this is cut to $15.5 Million.

Lewis finished his presentation highlighting Bitcoins move from $100 to $1,000.

He believes the biggest struggle in Bitcoin is people thinking they’ve missed the boat.

Lewis thinks this is ridiculous:

“Bitcoin is just as cheap today as it ever has been. Still very few people own it. Where Bitcoin is today, will look the same way that $100 to $1,000 move looked.”

His final point?

“You don’t unsee Bitcoin.”

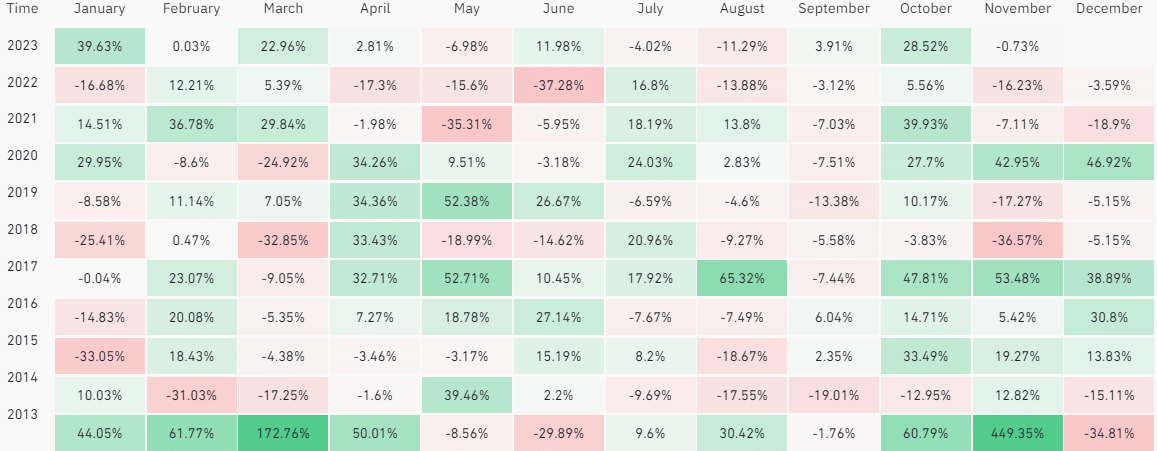

UPTOBER DELIVERED 🤑

It turns out “Uptober” isn’t just a meme.

Bitcoin closed October above $34,000.

That’s an increase of 28.52%, the second largest monthly return of the year, after January at 39.63%.

Bitcoin monthly returns

Ethereum also had a great month locking in returns of 8.69%.

Although not as significant as Bitcoin’s gains, this was still Ethereum’s third best month behind January and March.

Ethereum monthly returns

To put Bitcoin’s October performance into context let’s look at some technical models.

🟣 The Pi Cycle Indicator (111D MA): the 111 day moving average which captures short-mid term market momentum

🟢 The Mayer Multiple (200D MA): the 200 day moving average which highlights the transition between bull and bear markets

🔵 Yearly Moving Average (365D MA): the 365 day moving average provides a baseline for long-term market momentum

🔴 The 200 Week Moving Average (200W MA): captures the baseline momentum of Bitcoin’s 4 year cycle

During October, Bitcoin blasted through the 111D, 200D and 200W moving averages.

These averages surprisingly hold significant weight on investor sentiment.

The 200D moving average is also popular in analysis of traditional assets such as stocks.

Blasting through these key averages signals strong bullish momentum. 🐂

Bottom Line: October was exactly what the market needed. We’re in a much better spot compared to September.

All eyes on November now, can it deliver? 😎 (more on this tomorrow…)

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Everyday AI

Helping everyday people learn and leverage AI

Sponsored

The BRRR

We help you print money. Join the 10,000+ investors staying ahead of the AI and crypto markets.

Sponsored

Alex & Books Newsletter

Join 50,000+ subscribers and get the best 5-minute book summaries every week + my list of 100 life-changing books.

CAN YOU CRACK THIS NUT? ✍️

This altcoin is meant o be “silver to Bitcoin’s gold“.

A) Ethereum

B) Dogecoin

C) XRP

D) Litecoin

Find out the answer at the bottom of “Meme Corner” below 😀

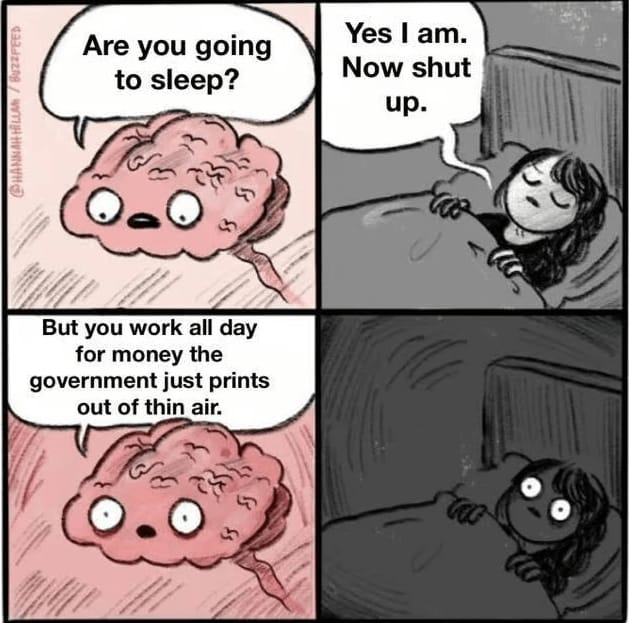

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Litecoin 🥳

Litecoin is an early altcoin developed by former Google engineer Charlie Lee in 2011. It had once been called the silver to Bitcoin's gold and was the 3rd largest cryptocurrency by market cap at its height.

GET IN FRONT OF 15,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research