GM to all 17,630 of you. Crypto Nutshell #138 swoopin’ in. 🦅 🥜

We’re the crypto newsletter that won't derail you like a chemistry teacher turned meth manufacturer... 🧪🚐

Today, we’ll be going over:

🌆 Hong Kong wants to be a crypto hub

🌌 Bitcoin is in a different universe

💪 Long-term holders refuse to sell

💰 And more…

MARKET WATCH ⚖️

Prices as at 4:40am ET

Only the top 20 coins measured by market cap feature in this section

HONG KONG CRYPTO HUB? 🌆

Breaking: Hong Kong considers allowing retail investors to trade spot crypto ETFs

This announcement continues the trend of Hong Kong rolling out pro-crypto initiatives.

Julia Leung, the Chief Executive Officer of Hong Kong’s Securities and Futures Commission (SFC) welcomed the possibility of spot crypto ETFs.

“We welcome proposals using innovative technology that boosts efficiency and customer experience… We’re happy to give it a try as long as new risks are addressed. Our approach is consistent regardless of the asset.”

It’s also worth mentioning that earlier this year, three futures based ETFs were approved in Hong Kong.

Samsung Bitcoin Futures Active ETF

CSOP Bitcoin Futures ETF

CSOP Ether Futures ETF

Throughout the year, Hong Kong has clearly been positioning itself as a crypto hub. Other incentives announced this year include:

Licensing framework for crypto exchanges

Financial support for web3 development

Regulatory mandates urging banks to provide fair treatment to crypto clients

Spot crypto ETFs have been all the rage of 2023.

We’ve been heavily focusing on the US based ETF applications from companies like BlackRock (because they’re absolutely huge).

But it’s also important to see what other countries are doing.

Bitcoin is a global asset after all…

Despite all of the hype surrounding the ETFs approval. The SEC is still yet to approve a spot Bitcoin ETF.

If the US doesn’t get it’s act together, innovation might just leave to other countries…

Click here to read more.

TOGETHER WITH VENTURE SCOUT 🎯

Check out these returns from IPO to September 2021:

Google (Alphabet) 64.24x

Netflix 550.47x

Facebook 9.02x

Question: What do these companies all have in common?

Answer: They’re all software companies.

Software companies, in our opinion, offer the highest potential returns to investors. (outside the world of crypto 😉)

The problem?

Keeping up with software startups is f*cking difficult.

The SAAS world is practically impossible to keep up with.

That’s why we read Venture Scout.

It’s a high quality weekly report on all the latest and greatest software startups, so you can keep a finger on the pulse of one of the greatest opportunities of our generation.

The best part? Just like us, their reports are completely free.

Subscribe now by hitting that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

BITCOIN IS IN A DIFFERENT UNIVERSE 🌌

Behind BlackRock and Vanguard, Fidelity is the third largest asset manager in the world.

They have $4.5 trillion dollars in assets under management. They’re also one of the institutions in the race for a spot Bitcoin ETF.

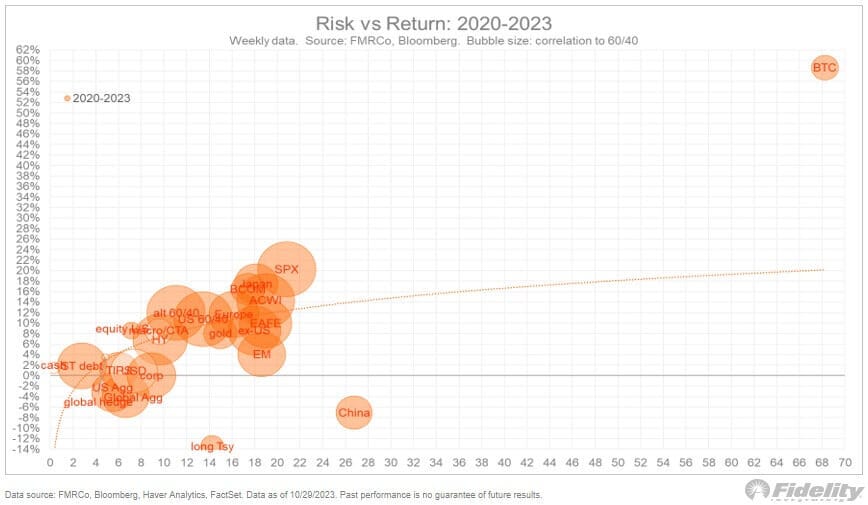

And their Director of Global Macro just said Bitcoin’s risk-return is “in a different universe”.

He’s got the charts to prove it too.

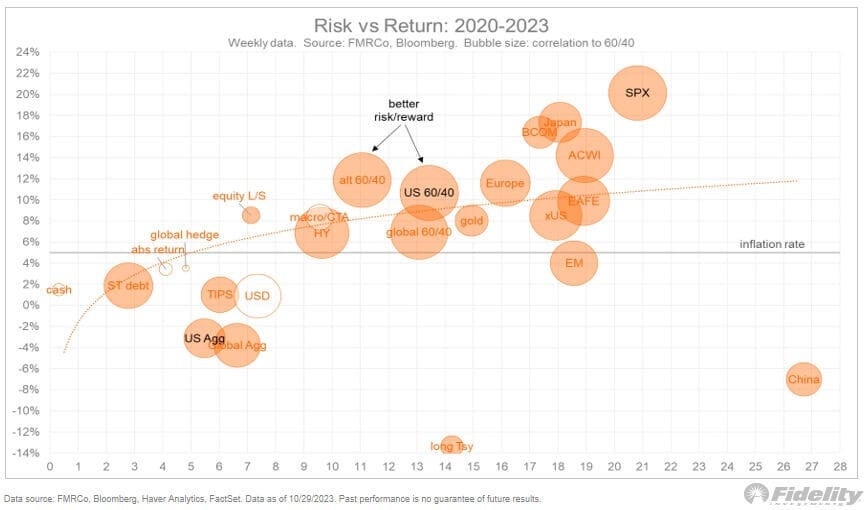

The director, Jurien Timmer, broke down Bitcoin’s volatility in a thread.

First, he plotted the risk vs return of assets from 2020 - 2023.

Then, he added Bitcoin. 🤯

As he said, Bitcoin is in a different universe.

“Government bonds can’t hold a candle to that risk-reward math, and neither can many other asset classes, at least at this moment.”

His main takeaway?

Bitcoin’s price volatility gets a bad rap. But the huge drops in price come with huge gains.

Which reminds me of one of Michael Saylor’s famous sayings…

“If you can’t stomach the volatility, you don’t deserve the out-performance.”

LONG-TERM HOLDERS REFUSE TO SELL 💪

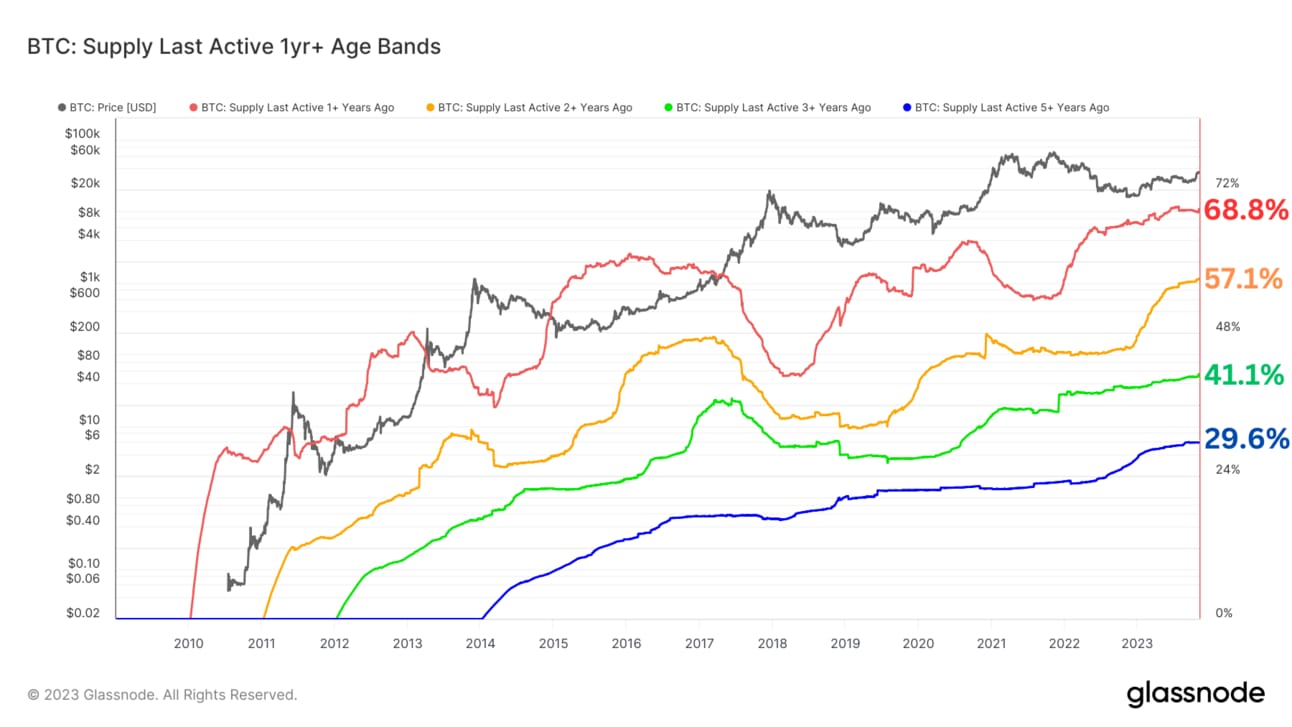

Despite the crazy performance of Bitcoin this year (+113.07% YTD), long-term holders aren’t letting go of their coins.

Today’s chart is the Supply Last Active 1yr+ Age Bands.

This metric simply categorises coins based on how long it has been since they last moved on-chain.

As coins are accumulated by long-term holders, this metric will rise

As long-term holders spend their coins, this metric will decline with older coins becoming young again as they change hands

Here’s the rundown as of today:

🔴 Supply Last Active 1+ Years Ago: 68.8%

🟡 Supply Last Active 2+ Years Ago: 57.1%

🟢 Supply Last Active 3+ Years Ago: 41.1%

🔵 Supply Last Active 5+ Years Ago: 29.6%

This chart gives us a lot of insight into the cyclicality of Bitcoin (4 year cycles) and investor sentiment (accumulate or sell).

Taking a look at the 1-year+ age band, notice how it sharply increases during bear markets and sharply declines during bull markets.

This cyclical behaviour gets smaller and smaller as the coins get older and older. It’s practically non-existent for the 5-year+ coins.

Right now, all of these age bands are at all-time highs.

Meaning, there just isn’t enough motivation for long-term holders to sell their coins.

In other words, the price of Bitcoin isn’t high enough yet. Which makes sense as Bitcoin is currently just over half of it’s all time high (~$69,000).

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

CAN YOU CRACK THIS NUT? ✍️

The Bitcoin blockchain holds _________ transactions.

A) Confirmed

B) New

C) Unconfirmed

D) Confirmed & Unconfirmed

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) Confirmed 🥳

The blockchain holds “archived” or confirmed transactions (packaged in “blocks”).

GET IN FRONT OF 17,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.