GM to all you crypto nuts. Crypto Nutshell #404 dancin’ the tears away🕺

We're the crypto newsletter that's more exhilarating than a high-speed heist... 🚗💨

What we’ve cooked up for you today…

🤮 Why Bitcoin just puked

💰 Bitcoin is the answer

📈 Stablecoins rising

💰 And more…

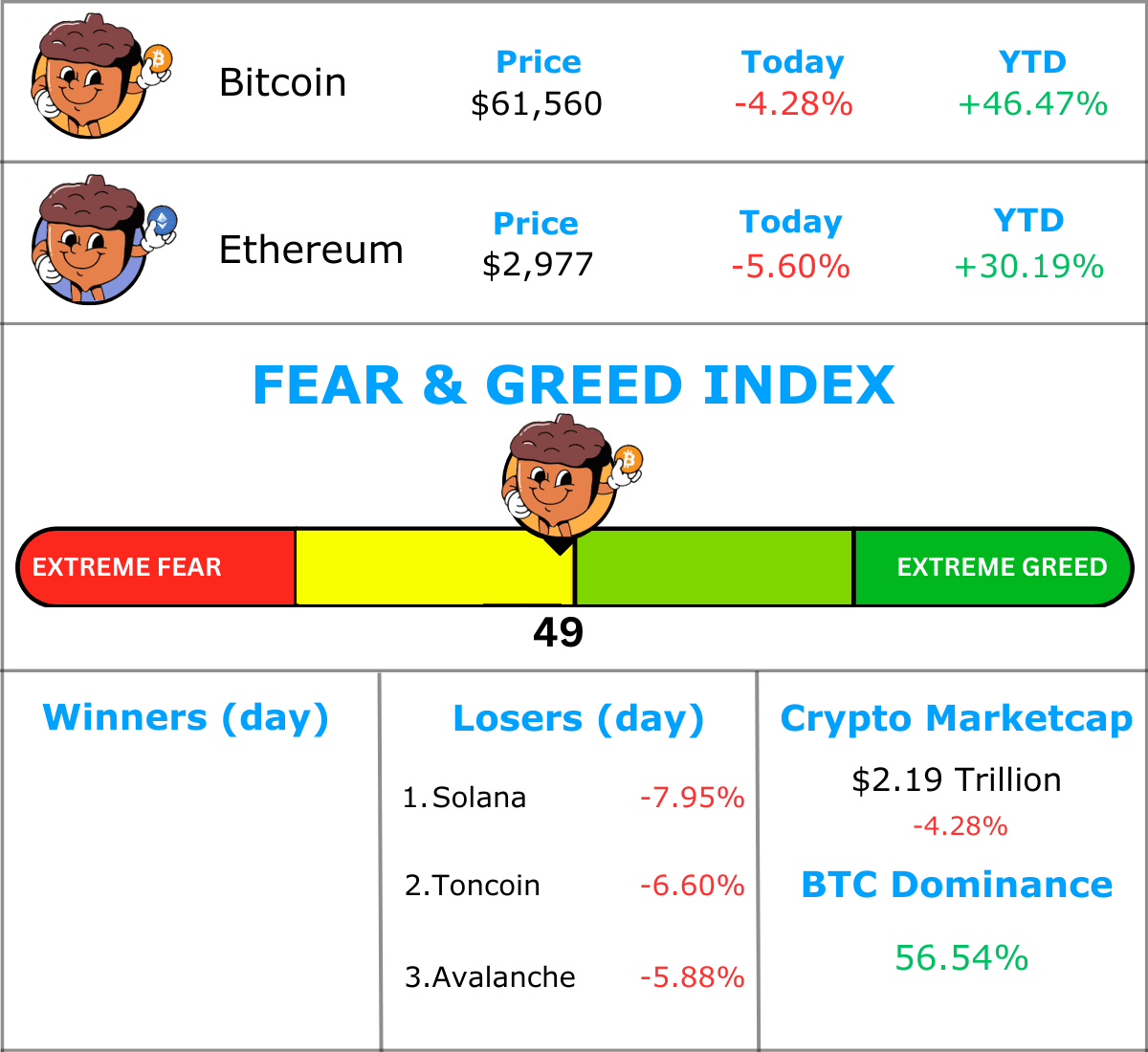

MARKET WATCH ⚖️

Prices as at 4:45am ET

Only the top 20 coins measured by market cap feature in this section

A RECESSION MAY BE COMING… 🤮

BREAKING: Bitcoin price dips after weak US jobs report sparks wall street panic

Well that was a rough Friday…

Bitcoin just puked from $65,000 down to ~$61,000.

But why?

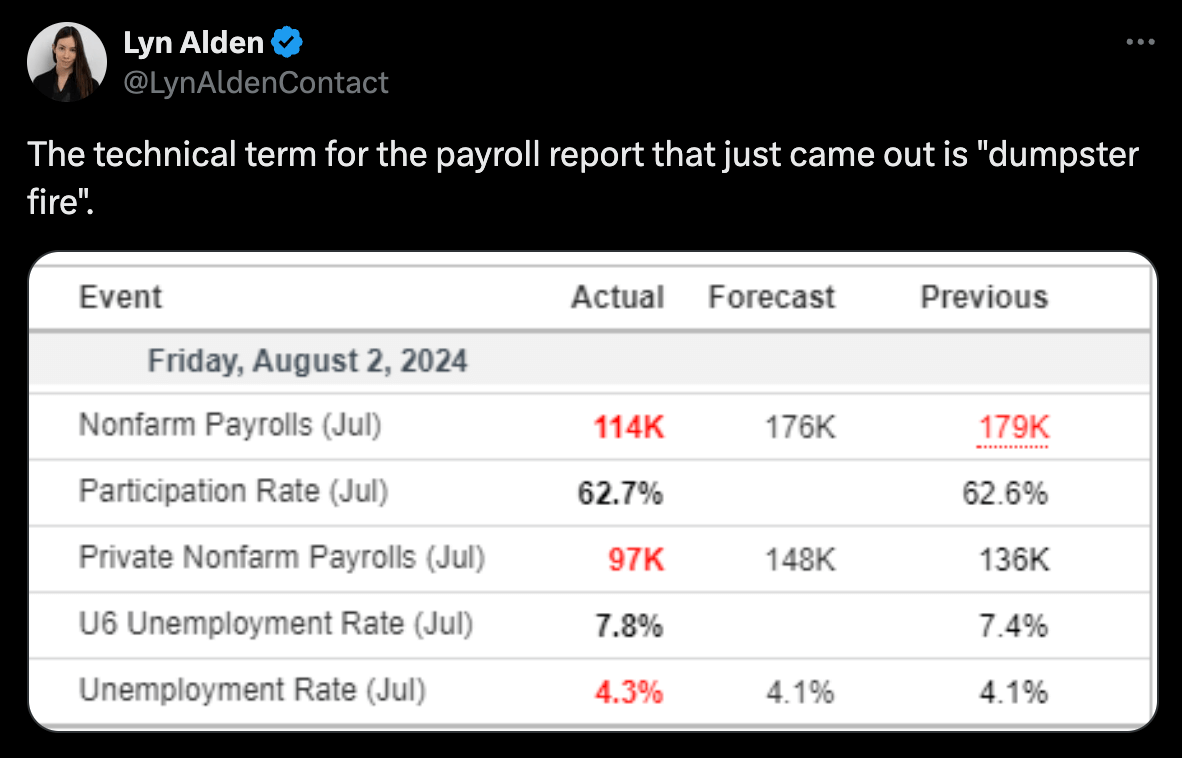

Well, the Labor Department reported that the unemployment rate ticked up to 4.3% in July. (forecast was 4.1%)

That’s the highest level we’ve seen since October 2021.

This report sparked fears that the US economy could be heading towards a recession.

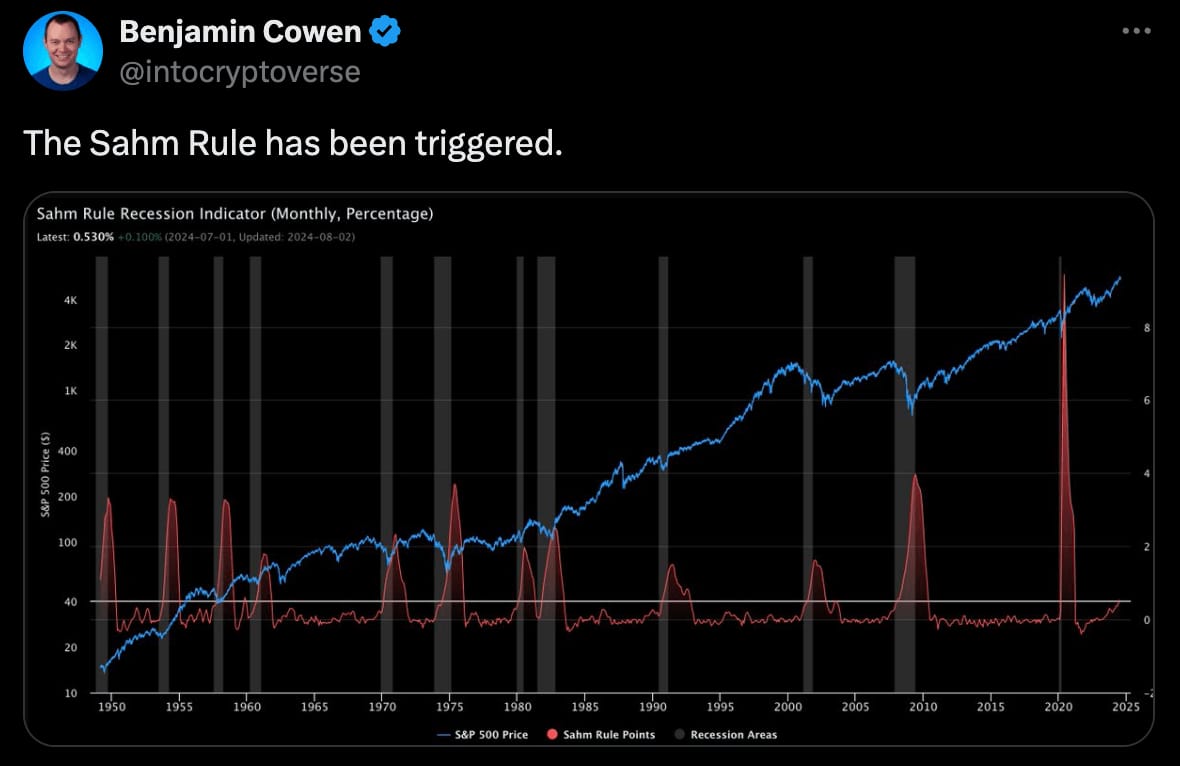

And to make matters worse, the Sahm rule triggered. 😨

We hear you… you’re probably wondering what the Sahm rule is…

Well here’s a simple explanation of what it tells us:

According to the Sahm Rule, the early stages of a recession is signalled when the three-month moving average of the U.S. unemployment rate is half a percentage point or more above the lowest three-month moving average unemployment rate over the previous 12 months.

The short-term outlook is not great…

Since the release of this report, the entire crypto market cap has fallen 4.53% down to $2.19 trillion.

US stocks were also impacted:

Dow Jones Industrial Average fell 1.5%

The S&P 500 fell 1.8%

The Nasdaq fell 2.4%

In the next section, we’ll be breaking down why rate cuts are just around the corner.

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

BITCOIN IS THE ANSWER 💰

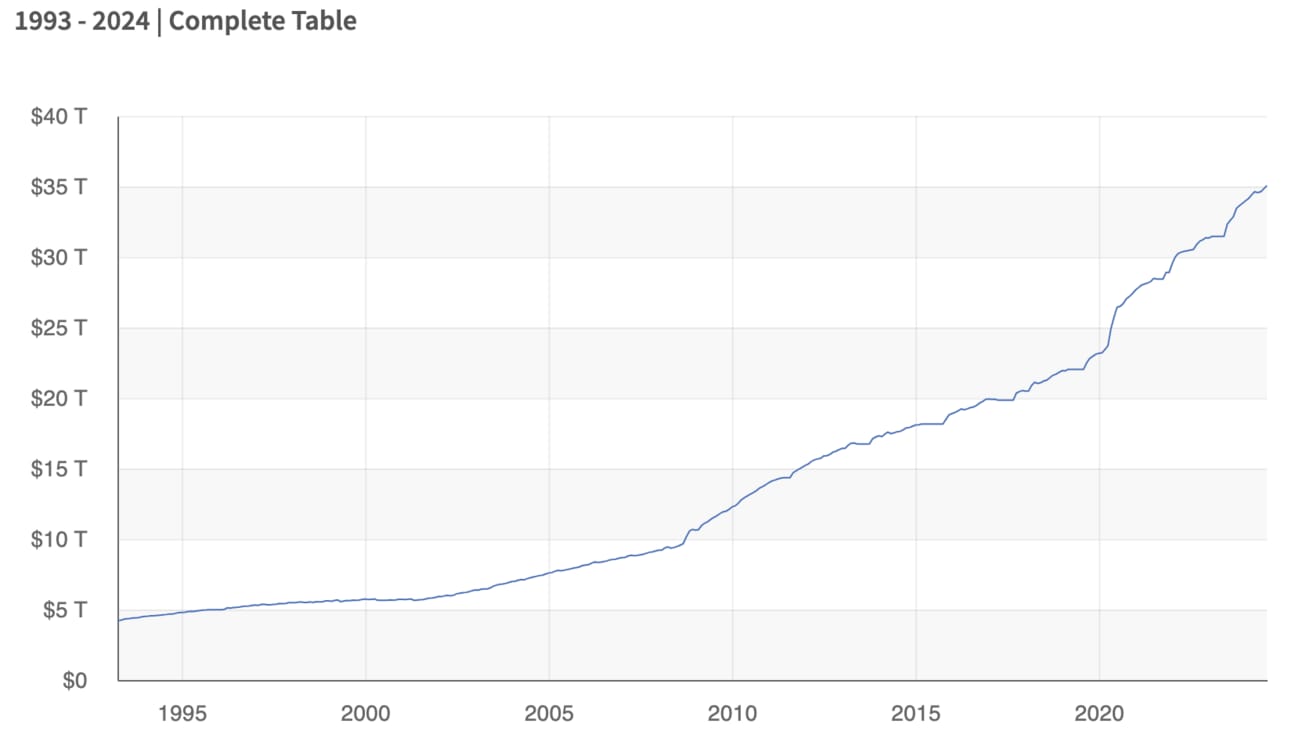

US debt is getting out of control.

But rate cuts are likely just around the corner…

That’s the latest message out from Lyn Alden.

In her latest interview, Alden broke down the current macro environment.

And the US finds itself in a tricky position…

Alden explains that we’ll likely see interest rate cuts soon:

“The current market expectations for mild cuts in the back half of this year do make sense based on the data we currently have. But if we zoom out and ask ‘should a central bank even control the price of money?’ I’d have a very different answer.”

Analysts have been predicting we’ll see the first rate cut in September 2024.

And Polymarket currently has it at a 94% chance.

And now with unemployment coming in worse than expected, things need to change.

Alden also explains that since the US debt is so high (123% of GDP), interest rates become less effective at fighting inflation.

“When you get to public debt to GDP of over 100%, interest rates become less effective at fighting inflation in the first place.”

Typically high interest rates are used to slow down the economy - therefore slowing down inflation.

But high interest rates also increase the interest repayments on the governments already insanely high debt…

This is essentially a debt death spiral…

“Basically it’s a rock in a hard place. If you leave rates high you continue to blowout the fiscal deficit. If they do cut, your currency is less attractive to the foreign market. It’s not a position I’d want to be in if i was the Fed.”

And in case you didn’t know, US debt recently crossed over $35 trillion…

Total US Debt

This is why there’s been talk of a strategic Bitcoin stockpile…

It may be the only hope.

And represents an innovative solution to the problem.

Even Donald Trump mentioned it in an interview yesterday:

"Who knows, maybe we'll pay off our $35 trillion dollar [national debt], hand them a little crypto check, right? We'll hand them a little Bitcoin and wipe away our $35 trillion."

Checkout the clip below.

With unemployment rising as much as it has, the Fed basically has no choice but to lower interest rates.

But have they left it too late? 🤷

STABLECOINS RISING 📈

It’s time for a check in on the stablecoin supply.

Stablecoin’s play an important role in the wider crypto market. They are often used on centralized and decentralized exchanges to purchase other digital assets.

By taking a look at the stablecoin market, we can gauge the demand for digital assets.

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: net capital outflows from digital assets 🐻

The last time we checked in on this metric, the stablecoin market cap was ~$153.31 billion.

Today the aggregate stablecoin market cap is ~$153.57 billion. 📈

That’s an increase of $260 million.

Which sounds like a lot but it’s actually a little bit of a slowdown compared to the usual rate of growth we’ve seen. (we’re used to seeing increases in the billions)

But…

This metric is only ~$9.38 billion short of surpassing it’s all-time high.

There’s one clear takeaway from this data.

And that’s liquidity continues to pour back into the crypto industry every single day.

CRACKING CRYPTO 🥜

VanEck CEO foresees Bitcoin hitting $350k as regulators begin quantitative easing. VanEck's CEO believes Bitcoin will hit 50% of gold's market cap as central banks begin the process of quantitative easing.

Trump floats paying off $35T national debt using Bitcoin. In a recent interview with Fox Business, former President Trump suggested using Bitcoin to pay off the US government’s massive national debt.

U.S. Added Just 114K Jobs in July, Unemployment Rate Shoots Up to 4.3%. The price of bitcoin initially showed little reaction to the soft data even as traders quickly amped up bets on big Fed rate cuts in the second half of the year.

Morgan Stanley to Offer Bitcoin ETFs to Wealthy Clients. The move will take effect on Wednesday and will be open to clients with a net worth of at least $1.5 million.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Seven Point Sunday (link) - Learn to build your career every Sunday

Bullseye Trades (link) - Daily stock market tips

Crypto Pragmatist (link) - Actionable alpha 3x a week

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

Sponsored

Knocked-up Money

Oh dip! Kids are expensive. Learn to grow your family’s wealth—what you’ll find here are no-nonsense quick tips to help you unlock financial freedom and create generational wealth. Join 1.8k+ busy ...

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

How often are new Bitcoin created?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) 10 minutes 🥳

Bitcoin adds a new block to the ledger about once every 10 minutes.

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.