GM to all of you nutcases. It’s Crypto Nutshell #609 speedin’ in… 🏎️ 🥜

We're the crypto newsletter that's more heartwarming than a bear making marmalade and finding a home in London... 🧸🍯

What we’ve cooked up for you today…

🤑 Buy Bitcoin now

🤯 Bitcoin to $10 million

🔥 Two in a row

💰 And more…

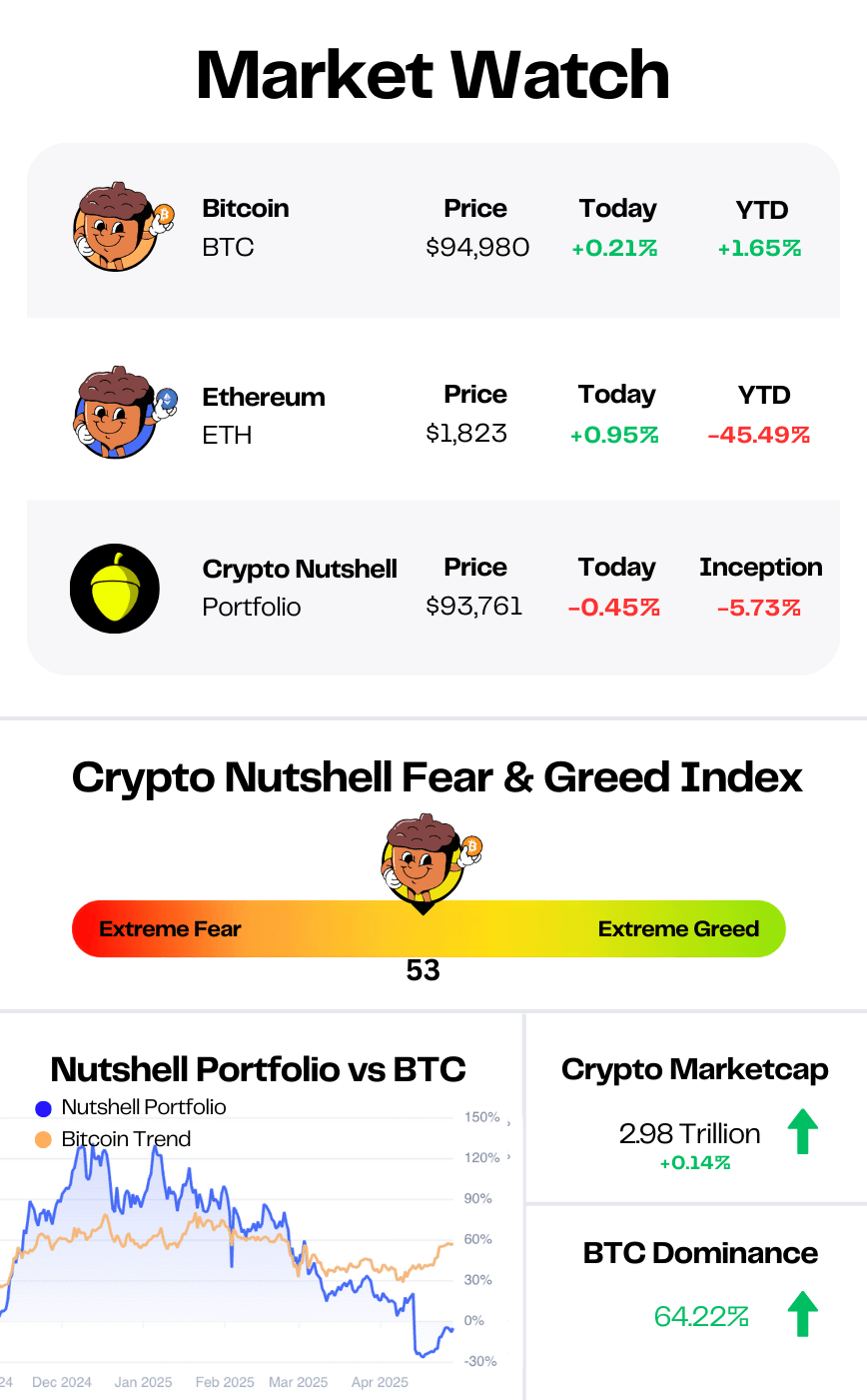

Prices as at 4:05am ET

BUY BITCOIN NOW 🤑

BREAKING: Standard Chartered says buy bitcoin 'now,' sees rally to $120,000 in Q2

Standard Chartered just cranked up the bullishness…

In a new report, Geoffrey Kendrick, the bank’s Global Head of Digital Assets Research, believes Bitcoin is about to smash a fresh all-time high of $120,000 this quarter.

His advice?

"Now is the time to buy."

Kendrick also sees Bitcoin hitting $200,000 by the end of 2025.

According to Kendrick, a perfect storm is brewing.

U.S. Treasury term premium (which has a close correlation to BTC) is at a 12-year high.

Strong Whale accumulation

Major ETF inflows (More on this later)

"U.S.-based investors may be seeking non-U.S. assets… We expect a strategic asset reallocation away from U.S. assets to trigger the next sharp upswing in Bitcoin in the coming months."

Bitcoin’s bounce from $75,000 to $95,000 already shows the tide turning - fuelled by growing optimism over global trade tensions cooling.

Meanwhile, whales are back in accumulation mode - a classic signal that the smart money is positioning for the next major move.

Kendrick also argued that Bitcoin is now a "better hedge than gold" against financial system risks, with ETF flows shifting away from gold and into BTC.

Timing a breakout isn’t easy.

But Kendrick’s message is clear:

The breakout is building - and it’s time to be ready. 🚀

Smarter Investing Starts with Smarter News

Cut through the hype and get the market insights that matter. The Daily Upside delivers clear, actionable financial analysis trusted by over 1 million investors—free, every morning. Whether you’re buying your first ETF or managing a diversified portfolio, this is the edge your inbox has been missing.

BITCOIN TO $10 MILLION 🤯

"If people knew what I knew, Bitcoin would go to $10 million tomorrow."

That’s Michael Saylor’s message.

In a recent interview, Saylor explained it simply: Most of the world still doesn’t understand Bitcoin.

And that ignorance? It’s your opportunity.

Volatility Protects the Faithful

Saylor had this to say about Bitcoin’s volatility this year:

"Volatility is a gift to the faithful. It scares away the tourists, the lazy, and the already-rich."

If Bitcoin's price was stable, if everyone agreed it was the obvious play - you’d already be priced out.

You want it to be volatile. You want it to be misunderstood.

Because that’s the only reason you still have the chance to stack under $10 million.

Saylor’s Conclusion? Simple.

Saylor is a self-made billionaire.

He’s spent thousands of hours studying how to build wealth, analyzing investments, and understanding Bitcoin.

And after all that work?

His conclusion is simple: Go all in on Bitcoin.

You can either spend the next decade trying to figure it out yourself or you can follow the man with the track record to back it up.

We know what we’re doing. 🫡

TWO IN A ROW 🔥

Momentum is building again…

Last week, digital asset funds pulled in a massive $3.4 billion

That’s the largest weekly inflow since mid-December and the 3rd largest weekly inflow on record!

Let's break it down.

Bitcoin was the clear favourite, attracting $3.19 billion in net inflows

Ethereum finally snapped its brutal eight-week outflow streak, pulling in $183 million.

XRP and Sui also posted strong gains, with inflows of $20.7 million and $31.6 million, respectively.

The only major standout was Solana, which bucked the trend and recorded $5.7 million in net outflows despite the broader risk-on sentiment.

U.S. investors led the charge in a big way, accounting for $3.3 billion of the total inflows.

Germany followed with $51.5 million, while Switzerland added another $41.4 million.

According to CoinShares, this sudden surge in flows is a direct response to Trump’s tariffs.

As trade tensions continue, investors are increasingly turning to digital assets - positioning Bitcoin and crypto as the emerging safe haven plays.

Exactly as we’ve been saying for weeks. 👀

CRACKING CRYPTO 🥜

U.S. SEC greenlights ProShares XRP futures ETFs for April 30 launch. ProShares Trust will launch three XRP futures ETFs that will offer exposure to the price movements of XRP via an index.

Arizona legislature passes Bitcoin reserve bills, moving closer to stockpiling crypto. The Arizona House of Representatives approved two bills proposing different methods that the state could use to establish a cryptocurrency reserve.

Strategy Adds Additional $1.42B of Bitcoin With Latest Purchase. The company stack is worth more than $52 billion at bitcoin's current price of $95,000.

Mastercard moves to integrate stablecoins into global payments network. The company is also partnering with cryptocurrency exchange OKX to issue a card.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What was the nickname of Ethereum’s EIP-1559 upgrade, launched in 2021?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: London Hard Fork 🥳

The London Hard Fork introduced EIP-1559, changing how gas fees work by burning a portion of transaction fees — making ETH more deflationary over time. 🔥

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.