GM to all of you nutcases. It’s Crypto Nutshell #784 awaitin’ the fireworks … 🎆🥜

We’re the crypto newsletter that’s more unpredictable than a crew waking up to find the mission has gone very, very wrong… 🚀😨

What we’ve cooked up for you today…

🏦 It’s yield time

🤔 Bitcoin to triple?

💪 The base is strengthening

💰 And more…

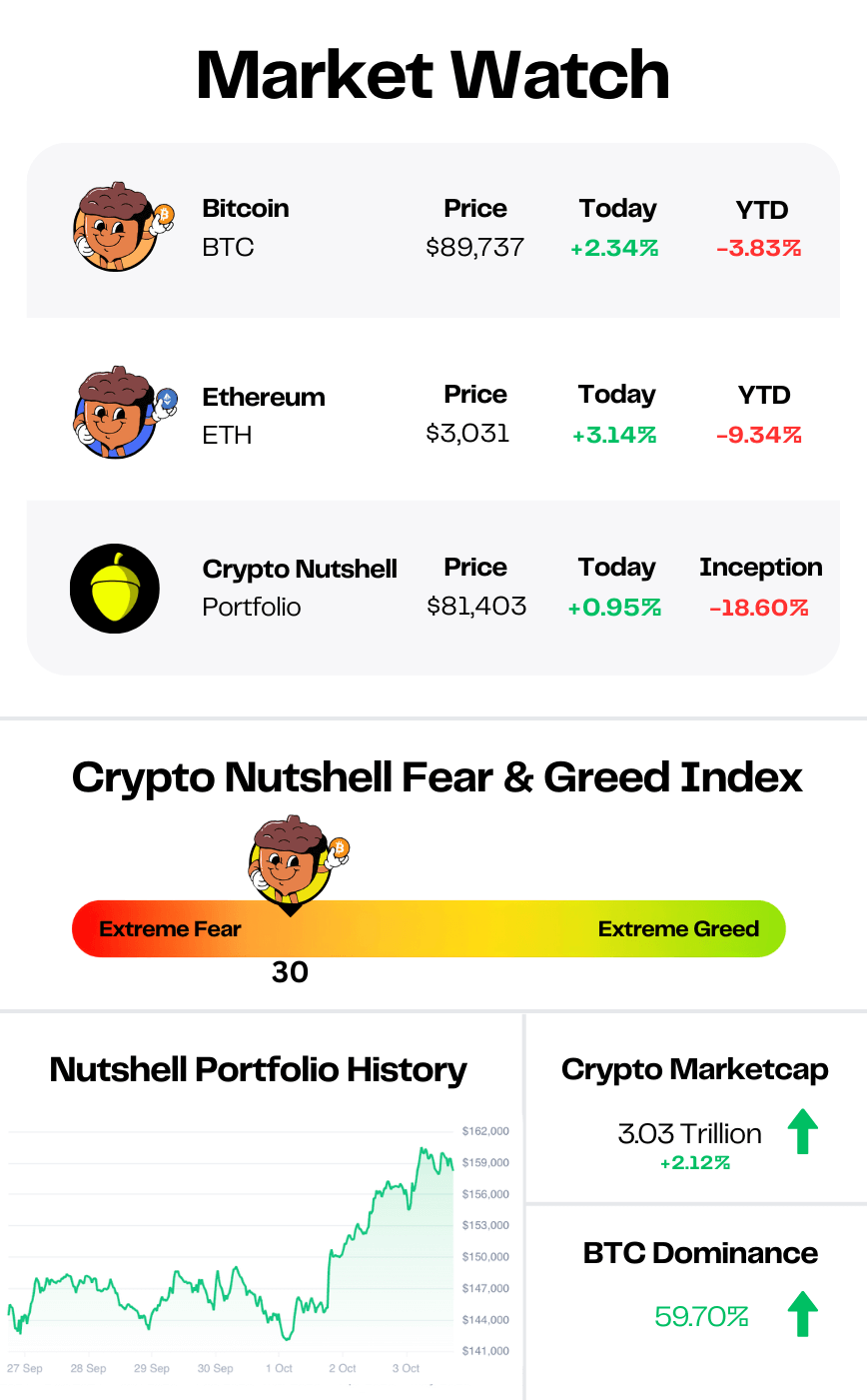

Prices as at 1:55am ET

IT’S YIELD TIME 🏦

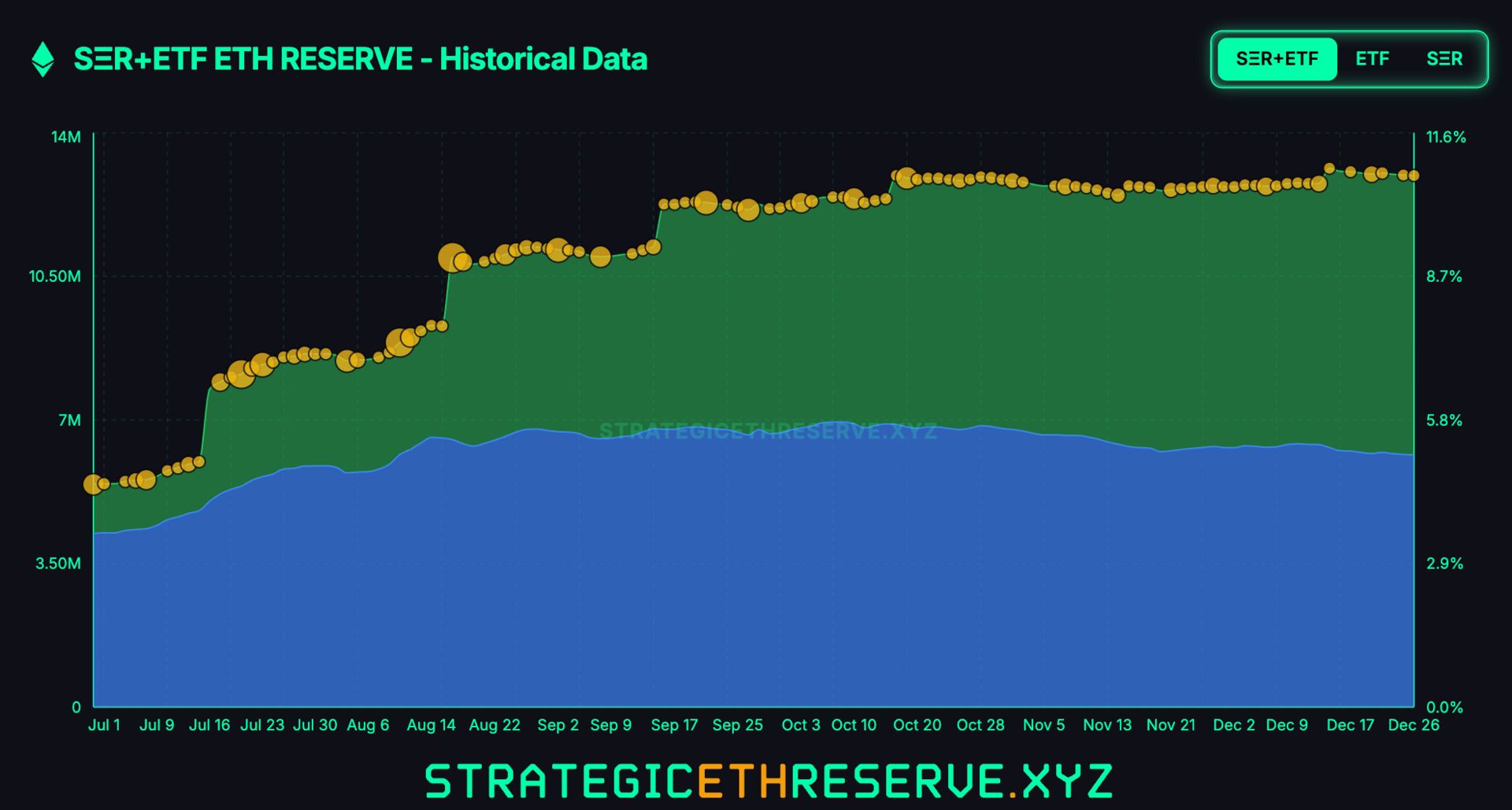

BREAKING: Bitmine begins staking ETH, deposits $219M into Ethereum PoS contract

BitMine just started staking its Ethereum.

The largest corporate ETH holder deposited 74,880 ETH - worth $227 million - into Ethereum's staking contracts on Friday.

That's just 1.8% of BitMine's 4.07 million ETH holdings, currently valued over $12 billion.

But it signals a major shift in strategy.

If BitMine stakes its entire treasury at the current 3.12% APY, it would generate roughly 126,800 ETH annually - worth $385 million at current prices.

That turns BitMine from a passive holder into a yield-bearing vehicle tied to Ethereum's consensus layer.

The target

BitMine's goal: acquire and stake 5% of Ethereum's total supply.

The company is building the Made in America Validator Network (MAVAN), launching in early 2026.

"This will be the 'best-in-class' solution offering secure staking infrastructure."

BitMine currently holds 3.36% of ETH's total supply. MAVAN would push that toward 5%.

The risks

The strategy introduces new risks.

Staked ETH can't be liquidated immediately. Validators must pass through an exit queue. That delays access to capital during volatile markets.

In a liquidity crunch, BitMine could be exposed to price swings a non-staking treasury would avoid.

Why this matters

Sharplink Gaming's co-CEO - whose company holds 798,000 ETH - predicts Ethereum's TVL could increase tenfold in 2026 as institutions expand participation.

Stablecoins are the key driver. The market could hit $500 billion by end of 2026, up 62% from current levels. Over half of stablecoin activity already happens on Ethereum.

BitMine staking its treasury validates that thesis. Institutions aren't just holding ETH anymore. They're deploying it as productive capital.

The tradeoff: yield versus liquidity

BitMine just made its bet. 🚀

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

BITCOIN TO TRIPLE? 🤔

There’s a reason Fred Krueger has made tens of millions of dollars…

He’s right more often than he’s wrong.

He’s a mathematician, serial entrepreneur, and long-time macro thinker who looks at markets through probabilities. When Fred talks, it’s usually worth listening.

Fred Krueger pictured, right.

This week, he dropped a simple observation:

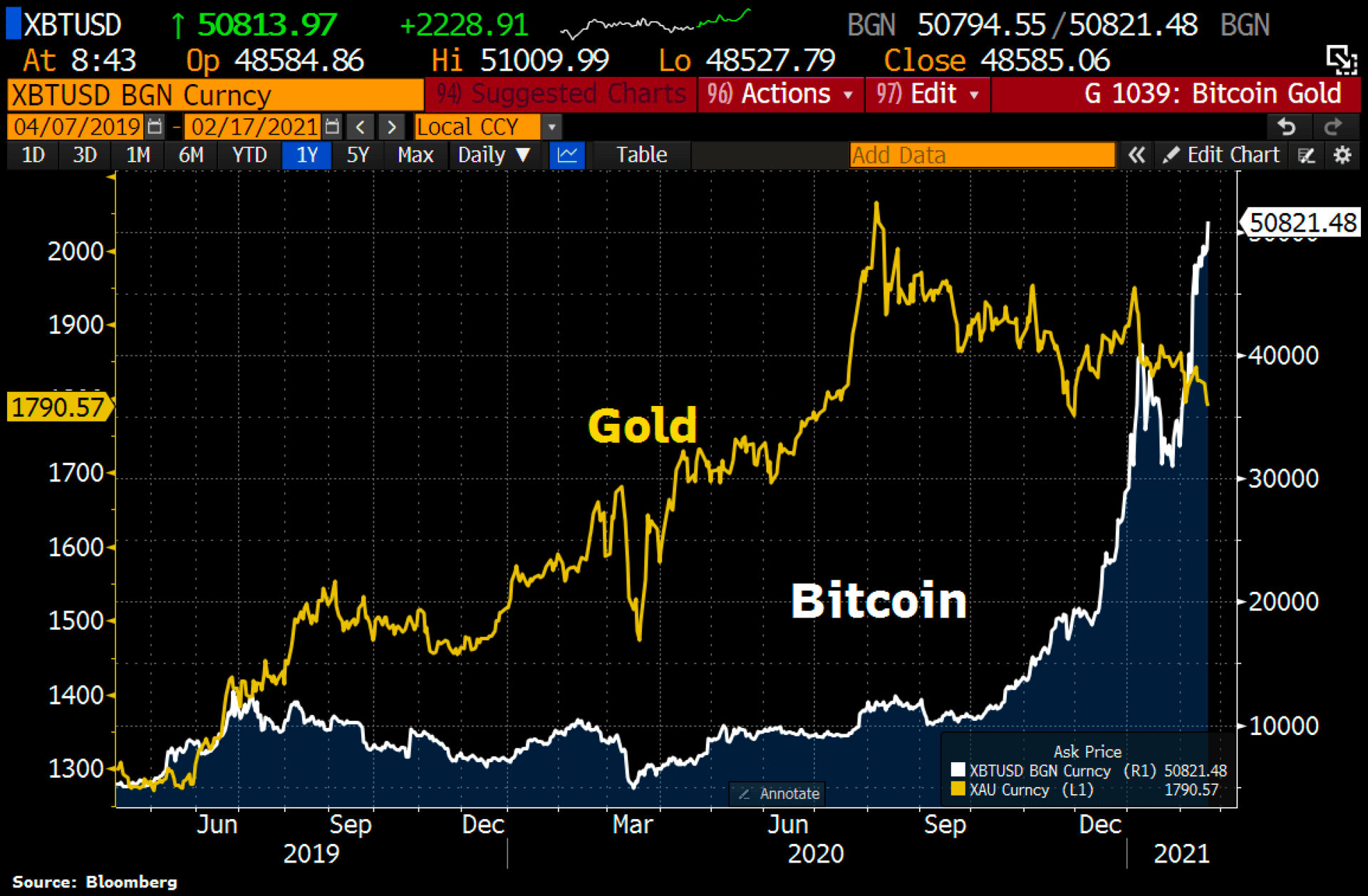

That sounds aggressive - until you zoom out.

Fred pointed out something most people (us included) completely missed this year.

Gold & silver.

While everyone was debating rate cuts, recessions, and4four-year cycles, precious metals quietly did the unthinkable.

Gold kept printing new all-time highs.

Silver nearly tripled in 2025.

Silver.

An asset most people wrote off as dead money at the start of the year.

Fred even highlighted Hecla, the largest silver producer in the U.S., is now back near levels it traded at decades ago when he first owned it - after almost quadrupling this year.

Here’s the important connection.

Bitcoin has historically followed gold and silver - just on a lag.

Bitcoin prices followed Gold prices in 2020/21 on a ~6 month lag

And unlike both of them, Bitcoin is:

• harder capped

• globally liquid

• digitally native

• instantly transferable

In other words, Bitcoin is superior monetary technology.

So if gold and silver can explode higher after years of boredom - surprising almost everyone - why couldn’t Bitcoin do the same next?

Especially when:

• global debt is rising

• currencies are being diluted

• and capital is searching for scarce assets again

Fred’s point isn’t that Bitcoin must triple.

It’s that markets routinely do things almost no one expects - after people give up on the idea entirely.

Gold did it.

Silver did it.

Bitcoin just tends to move last.

So yes - could Bitcoin realistically triple in 2026, even if nobody believes it today?

Absolutely. 🤔

THE BASE IS STRENGTHENING 💪

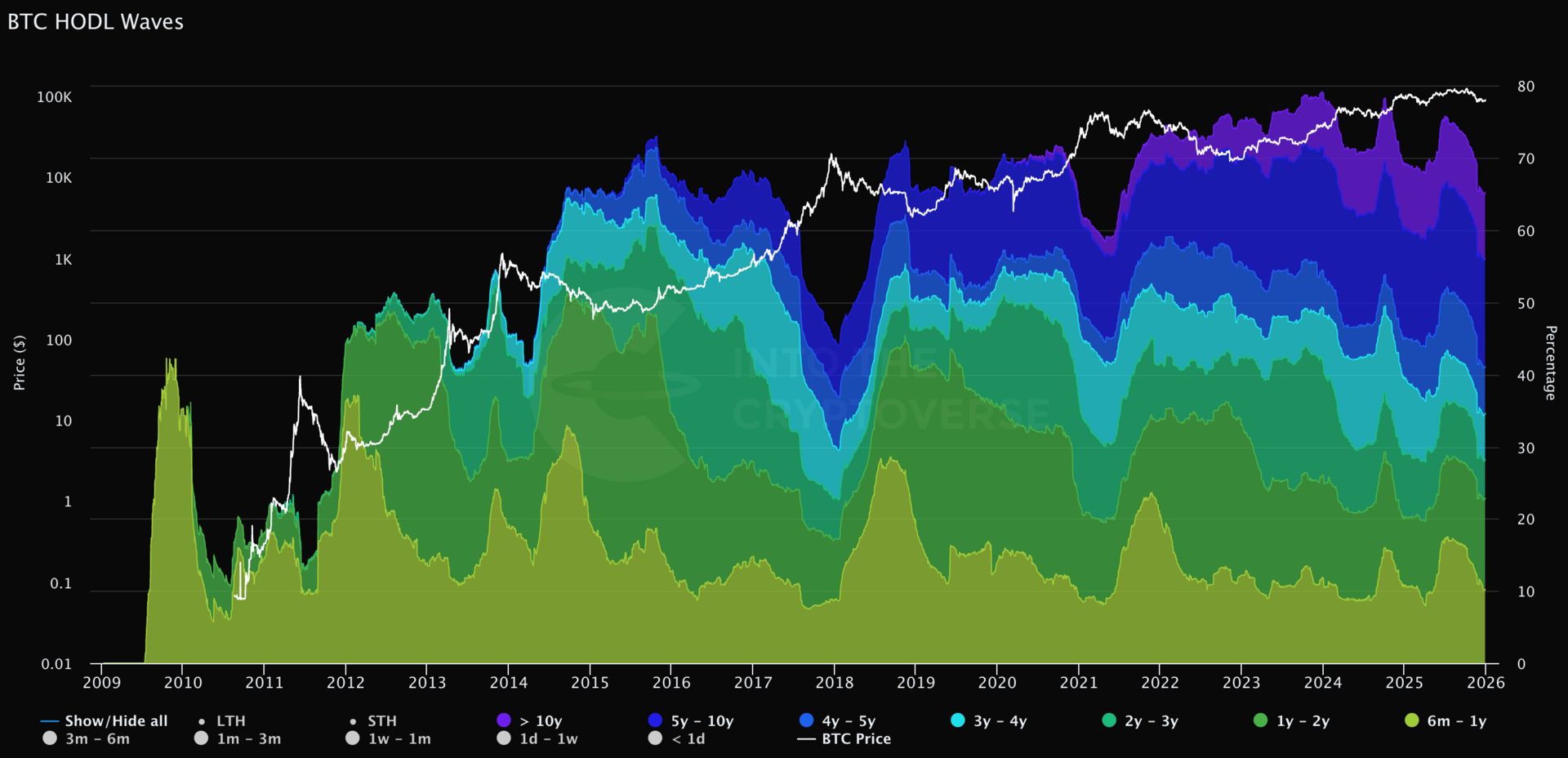

Let’s kick off the week with a look at the Bitcoin HODL Waves - one of the clearest snapshots of market conviction.

Each coloured band represents the percentage of Bitcoin that last moved within a specific time frame.

The cooler the colour, the older the coins - with purple showing Bitcoin that hasn’t moved in 10+ years.

Today we’ll be focusing on long-term holders (LTHs) - defined as coins held for more than six months.

Here’s how the Bitcoin supply breakdown looks today compared to two weeks ago:

6m - 12m: 10.23% (down from 10.89%)

1y - 2y: 12.61% (up from 12.04%)

2y - 3y: 5.37% (down from 5.53%)

3y - 4y: 6.39% (up from 6.25%)

4y - 5y: 6.52% (down from 6.66%)

5y - 10y: 14.94% (up from 14.85%)

>10y: 9.22% (up from 9.17%)

TL;DR: 65.28% of all Bitcoin has not moved in over six months. 🔒

That's down 0.11% from two weeks ago. Basically flat.

The story here is rotation, not capitulation.

The 6-12 month cohort shed 0.66% as some shorter-term holders took profits. But that supply didn't leave the system - it moved into stronger hands.

The 1-2 year band jumped 0.57%, absorbing coins from below. The 3-4 year group ticked up too.

And the oldest bands? Still climbing. The 5-10 year and 10+ year cohorts both pushed higher.

This is what conviction looks like during a pullback.

No mass exodus. Just coins aging into deeper dormancy whilst short-term traders do their thing.

Bottom line: supply is locked, long-term holders aren't flinching, and the base keeps strengthening. 💎

CRACKING CRYPTO 🥜

Coinbase claims arrest in the $355 million insider extortion scheme that targeted nearly 70,000 customers. An arrested support agent and a massive bribery plot have forced the exchange to reimburse millions while facing a federal probe into its outsourced security teams.

Ethereum’s ‘Hegota’ upgrade slated for late 2026 as devs accelerate roadmap. Hegota will follow “Glamsterdam,” Ethereum’s next major upgrade, which is currently expected to roll out in the first half of 2026.

China to let banks pay interest on digital yuan to drive adoption. China's central bank will allow commercial banks to pay interests on digital yuan holdings in a new framework taking effect on Jan. 1, 2026.

Analyst Asks Whether BTC Will End 2025 in the Green or the Red. The price of Bitcoin must rally by about 6.24% to end 2025 at a higher price than the start of the year, according to market analyst Nic Puckrin.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Before founding Cardano, Charles Hoskinson was a co-founder of which major blockchain?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Ethereum 🥳

Charles Hoskinson was one of Ethereum's eight co-founders in 2014 but left the project in 2014 after disagreements with Vitalik Buterin about whether Ethereum should be a for-profit company. He went on to found IOHK and launch Cardano in 2017.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.