GM to all of you nutcases. It’s Crypto Nutshell #788 hittin’ resolutions… 💪🥜

We’re the crypto newsletter that’s more high-pressure than a crew trapped underground with seconds left on the clock… ⛏️⏱️

What we’ve cooked up for you today…

🏦 Is the four year cycle dead?

🤦 Why did Bitcoin underperform in 2025?

📈 Expanding

💰 And more…

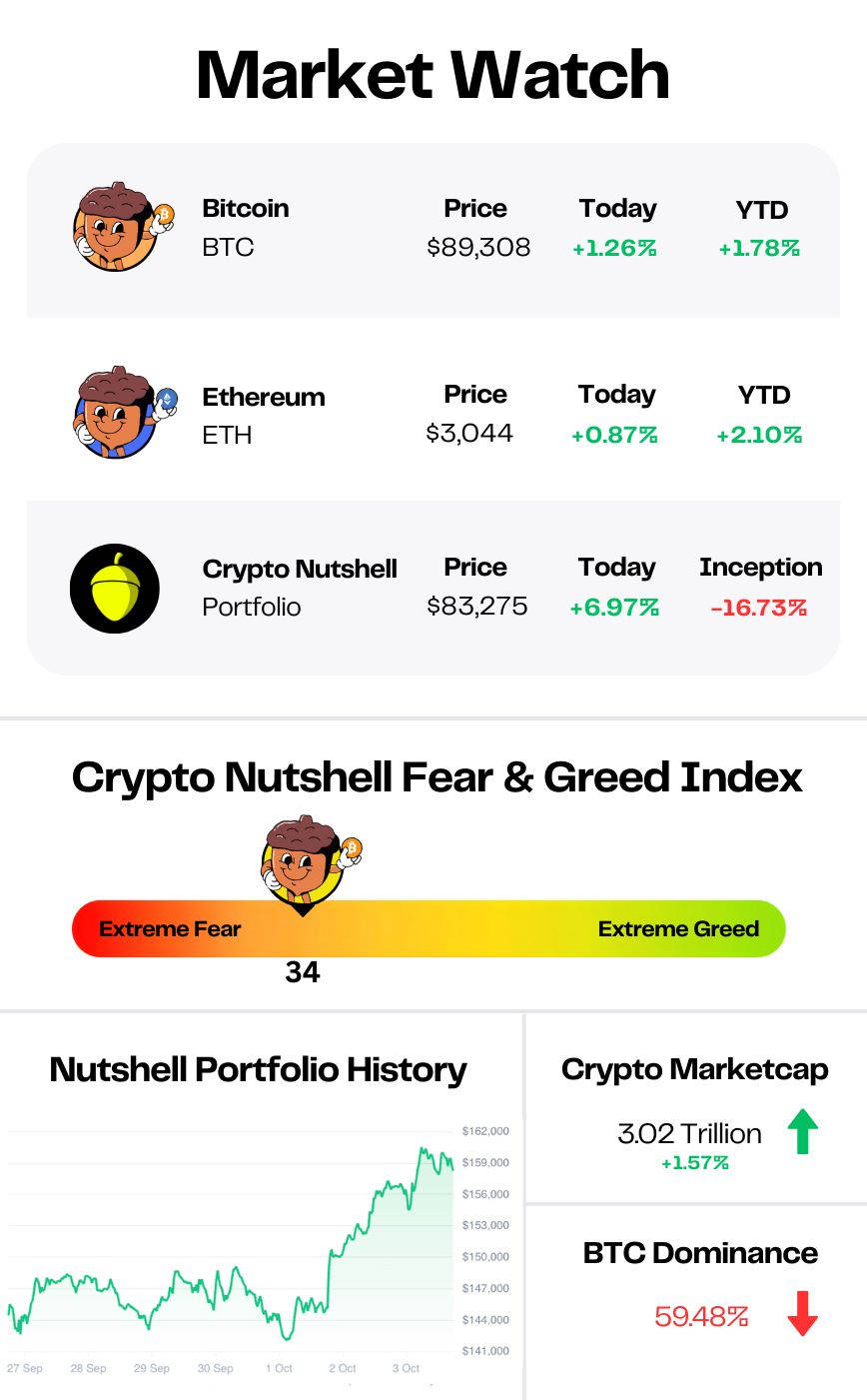

Prices as at 4:50am ET

IS THE FOUR YEAR CYCLE DEAD? 🏦

BREAKING: BTC ends year after halving in red

Bitcoin just broke a perfect streak.

For the first time ever, BTC ended a post-halving year in the red.

The pattern held for over a decade:

2012 halving → 2013 surge to new highs - green year

2016 halving → 2017 surge to new highs - green year

2020 halving → 2021 surge to new highs - green year

This time, Bitcoin peaked at $126,080 on October 6, then dropped over 30% to end the year around $88,500.

The four-year cycle just died. Or did it?

"Officially dead"

Vivek Sen, founder of Bitcoin PR firm Bitgrow Lab, declared the four-year cycle "officially dead" after Bitcoin ended the year down.

Investor Armando Pantoja agreed, pointing to new market dynamics.

"The market has new players. Crypto isn't 2016 or 2020 anymore. ETFs, institutions, and corporate balance sheets don't trade like hype-driven retail… Bitcoin trades macro now. BTC reacts to liquidity, rates, regulation, and geopolitics — not a perfect halving calendar."

Pantoja acknowledged the halving still matters long-term. But supply is increasingly locked, miners have financing options, and price dynamics aren't as automatic as before.

Split opinions

Cathie Wood, Arthur Hayes, and Bitwise executives Matt Hougan and Hunter Horsley all said throughout 2025 that the four-year cycle was dead.

But others argue it's still alive - just playing out differently.

Markus Thielen, head of research at 10x Research, said the cycle remains intact but is no longer dictated by programmed supply cuts.

The shift makes sense.

Spot Bitcoin ETFs launched in January 2024. That led to institutional capital flows based on macro conditions, not halving calendars.

Corporate treasuries now hold over 1 million BTC. They accumulate based on balance sheet strategy, not four-year patterns.

Miners now have access to debt financing and equity markets. They're not forced to sell immediately after halvings like they were in prior cycles.

And Bitcoin increasingly trades as a macro asset correlated with liquidity conditions, Fed policy, and geopolitical risk - not a predictable supply-driven pump.

What this means

The four-year cycle was never a law. It was an observed pattern driven by supply shocks in a small, retail-dominated market.

That market no longer exists.

Bitcoin is now a $1.7 trillion asset class with institutional infrastructure, regulated ETF products, corporate treasury adoption, and macro correlation.

The halving still reduces new supply. But in a market with deep liquidity, mature derivatives, and diversified holders, supply cuts don't automatically trigger parabolic rallies.

If the cycle is dead, it died because Bitcoin matured.

And that might be more bullish long-term than any four-year pattern. 🚀

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

WHY DID BITCOIN UNDERPERFORM IN 2025? 🤦

Just over a year ago, Bitcoin had just crossed $100,000 for the first time.

Today, it’s trading closer to $85,000.

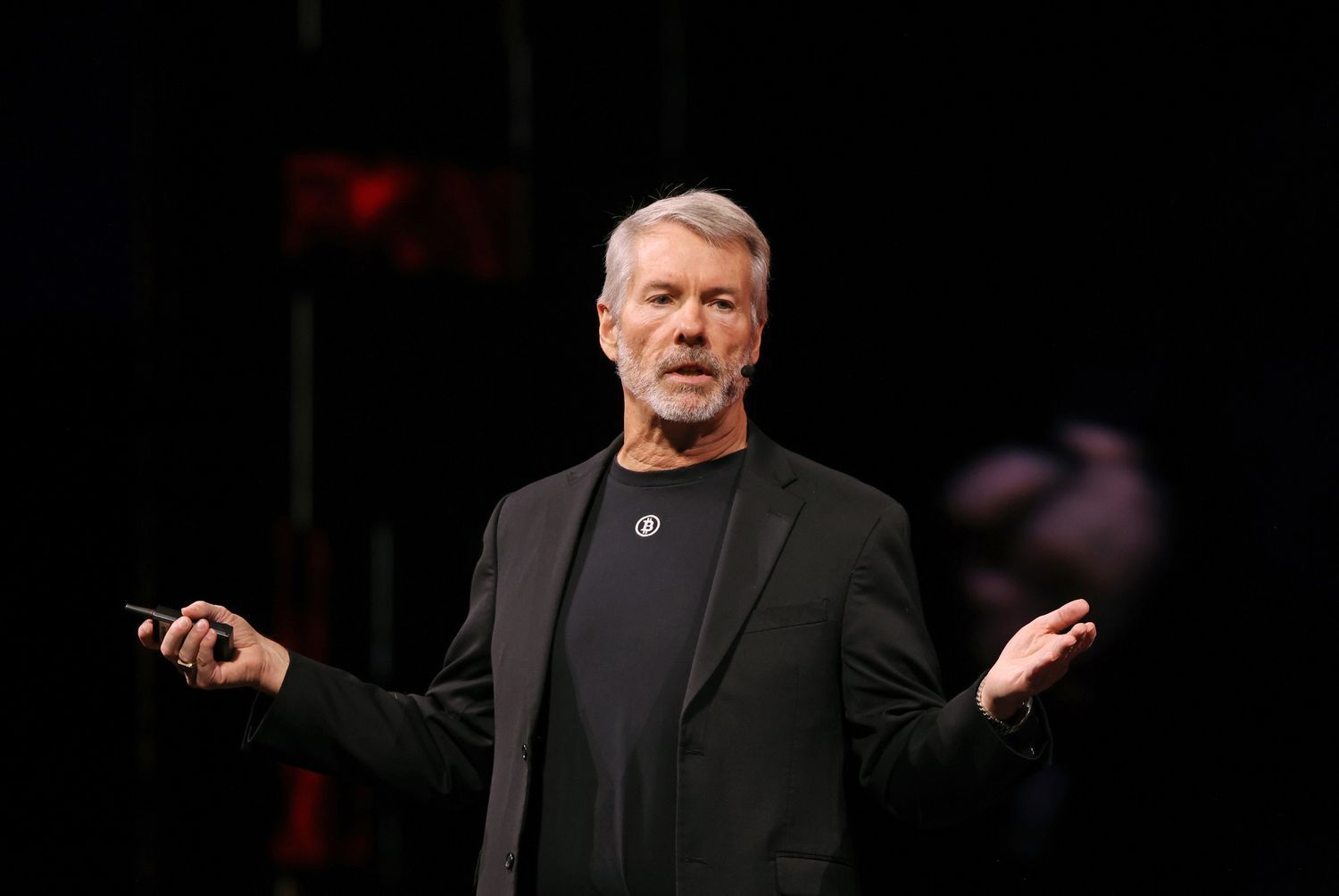

So Michael Saylor got asked the obvious question:

Why did Bitcoin underperform so bad in 2025?

Michael Saylor at Bitcoin 2025

His answer was simple - and very revealing.

First, Saylor explained who actually controls Bitcoin’s price.

Despite all the attention on ETFs, corporations, and headlines, most Bitcoin is still held by early adopters and long-time holders - not institutions.

“85% of the Bitcoin is held in crypto OG hands… people we can’t even identify.”

That matters because, in the short term, price isn’t set by long-term investors quietly accumulating.

It’s set by traders using leverage.

“The derivatives market… drives this much more than spot.”

In plain English:

Bitcoin’s short-term price is being pushed around by leveraged trading, not fundamentals.

That’s why Bitcoin can chop sideways or fall even when the news looks so bullish.

But Saylor did make 1 thing very clear.

Short-term price action completely misses what’s actually happened this year:

“The last 12 months have been probably the best 12 months in the history of the industry in terms of fundamentals.”

And then he rattled them off:

Supportive administration.

Supportive SEC, CFTC, Treasury.

Spot Bitcoin ETFs fully unlocked.

Onshore derivatives exploding from zero to $50B.

Banks offering credit against Bitcoin.

Fair-value accounting finally approved.

Hundreds of public companies adding crypto to balance sheets.

His takeaway?

Although price has lagged - fundamentals didn’t.

Bitcoin didn’t underperform because the thesis broke.

It underperformed because a free market driven by leverage takes time to digest supply.

Saylor’s view is clear:

The foundation has never been stronger.

The structure is still forming.

The price will eventually follow. 🌊

EXPANDING 📈

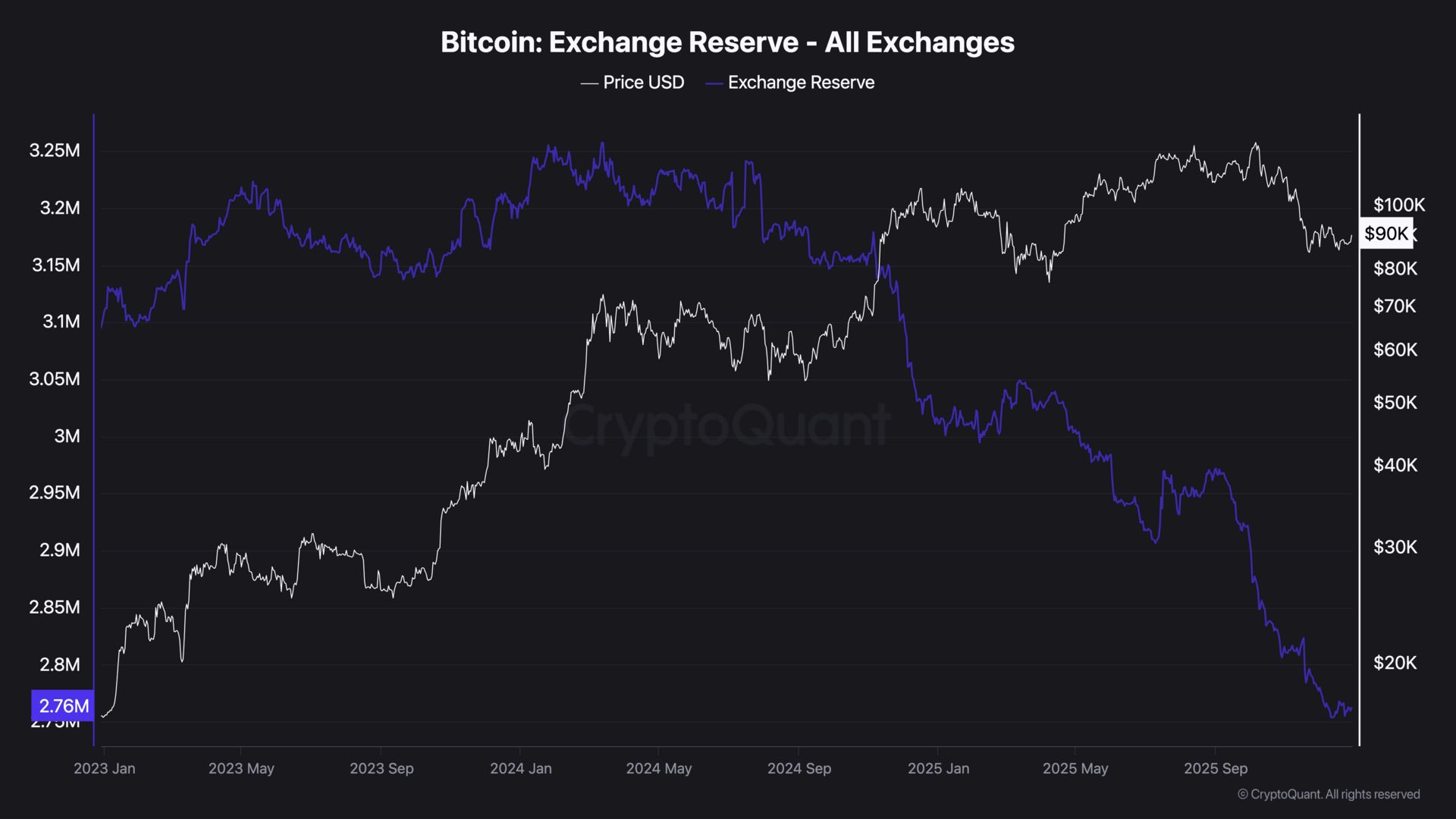

Today we’ll be taking a look at the amount of Bitcoin available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

Just 2.76 million BTC now sit on exchanges - 13.83% of the total supply.

Since January, around 248,818 BTC have been withdrawn - roughly $23 billion pulled off the open market and into cold storage, treasuries, and long-term wallets.

Yes, some weak hands are folding. Short-term holders are capitulating. Fear's doing its job.

But the bigger picture hasn't budged.

The liquid float keeps shrinking. The base of committed holders keeps expanding.🧱

CRACKING CRYPTO 🥜

Bitcoin "died" four times in 2025, but a hidden infrastructure boom proves the skeptics completely wrong. Crypto "died" four times in 2025. Yet ETFs pulled $46B, stablecoin laws passed, and Vanguard reversed its crypto ban.

Vitalik Buterin on the two goals Ethereum must meet to become the ‘world computer’. A New Year’s message from Ethereum co-founder Vitalik Buterin explains why the network’s future hinges on more than hype or short-term crypto trends.

Bitcoin Price Volatility Signals Ignite for 2026 TradFi Return. Bitcoin market participants expect upside BTC price volatility to make a comeback based on chart signals.

BTC, SOL and HYPE treasury execs forecast M&A, diversification and more institutional adoption in 2026. More than 200 new DATs are estimated to have launched in 2025, pushing the value of crypto held by companies beyond $100 billion.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Are you ready for this week’s quiz?

5 questions. All from this week’s issues. If you’ve been paying attention, you’ll crush it. If you’ve been skimming, it’ll show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

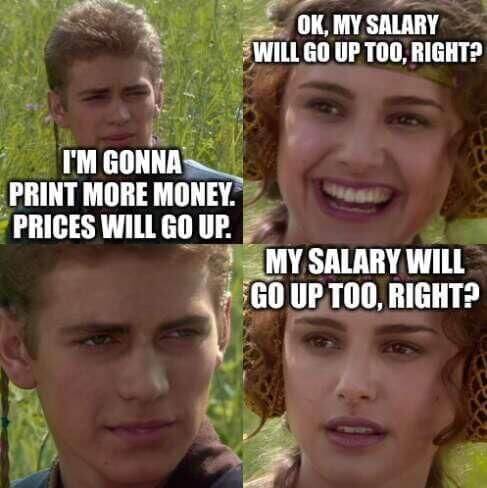

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.