Today’s edition is brought to you by Masterworks - invest in shares of blue-chip art today!

GM to all 13,772 of you. Crypto Nutshell #108 climbin’ the peaks.⛰️🥜

We’re the crypto newsletter that's as exciting as a group of rebels fighting against an oppressive empire... 🌌🚀

Today, we’ll be going over:

👨⚖️ The SEC’s big decision

🚀 Why Bitcoin will hit $70k in 2024

😁 It’s all coming together

🤑 And more…

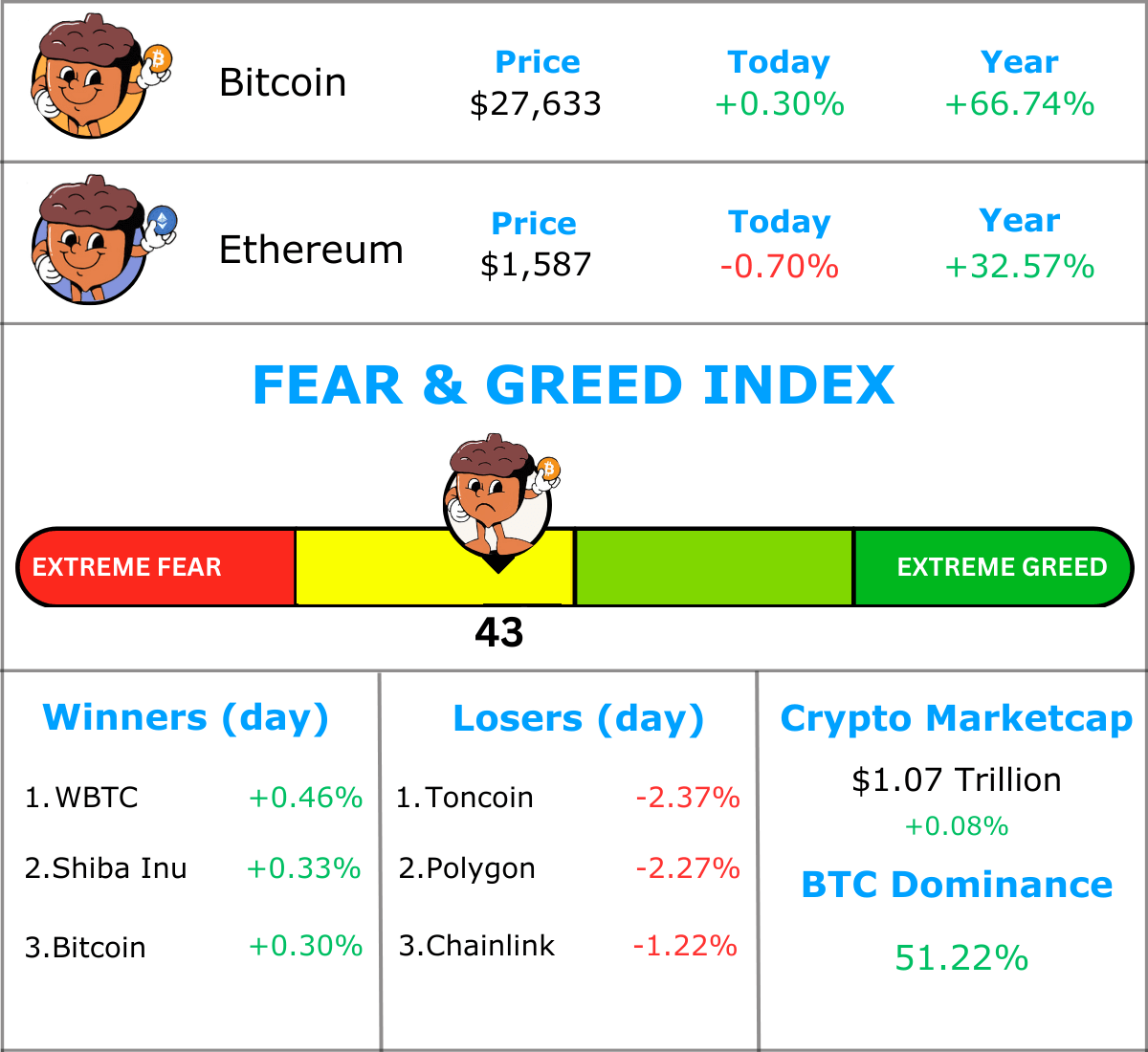

MARKET WATCH ⚖️

Prices as at 7:00am ET

Only the top 20 coins measured by market cap feature in this section

THE SEC’S BIG DECISION 🧑⚖️

BREAKING: The SEC has until this Friday to appeal the Grayscale ruling

The deadline for the SEC’s decision is only one week away. The regulator’s decision is a major key in the fate of spot Bitcoin ETFs. 🔑

There’s mixed opinions on what this decision could entail. Some have said an SEC appeal could be bearish for ETF approvals. Some expect the SEC not to appeal. Most believe the Bitcoin ETFs are inevitable, regardless of this decision.

In August a Judge made a ruling in Grayscale's favour over the SEC. Grayscale wanted to convert their Bitcoin Trust into an ETF and the SEC said no. The judge believed the SEC's decision was "arbitrary and capricious". Based on the fact that they recently approved Bitcoin futures ETFs. 🤔

The SEC has 3 choices:

Appeal to the US Supreme Court (if a certiorari petition is granted)

Request an “en banc” panel of the Court of Appeals to revisit the ruling

Decide not to appeal

Analysts believe the first 2 options are unlikely…

So what happens if the SEC does not appeal?

Well, according to a blog post from law firm Winston & Strawn, the court will be:

“Instructing the SEC to approve the application, or to revisit Grayscale’s application, in which case the SEC could still reject the proposal on other grounds,”

Unfortunately, most analysts are predicting the SEC will continue playing the villain. This means that they can still decline Grayscales application for other reasons…

Fineqia International analyst Matteo Greco had this to say:

“The SEC can still decline the conversion for different reasons, making the need for an appeal less compelling than it was in the Ripple case, where the judge’s decision was definitive and held significant implications for the legal classification of digital assets,”

We’ll have to wait and see what they do, but the decision this week will have a big impact on crypto…

If you’d like to read more click here.

TOGETHER WITH MASTERWORKS 🎨

Billionaires wanted it, but 54,578 everyday investors got it first… and profited

When incredibly rare and valuable assets come up for sale, it's typically the wealthiest people that end up taking home an amazing investment. But not always…

One platform is taking on the billionaires at their own game, buying up and fractionalizing some of history’s most prized blue-chip artworks for its investors.

It's called Masterworks. Their nearly $1 billion collection includes works by greats like Banksy, Picasso, and Basquiat, all of which are collectively owned by everyday investors. When Masterworks sells a painting – like the 16 it's already sold – investors reap their portion of the profits.

Offerings can sell out in minutes, but Crypto Nutshell readers can skip the waitlist to join with this exclusive link.

WHY BITCOIN WILL HIT $70K IN 2024 🚀

Crypto expert Arthur Hayes just dropped a bombshell prediction. 💣

He believes Bitcoin will hit a new all time high by the end of 2024.

What’s more?

He thinks Bitcoin will continue to march upwards to $750,000 - $1,000,000 by 2026.

If you don’t know who Arthur is, here’s why you should listen to him:

Crypto veteran who founded BitMex (crypto exchange)

Net worth of over $500+ million

10+ years in crypto and expert in macroeconomics

In his most recent interview with Tom Bilyeu, he broke down his prediction:

“We get to around $70,000 by the end of 2024. That's the combination of the crypto Halving event, there's going to be a few ETFs launched by large asset managers in the U.S, Europe, China maybe Hong Kong. To be specific. we regain the all-time high by end of 2024. That's when the real fun starts. That's when the real bull market starts.”

That’s not all. Arthur believes we will then enter the biggest bull market the world has ever seen… 🌎

“My mental model for where we could go? I think we're going to go somewhere between you know $750,000 to $1,000,000 in Bitcoin… I believe this is going to be the largest financial bull market in financial assets we have ever seen.”

Arthur is predicting a 154% price increase by the end of 2024. Then a 2600% - 3500% increase over the next 3 years…

Why does he think these predictions will play out?

It all comes down to the government debt crisis.

Arthur argues that the government has quite literally printed itself into a corner. 🖨

With debt levels now over $33.5 trillion and debt-to-GDP at over 120%, the U.S has a problem.

Raise interest rates and you have to pay interest on debt through T-Bills. With such high levels of debt, this pours more money to the economy.

Lower interest rates and borrowing gets cheaper and liquidity is added to the system. This also pours money into the economy.

Whatever route the government decides, the outcome is the same. More stimulus and money printing. This means the devaluation of the dollar.

Arthur believes this will be the fuel for a huge bull-run in crypto, the stock market and other financial assets.

It’s not prices increasing, it’s also the devaluation of the currency.

With the government adding $275 billion debt in a single day last week, Arthur Hayes does make a strong point…

IT’S ALL COMING TOGETHER 😁

Today we’ve got something super interesting to share with you…

Popular twitter technical analyst Mags just put out a chart comparing previous halving cycles. The main point of comparison was Bitcoins price 200 days before the halving vs it’s all time high.

Take a look at the chart below, are you seeing what we’re seeing…

The resemblance is scary.

Here’s the breakdown:

2016 cycle: Bitcoin was -65% below its all-time high

2019 cycle: Bitcoin was -60% below its all-time high

2023 cycle: Bitcoin is currently -60% below its all-time high

The last 3 cycles have been in the exact same spot 200 days before the halving. 👀

Mags finishes their post by mentioning that even though Bitcoin’s price isn’t moving much these days. It’s following a similar pattern to previous cycles.

Also, take a look at Bitcoin’s price one year after the halving. The last two have been parabolic…

Now you know we normally stick to on-chain data. But when we saw this we knew we had to share it with you guys.

Charts like this are fun but keep in mind, past performance is no guarantee of future results.

“History doesn’t repeat itself but it often rhymes,”

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

Sponsored

Everyday AI

Helping everyday people learn and leverage AI

CAN YOU CRACK THIS NUT? ✍️

What is the name of the famous Bitcoin exchange from Japan that collapsed in 2014?

A) Binance

B) FTX

C) Mt. Gox

D) Bitstamp

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Mt. Gox 🥳

In 2014, Mt. Gox was hacked and thousands of Bitcoins were stolen; the company filed for bankruptcy shortly thereafter.

GET IN FRONT OF 13,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.

Past performance is not indicative of future returns, Investing involves risk. See disclosures