GM to all of you nutcases. It’s Crypto Nutshell #632 sneakin’ by… 🥷🥜

We're the crypto newsletter that's more explosive than a cyber-heist on the world’s most advanced AI system... 💾💣

What we’ve cooked up for you today…

🏦 Another one?

🏆 Wall Street Legend: Bitcoin Wins

📈 So close

💰 And more…

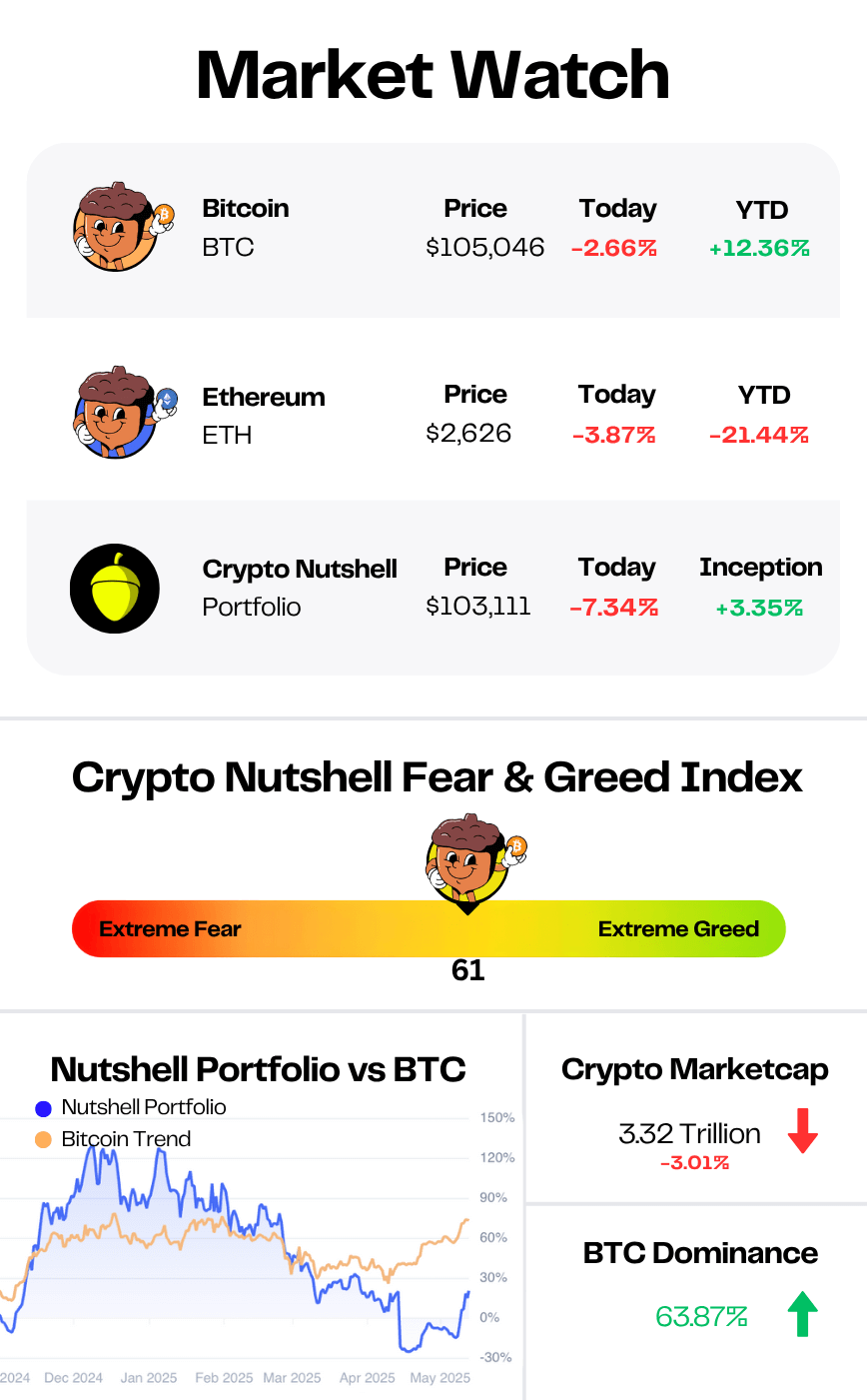

Prices as at 4:00am ET

ANOTHER ONE? 🏦

BREAKING: Champions League finalist PSG confirms Bitcoin treasury, looks for Web3 builders

The theme this week seems to be corporate Bitcoin adoption.

And no one expected this one…

Paris Saint-Germain (PSG) has confirmed it holds Bitcoin on its balance sheet.

This makes PSG the first professional sports club in the world to adopt a formal Bitcoin treasury strategy.

The announcement was made live at Bitcoin 2025 in Las Vegas - just days before PSG steps onto the field for the Champions League Final. (Pinnacle of European club football)

Who’s PSG Again?

PSG is one of Europe’s most dominant football clubs, current Ligue 1 champions, and home to a global fanbase of over 500 million people.

But more than just football, PSG calls itself a “lifestyle brand” - and it’s been experimenting in crypto since 2018.

Now, it’s going full Bitcoin.

What’s the Strategy?

According to PSG Labs head Pär Helgosson, the club converted part of its fiat reserves into BTC last year and still holds the position today:

“We put Bitcoin in our books. We took our fiat reserves and we actually allocated Bitcoin… We still have it in our books. And as one of the largest clubs in the world, we’re the largest player in the sports ecosystem to do that."

But this isn’t just a treasury play.

PSG also announced plans to back Bitcoin entrepreneurs and startups - offering funding, product pilots across its massive digital reach, and go-to-market support through PSG Labs.

Their Web3 push includes support for:

Tokenization

DAOs

NFTs

Stablecoins

On-chain gaming

Custody solutions

PSG was already the first team to launch a fan token (via Socios), run a validator on Chiliz, and strike a multi-year deal with Crypto.com.

But this move signals a deeper shift - from crypto marketing to Bitcoin conviction.

Why Now?

PSG’s fanbase is 80% under 34 - digitally native, crypto-aware, and globally distributed.

Corporate Bitcoin adoption is surging: GameStop, Trump Media, MetaPlanet, and now PSG.

Bitcoin just hit an all-time high of $111,800 last week, and even with a brief 5% pullback, the demand narrative remains strong.

The Bottom Line:

This isn’t another crypto sponsorship deal.

PSG has skin in the game - and they’re not just holding BTC, they’re building with it.

Top investors are buying this “unlisted” stock

When the team that co-founded Zillow and grew it into a $16B real estate leader starts a new company, investors notice. That’s why top firms like SoftBank invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties – revamping a $1.3T market.

By handing keys to 2,000+ happy homeowners, Pacaso has already made $110m+ in gross profits.

Now, after 41% gross profit growth last year, they recently reserved the Nasdaq ticker PCSO. But the real opportunity is now, at the unlisted stage.

Until May 29, you can join Pacaso as an investor for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

WALL STREET LEGEND: BITCOIN WINS 🏆

Ric Edelman just went on CNBC and made one of the clearest, most bullish cases for Bitcoin yet.

This isn’t a crypto bro, but from one of the most respected voices on Wall Street.

Who is Ric Edelman?

📊 Founder of Edelman Financial Engines - manages over $270 billion in assets

📚 #1 NYT bestselling author on personal finance

🏛️ Named #1 Independent Financial Advisor in America 3x by Barron’s

His Core Message?

“Bitcoin is the best-performing asset class in history.”

And more importantly?

“It’s uncorrelated to stocks, bonds, gold, real estate, oil - everything.”

That’s what makes it such a powerful addition to a portfolio.

Why It Matters

Edelman says Bitcoin is:

A diversifier that lowers risk

A performance booster that improves long-term returns

The first new asset class in 170 years - since oil in the 1850s

“If you believe in modern portfolio theory - you have to own Bitcoin.”

This is the kind of language that financial advisors understand - and many are just now starting to pay attention.

Final Take

Ric Edelman isn’t here for memes or moonshots.

He’s here to tell traditional investors:

You don’t need to believe in Bitcoin.

You just need to understand basic portfolio theory. 💼

SO CLOSE 📈

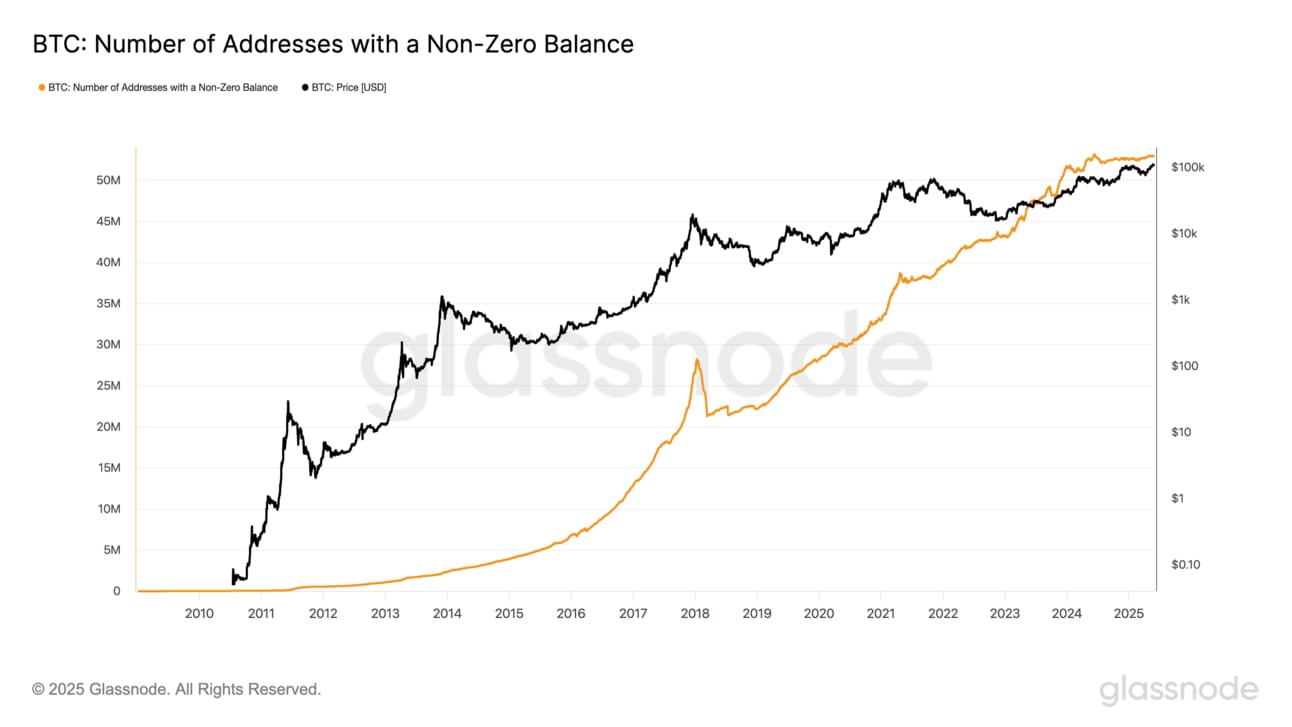

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

As of today, 53,019,115 wallets now hold some Bitcoin.

That’s +77,614 in the past two weeks alone.

Since January? A massive +495,578 new wallets have joined the network. 😳

And we’re now just 160,939 wallets away from setting a new all-time high.

The signal is loud and clear:

The network is expanding

Adoption is accelerating

And momentum is compounding

CRACKING CRYPTO 🥜

XRP's profitability surges over 90%, outpacing Ethereum, Chainlink, and others. More than 90% of XRP's supply is in profit, surpassing leading altcoins and nearing Bitcoin's market performance.

US lawmakers introduce bipartisan regulatory framework for digital assets. US lawmakers introduced the CLARITY Act on May 28, aiming to bring regulatory clarity to digital asset markets and to address gaps in crypto oversight.

SEC Files to Dismiss Regulator's Long-Running Lawsuit Against Binance, CZ, Binance.US. The SEC sued Binance in June 2023, but moved to pause the case after Donald Trump retook the Oval Office.

SEC Commissioner Peirce warns that a change in pace doesn't mean free rein for bad actors in crypto. The SEC will still bring enforcement cases against bad actors in crypto, said SEC Commissioner Hester Peirce.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Who was the founder and CEO of FTX, the crypto exchange that collapsed in November 2022?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Sam Bankman-Fried 🥳

Sam Bankman-Fried (SBF) went from crypto golden boy to convicted felon after it was revealed that FTX misused billions in customer funds, triggering one of the worst scandals in crypto history.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.