GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter that's more captivating than waking up in the golden era of advertising, with a whiskey in one hand and a creative pitch in the other. 🍸🚬

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Crypto bears are about to get absolutely pummelled 🤑

Bitcoin is doing better than previous cycles?💰

And more…

MARKET WATCH ⚖️

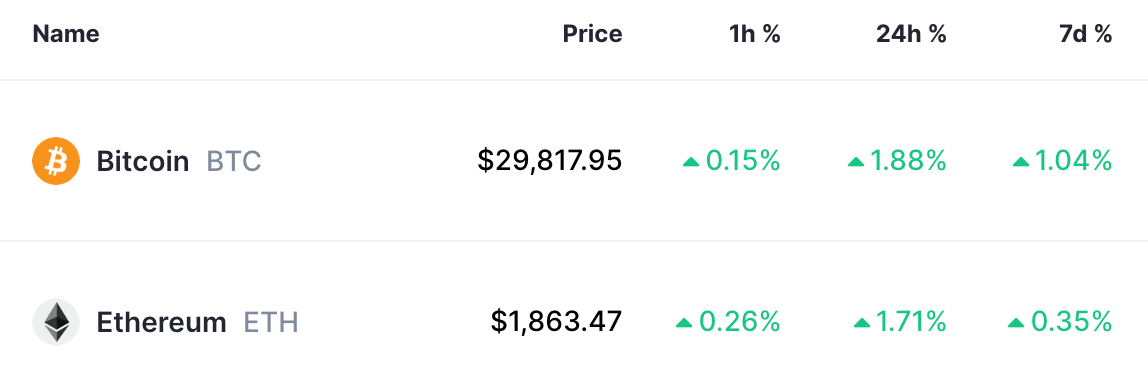

BTC Dominance is currently at 50.65% and the current crypto market cap is $1.18T ▲1.73%

Biggest Winners of The Day 🤑

Shiba Inu (SHIB) ▲9.91%

Solana (BTC) ▲6.72%

Toncoin (TON) ▲4.96%

Biggest Losers of The Day 😭

A beautiful day in the crypto world, no losers in the top 20 😄

Only the top 20 coins measured by market cap feature in this section

JUST IN: BlackRock insiders say Bitcoin ETF is likely 6 months away ⏰

During an earnings call Galaxy Digital CEO Mike Novogratz had this to say in regards to the Bitcoin ETF approvals:

“This is probably [...] four to six months if you had to put a ‘pin the tail on the donkey’ on it, that the SEC is going to approve a Bitcoin ETF.”

Novogratz’s Galaxy Digital is one of the many contenders for a spot Bitcoin ETF.

When they do eventually get approved, it’s going to be all out war for who can gain the most market share as quickly as possible.

“The news of both BlackRock filing ETF and quite frankly, Invesco Plus Galaxy, we're going to fight like cats and dogs to win market share there once it gets approved.”

All price data as of 7:00am ET

EXPERT OF THE DAY 💰

This expert is making a prediction that crypto bears are about to get absolutely pummelled. 🐻🥊

Today’s expert of the day is Pentoshi - an anonymous technical analyst that regularly posts his charts, trades & theses on twitter. (Btw - he uses a penguin as his identity) 🐧

As you’ll know by now - we aren’t huge fans of technical analysis here at the Crypto Nutshell.🤨

However we have to give Pentoshi his flowers - he has been blisteringly accurate over the last 2 years. There’s a reason he has amassed an audience of 700,000 crypto investors.

We witnessed first hand Pentoshi calling the top for both Bitcoin & Ethereum in 2021 and on top of this, he’s been spot-on in his calls all the way down.

To illustrate this point:

Just yesterday Pentoshi tweeted out:

Lo and behold - today we get a pop up in Bitcoin to $30,000.

Impressive stuff.

He also made another prediction: Crypto bears are going to get absolutely wrecked over the next 9 months leading into the Bitcoin halving.

While all the trading is cool, I think bears are going to get absolutely pummelled before the halving anyways and any profits will prob be given back trying to time it all perfectly and over-trade etc

In short, I think patience will pay and less is more

Wise words. 🧙

Revealed in his charts were 2 other key areas investors should be looking at keenly.

$31,000 & $32,400

We get a clean break above these key areas of resistance & we’re ready to announce the crypto bull market is back in full swing. 🐂

Nutty’s Takeaway: We agree with Pentoshi here - Crypt bears are fu#%ed. 😳

We like to weight our investing thesis 80% towards fundamental analysis and around 20% towards technical analysis - this time it looks like the stars are aligning on both.

Barring a black swan event - the foreseeable future for Bitcoin is looking better & better by the day. 🍻

ON CHAIN DATA DIVE 📊

Bitcoin has been seriously quiet for what feels like forever. 🥱

Volatility is approaching all time lows and the price has been hovering between $29,000 - $31,000.

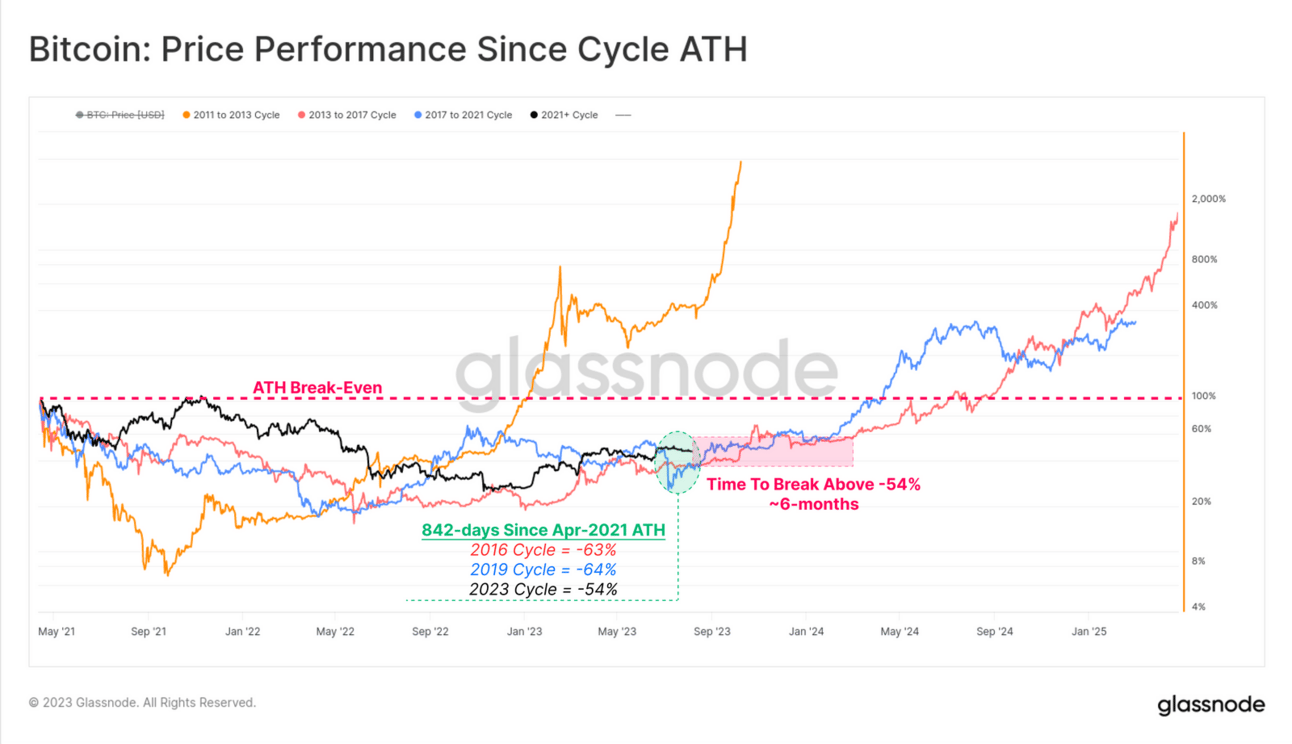

Today we’ll be taking a look at how this quiet period compares historically to previous cycles. To do this we’ll be using the Price Performance Since Cycle ATH chart, and the findings are super interesting… 👀

Before going any further it’s important to keep in mind that past performance isn’t a clear indicator of what the future will being but it’s always nice establishing where we are in the cycle.

We know this chart looks a little intimidating but its actually quite simple. All it’s doing is just tracking the cycle performance relative to the previous all time high (ATH). The horizontal red line is the breakeven point, crossing this line means that the cycle has reached a new all time high.

Orange line: 2011 to 2013 Cycle

Red line: 2013 to 2017 Cycle

Blue line: 2017 to 2021 Cycle

Black line: 2021+ Cycle

So it’s been 842 days since the bull market peak back in April 2021 and guess what…

The 2023 recovery has been performing better than the last two cycles 😲

Bitcoin is currently trading -54% below the ATH, compared with -64% of previous cycles.

Notice how the red and blue lines have a long period of relatively flat price movements? Yeah well this lasted 6 months before any significant price movement happened… Interestingly the black line (current cycle) seems to be following this trend.

Nutty’s Takeaway: If history is any guide you better prepare yourself for a long 6 months of boring sideways trading and not much happening…

But we do still have the halving to look forward to…

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

Smart contracts are executed by the _______.

A) EMF

B) EVD

C) EAT

D) EVM

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) EVM 🎉

The Ethereum Virtual Machine (EVM) executes smart contracts on the Ethereum blockchain.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.