Today’s edition is brought to you by Gemini

Get $25 in bitcoin when you trade $100.

GM to all of you nutcases. It’s Crypto Nutshell #654 paddlin’ in… 🛶🥜

We're the crypto newsletter that's more emotional than two souls finding each other through time, dreams, and a comet... 🌠💞

What we’ve cooked up for you today…

🏦 Solana ETF is here

🩸 The boom… before the bloodbath?

📈 Nothing stops this train

💰 And more…

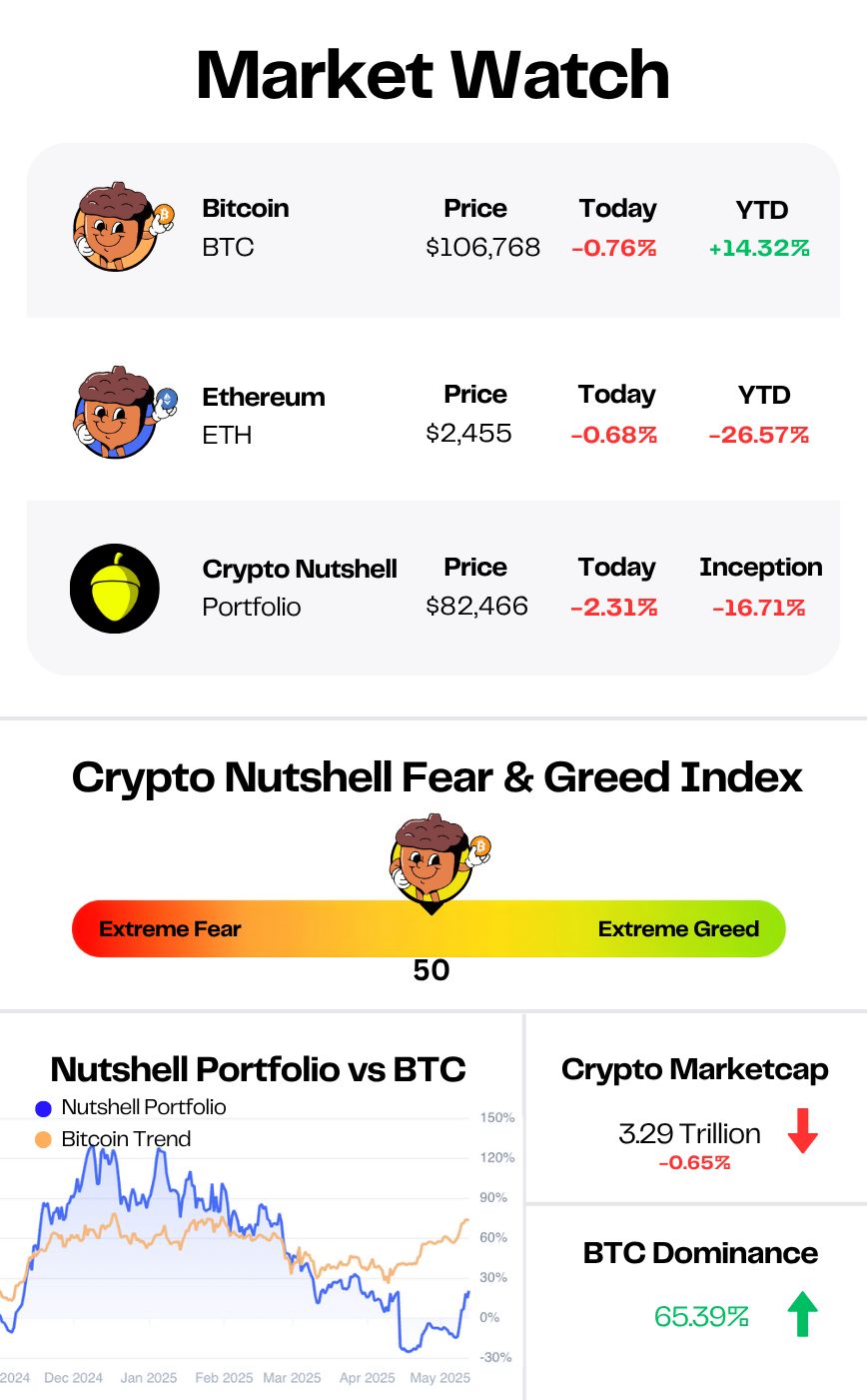

Prices as at 4:55am ET

SOLANA ETF IS HERE 🏦

BREAKING: Rex-Osprey Solana ETF to Debut 'First-Ever' US Crypto Fund With Staking

It’s official.

Rex Shares and Osprey Funds are launching the first-ever U.S. crypto ETF with staking rewards - and they’re doing it with Solana.

Set to begin trading this Wednesday, the “SOL + Staking ETF” offers direct exposure to Solana’s spot price and delivers staking yields to investors.

That makes it the first U.S. ETF to provide on-chain yield from a crypto asset - a milestone that could open the floodgates for a new wave of staked ETFs.

Here’s why it matters:

Unlike traditional spot ETFs, this product is structured as a C-corporation, taxed internally, and approved under the Investment Company Act, sidestepping the usual commodity trust model.

At least 50% of the fund’s Solana will be staked, offering dividend-style returns to shareholders.

The launch arrives ahead of at least nine other spot Solana ETF applications, many of which are still awaiting SEC approval.

Solana surged 5% on the news Monday, briefly hitting $157.

With the SEC signalling a more favourable stance under the Trump administration, ETF analysts now see a 95% chance that broader Solana ETF approvals will follow in the coming months.

This move also puts pressure on competitors.

Grayscale is pushing to convert its Digital Large Cap Fund into an ETF - with a key SEC decision due this week - while Bitwise preps Dogecoin and Aptos ETFs in the background.

Bottom line?

This isn’t just a win for Solana - it’s a watershed moment for the entire staking sector.

Wall Street wants yield.

Crypto just found a way to deliver it. 🔥

THE EASIEST WAY TO BUY CRYPTO 🤑

With all the ways to buy crypto today, making your first purchase isn’t the hard part.

Knowing where to keep it? That’s where things get tricky.

That’s why more and more traders are turning to Gemini - one of the most trusted names in the game.

Here’s what makes Gemini stand out 👇

A clean, beginner-friendly interface that makes buying your first crypto feel effortless

An advanced “ActiveTrader” platform for pros with real-time data, charting tools, and low fees

Over 80 assets to choose from - including Bitcoin, Ethereum, stablecoins, and various altcoins

Simple staking that lets you earn up to 4.98% APY just by holding your crypto

You’ll also get tools like price alerts, recurring buys, and a mobile app that mirrors the full desktop experience - perfect for tracking your portfolio on the go.

Whether you're starting with $100 or scaling up a strategy, Gemini has your back.

As a bonus for Crypto Nutshell readers, Gemini is offering $25 in Bitcoin when you trade $100!

👉 Check it out at gemini.com (Promo code: CryptoNutshell)

THE BOOM… BEFORE THE BLOODBATH?🩸

Fred Krueger just dropped his latest crypto thesis.

And it’s… wild.

According to Fred, we’re about to see:

📜 The stablecoin bill pass

🏦 Fed rate cuts begin

📈 BTC up 2-3x

🔥 Solana and ETH go even harder

🥴 Bitcoin treasury firms buy like “drunken sailors”

But then?

Fred predicts everything reverses:

📉 Bitcoin crashes from $300K+ down to $100K

🚫 No one wants to buy

📉 Bitcoin funds collapse to 60% of NAV

And the craziest part?

Even Fred has no idea when it hits.

“What is t? Honestly no clue. But we need to at least double from here first.”

Why It Matters

Fred isn’t just another Twitter trader.

He’s a quant. A macro thinker. A guy who spots trends early.

And right now, he’s warning that we may see the craziest melt-up in crypto history…

Followed by a brutal unwind that catches everyone off guard.

If Fred’s correct - which he often is - get ready for liftoff.

But don’t forget to pack a parachute. 🎢

NOTHING STOPS THIS TRAIN 📈

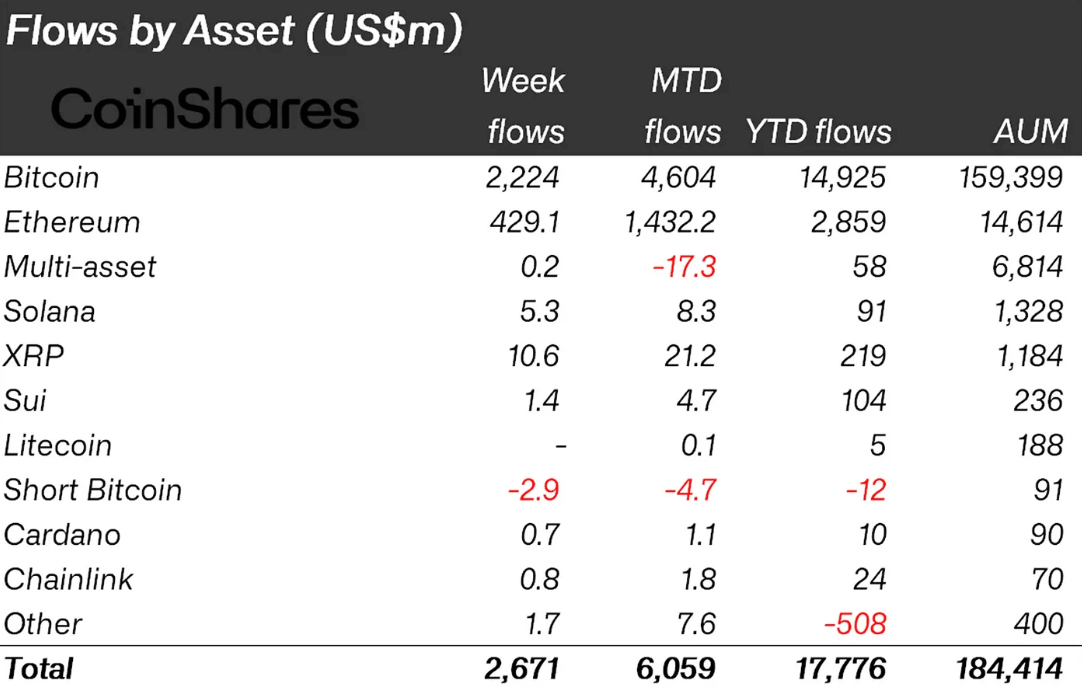

For the eleventh week in a row, digital asset funds saw net inflows of $2.67 billion.

That pushes year-to-date inflows to a new high of $17.78 billion.

Let’s break it down.

Bitcoin once again led the charge, pulling in $2.2 billion in inflows.

Ethereum followed with $429 million

While XRP and Solana posted modest gains of $10.6 million and $5.3 million respectively.

Regionally, the United States dominated with $2.65 billion in inflows.

Switzerland contributed $23 million, Germany added $19.8 million, and Australia brought in $8.7 million.

In contrast, Sweden, Canada, and Brazil each saw outflows of $15.9 million, $13.6 million, and $2.4 million respectively.

CoinShares notes that the pace of inflows is now tracking closely with 2024.

Also noteworthy: short-Bitcoin products have seen $12 million in outflows year-to-date, a clear sign that sentiment remains firmly bullish.

This resilient investor demand continues to be fuelled by rising geopolitical tensions and growing uncertainty around monetary policy.

In an environment where trust in traditional financial systems is being tested, crypto is once again proving to be a magnet for capital.

CRACKING CRYPTO 🥜

Robinhood unveils crypto-heavy roadmap that lifts stock to all-time high. Robinhood's ambitious crypto expansion, showcasing its Layer 2 blockchain and tokenized stocks, propels shares to new heights.

Kazakhstan plans to establish national crypto reserve. The National Bank of Kazakhstan is preparing to launch a government-managed crypto reserve, with funding expected to come from seized digital assets and public sector mining.

Circle applies for US banking license, enabling it to act as custodian for USDC reserves. Circle has applied for a national banking license, according to Reuters. which would enable it to act as a custodian for its own reserves.

Bitcoin Carries Crypto Markets in 2025's First Half as Altcoins Crumble. Crypto stayed flat in a volatile first half of the year thanks to bitcoin. Meanwhile, Ethereum's ETH, Solana's SOL and small caps endured steep losses.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which of the following statements about “Ethereum 2.0” is false?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: It reduced Ethereum’s gas fees 🥳

The Merge didn’t reduce gas fees. That’s a common misconception — it improved energy efficiency and set the stage for scaling, but fees remain tied to demand. 🧠💡

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.