GM to all of you nutcases. It’s Crypto Nutshell #760 soundin’ the alarms… 🚨🥜

We’re the crypto newsletter that’s more ruthless than a mastermind who plans heists with the precision of a surgeon… 🎭🔫

What we’ve cooked up for you today…

📈 Here come the altcoins

👀 Close to the bottom

😱 Outflows continue

💰 And more…

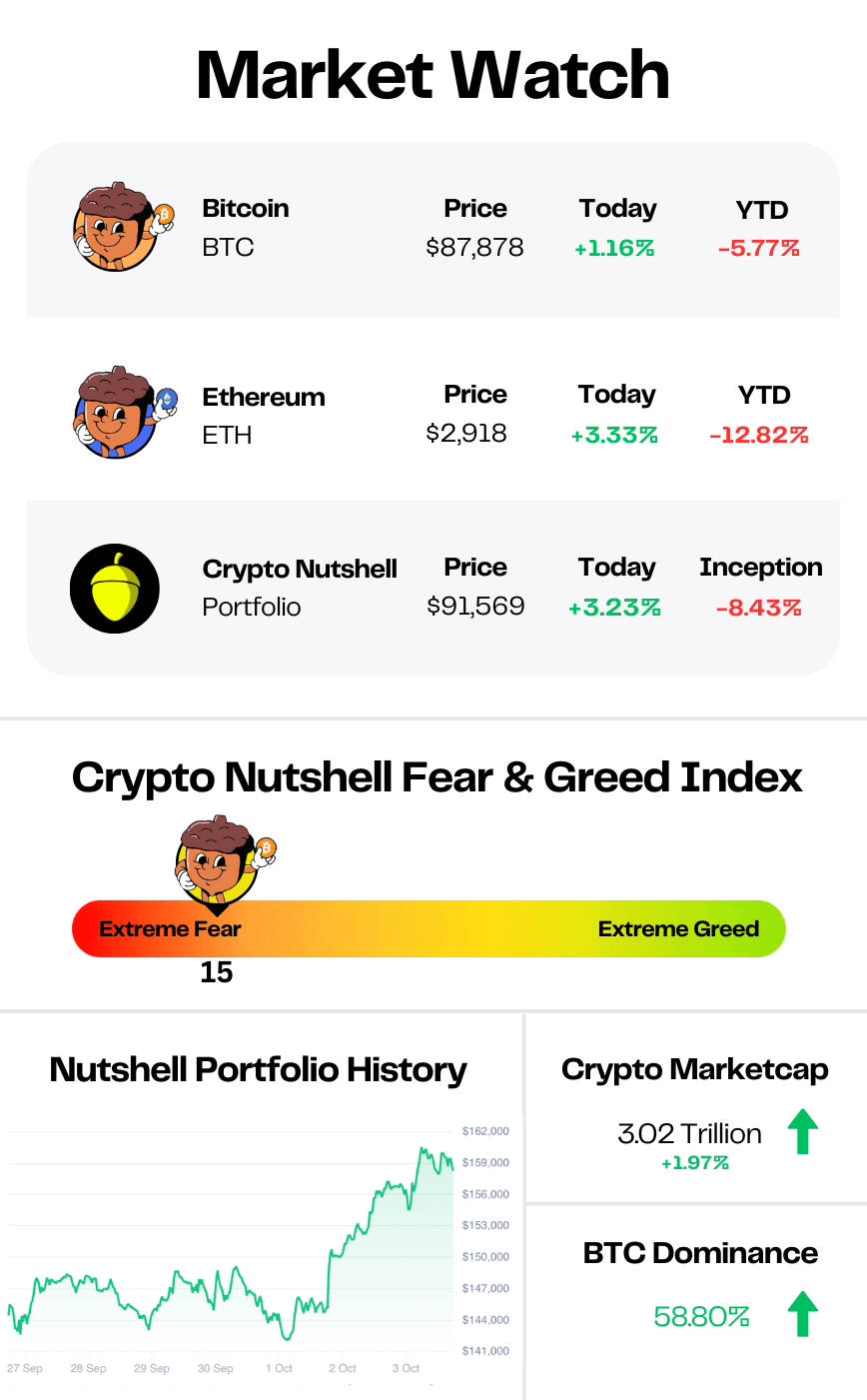

Prices as at 2:25am ET

HERE COME THE ALTCOINS 📈

BREAKING: Grayscale Dogecoin, XRP ETFs Add to Flurry of Altcoin Fund Debuts

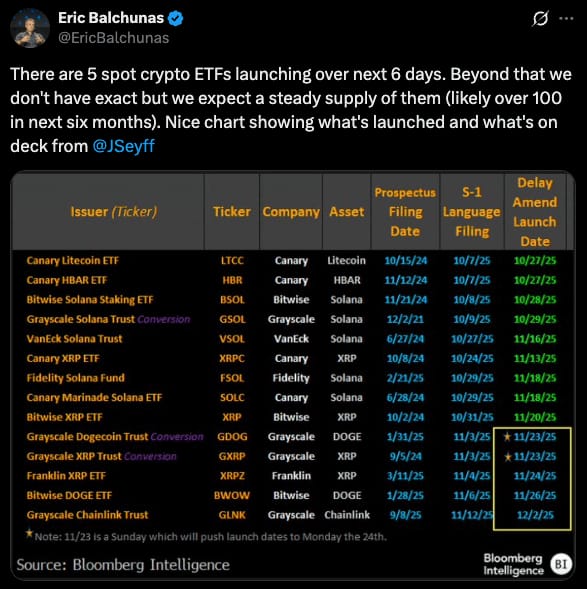

Even in the middle of a correction we’re still getting altcoin ETF approvals…

Grayscale just listed GXRP and GDOG (XRP & Dogecoin), converting its existing trusts into full ETFs and with a 0% fee for the first three months or until they hit 1 billion dollars in trading volume.

At the same time, Franklin Templeton’s XRPZ ETF started trading, adding another regulated on-ramp into the XRP ecosystem.

This is not a one off. It is turning into an altcoin ETF bonanza.

Bloomberg’s ETF analysts now expect 100 plus new crypto ETFs across different assets over the next six months as issuers rush to lock in ticker symbols.

XRP is the clearest example of how fast the tide has turned.

Five years ago, the SEC was suing Ripple for a $1.3 billion unregistered securities offering.

That case is now wrapped up, appeals dropped, and under the current administration the SEC is approving multiple XRP products and formally updating rules for digital assets.

Today you have:

Canary Capital’s XRPC kicking off the first US spot XRP ETF

Bitwise, 21Shares, CoinShares and REX Shares all launching XRP funds

Franklin and Grayscale now stacking on top with XRPZ and GXRP

And Dogecoin is getting the same treatment.

Grayscale’s GDOG is now the second DOGE ETF in the United States, following REX Osprey’s product.

What started as a meme is now a fully wrapped Wall Street vehicle, sitting inside brokerage accounts and model portfolios.

Grayscale is very explicit about the play: DOGE has moved from “internet culture” to “real world utility,” and they want to make it as easy to buy as any stock or sector ETF.

The irony is hard to miss…

Prices are still weak but recovering. XRP is still more than 40% below its July high. DOGE is down around 80% from the 2021 peak. Bitcoin is stuck in a deep mid-cycle correction.

Yet the infrastructure is exploding.

More issuers. More tickers. More ways for traditional capital to get exposure without ever touching an exchange or a wallet.

That is the bigger story here.

The market is pricing in fear and short term pain. The product pipeline is pricing in the next wave of demand. 🌊

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

CLOSE TO THE BOTTOM 👀

When crypto pukes, you find out who actually understands this market.

Bitwise CIO Matt Hougan - who manages $15B for institutions - went on CNBC this week and dropped the clearest take yet:

“You’re starting to see long-term investors nibble at these prices… the long-term trend is up… regulation is up… institutional buying is up.”

Short-term traders are staring at fear.

But Hougan says the real players are stepping in:

“Could we dip a bit lower? Sure. But we’re closer to the bottom than the beginning of this pullback.”

He points to the same buyers we highlighted yesterday:

Harvard’s endowment.

Abu Dhabi’s sovereign wealth fund.

And every fund manager thinking in years, not weeks.

Why?

“It comes down to your time frame… For long-term investors looking out to 2026 and beyond, this is a great entry.”

When the guy advising institutions is this calm…

And the smartest capital on Earth is buying red candles…

You don’t panic. You pay attention. 👀

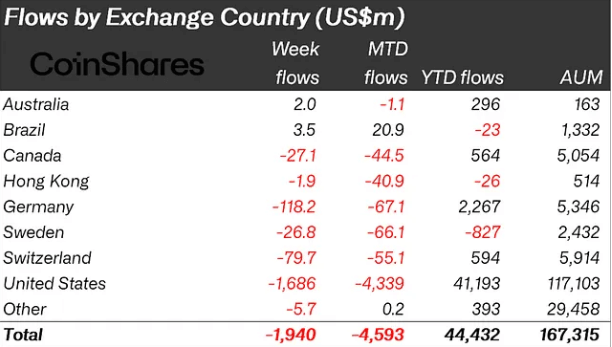

OUTFLOWS CONTINUE 😱

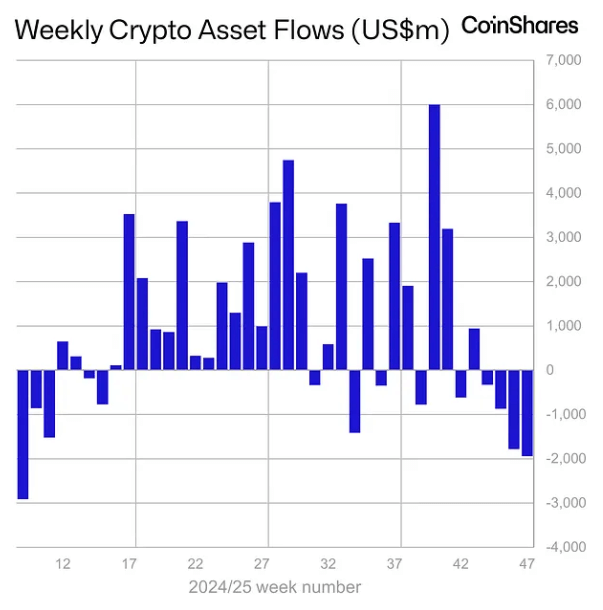

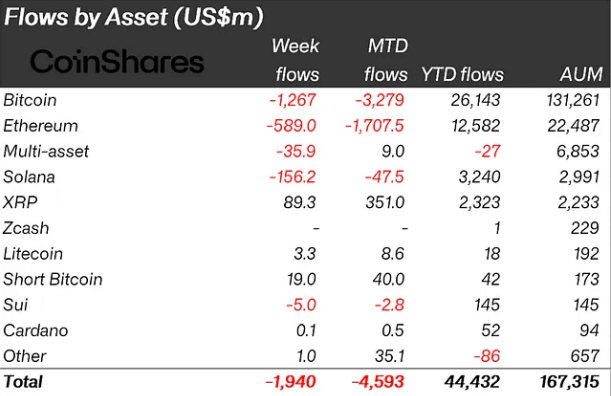

Digital asset funds logged a fourth straight week of outflows last week, with another $1.94 billion heading for the exits.

This stretch of outflows now matches the 3rd largest run of outflows since 2018.

Despite this, total inflows this year remain high at $44.43 billion.

Let’s break it down.

Bitcoin saw the majority of outflows totalling $1.27 billion last week.

Ethereum also saw substantial outflows totalling $589 million.

Whilst XRP saw inflows of $89.3 million

Regionally, the U.S. was the clear driver of risk-off flows, with $1.69 billion in outflows.

Germany, Switzerland, and Canada followed with outflows of $118.2 million, $79.7 million, and $27.1 million respectively.

Sentiment was ugly for most of the week.

But by Friday, the tone finally shifted.

Funds saw a modest rebound, with $258 million in net inflows breaking a seven-day losing streak.

Bitcoin led that rebound, pulling in $225 million on the day.

CRACKING CRYPTO 🥜

Solana’s supply crunch deepens as 80% of holders sit underwater, setting the stage for a high-stakes reset. Solana's radical proposal aims to counteract heavy sell-off and reduce the network inflation by 30% annually by 2029.

Bitcoin price $80K low was bottom, thinks Arthur Hayes. Bitcoin should hold $80,000 support in exchange for "chop" next, says Arthur Hayes' BTC price prediction.

Gaining on Monday as Markets Rebound From Last Week's Flush. The price of bitcoin jumped back above $87,000 and crypto miners with a focus on AI/high-performance computing are surging.

As 2026 midterms near, Stand With Crypto zeroes in on state and federal races with new candidate survey. The crypto advocacy group Stand With Crypto has begun surveying political candidates as the 2026 midterms draw closer.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What was the main reason behind the creation of Bitcoin Cash in 2017?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A dispute over block size limits 🥳

Bitcoin Cash forked off Bitcoin due to debates about how to scale transaction throughput. 💥

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.