GM to all of you nutcases. It’s Crypto Nutshell #587 buzzin’ in… 🐝 🥜

We're the crypto newsletter that's more thrilling than escaping a theme park where dinosaurs run wild... 🦖🏃♂️

What we’ve cooked up for you today…

🛡 Brace yourself

⏳ The pain is almost over...

📈 Focus on the long-term

💰 And more…

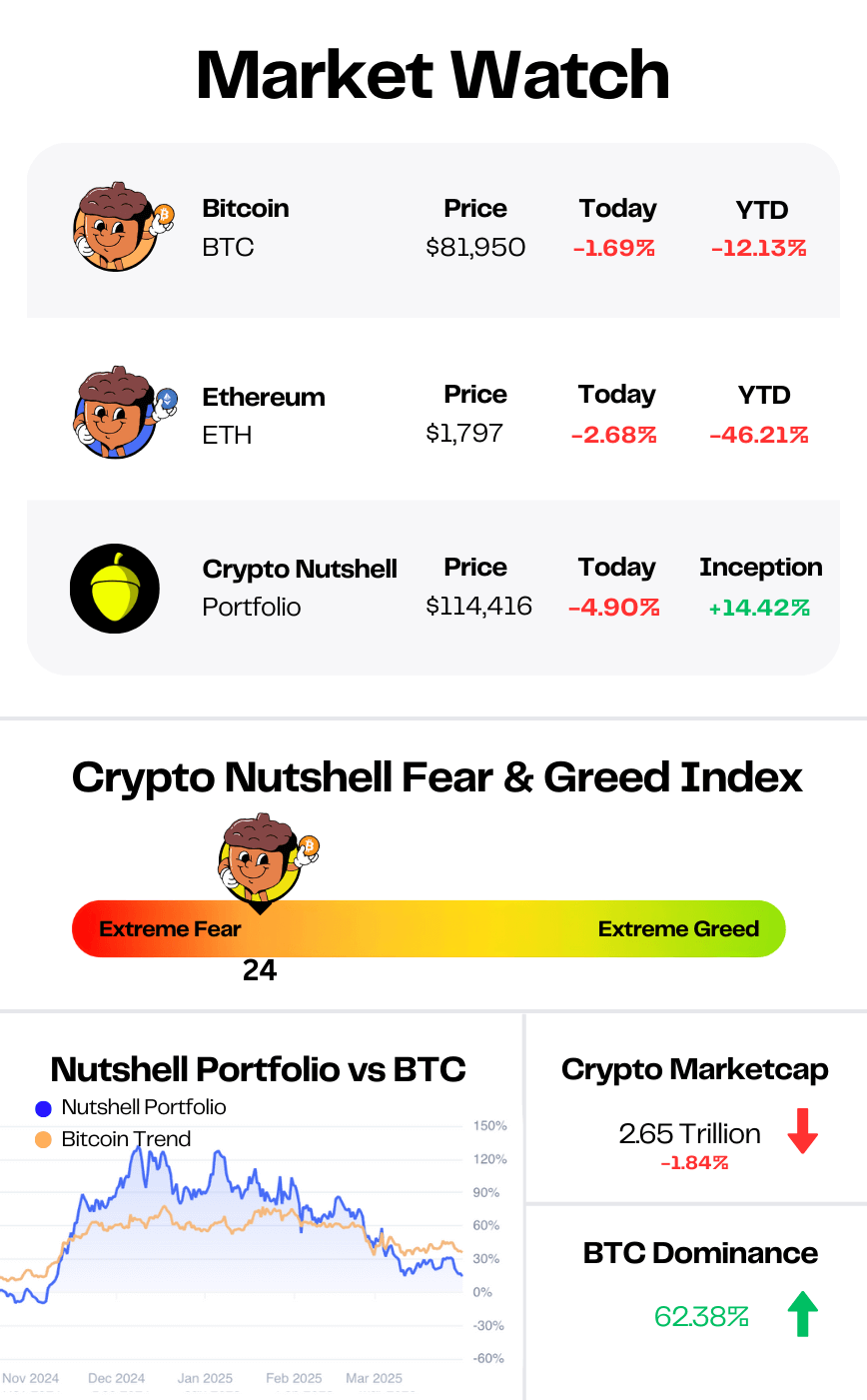

Prices as at 5:00am ET

BRACE YOURSELF 🛡

BREAKING: Bitcoin falls to $81.5K as US stock futures sell-off in advance of Trump’s ‘Liberation Day’ tariffs

Well that’s not a great start to the week…

Bitcoin tumbled to a low of $81,500, marking seven straight days of lower lows. (At the time of writing, it’s bounced slightly to ~$82,100)

So what’s driving the drop?

You guessed it: macro strikes again. 🥲

The sell-off comes as markets are bracing for Trump’s April 2nd “Liberation Day”:

A new wave of sweeping 20%+ tariffs on over 25 countries. 😲

The goal of these tariffs?

Raise $600B annually via a new “External Revenue Service.”

But in the short term, analysts warn it could backfire - driving up inflation, tanking stocks, and crushing consumer confidence.

To make matters worse, Goldman Sachs just raised U.S. recession odds from 20% to 35%:

“The upgrade from our previous 20% estimate reflects our lower growth beeline, the sharp recent deterioration in household and business confidence and statements from White House officials indicating greater willingness to tolerate near-term economic weakness in pursuit of their policies.”

The key phrase here from Goldman Sachs is “near-term economic weakness”.

As we’ve been explaining for the past few weeks, Trump’s policies are designed to inflict short-term pain, pressuring the Fed into cutting rates.

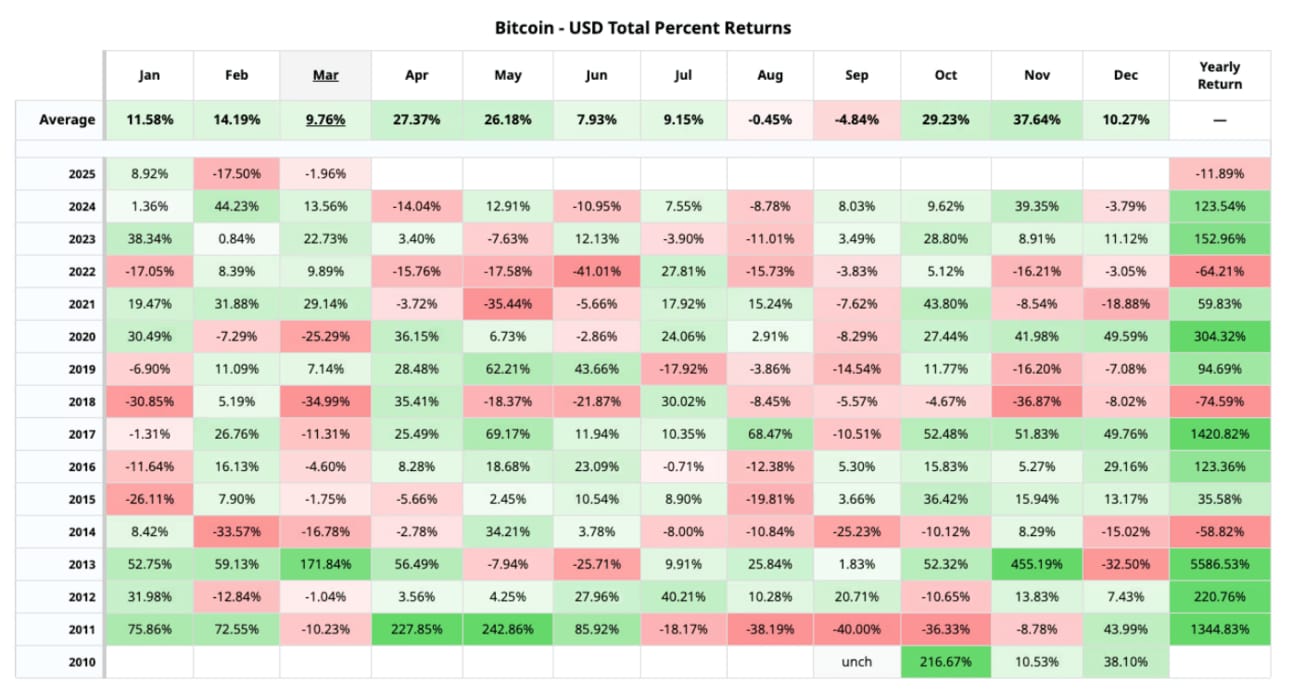

What About April? Is There Hope?

Yes there is…

If history’s anything to go by.

Since 2010, April has delivered an average 27% return for Bitcoin, making it the third-best month on record.

Pair that with recent trends in Global Liquidity (M2), and there's a real case to be made:

The bottom may already be in - likely during the first week of April.

But more on that in the next section…👇

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

THE PAIN IS ALMOST OVER... ⏳

It’s been a rough year so far in crypto.

Bitcoin has stalled. Alts have bled.

The mood? Everyone's either bored or panicked.

But Raoul Pal says this was all expected.

Raoul just shared this updated chart: Global M2 vs Bitcoin, using his classic 10-week lead.

“The waiting game is almost over…”

As you can see, Bitcoin continues to follow Global M2 with near-perfect lag.

That “bottoming zone” we’ve been stuck in? It’s playing out right now - and Global M2 is already moving higher.

Which means Bitcoin could be next.

If Bitcoin keeps tracking Global M2, we could see the next leg up kick off in the first week of April.

Aka - right now.

All indicators suggest we are setting up for a strong April.

Buuut - the next few days could be dicey.

With:

Global trade wars heating up 🌍

Rate cut timing still uncertain 🏦

We’re expecting volatility in both directions.

But the bigger picture is this: The waiting game is done.

Are you ready?

FOCUS ON THE LONG-TERM 📈

Time for a check-in on the Long/Short-Term Holder Threshold.

Here’s how this metric works:

🔴 Short-Term Holders (STHs): Coins held for less than 155 days

🔵 Long-Term Holders (LTHs): Coins held for more than 155 days

🟥 Short-Term Holder Cost Basis: All coins purchased in this price range are STHs

🟦 Long-Term Holder Cost Basis: All coins purchased in this price range are LTHs

This metric is powerful because it shows exactly what price range long and short term holders bought their Bitcoin at. 🔍

The current threshold date is October 27th, 2024, when Bitcoin was trading around $67,940

All coins purchased before this date are classified as LTHs.

All coins purchased after this date are classified as STHs.

Today, there are currently 13,472,258 Bitcoin in the hands of LTHs. (67.89% of the circulating supply) 💪

Whereas the amount of coins held by STHs is only 3,729,031. (18.79% of the circulating supply)

Over the last 30 days, ~302,548 BTC has transitioned from short-term to long-term holders - a massive sign of growing conviction.

Historically, a rising LTH supply tends to precede major bull runs.

In simple terms: more and more investors are preparing for long-term gains, not short-term flips.

And with fundamentals stronger than ever, that conviction looks well-placed. 👀

We’ll check back in on this metric in 2 weeks’ time to see how this trend evolves.

CRACKING CRYPTO 🥜

Fidelity says Bitcoin could potentially overtake gold, echoing Saylor’s absorption theory. Fidelity's cautious view contrasts with Saylor's optimism as both eye Bitcoin's trajectory amid growing institutional support.

Stablecoin rules needed in US before crypto tax reform, experts say. Crypto industry professionals say US regulation must clarify banking and stablecoins before focusing on taxes, as Trump-backed reforms push crypto into the spotlight.

FTX to Begin $11.4B Creditor Payouts in May After Years-Long Bankruptcy Battle. Payments to FTX’s largest creditors will start May 30, nearly three years after the exchange collapsed.

PumpSwap DEX nears $2.5 billion in cumulative volume 10 days after launch. The DEX’s successful launch puts it second behind Raydium in terms of market share.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: XRP 🥳

XRP first launched in June 2021.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.