GM to all of you nutcases. It’s Crypto Nutshell #783 sleddin’ in … 🛷🥜

We’re the crypto newsletter that’s more calculated than a quiet outsider dismantling an entire system piece by piece… ♟️🧠

What we’ve cooked up for you today…

🏦 Will quantum crack Bitcoin?

🐳 The whales are bullish

📈 Only up

💰 And more…

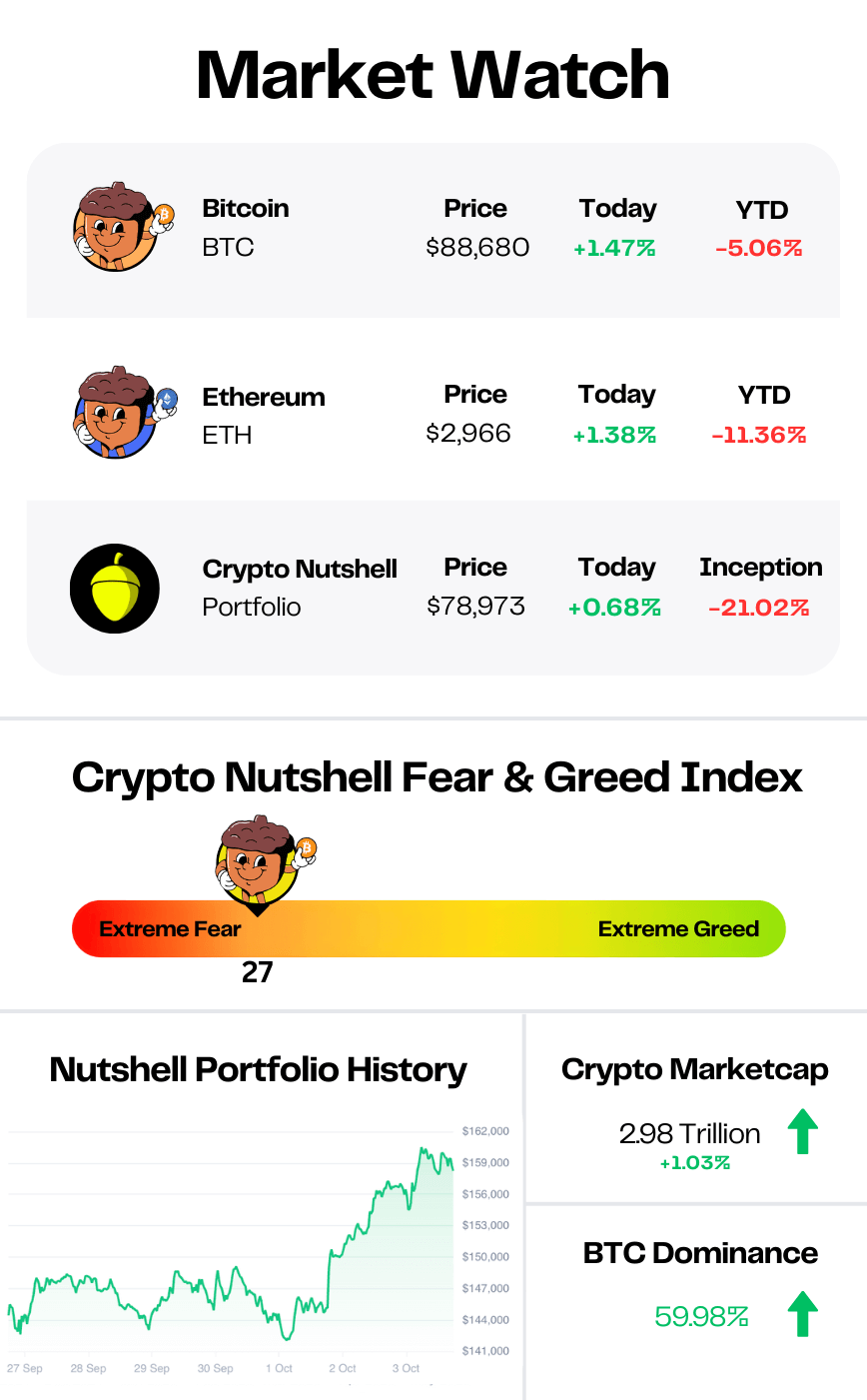

Prices as at 4:35am ET

WILL QUANTUM CRACK BTC? 🏦

BREAKING: Quantum computing in 2026 - No crypto doomsday, but time to prepare

Quantum computing likely won't crack Bitcoin in 2026.

But that doesn't mean the threat isn't real…

The issue isn't what quantum computers can do next year. It's what attackers are doing right now.

"The whole 'quantum threat to Bitcoin' narrative is 90% marketing and 10% imminent threat… We're almost certainly at least a decade away from computers that can actually break existing cryptography."

Current quantum devices have only hundreds or thousands of noisy qubits.

Running a realistic attack would require millions of qubits, ultra-low error rates, and millions of sequential operations without losing coherence.

That needs breakthroughs in materials science, quantum control, and signal isolation.

"The bottleneck is not just engineering - it is the fundamental physics of the universe.”

The real threat: "harvest now, decrypt later"

Attackers aren't waiting for quantum computers to be ready.

They're collecting encrypted data now. When the technology arrives, all that archived data becomes readable.

"Bad actors are already collecting as much encrypted data as possible… so that, when the tech is ready, all that archived data becomes readable."

Someone could be downloading terabytes of onchain data right now. Collecting public keys. Waiting to decode private keys later.

The exposure is significant.

Kireieva estimates 25-30% of all BTC - around 4 million coins - sit in vulnerable addresses.

Public keys already exposed onchain. Ready for private-key recovery once quantum computers arrive.

Bitcoin's elliptic curve digital signature algorithm (ECDSA) is the weakest link. SHA-256 hash functions are much more resistant.

What's being done?

In July, cryptography experts outlined a plan to replace Bitcoin's signature systems with quantum-resistant alternatives.

In November, Qastle announced quantum-grade security for hot wallets using quantum-generated randomness and post-quantum encryption.

Kireieva advised users to avoid address reuse. Keep public keys hidden until funds are spent. Prepare to migrate to quantum-resistant wallets when available.

Bottom line

No quantum doomsday in 2026. But the conversation has shifted from "if" to "when."

"The likelihood that a major quantum attack occurs by 2026 is low-to-moderate… However, the likelihood that quantum becomes a top-tier risk factor for crypto security awareness in 2026 is high."

The threat isn't imminent. But it's no longer purely theoretical. 🚀

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

THE WHALES ARE BULLISH 🐳

Most of the market still believes the same thing:

2025 was the run.

2026 is the hangover.

4-year cycle. 2026 is a down year. Time to move on.

But Raoul Pal says that’s not what the people inside the system are seeing.

In his latest podcast this week, he made this point very clearly:

“Speak to the team at Coinbase. Speak to any of these people. I don’t see any of these people saying it’s all over. They’re all saying it’s all coming.”

Why?

Because whales like these institutions don’t trade headlines.

They see pipelines.

Raoul explains that companies like Coinbase and Bitwise have visibility most investors don’t:

“If you’re at Coinbase, you know the pipelines of institutions who are going to use your rails to tokenize… If you’re Bitwise, you know what the RIAs are thinking, the endowments are thinking, the pension plans are thinking.”

That matters.

Institutions move slowly. They plan years ahead.

And they don’t build infrastructure for markets they think are about to die.

Raoul’s point is simple:

The 4-year-cycle crowd is looking backward. Institutions are looking at what’s being built next.

And the final unlock?

“We haven’t had the Clarity Act yet. Once that comes, it kind of is like, okay, it’s now free reign.”

So while most people are bracing for a “down year” in 2026…

The biggest players in the space are quietly preparing for expansion.

Raoul summed up his takeaway like this:

“How do I make it in crypto in 2026? Hold the right assets and do nothing.”

Not flashy.

Not exciting.

But that’s usually how the real money gets made. 🐳

ONLY UP 📈

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

There are now 55.57 million wallets holding Bitcoin.

That's roughly 90,000 more wallets than two weeks ago.

Zoom out and the trend gets sharper.

In 2025 alone, this number is up by 2.45 million.

Price has been choppy. Sentiment has been rough. ETF flows have been messy.

And yet... adoption just keeps climbing.

The network keeps getting stronger. 💪

CRACKING CRYPTO 🥜

Crypto sentiment is trapped in extreme fear because the industry’s biggest structural wins are failing to move prices. Bitcoin hit every 2025 milestone, but sentiment is poisonous. Discover why structural wins are failing to stop the worst Q4 crash since 2018.

Tokenization Expands the Definition of Money: Kraken Exec. Crypto tokenization is disrupting the idea that only fiat currencies can be used as money for trading, spending, and saving, says Kraken’s Mark Greenberg.

Bitcoin drives record spike in SEC filings in 2025 as regulatory clarity pulls institutions onchain. The filing surge coincided with meaningful legislative progress that provided clearer operational frameworks for market participants.

Bitcoin price analysis: BTC might have to spend time below $80,000 to build support. Five years of CME futures data shows where bitcoin has, and has not, built meaningful price support.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Are you ready for this week’s quiz?

5 questions. All from this week’s issues. If you’ve been paying attention, you’ll crush it. If you’ve been skimming, it’ll show.

Tap the button below to start this week’s quiz, then tell us how you scored in the poll at the bottom of this newsletter. 👇️

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.