GM and welcome to The Crypto Nutshell! 🥜 Your one-stop-shop for cracking open the day's most important crypto news, expert analysis, and on-chain data. We shell out this information to your inbox EVERY single day. Today, we’ll discuss:

JPMorgan on what the Bitcoin ETF’s could mean 🏦

Cathie Wood standing strong with Bitcoin 💪

What impact did Bitcoin Ordinals have on the market? 📈

And more…

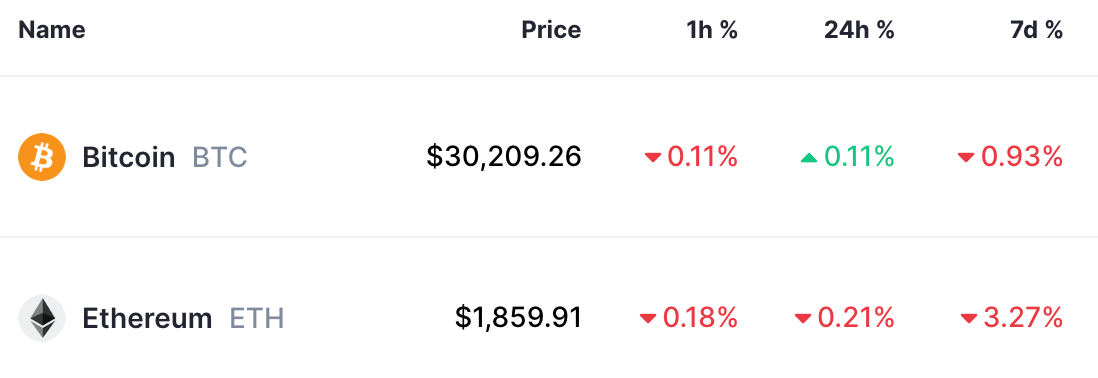

MARKET WATCH ⚖️

Prices at at 7:30am ET

A recent report from JPMorgan suggests that the approval of a spot Bitcoin ETF in the United States may not drastically alter the crypto markets as expected.

Nikolaos Panigirtzoglou, JPMorgan’s managing director, argues that similar approvals in Canada and Europe haven't drawn significant investor interest, thereby having a limited market impact.

While Panigirtzoglou acknowledges a U.S. Bitcoin ETF could enhance Bitcoin's liquidity, he suggests it may also redirect trading activity from BTC futures products. This view contrasts starkly with the popular belief that a U.S. Bitcoin ETF could revolutionize the crypto market and attract substantial investment.

However, BlackRock's CEO, Larry Fink, has a more optimistic perspective, viewing Bitcoin as an international asset that could serve as an alternative for investors amidst inflation and currency devaluation.

BlackRock's successful track record with ETF approvals, with only one rejection out of 550 applications, has generated hope that its bid for a Bitcoin ETF might succeed.

EXPERT OF THE DAY - CATHIE WOOD 🌳

Cathie Wood thinks Bitcoin is inevitable - no matter which way you think the economy is headed - inflation or deflation, Bitcoin stands to gain adoption and rise in price.

Revealed in her ‘In The Know’ update released today, Cathie spoke on the positive developments surrounding Bitcoin and why no matter which why you slice the pie - Bitcoin is poised to gain.

Pointing at positive catalysts such as applications by financial juggernauts BlackRock & Fidelity for a spot Bitcoin ETF (Cathie & ARK Invest also have a horse in the race), Cathie reminded viewers that what really kick-started the rally this year for Bitcoin was the regional banking crisis.

The other thing we'd like to reiterate is we saw Bitcoin take off from nineteen thousand to thirty thousand when the Regional Bank crisis was in full force in March / April and that told us the Bitcoin is a flight to safety currency. It's a hedge against inflation - it's a hedge against deflation.

Cathie was quick to point out that Bitcoin has no counter-party risk and is only going to continue to gain traction as investors will always want a flight to safety asset or an ‘insurance policy’ as you will.

ON CHAIN DATA DIVE 📊

Let’s take a look at Bitcoin Ordinals and the impact that they had on the market.

For those who are unfamiliar with Bitcoin ordinals, this video from Coin Bureau is an excellent introduction.

A key Bitcoin development last quarter, overshadowed by ETF news, was the substantial surge in ordinals usage.

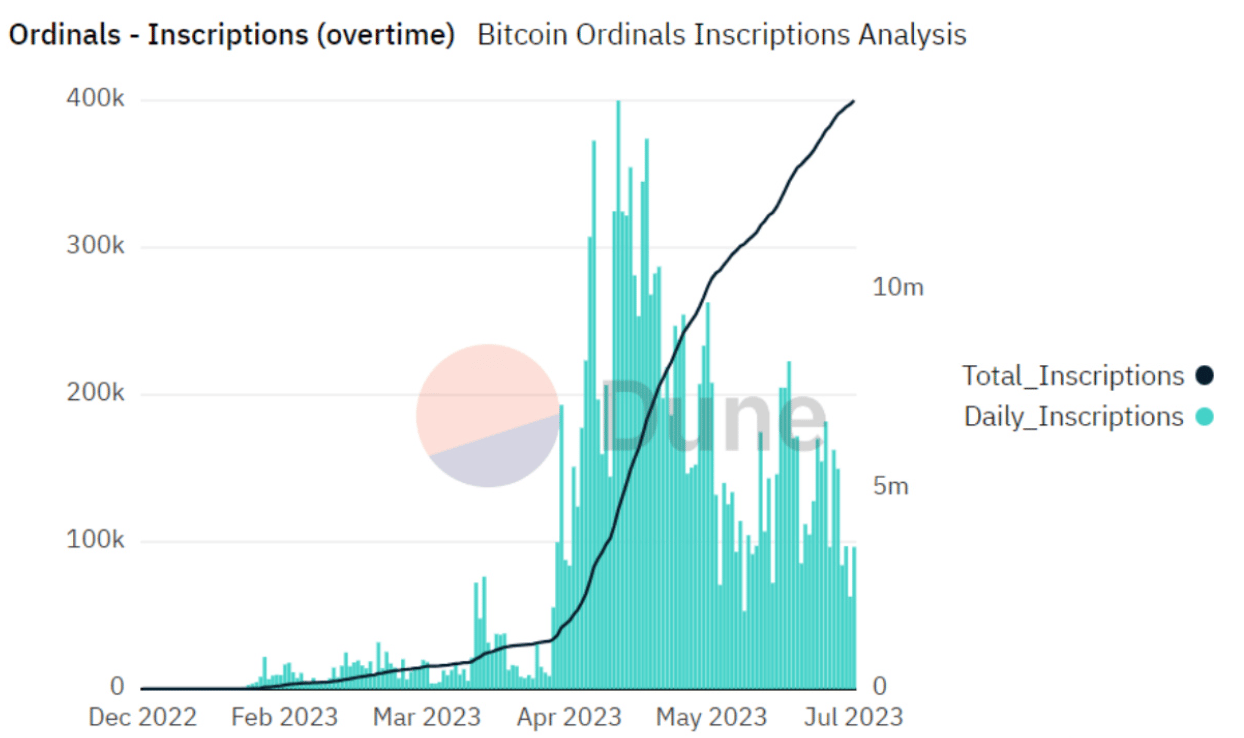

Starting in early April, ordinals inscriptions skyrocketed beyond 10 million, currently standing at 14,756,276. To date, this activity has contributed over $56 million in network fees.

Although the excitement around ordinals has cooled down, it's an area worth monitoring in the upcoming quarters.

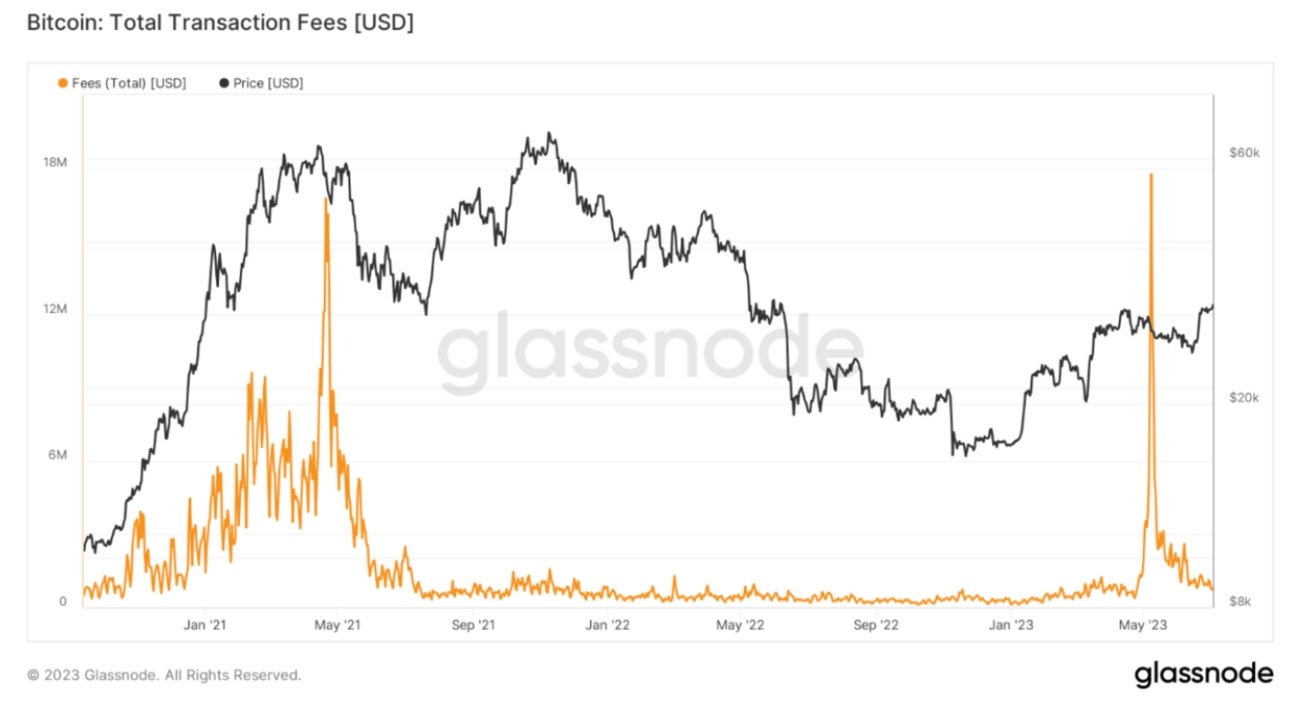

The surge in ordinals led to a significant increase in transaction fees, peaking at over $17.7 million, the highest since the excitement of 2021.

After this peak, fees almost entirely returned to previous levels. Despite initial worries about an overloaded transaction mempool potentially 'breaking Bitcoin', the network coped well with the frenzy, further showcasing Bitcoin's resilience.

CRACKING CRYPTO 🥜

US Presidential candidate RFK Jr.'s family owns up to $250,000 in Bitcoin. Known as a strong crypto advocate, Kennedy has won endorsements from prominent crypto personalities like Twitter's Jack Dorsey.

Ex-BitMEX CEO Arthur Hayes believes that the AI revolution could propel Bitcoin's price to $760,000, with Bitcoin being seen as the go-to currency for AI due to its inherent attributes.

Analyst Marcel Pechman highlights that Argentina's hyperinflation is driving altcoin investments. He further suggests that Bitcoin's solid monetary policies and potential U.S. dollar devaluation could fuel a $200,000 Bitcoin bull run.

Despite the recent departure of key executives, Binance experienced a nearly $2 billion inflow within 24 hours, primarily due to a massive surge in its TrueUSD (TUSD) balance. CEO 'CZ' Zhao dispelled concerns over the exits, emphasising the company's adaptability amidst changing crypto markets and promising user protection.

TRIVIA TIME ✍️

Who wrote Ethereum's Yellow Paper, which serves as the formal definition of the Ethereum protocol.

A) Vitalik Buterin

B) Jeffrey Wilcke

C) Charles Hoskinson

D) Gavin Wood

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Gavin Wood 🎉

The Ethereum Yellow Paper was written by Gavin Wood in 2015

What did you think of today's Newsletter?

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.