GM and welcome to The Crypto Nutshell! 🥜 Your one-stop-shop for cracking open the day's most important crypto news, expert analysis, and on-chain data. We shell out this information to your inbox EVERY single day. Today, we’ll discuss:

Larry Fink’s take on cryptocurrency 🪨

Cathie Wood’s latest Bitcoin breakdown 🤑

Some extremely juicy on-chain data 📊

And more…

MARKET WATCH ⚖️

Ready to jump in? 🌊

We're about to unpack the latest market prices for Bitcoin and Ethereum, and dig into the day's most tantalising crypto news. Brace yourself, it's time to uncover the crypto world!

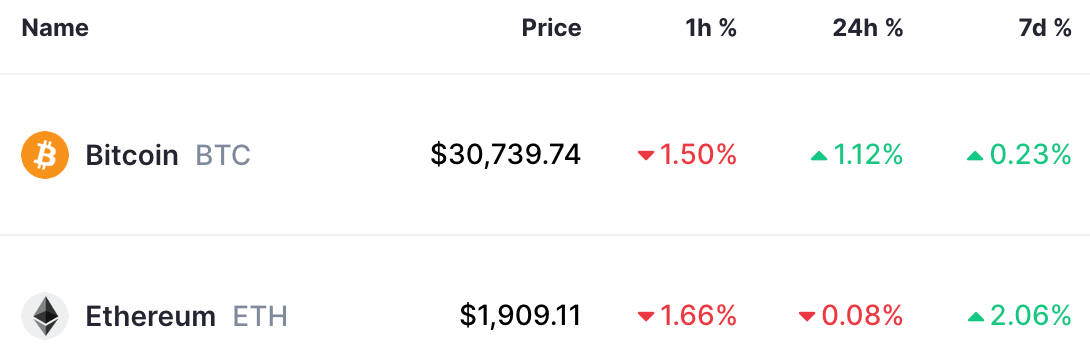

Prices as at 8:00am ET

BlackRock's CEO, Larry Fink, believes that cryptocurrency, in particular Bitcoin, is a digitised version of gold. 🏆

For ages, gold has been the go-to safety net for investors, protecting them from inflation and currency devaluation. Now, Fink argues that cryptocurrencies, especially Bitcoin, are stepping into this role.

He sees them as a new means to diversify portfolios and guard against the pitfalls of individual national currencies.

Fink lauds Bitcoin as a truly international asset, and why not? With its ability to transcend borders and be accessible to anyone with an internet connection, Bitcoin serves as a global digital treasure chest.

It's not tied down to any specific jurisdiction like traditional assets, making it a excellent choice for investors looking to safeguard against geopolitical uncertainties and currency volatilities.

BlackRock recently applied for a Bitcoin ETF which would basically open up a regulated and accessible route into the crypto market. From lone investors to colossal institutions, everyone could get a taste of the digital asset market. Now, isn't that a fascinating prospect?

EXPERT OF THE DAY - CATHIE WOOD 🪵

Cathie Wood and her team at ARK Invest are BULLISH asf on Bitcoin and think it’s gearing up for a big bull run 🚨🐂

Revealed in their June Bitcoin Monthly released today - they broke down a slew of positive developments that makes them optimistic about BTC.

Some of the highlights:

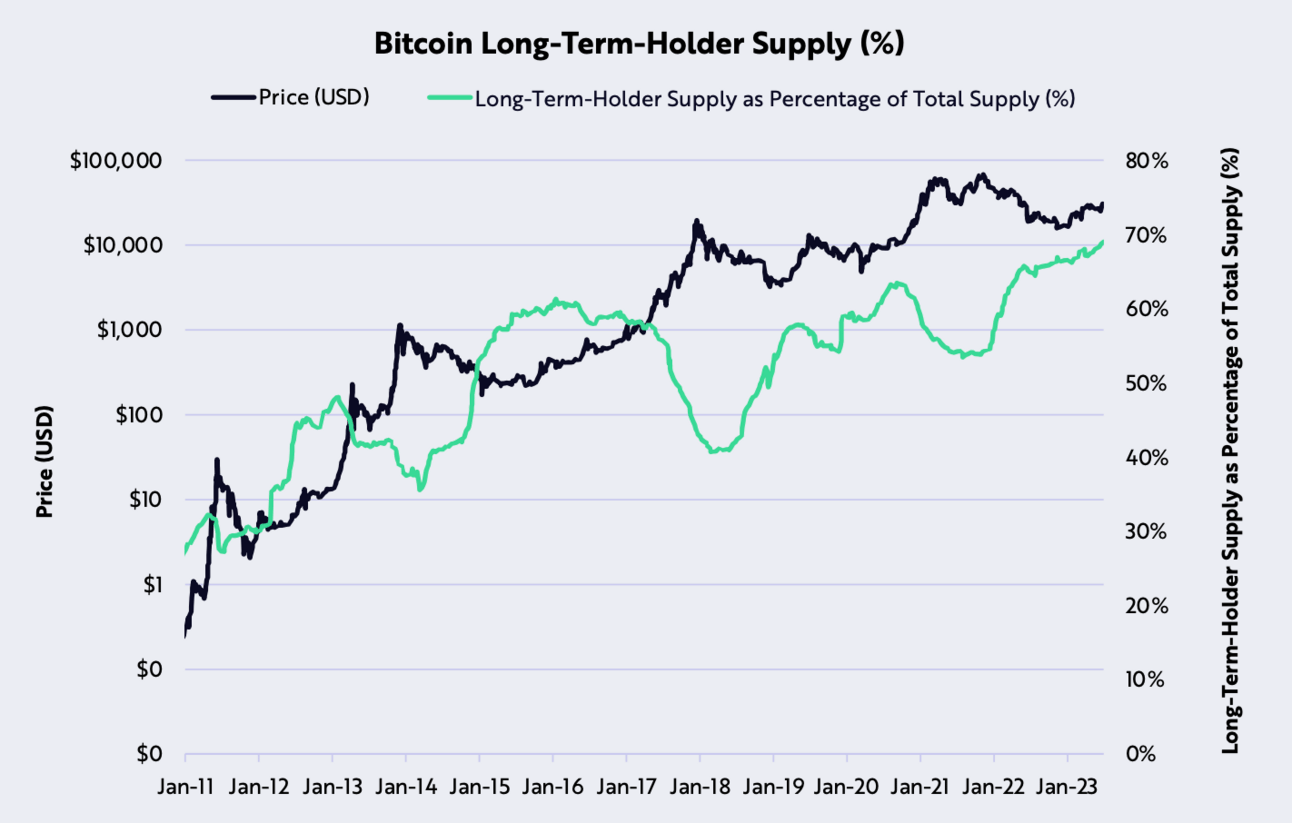

During June, the supply of bitcoin that has been unmoved for at least one year reached an all-time high, ~70% of circulating supply. ARK believes this is representative of a strengthening holder base. What other asset is backed by die-hard believers that will continue to buy & hold forever? 🤷♂️

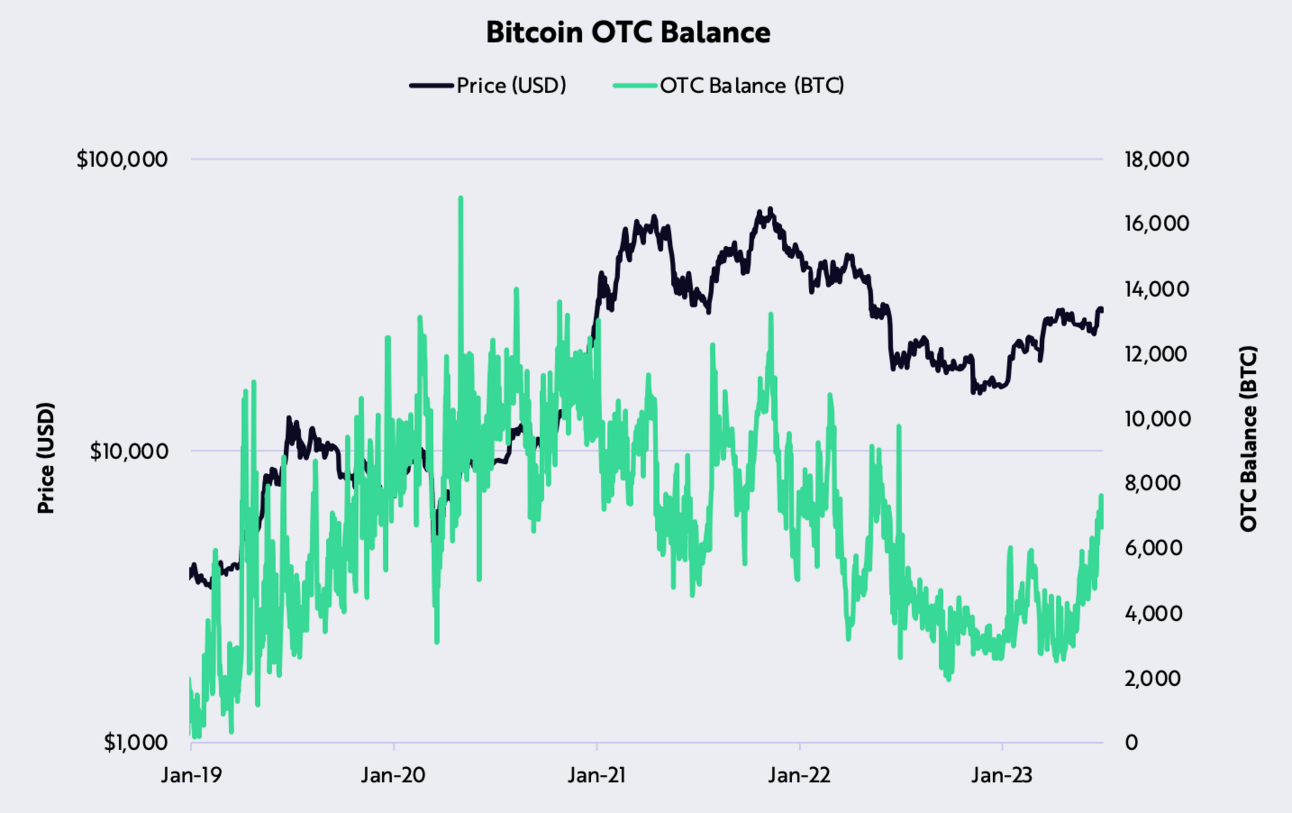

In June, Bitcoin holdings on over-the-counter (OTC) desks, platforms for large-scale trading, hit a one-year high. Cathie Wood and ARK view this surge in volume and balances as a sign of growing interest in Bitcoin among institutions and wealthy individuals.

The report also goes on to show various indicators that are flashing a recession in the economy, such as Real Gross Domestic Income & a slowdown in new manufacturing orders.

Nutty’s take? Contrary to what you would think, a recession would actually be bullish for Bitcoin. During a recession, we see a drop in interest rates & daddy Powell at the Federal Reserve turns back on that money printer.

In higher liquidity environments, assets further out on the risk curve tend to perform better. These assets = Tech Stocks & crypto.

ON CHAIN DATA DIVE 📊

Get your diving gear ready, as we plunge into the depths of the latest on-chain data, seeking to unearth the treasures of insight that lie beneath! 🤿

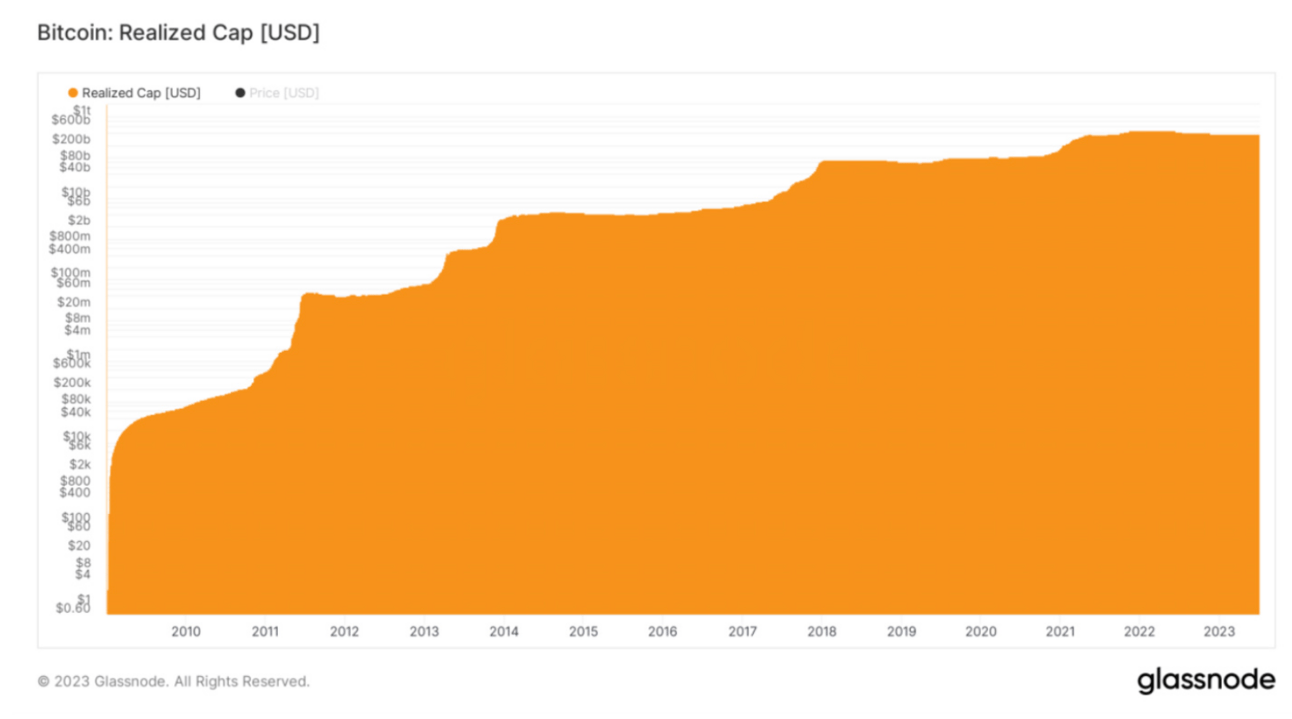

Bitcoin's realised capitalisation is rapidly advancing towards a staggering $400 billion milestone, having grown by approximately $13.7 billion over the last 90 days.

If 'Realised Cap' seems like a complex concept, consider it as market cap's more nuanced counterpart. It calculates the total value of each Bitcoin the last time it was transferred on-chain.

An increase in the realised cap typically suggests capital is flowing into Bitcoin, whereas a decrease hints at capital outflows.

This recent surge of $13.7 billion within the past 90 days signals a strong influx of capital into Bitcoin, painting an optimistic picture for its market.

CRACKING CRYPTO 🥜

BlackRock CEO Larry Fink, once skeptical, now likens Bitcoin to "digitizing gold" and lauds it as a potent "international asset". This pivot in viewpoint is reflected in BlackRock's active engagement in crypto markets, hinting that Fink may now consider cryptocurrencies "legitimate".

Bankrupt Celsius Network has relocated $70M in altcoins, prepping for their conversion to Bitcoin and Ethereum, in compliance with a court order to maximise asset value.

Binance CEO Changpeng Zhao predicted 2025, the year after the next Bitcoin halving, as the likely time for the next bull market. He also welcomed BlackRock's entry into the spot Bitcoin ETF field.

Despite a 6-month-old promise to refund $1.9M to investors in his troubled NFT project CryptoZoo, Logan Paul's plans remain unclear, as reported by YouTube detective, Coffeezilla.

TRIVIA TIME ✍️

What is considered the first altcoin? 🪙

A) Dogecoin (DOGE)

B) Litecoin (LTC)

C) Namecoin (NMC)

D) Ethereum (ETH)

Find out the answer at the bottom of this newsletter 😀

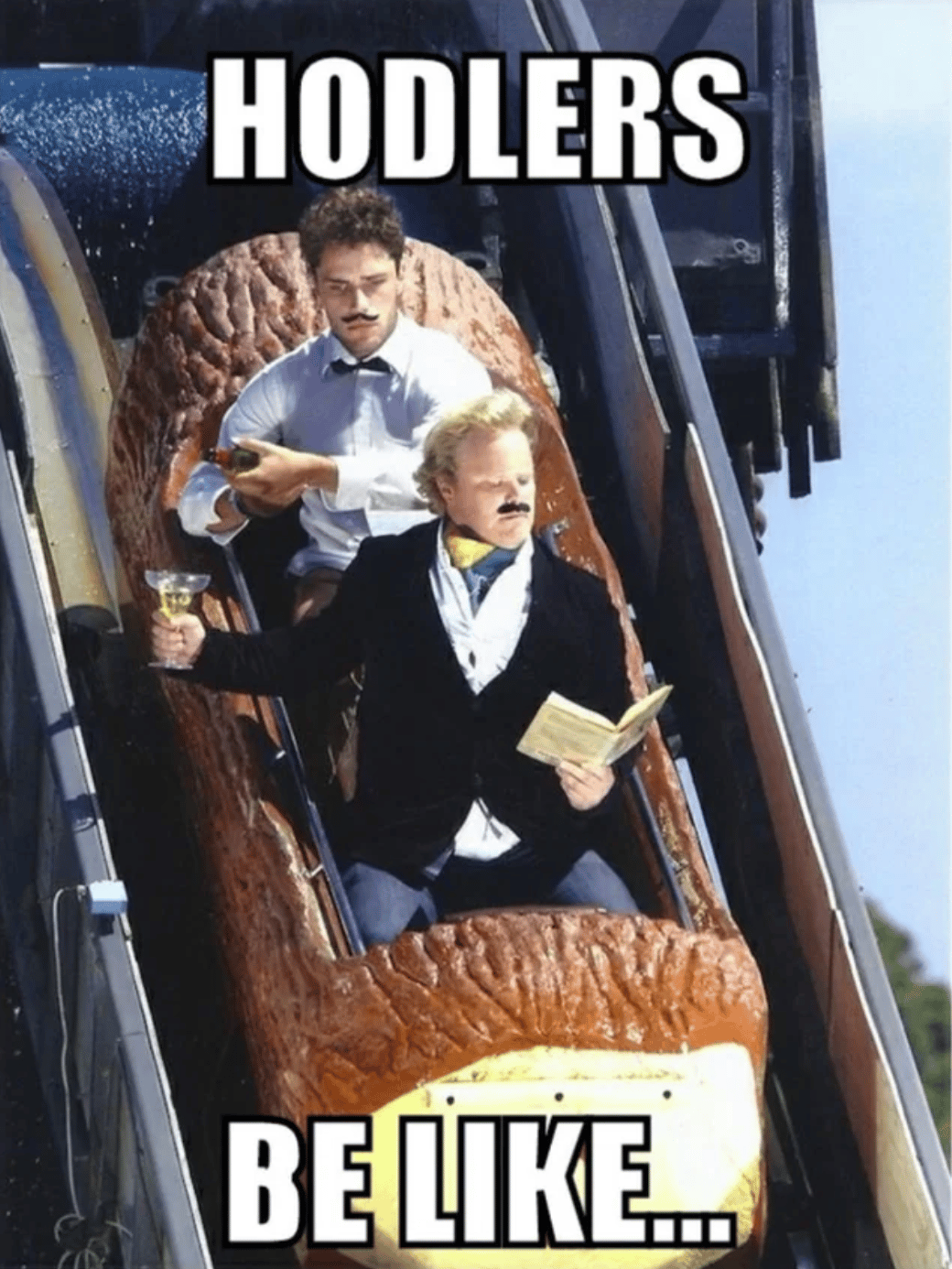

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Namecoin (NMC) 🎉

You may never have heard of it but Namecoin was the very first altcoin to be forked from Bitcoin. Namecoin was introduced in April 2011 and is based on Bitcoin's source code.

What did you think of today's Newsletter?

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.