GM to all of you nutcases. It’s Crypto Nutshell #591 stayin’ sly… 🦊🥜

We're the crypto newsletter that's more adventurous than treasure hunting with a map, a torch, and a whole lot of luck... 🗺️💎

What we’ve cooked up for you today…

⛈ Chaos continues

🧠 The best risk-adjusted buy in history

🚂 No stopping this train

💰 And more…

Prices as at 3:00am ET

CHAOS CONTINUES ⛈

BREAKING: Bitcoin Still to Hit $200K in 2025, Despite Trump Tariff Unrest

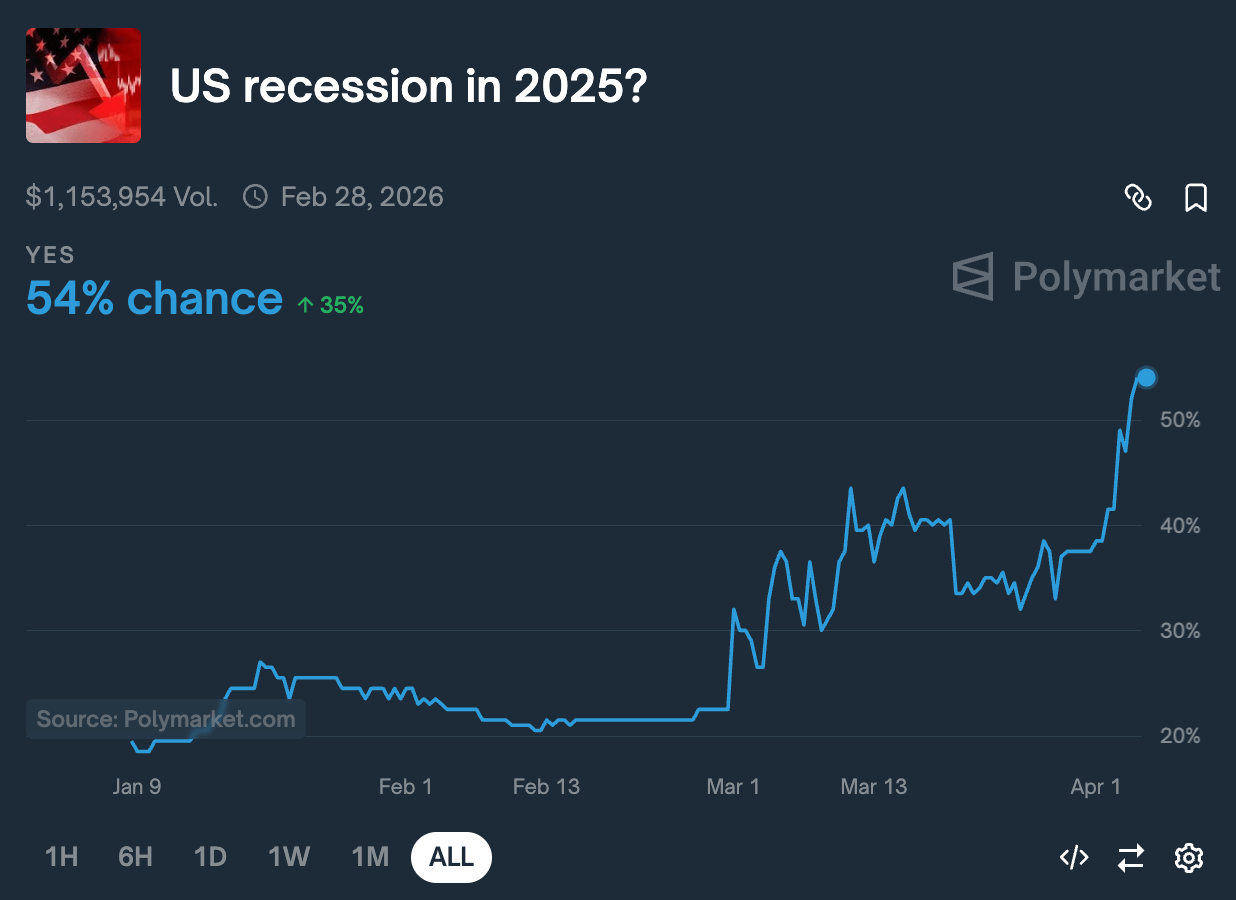

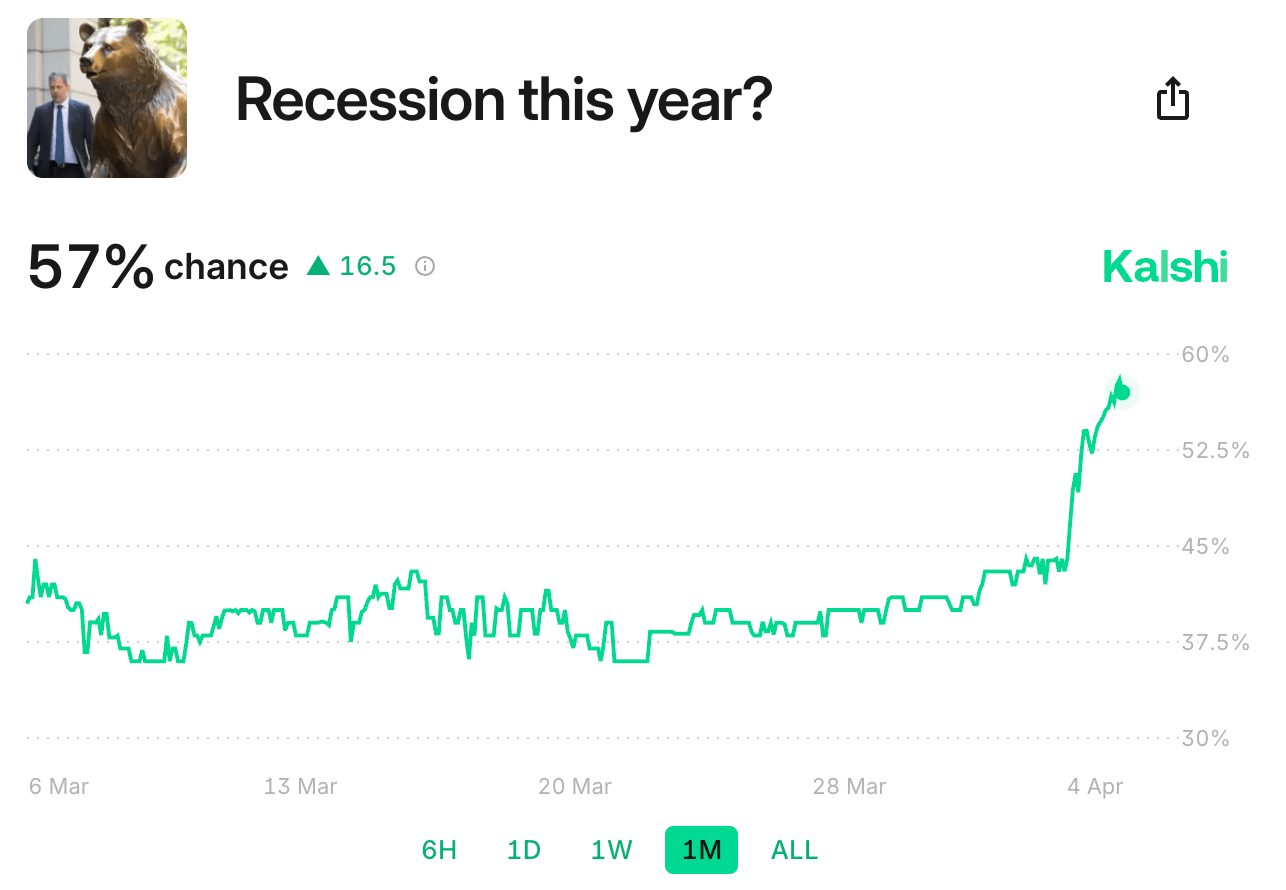

Following Trump’s sweeping “Liberation Day” tariffs, the odds of a US recession happening this year have spiked…

According to Polymarket, there’s now a 54% chance of a recession in 2025.

Kalshi have those odds even higher at 57%.

The fallout from Trump’s tariff shock has been devastating.

Literally no market is safe right now:

The S&P 500: down 4.84%

Nvidia: down 7.81%

Apple: down 9.25%

Amazon: down 8.98%

Risk assets are selling-off like crazy.

But interestingly, crypto is holding relatively steady.

Despite the chaos, the entire crypto market cap is only down ~0.37% over the last 24 hours.

That kind of strength during market weakness suggests the bottom may in fact be in.

And some experts aren’t sweating Trump’s tariffs one bit.

Ryan Rasmussen, Head of Research at Bitwise, is standing firm on his $200K Bitcoin price target for 2025.

Rasmussen calls the recent volatility “stored dry powder” that’ll ignite once markets stabilize:

“This market really should already be at $150K if we didn’t have the looming fear of tariffs… Once the market settles from this ‘Liberation Day’ chaos, we'll finally start seeing the market pullback upwards.”

Standard Chartered’s Geoff Kendrick agrees.

His year-end target? Also $200K.

According to Kendrick, these tariffs haven’t changed the big picture.

So yes, short-term pain may continue.

But long-term? The Bitcoin bull case is alive and well.

As Rasmussen puts it:

“Once the chaos clears, we’ll see the real move.”

Crypto’s Most Influential Event

Consensus is the world’s longest-running gathering of the global crypto, blockchain, and AI communities.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus will welcome 20,000 attendees shaping the decentralized digital economy to Toronto this May 14-16.

Ready to invest in your future?

Attending is your best bet.

THE BEST RISK-ADJUSTED BUY IN HISTORY? 🧠

Matt Hougan just dropped one of the strongest Bitcoin takes of 2025:

“Right now marks the single best moment in history to buy Bitcoin - on a risk-adjusted basis.”

Matt is the Chief Investment Officer at Bitwise, one of the biggest names in institutional crypto investing.

And in his latest memo, “The Great Derisking of Bitcoin” he laid out exactly why he thinks this moment is different.

Hougan first heard about Bitcoin back in 2011 — when it crossed $1.

He didn’t buy. A $1,000 investment back then would be worth $88 million today:

“Instead, I left the office and got a coffee.”

But looking back, he admits something we all forget:

“Putting $1,000 into Bitcoin in 2011 was a massive gamble… the risks were real.”

Exchanges were sketchy. Custody was unclear. Regulation was hostile.

Bitcoin was still proving it worked.

But now? Those risks are gone.

Hougan believes Bitcoin has knocked down every major existential risk over the last 14 years:

Custody? Fidelity and others now offer secure, institutional-grade solutions.

Regulation? Spot Bitcoin ETFs launched in 2024.

Criminal use? Overshadowed by legit adoption.

Government bans? That fear just got wiped out.

Hougan’s biggest concern used to be simple:

“What if the U.S. bans Bitcoin like it did with gold in 1933?”

But that changed last month when President Trump signed the executive order establishing a U.S. Strategic Bitcoin Reserve.

“Just like that, the last existential risk disappeared before my eyes.”

Hougan believes it’s simple:

If the dollar ever falls from its perch as global reserve currency, the U.S. would rather fall back on Bitcoin than the Chinese yuan.

Bitcoin is no longer the enemy - it’s the backup plan.

According to Matt, here’s the bottom line:

This is the best time in history to buy Bitcoin - not based on hype, but on risk-adjusted reward.

The risk of Bitcoin failing? Gone.

The upside? Still massive.

No one gets to buy Bitcoin at $1 anymore…

But today might just be the next best thing. 🌅

NO STOPPING THIS TRAIN 🚂

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

As of today there are 52,691,933 addresses holding at least a little Bitcoin.

Which marks a increase of 10,125 wallets compared to when we looked at this metric two weeks ago.

Year-to-date, this number has grown by 168,396 wallets. 😱

That’s some serious momentum.

Even during periods of price chop and macro stress, the Bitcoin network just keeps growing.

Bottom line:

Bitcoin adoption isn’t slowing down anytime soon.

CRACKING CRYPTO 🥜

Donald Trump White House meeting with Nayib Bukele ignites Bitcoin discussion hopes. US President Donald Trumo praises El Salvador's security measures as Nayib Bukele prepares for April 14 White House visit.

10-year Treasury yield falls to 4% as DXY softens — Is it time to buy the Bitcoin price dip? Will the US-led trade war lead to a golden buying opportunity in Bitcoin price or further downside in the short term?

U.S. SEC Nominee Atkins Gets Confirmation Nod From Senate Banking Committee. The panel voted to advance the confirmations of Paul Atkins to run the SEC and Jonathan Gould to lead the OCC, both of which would have a big say in crypto.

Fidelity's spot Solana ETF edges closer to approval as SOL slides 15% amid Trump tariffs turmoil. The SEC acknowledged Fidelity’s application for a spot Solana ETF, an incremental step that edges the product closer to approval.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What does the term “HODL” mean in cryptocurrency slang?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Hold On for Dear Life 🥳

The term "HODL" emerged from a misspelling of "hold" in a Bitcoin forum post in 2013 and has now been taken to mean “Hold On for Dear Life”.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.