GM to all of you nutcases. It’s Crypto Nutshell #624 flyin’ in… 🛩️🥜

We're the crypto newsletter that's more intense than surviving the wild with only a bow, instincts, and sheer will... 🏹🌲

What we’ve cooked up for you today…

🧑⚖ Strategy gets sued

🧠 Even ChatGPT Predicts $1 Million

🔥 Five in a row

💰 And more…

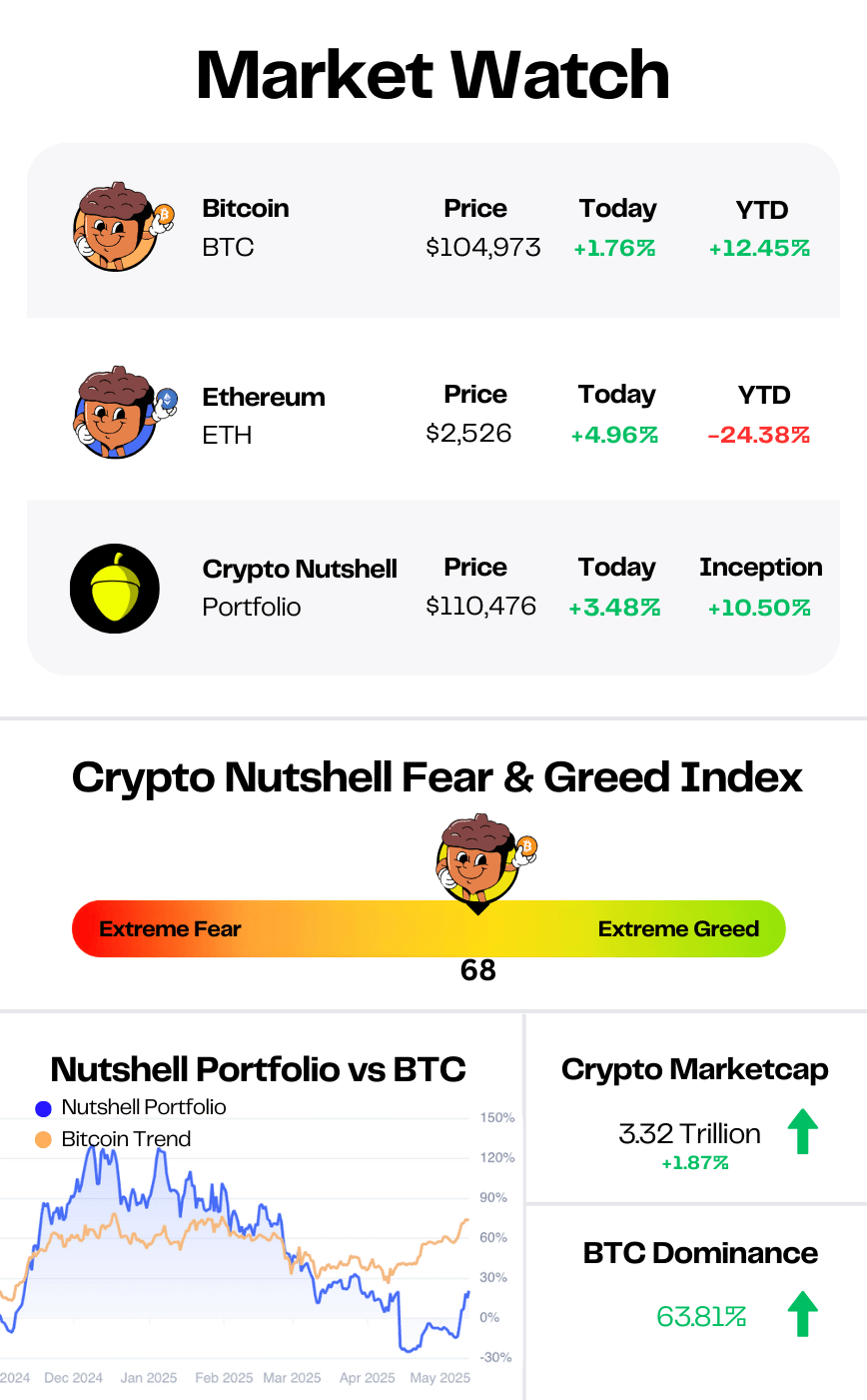

Prices as at 4:40am ET

STRATEGY GETS SUED 🧑⚖

BREAKING: Strategy adds 7,390 BTC for $765M, gets hit with class-action lawsuit

Michael Saylor’s Bitcoin buying spree isn’t slowing down…

Last week, Strategy (formerly MicroStrategy) added another 7,390 BTC to its stash - a $764.9 million purchase at an average price of $103,498.

That brings the company’s total holdings to 576,230 BTC, worth over $59 billion and representing more than 2.7% of the entire Bitcoin supply.

Unrealised gains? Roughly $19 billion. 🚀

But as the treasury grows, so does the legal scrutiny.

A new class-action lawsuit has been filed in federal court against Strategy. (Saylor, CEO Phong Le, and CFO Andrew Kang are also named)

The plaintiffs allege that the company made “materially false and misleading statements” about the profitability and risks of its Bitcoin-first strategy.

According to the complaint, Strategy promoted bullish metrics like BTC Yield and BTC $ Gain, while omitting the massive downside volatility now visible on their balance sheet:

“Defendants consistently provided rosy assessments of Strategy’s performance as a bitcoin treasury company following its adoption of ASU 2023-08 (Fair value accounting). They did this, in part, by reporting and projecting positive BTC Yield, BTC Gain, and BTC $ Gain results, while omitting the immense losses the Company could realize on its bitcoin assets after accounting for these assets under a fair value accounting methodology.”

Strategy pushed back in an SEC filing:

"The complaint seeks unspecified damages to the class, interest, attorneys’ fees, costs, and other relief… We intend to vigorously defend against these claims. At this time, we cannot predict the outcome, or provide a reasonable estimate or range of estimates of the possible outcome or loss, if any, in this matter."

Meanwhile… The Bitcoin Treasury Race Heats Up

Strategy may be leading the charge, but it’s no longer alone.

Over 70 companies now hold Bitcoin on their balance sheets.

Just last week:

🇯🇵 Metaplanet added 1,004 BTC (~$104.3M)

🇧🇷 Méliuz bought 274.5 BTC

🇧🇭 A Bahrain-based firm adopted a BTC treasury model

Even a luxury watchmaker renamed itself AsiaStrategy and jumped on the BTC bandwagon.

Saylor’s playbook is now the blueprint for a growing wave of corporate Bitcoin treasuries.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

EVEN CHATGPT PREDICTS $1 MILLION 🧠

Turns out Arthur Hayes isn’t the only one calling for $1M Bitcoin by 2028…

This week, Fred Krueger shared ChatGPT’s take on when Bitcoin will hit $1 million.

The answer?

“Monday, July 12, 2028.”

Yup. The AI agrees with Arthur.

The Math Behind the Madness

ChatGPT analyzed Bitcoin’s past price ranges, and how long it historically took to break through each:

$0–$10: 674 days

$10–$100: 381 days ↓

$100–$1,000: 1,333 days ↑

$1,000–$10,000: 1,106 days ↓

$10,000–$100,000: 1,887 days ↑

Average time per 10x range? 1,076 days.

Now that Bitcoin crossed $100K in May 2025, ChatGPT estimated:

Next step = ~$1M in 1,167 days

→ Target date: July 12, 2028

Why It Matters

Yesterday, we broke down Arthur Hayes $1 million Bitcoin by 2028 prediction.

It’s one thing when Arthur Hayes makes a bold macro call.

It’s another when AI, trained on patterns, independently lands on the exact same timeline.

The data says we’re right on schedule.

And if history repeats?

The path to $1 million has already begun. 🚂

FIVE IN A ROW 🔥

The streak live on…

Digital asset funds just posted their fifth consecutive week of inflows, with $785 million pouring in.

This pushes year-to-date inflows to $7.5 billion, officially surpassing February’s $7.2B peak.

Let's break it down.

Bitcoin remains the top dog with $557M in inflows.

But this week’s standout?

Ethereum, which caught fire with $204.9M in inflows - its biggest week in months.

Sui and XRP also had solid weeks with inflows of $4.9m and $9.3m respectively.

Whilst Solana stumbled again with outflows of $0.9m.

As usual, the US saw the majority of inflows with $681 million coming in for the week.

Germany, Hong Kong and Australia followed with inflows of $86.3m, $24.2m and $13.5m respectively.

Whilst Sweden, Canada and Brazil saw outflows of $16.3m, $13.5m and $3.9m respectively.

Macro pressures are easing.

And Bitcoin’s role as a hedge against fiscal chaos is entering the mainstream financial conversation.

Institutional demand continues to grow. 🚀

CRACKING CRYPTO 🥜

Ripple partners with major UAE banks to integrate XRP into payment infrastructure. Ripple expands influence in UAE with strategic partnerships with Zand Bank and Mamo, enhancing blockchain-based payments.

Bitcoin notches record weekly close after highest-ever daily close candle. Bitcoin's momentum continues to build as it recorded its highest ever weekly and daily closures as it nears its all-time high.

Jamie Dimon Says His Bank Will Allow Purchases. A longtime vocal critic of bitcoin, Dimon said the bank he runs will now let clients to buy the crypto.

DOJ launches investigation into Coinbase cyberattack. The attackers did not access any customer funds, private keys, or login systems, and the breach affected less than 1% of Coinbase users.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

Which blockchain is known for its high-speed transactions, often processing thousands of transactions per second (TPS)?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Solana 🥳

Solana is famous (and sometimes infamous) for its lightning-fast throughput — boasting 65,000+ TPS in theory, though real-world numbers vary. ⚡🧬

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.