Today’s edition is brought to you by Crypto Nutshell Pro.

If you’re interested in altcoin coverage, buy recommendations & want to know what’s in the Crypto Nutshell Portfolio, click here to join the waitlist!

GM to all of you nutcases. It’s Crypto Nutshell #702 keepin’ an eye… 🫣🥜

We're the crypto newsletter that's more epic than watching gods and monsters battle for Earth’s future... ⚡🗿

What we’ve cooked up for you today…

🏦 Bitcoin treasury milestone

🧠 $400k Bitcoin is just common sense

📈 This metric only goes up

💰 And more…

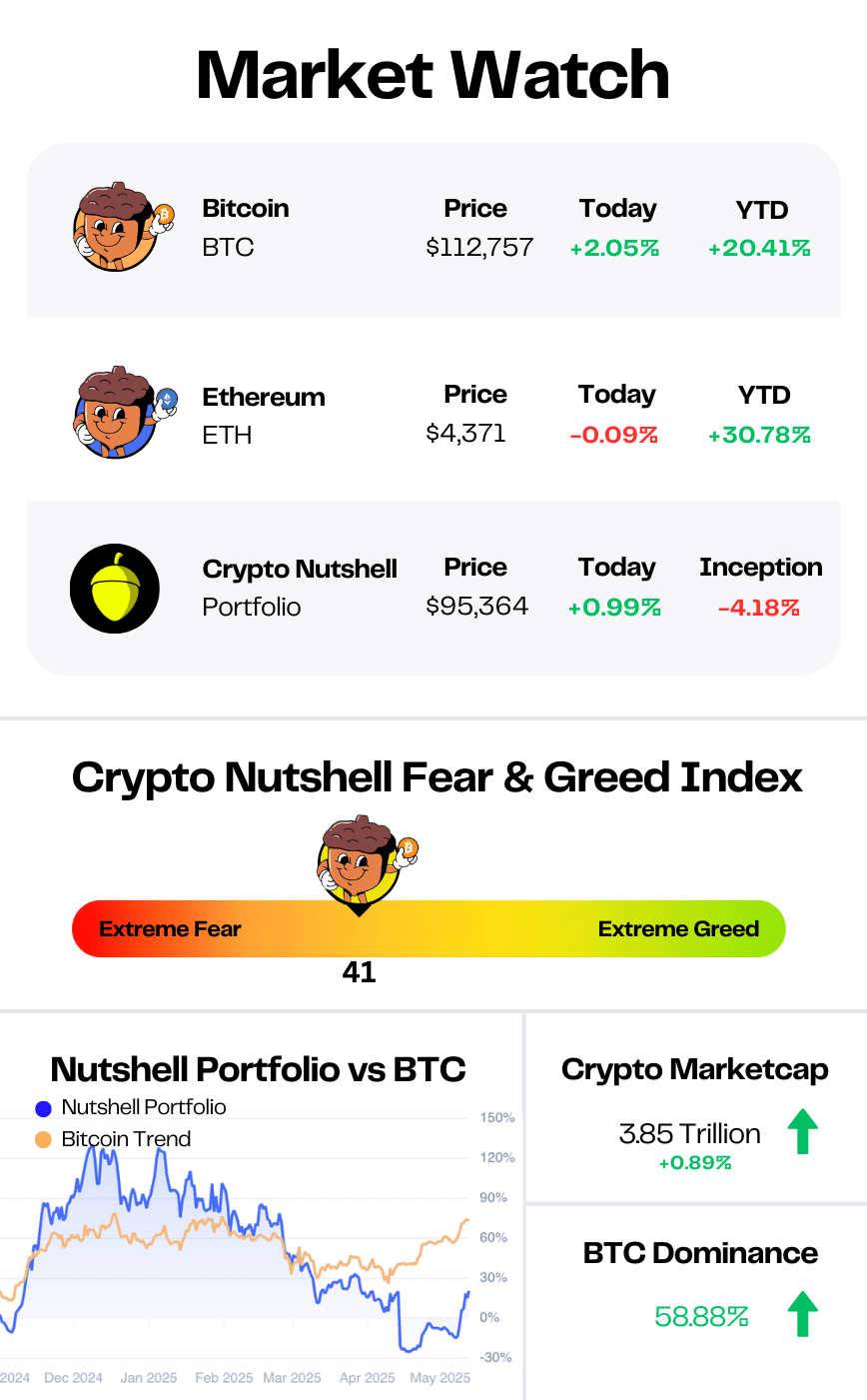

Prices as at 3:25am ET

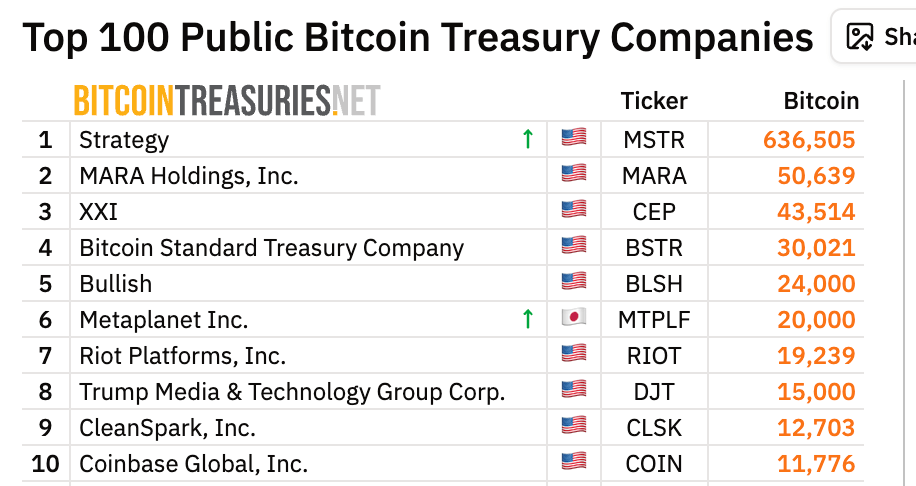

BITCOIN TREASURY MILESTONE 🏦

BREAKING: Public companies reach 1M Bitcoin, hitting 5.1% of BTC supply

We’ve been talking about Ethereum treasury company’s quiet a lot over the last two weeks.

But that doesn’t mean that the Bitcoin treasuries have slowed down…

As of today, public companies now hold over 1 million Bitcoin.

That’s 5.1% of the circulating supply - worth more than $111 billion.

The milestone, confirmed by BitcoinTreasuries.net, marks one of the clearest signs yet that corporate adoption has gone from “experiment” to full-blown movement.

Michael Saylor’s Strategy still leads the pack with 636,505 BTC, while MARA Holdings holds 52,477 BTC.

But the next wave of players is closing in fast: Jack Mallers’ XXI sits at 43,514 BTC, Bitcoin Standard Treasury owns 30,021 BTC, and names like Bullish, Metaplanet, and even Trump Media & Technology Group now sit among the top 10 holders.

And it’s not just the U.S. - adoption is spreading worldwide, from Canada to Japan to South Africa.

This isn’t just headline hype. The math speaks for itself:

ETFs + corporates = demand shock

New BTC issuance = ~450 btc/day

Public companies alone are stacking faster than miners can produce

That dynamic has already helped drive Bitcoin to new highs above $124K last month.

And with firms like Metaplanet and Semler Scientific pledging to expand their stashes by 10x–20x by 2027, the pressure on supply is only going to tighten.

Remember: Strategy was mocked for its “wild experiment” back in the 2022 bear market.

But Saylor rode BTC down to $15K and held.

Now, his playbook is the template Wall Street is copying - using equity raises, debt financing, and SPACs to funnel capital straight into Bitcoin.

The bottom line: 1 million BTC is gone from circulation and locked into corporate vaults.

With only 21 million ever to exist - and less than 5.2% left to even be mined - this corporate arms race isn’t just a sideshow.

It’s the supply squeeze that defines this cycle. 🚀

Crypto Nutshell Pro is now CLOSED. ❌

Crypto Nutshell Pro is officially sold out and closed.

Thank you to the 25 fast movers who jumped in - every single spot was taken.

We don’t know when the doors will open again. But if (and when) they do, it will be months from now - and at higher prices.

For everyone inside Crypto Nutshell Pro, we’ll see you Sunday with a massive portfolio update:

A deep dive of our top altcoin picks in the Ethereum ecosystem

Plus a mystery pick our analysts believe will be a top performer over the next 6 months. (Trust us, it’s not the coin you think it is…)

Stay tuned.

For everyone who didn’t make it in this time…

If you want to be first in line when the doors open again, click below to join the waitlist.

$400K BITCOIN IS JUST COMMON SENSE 🧠

Jan van Eck, CEO of VanEck, one of the biggest ETF issuers on Wall Street, just laid it out plain and simple:

Bitcoin’s outperformed the S&P 500 over 1 year, 3 years, 5 years, even 10 years.

On every timeframe.

And it’s not even close.

What’s more?

A $400k Bitcoin isn’t a wild prediction - it’s now just common sense.

Jan van Eck - CEO of VanEck

In his latest interview, he laid out his logic:

Bitcoin is digital gold.

Supply is capped.

Demand is only rising.

So if Bitcoin simply grows to just 50% the size of gold’s market cap…

That would equal $400,000 per BTC.

As Jan put it:

“Once you value it as digital gold and assume it captures half of gold’s market value… boom, that’s $400,000 per Bitcoin. It’s not crazy, it’s just common sense.”

No wild models. Just math.

When one of Wall Street’s top ETF CEOs explains it like that… you would have to be out of your mind to fade Bitcoin.

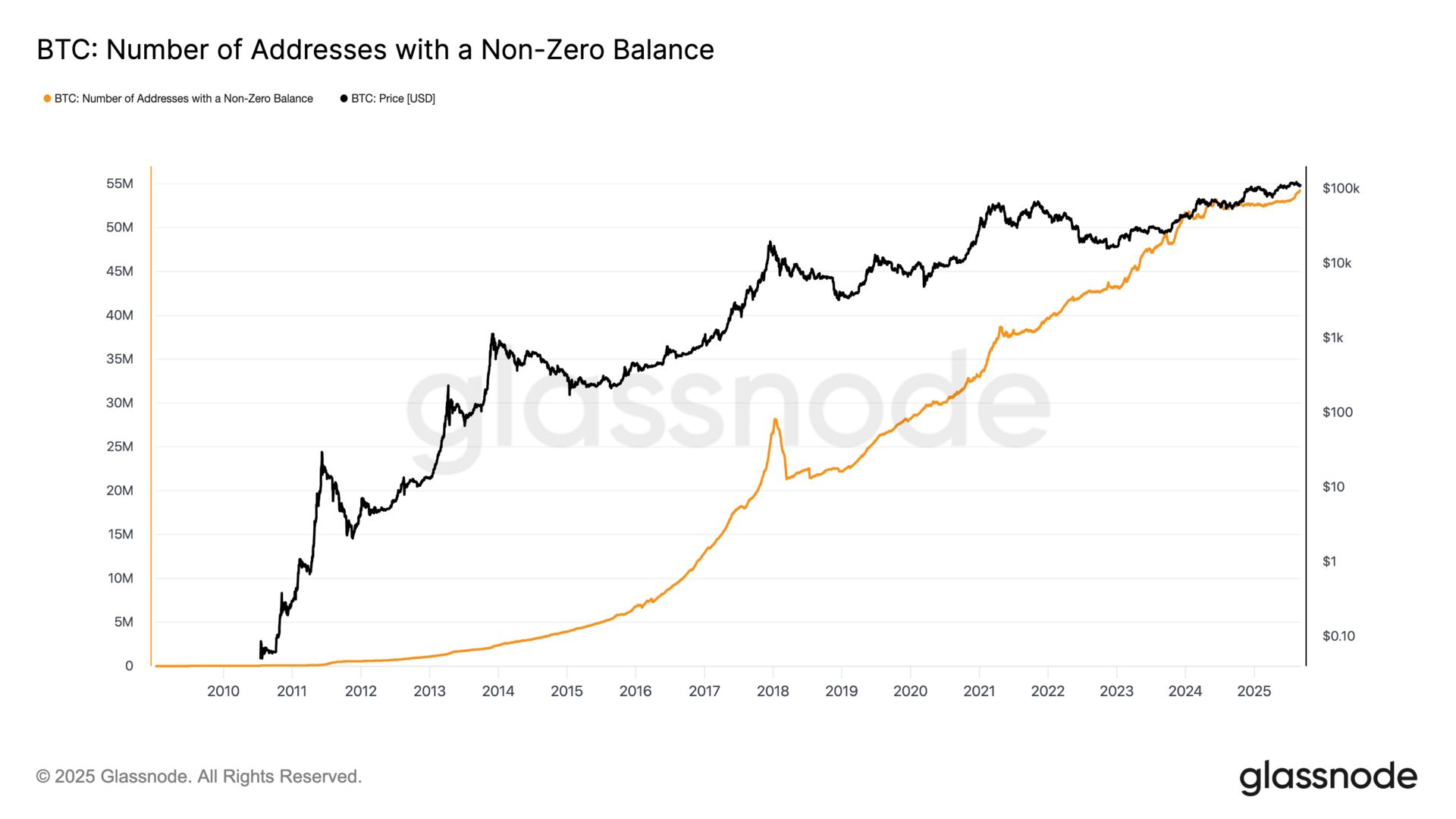

THIS METRIC ONLY GOES UP 📈

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

There are now 54,218,590 wallets holding Bitcoin.

That’s +242,936 in just the last two weeks.

Zoom out? 2025 alone has added 1.69M new wallets.

The signal couldn’t be clearer:

Adoption is accelerating.

The holder base keeps expanding.

Conviction is compounding through every swing.

Prices rise and fall. But the network?

It only grows stronger. 💪

CRACKING CRYPTO 🥜

Bloomberg analyst says altcoin ETF approvals unlikely to trigger a traditional alt season. James Seyffart noted that investment advisors prefer diversification over concentrated positions in individual altcoins.

MSTR, NAKA, BMNR Punished as Crypto Treasury Bubble Further Deflates. The major U.S. exchange will require at least some companies to get shareholder approval prior to raising money to buy crypto, according to The Information.

Solana treasury DeFi Development's holdings surpass 2 million SOL. The latest buy brings the company’s total holdings to 2,027,817 SOL, worth around $409 million at current prices.

SEC’s agenda proposes crypto safe harbors, broker-dealers reforms. Several rule changes proposed as part of the SEC’s spring agenda could radically change the way US regulators oversee cryptocurrency and blockchain companies.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What mechanism adjusts Bitcoin’s mining difficulty roughly every 2 weeks?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Difficulty retarget 🥳

Bitcoin’s difficulty retarget ensures block times stay close to 10 minutes, no matter how much mining power joins. 🔄

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.