Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all of you nutcases. It’s Crypto Nutshell #606 predictin’ out… 🔮🥜

We're the crypto newsletter that's more gripping than surviving in space with nothing but duct tape and genius... 🧑🚀🛠️

What we’ve cooked up for you today…

🏆 The dream team?

🌍 Countries are coming…

💪 Another high

💰 And more…

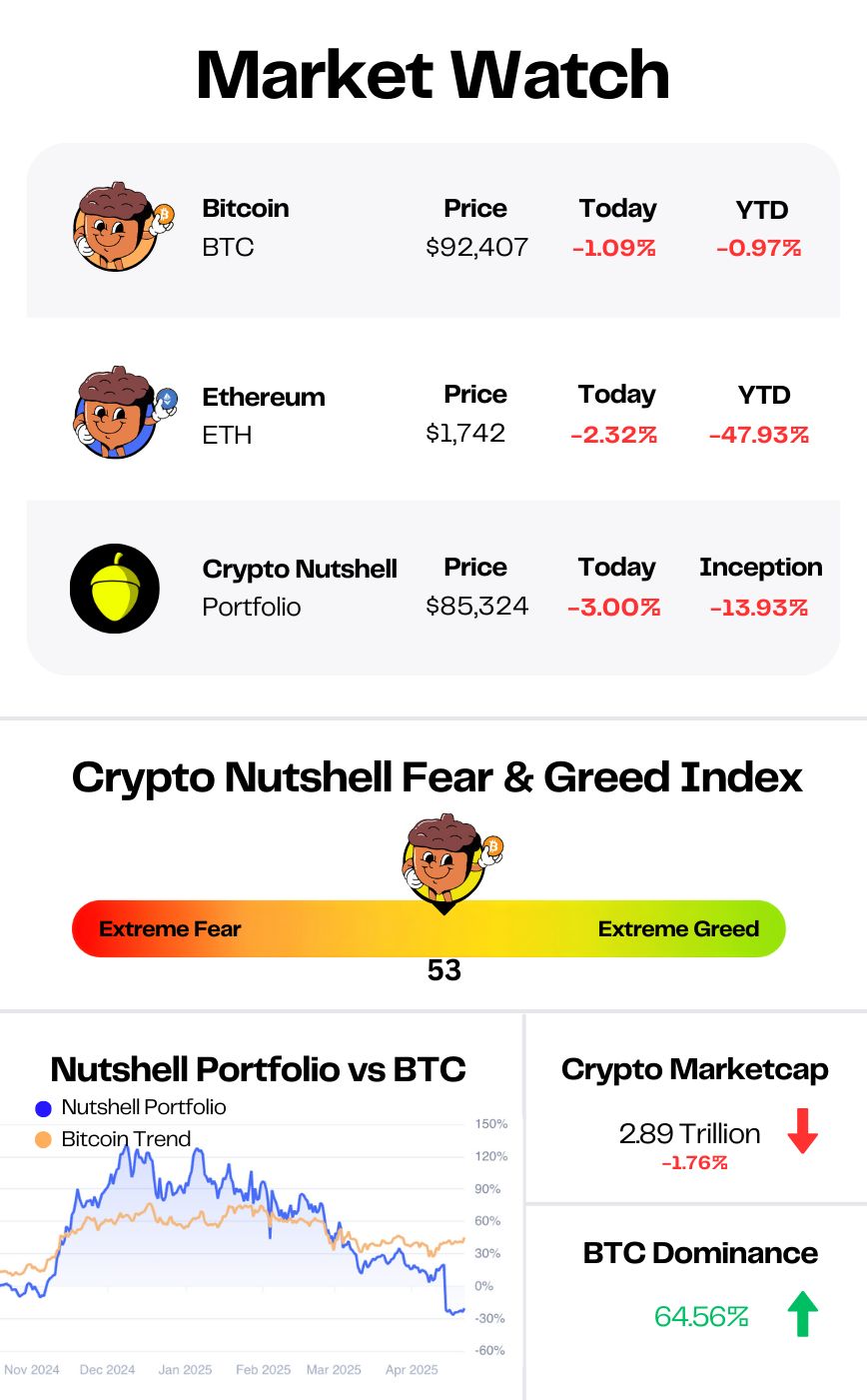

Prices as at 6:15am ET

THE DREAM TEAM? 🏆

BREAKING: Tether, Bitfinex, Cantor and SoftBank to Launch Bitcoin Company With $3.9 Billion Treasury

A new Bitcoin juggernaut just quietly stepped onto the Nasdaq…

Introducing: Twenty One Capital - a $3.9 billion Bitcoin-first public company backed by:

Tether

Bitfinex

SoftBank

Cantor Fitzgerald

It’s going public via a SPAC merger with Cantor Equity Partners (CEP), and will trade under the ticker XXI.

Their starting stack? 42,000 BTC.

That makes it the third-largest Bitcoin treasury on the planet - behind only Strategy (538K BTC) and MARA (47K BTC).

Twenty One isn’t dabbling in Bitcoin. It’s purpose built for it.

Led by Jack Mallers, the company’s mission is razor sharp:

“Our mission is simple: to become the most successful company in Bitcoin, the most valuable financial opportunity of our time… We’re not here to beat the market, we’re here to build a new one.”

This isn’t just corporate BTC on the balance sheet.

Everything at Twenty One is measured in Bitcoin:

Bitcoin Per Share (BPS) – How much BTC each share represents

Bitcoin Return Rate (BRR) – The growth rate of BPS over time

On top of the $3.9B base, they’re raising another $550M through debt and equity…

And yep, it’s all going to buy more Bitcoin.

Twenty One doesn’t plan to just stop at buying and holding BTC.

Down the line, they plan to:

Launch Bitcoin lending and financial products

Create original Bitcoin-focused media

Serve as a full-spectrum proxy for BTC exposure

Think of it as Strategy 2.0 - but with a more aggressive, more Bitcoin-maxi DNA.

This marks a pivotal moment in institutional adoption - where TradFi giants aren’t just buying Bitcoin…

They’re building around it.

Bitcoin isn’t a hedge anymore. It’s the main event. 🚀

MAKE EVERY TRANSACTION COUNT 💳

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.*

COUNTRIES ARE COMING…🌍

Anthony Pompliano just dropped a market update confirming what Bitcoiners have been predicting for years:

“Nation states around the world are setting up Strategic Bitcoin Reserves.”

El Salvador was the test.

Bhutan was the quiet follow-up.

Then, the United States joined the game. 🇺🇸

Now, like it or not, every other country has to make a move.

Why?

Game theory.

The Bitcoin arms race has begun

In his update, Pompliano broke down that Binance is actively advising sovereign wealth funds and governments on:

Bitcoin policy 📜

Strategic reserves 🏦

National-level accumulation 🧠

If that doesn’t sound like a big deal… it is.

“Once one large nation starts to accumulate Bitcoin, all others are now incentivized to compete.”

This is no longer fringe. This is fiat survival.

You either hold Bitcoin, or you fall behind.

The dominoes are falling

Panama just became the first public institution in Latin America to accept crypto for:

Taxes

Fees

Permits

Fines

Other countries are quietly mining, buying, or writing policy.

And just like that — the game theory loop has activated:

✅ U.S. starts stacking

✅ Binance advises others

✅ Strategic reserves multiply

✅ Everyone FOMOs in

The bottom line?

Bitcoin is now a undeniably a geopolitical asset. 🧨

The moment one superpower says “this is strategic,” the rest are forced to play catch-up.

The window to front-run the world is closing.

Game theory is a beautiful thing. ♟️

ANOTHER HIGH 💪

It’s time for another look at Ethereum’s supply side dynamics.

Today we’ll be focusing on the amount of Ethereum currently being staked.

Quick Note: Ethereum staking involves locking up ETH to support the blockchain’s security. In return, users earn rewards for staking.

If you’d like to learn more about staking, check out this article.

As of today, 60,533,705 ETH is staked.

That’s an increase of 787,703 ETH in just the past two weeks. (~$1.41 billion at today’s prices)

And yes… that’s yet another all-time high.

(You know the drill by now - this chart literally sets a new record every day)

To put that into perspective:

Staked ETH now accounts for 50.12% of the total circulating supply.

Which means that half of all Ethereum is locked up - held by investors who clearly aren’t in any rush to sell.

Conviction remains sky-high.

Supply continues to tighten.

And this all sets the stage for what could eventually become a textbook supply squeeze.

CRACKING CRYPTO 🥜

Cantor Fitzgerald spearheads $3B move into Bitcoin with Tether, SoftBank, and Bitfinex. Cantor Fitzgerald's Bitcoin-focused strategy aims to emulate Strategy's success, fueled by notable partners like Tether and SoftBank.

Bitcoin ETF inflows top 500 times 2025 average in 'significant deviation'. Bitcoin institutional investment undergoes an instant reversal thanks to BTC price rises, with daily ETF inflows standing out in 2025 and further back.

Riot Platforms Secures $100M Bitcoin-Backed Credit Line From Coinbase. The funds will be used for strategic initiatives and general corporate purposes, and cash drawn from the line will carry at least a 7.75% interest rate.

FBI says Americans over 60 lost nearly $3 billion to crypto scams in 2024. People between 40 and 49 were the second-largest age group to experience cryptocurrency fraud, with $1.46 billion in losses in complaints involving cryptocurrency.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What major change occurred during Ethereum’s Merge in September 2022?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Switch from Proof of Work to Proof of Stake 🥳

The Merge was Ethereum’s biggest upgrade ever — slashing energy use by over 99% and setting the stage for future scaling.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.